• Inflation jolt. Stronger than expected US PPI data pushed US bond yields & the USD higher. US retail sales & FOMC meeting minutes due this week.

• AUD struggles. Shaky sentiment & a firmer USD have weighed on the AUD. Since 2015 the AUD has only traded sub $0.65 ~3% of trading days.

• Upcoming events. In addition to the US releases, the China data batch, RBNZ meeting, UK CPI, AU wages & AU jobs report are in focus this week.

Equity markets remained on the backfoot on Friday as bond yields continued to edge higher following a run of stronger than expected UK GDP and US Producer Price Inflation data. The PPI is a leading indicator for CPI inflation. The UK economy expanded by 0.2% in Q2, beating consensus estimates looking for no growth. As a result, UK interest rate expectations rose with markets now factoring in ~2 more BoE hikes by February. In the US, PPI re-accelerated. Notably, the core PPI is now running at ~2.7%pa with a range of ‘sticky’ services prices picking up. This has fanned concerns that the battle against inflation is still far from over.

The US S&P500 eased 0.1% with the tech-focused NASDAQ underperforming (-0.7%). European equities also fell back (EuroStoxx50 -1.4%), with another drop in China (CSI300 -2.3%) on the back of ongoing growth concerns following another set of weak credit data also a factor at play. Across bonds, US yields increased ~6bps across the curve, with the 10-year rate (now 4.15%) near the top of its 2023 range. There were relatively larger moves in Europe with the UK 10-year rising ~16bps (now 4.53%) and the German 10-year up ~10bps (now 2.62%). In FX, the USD’s upswing continued with EUR slipping down to ~$1.0950 and USD/JPY (now ~144.95) tracking the rise in yields. GBP held steady near ~$1.27. The negative risk environment exerted pressure on NZD which has dipped to its lowest level since mid-November. The AUD has also continued to be weighed down (now ~$0.6497).

