• US CPI. The July report was largely as expected. But the rebound in commodity prices, particularly oil, points to higher US inflation over coming months.

• Bond yields. US yields rose post the data following a lackluster bond auction. This dampened risk sentiment & supported the USD later in the day.

• AUD sluggish. AUD/USD remains near the bottom of its ~2-month range. Outgoing RBA Governor Lowe gives his last Parliamentary Testimony today.

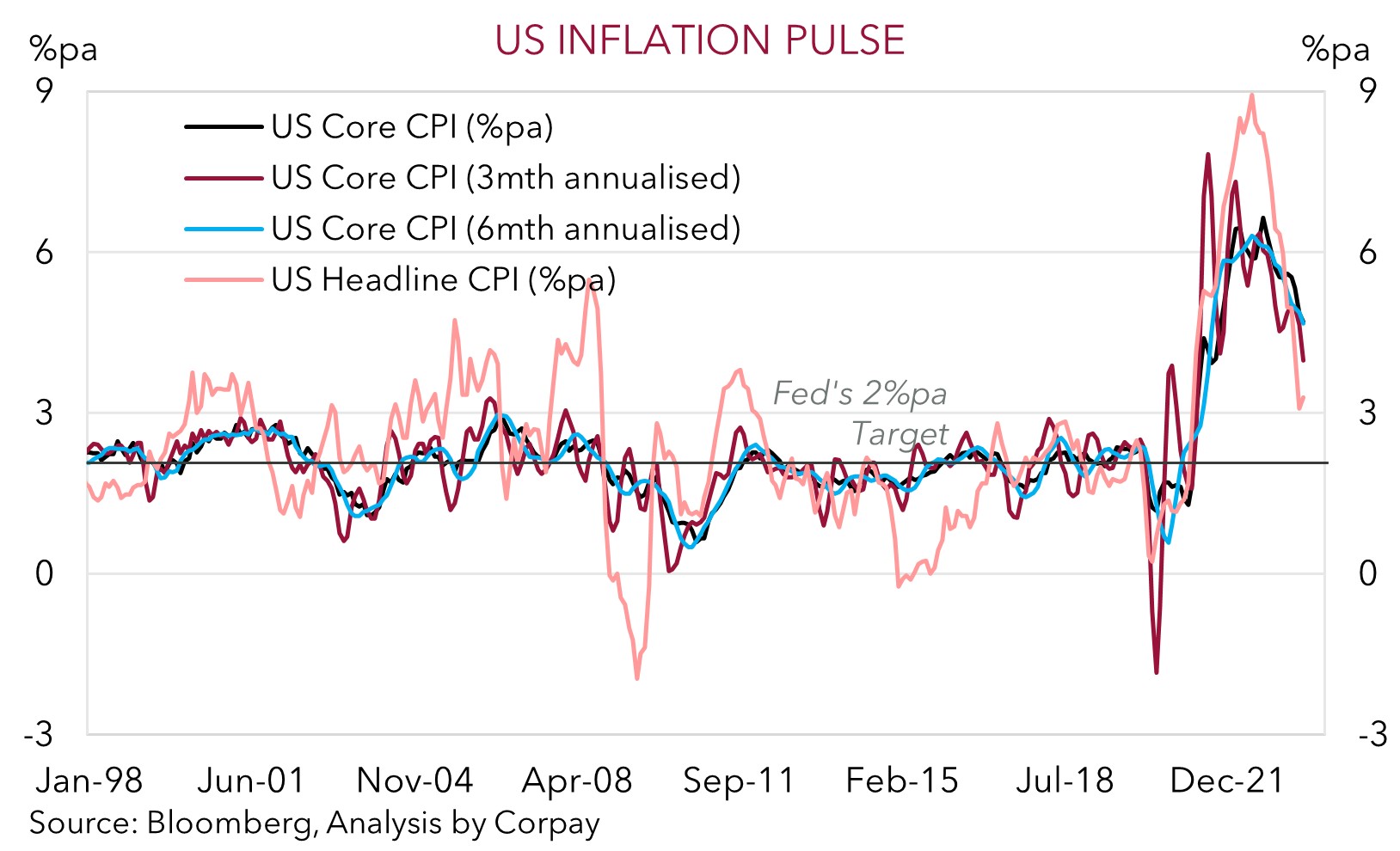

The keenly anticipated US CPI report was released overnight, and while markets initially breathed a sigh of relief bond market gyrations later in the session unnerved investors. In terms of the data, US inflation printed close to expectations, with both headline and core (ex food and energy) CPI rising by ~0.2% in July. As a result, annual headline inflation ticked back up to 3.2%pa, while core inflation nudged down to a still uncomfortably high 4.7%pa. A closer look at the detail shows that the unwinding of supply-chain disruptions coupled with reduced demand continues to weigh on ‘goods’ prices. But at the same time, although ‘services’ inflation is easing it remains a slow process due to the stickiness in areas like rents and robust wage growth. Indeed, had it not been for another unusually large fall in airfares in July (-8%), services and/or core inflation may have exceeded expectations.

