• Jittery markets. Higher oil & gas prices have raised some concerns inflation could re-accelerate over coming months. US equities slipped back.

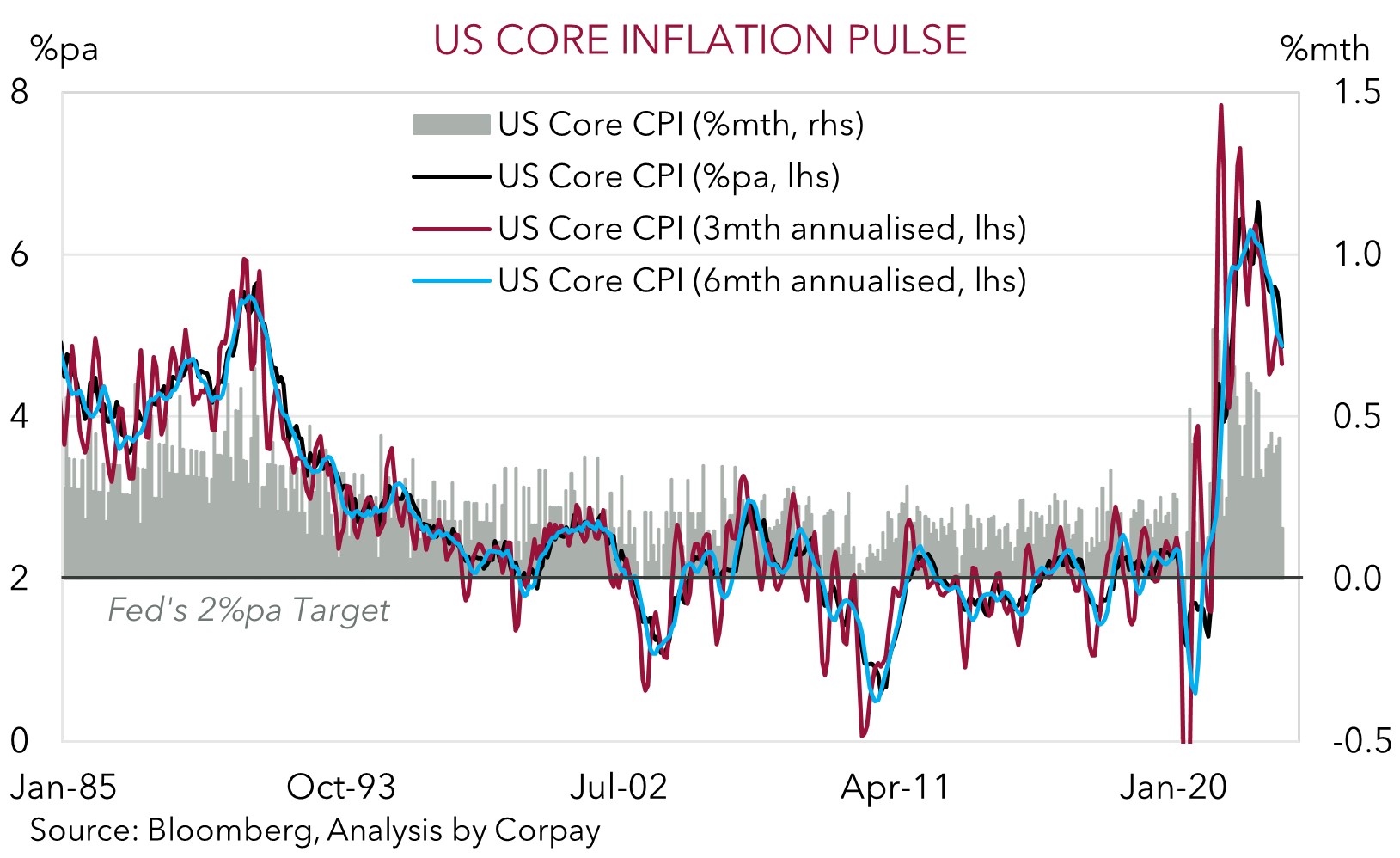

• US CPI. Focus is on tonight’s US inflation data. Base-effects have run their course. Inflation may start to surprise ‘optimistic’ markets.

• AUD sluggish. AUD/USD hovering near the bottom end of its ~2-month range. The weakness (so far) in August is inline with the seasonal pattern.