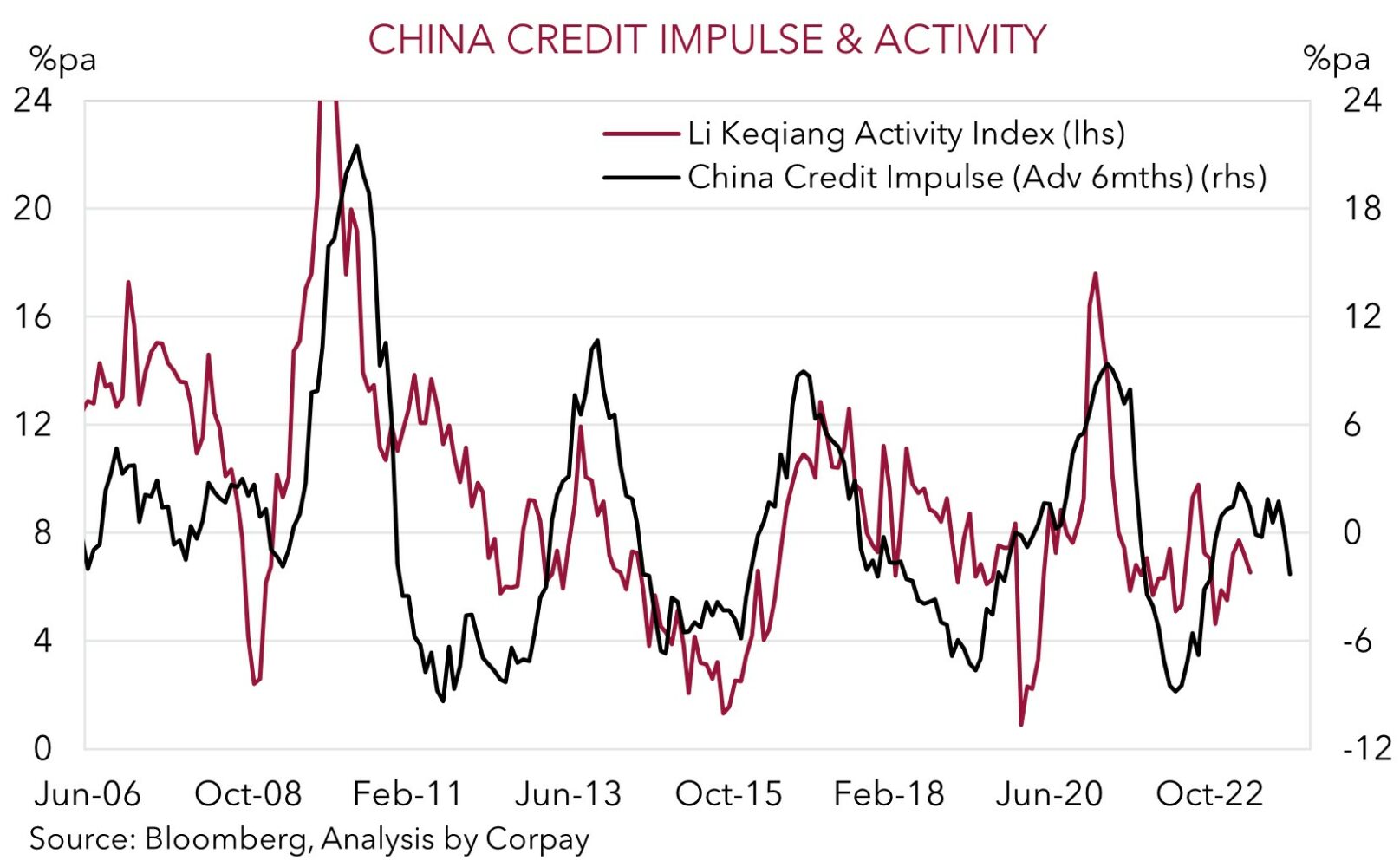

We think this weeks major global data/events should continue to support the USD. Based on the sluggish credit impulse, low consumer confidence, and global slowdown, we believe the China activity data batch (released Tuesday AEST) risks underwhelming. If realised, this could further dampen risk sentiment. By contrast, we expect Prime Day sales to have given US retail sales a boost (Tuesday 10:30pm AEST). In our view, solid US consumer spending combined with a bounce back in US housing and production data, and a message from the FOMC meeting minutes (Thursday 4am AEST) that policymakers are still open to raising rates and/or that rate cuts are some time away could generate a USD supportive upward repricing in US yields. The USD’s revival isn’t unusual for this time of the year. As noted before, the USD tends to be seasonally stronger in August, though trends have typically turned less favorable over Q4 (see Market Musings: History doesn’t repeat, but…).

Global event radar: China Activity Data (Tues), US Retail Sales (Tues), RBNZ Meeting (Weds), UK CPI (Weds), FOMC Minutes (Thurs), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The downward pressure on the AUD continued at the end of the last week. The stronger USD stemming from the higher than forecast US PPI data, rising bond yields, and shaky risk sentiment (see above) has pushed the AUD (now $0.6495) towards the bottom of its 2023 range. The AUD has also struggled on most crosses, with AUD/NZD (+0.3%, now ~1.0854) an exception.

As outlined above, we think the USD can remain firm over the near-term which in turn can keep the AUD on the backfoot. We believe the China activity data (Tuesday AEST) is at risk of undershooting consensus forecasts, while at the same time, US retail sales (Tuesday 10:30pm AEST), and the key US housing and production data (Wednesday night AEST) may come in better than anticipated. This, coupled with a relatively ‘hawkish’ sounding higher for longer mantra in the FOMC meeting minutes (Thursday 4am AEST) may shift relative yield differentials in favour of a stronger USD.