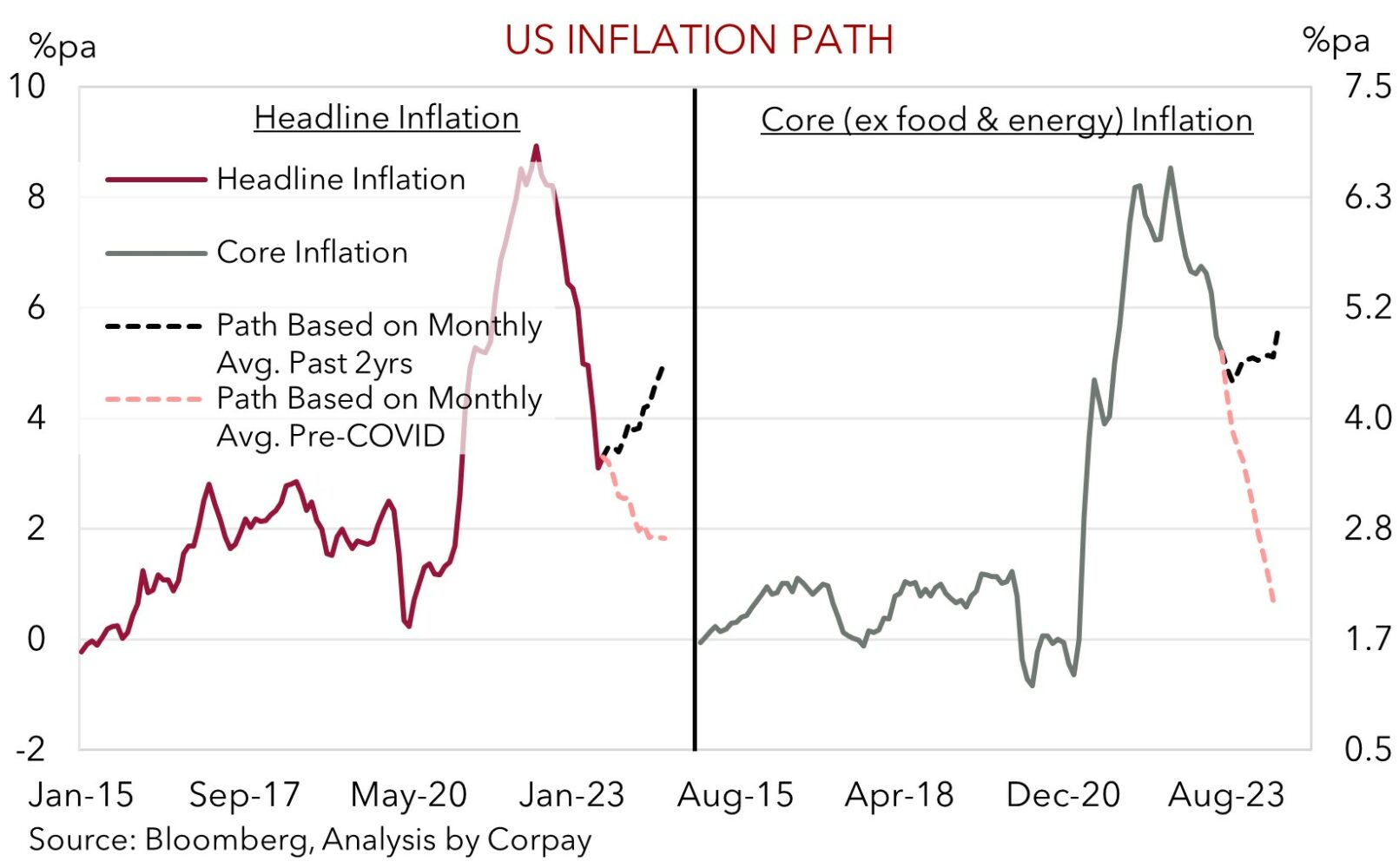

In our mind, an unwind of the drop in airfares combined with the rebound in commodity prices, particularly oil, points to an acceleration in US inflation over August/September. As our second chart below shows, we are now at an interesting inflation inflection point where the ‘easy wins’ stemming from base-effects are behind us. And while the July CPI report supports the case for the US Fed to ‘skip’ a rate hike at the September meeting, a renewed upswing in inflation, particularly if it were to bleed into inflation expectations, could see policymakers keep their options open for another move later in the year, or at the very least continue to stress that rate cuts are a long way away. This was the general message from Fed member Daly post the US CPI data.