Markets remain somewhat jittery ahead of the release of the July US CPI report (10:30pm AEST), and with higher commodity prices fanning concerns of a re-acceleration in inflation down the track. Brent crude oil rose another 1.4% taking its rally from its late-June low to ~22%. Signs of tightening supply are boosting oil prices. European natural gas prices also leapt higher (+29% overnight) on news of potential industrial action in Australia which would disrupt global supply. The inflation worries weighed on US equities (S&P500 -0.7%) with the tech-focused NASDAQ underperforming (-1.2%). Across other markets, the US yield curve flattened with shorter-dated yields rising (2-year +6bps to 4.81%) and long-end yields treading water (10-year -1bps to 4%). FX markets held steady. The USD Index has tracked sideways with EUR hovering around ~$1.0975 and USD/JPY (now ~143.70) ticking up inline with the lift in US 2-year yields. The AUD is holding down near the bottom end of its ~2-month range (now ~$0.6529).

Data released yesterday showed that unlike the other major economies China doesn’t have an inflation problem. Rather deflation is an issue. Consumer and producer prices both fell in the year to July. Annual CPI inflation (-0.3%pa) had its first decline since early 2021, while producer prices went backwards for the 10th straight month (-4.4%pa). The data, combined with contracting imports (-12.4%pa in July) and sluggish retail sales, are signs of weak consumer demand. This, in our view, reinforces the case for policymakers to step up their policy support. Based on the China’s high youth unemployment and low consumer confidence, we continue to think that stimulus measures will be skewed towards bolstering labour-intensive consumption growth.

Market attention will be on tonight’s US CPI data (10:30pm AEST). Weekly initial jobless claims are also released. As discussed previously, we are now at a trickier phase with the sharp mechanical deceleration in US inflation behind us. The ‘easy wins’ from base-effects as last years large price rises washed through the calculations have come to an end. Consensus is looking for US headline inflation to re-accelerate from 3%pa to 3.3%pa, with core inflation remaining firm at a well above target ~4.7%pa. In our view, markets, which have been quick to latch on to the ‘soft landing’ narrative, appear complacent to renewed upside US inflation surprises over the next few months on the back of the upswing in commodities and still robust wage growth. We believe signs that inflation is ‘sticky’ could rattle market nerves and/or provide the USD with some further short-term support.

Global event radar: US CPI (Tonight), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD has consolidated over the past 24hrs down near the bottom end of its ~2-month range (now ~$0.6529). The still firm USD and jittery risk sentiment remain AUD headwinds (see above). On the crosses, AUD/EUR (now ~0.5950) is tracking around its lowest level since mid-2020, while AUD/GBP (now ~0.5135) is near the bottom of the range it has occupied since April 2020. AUD/NZD remains sub-1.08, with AUD/CNH (now ~4.72) close to its 1-year average.

Markets have a laser-like focus on tonight’s US CPI report (10:30pm AEST). As outlined above and earlier this week, US inflation is now at an interesting inflection point with base-effects no longer as helpful to bring down annual rates. Last year’s big price increases have now washed through the calculations. Given the rebound in a range of commodity prices, particularly oil, and still solid US wage growth, we think US inflation risks coming in above market expectations. Based on the markets ‘soft landing’ assumptions we believe a positive inflation surprise could dampen risk sentiment and help the USD, particularly against cyclical currencies like the AUD.