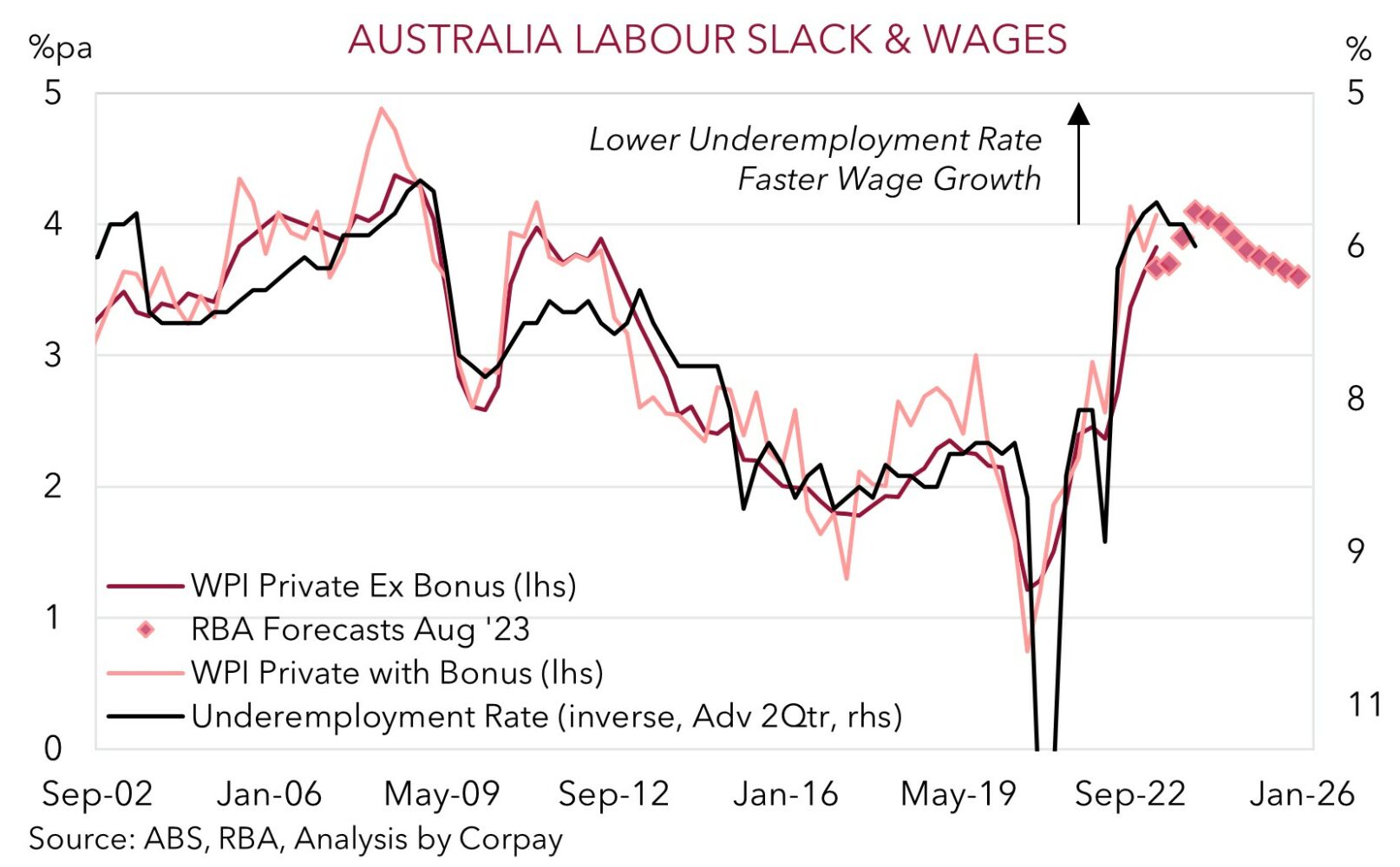

That said, as noted previously, while we don’t see the AUD springing back for a while yet, we also don’t want to be too downbeat around current levels. Fundamental supports such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should, in our opinion, continue to act as downside cushions (since 2015 the AUD has only traded sub ~$0.65 ~3% of trading days). And we think this weeks Australian Q2 wages (Tuesday AEST) and July jobs report (Thursday AEST) could generate some support for the beleaguered AUD on the crosses. A tick up in wage growth and/or still low unemployment may see markets question their assumption that the RBA rate hike cycle is over. In our judgement this may see the AUD claw back some lost ground against currencies like the EUR, GBP and JPY, while we see AUD/NZD continuing to grind up with the RBNZ expected to keep interest rates on hold once again and flag that further tightening is data dependent (Wednesday AEST). Over the medium-term, with seasonal trends set to become more positive for the AUD (and negative for the USD) later this year, and with CNH projected to strengthen on the back of more growth-friendly stimulus in China over the period ahead, we continue to forecast the AUD edging up into the low 0.70’s by mid-2024.

AUD event radar: AU Wages (Tues), China Activity Data (Tues), US Retail Sales (Tues), RBNZ Meeting (Weds), UK CPI (Weds), FOMC Minutes (Thurs), AU Jobs (Thurs), Japan CPI (Fri), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6403, 0.6480 / 0.6610, 0.6664

SGD corner

USD/SGD has continued to press higher with the negative risk sentiment, higher US bond yields, and stronger USD following the re-acceleration in US PPI inflation (see above) pushing the pair (now ~$1.3530) to within ~0.4% of its 2023 highs. On the crosses, EUR/SGD (now ~1.4804) has consolidated recent gains, while SGD/JPY (now ~107.12) is still historically high.

As outlined above, we think the USD can remain supported this week with the incoming US retail sales, housing, and production data at risk of exceeding consensus expectations. We also believe the FOMC meeting minutes could sound somewhat ‘hawkish’ with policymakers likely to keep their options open around further rate rises and/or push back on the idea that rate cuts could occur any time soon. This, in combination with sluggish activity data out of China, could see USD/SGD edge even higher, in our opinion.

SGD event radar: China Activity Data (Tues), US Retail Sales (Tues), UK CPI (Weds), FOMC Minutes (Thurs), Japan CPI (Fri), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3385, 1.3417 / 1.3560, 1.3590