Across markets, the initial rally in US equities, dip in US bond yields, and weaker USD in the wake of the CPI release wasn’t sustained. The S&P500 ended the day flat, with the rebound in US yields, particularly at the long end of the curve (10yr +10bps to 4.11%) following a lackluster bond auction, the catalyst. The US’ persistently large budget deficits means there is a lot of bond supply that needs to be absorbed, and higher yields may be needed to entice fatigued buyers. In FX, the lift in US yields gave the USD renewed support. EUR slipped back down towards ~$1.0980 and USD/JPY pushed above 144.50 for the first time in a month. After spiking higher post the US CPI, the AUD fell back and at ~$0.6517 is lower than this time yesterday.

Tonight, US Producer Price Inflation (10:30pm AEST) and University of Michigan sentiment (12am AEST) are released. While PPI growth should cool, we think markets could be more attuned to the confidence gauge, especially the inflation expectations components. In our view, an unexpected lift in inflation expectations could be another USD supportive reminder that the US Fed’s work still isn’t done.

Global event radar: China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD endured some volatility overnight. The initial knee-jerk gains following the largely as anticipated US CPI report more than unwound as the USD tracked US bond yields higher in the wake of the sub-par US bond auction (see above). On net, at ~$0.6517 AUD/USD is a bit lower compared to this time yesterday. On the crosses, while the AUD managed to claw back some ground against the JPY (+0.5%), GBP (+0.2%) and NZD (+0.3%), AUD/EUR (now ~0.5936, -0.2%) remains near its lowest level since mid-2020.

As discussed above, although the July US CPI report supports the case for the US Fed to hold fire at the late-September meeting, the potential re-acceleration in inflation over coming months is likely to keep the door open to further action later in the year, in our opinion. We believe this, the unfolding step down in global industrial activity, and slowing in Australia’s growth pulse on the back of the large jump up in mortgage costs, could keep the AUD pinned down for a while yet. In today’s Asian session, outgoing RBA Governor Lowe gives his last Parliamentary Testimony (from 9:30am AEST). While we think that Governor Lowe and Deputy Governor Bullock should reiterate that some further tightening may be needed, this is ‘soft’ conditional guidance with further action data dependent. In our view, the RBA’s focus on trying to preserve as many of the COVID-era job gains as possible and ‘natural’ tightening in conditions generated by the refinancing of cheap fixed rate loans, points to no further RBA rate rises this cycle.

However, as noted previously, while we don’t see the AUD springing back for a while, we also don’t want to be bearish down around current levels. We expect fundamental supports such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade to act as downside cushions. Since 2015, when these forces kicked into gear, the AUD has only traded sub-$0.6550 ~4% of the time. With seasonal trends set to become more positive for the AUD (and negative for the USD) later this year (see Market Musings: History doesn’t repeat, but…), and with CNH projected to strengthen on the back of more growth-friendly stimulus in China, we continue to forecast the AUD grinding up into the low 0.70’s by mid-2024.

AUD event radar: AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6403, 0.6500 / 0.6610, 0.6664

SGD corner

While there was a bit of intra-day volatility around the US CPI release, on net, USD/SGD has extended its move higher with the USD boosted by the upswing in US yields following the tepid bond auction (see above). At ~$1.3490 USD/SGD is near a ~1-month high. On the crosses EUR/SGD (~1.4820) is within striking distance of its mid-July cyclical highs, while SGD/JPY (now ~107.33) is within a whisker of its historic peak.

As outlined, while the July US CPI report adds to the case for the US Fed to hold firm at the late-September meeting, the potential jump in US inflation over the next few months as higher commodity prices flow through the calculations could unnerve markets and/or see policymakers keep the door open to further action down the track. In our opinion, this, combined with higher US yields due to greater bond supply and the ongoing slowdown in global industrial activity as tighter global monetary conditions continue to bite is likely to keep USD/SGD supported over the near-term.

SGD event radar: China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3300, 1.3380 / 1.3510, 1.3590