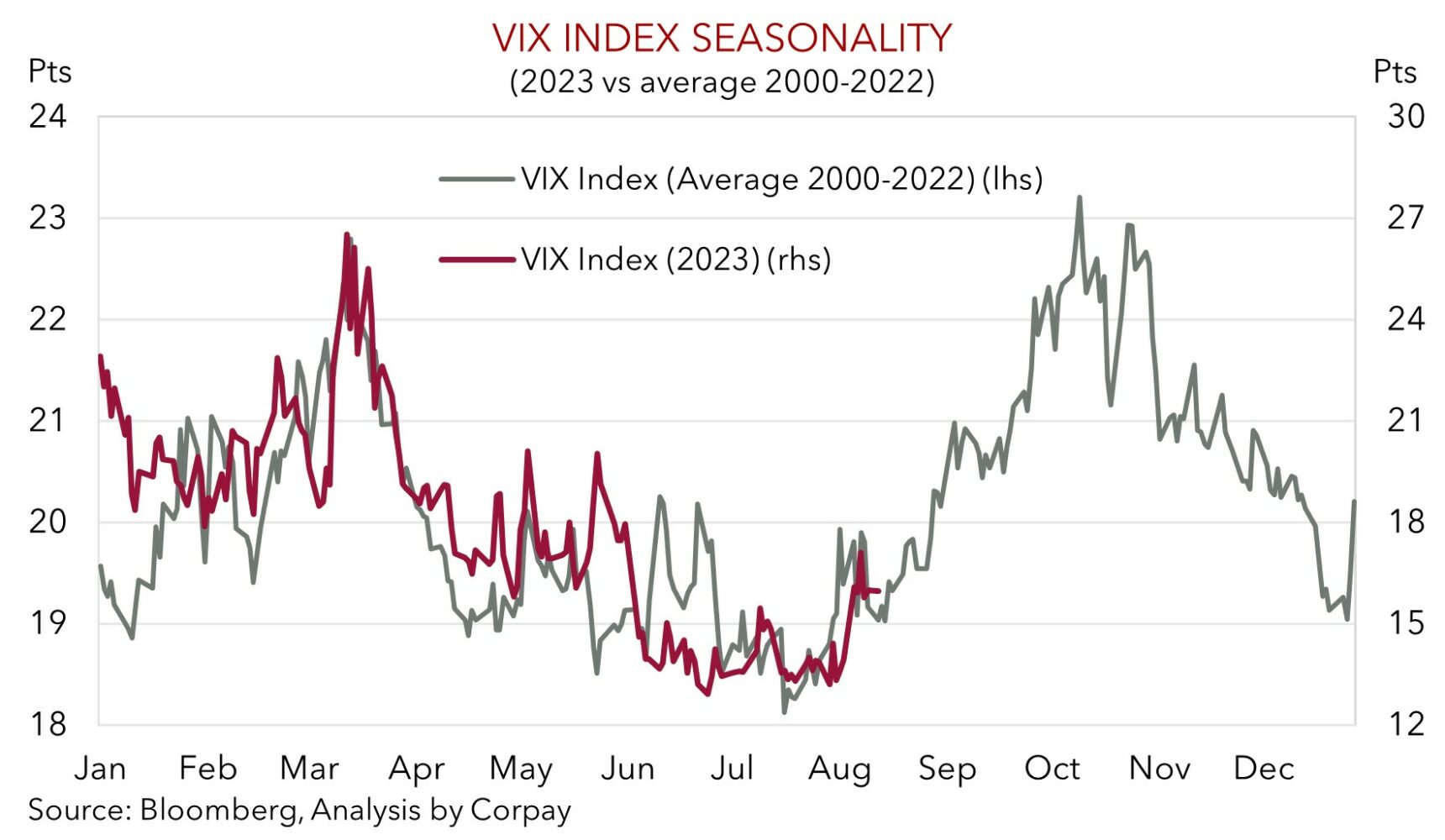

The AUD’s weakness (so far) in August is not out of the norm. Our analysis of the seasonal performance of the major currencies and other key financial markets finds that the recent market turbulence, USD revival, and AUD underperformance are broadly in line with the pattern for this time of the year (see Market Musings: History doesn’t repeat, but…). As discussed, swings in things like Chinese steel production, Australia’s trade flows, iron ore/base metal demand, CNH/Asian currencies, and risk sentiment/higher volatility, often coincide with a softer AUD over August/September. 2023 is proving to be no different. In our judgement the AUD’s rough ride may extend a while longer. However, after a few more tricky months where we expect the AUD to continue to be pushed and pulled by the support afforded from Australia’s current account surplus (~1.4% of GDP) and the high level of the terms-of-trade, and the headwinds created by the step down in global growth, we continue to forecast the AUD to grind back up into the low 0.70’s by early-2024. Seasonal trends should become more AUD positive (and negative for the USD) later this year, while the projected rebound in the CNH on the back of more growth-friendly stimulus in China is also expected to drag the AUD higher.

AUD event radar: US CPI (Tonight), AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6403, 0.6500 / 0.6610, 0.6664

SGD corner

USD/SGD has extended its grind higher over the past few days, with the firm USD and shaky risk sentiment factors at play (see above). At ~$1.3460 USD/SGD is near a ~1-month high, with the pair pushing above its 200-day moving average. On the crosses EUR/SGD (~1.4780) is within 1% of its cyclical peak, while SGD/JPY (now ~106.70) remains at a historically high level.

As outlined above, focus will be on tonight’s US CPI inflation data. US inflation has slowed meaningfully over the past few months as last year’s big price increases dropped out of annual calculations. But this has largely run its course. With base-effects now more difficult to overcome and with wages still quite strong, we think US inflation could surprise vulnerable markets. In our opinion, ‘sticky’ US inflation could see markets add to their near-term US Fed rate rise bets, and/or push out future rate cut expectations. This could give USD/SGD an additional kick along, in our opinion.

SGD event radar: US CPI (Tonight), China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3300, 1.3380 / 1.3510, 1.3590