Republican Donald Trump has defeated Democrat Kamala Harris to secure a second term as US president. His triumph, called just after 5:45 eastern time this morning by news outlets including the Associated Press, ABC, CNN, and the New York Times, could usher in a new wave of US protectionism, mark a shift toward an “America First” foreign policy stance, and end a period of relative calm in foreign exchange markets.

Republicans also took majority control of the Senate, and look* set to retain the House of Representatives, handing Trump the power to enact a wide-ranging and radical policy agenda. He has pledged to act quickly to cut taxes across a wide range of income types, tighten immigration controls and deport undocumented workers, and raise tariffs substantially against China and most other US trading partners.

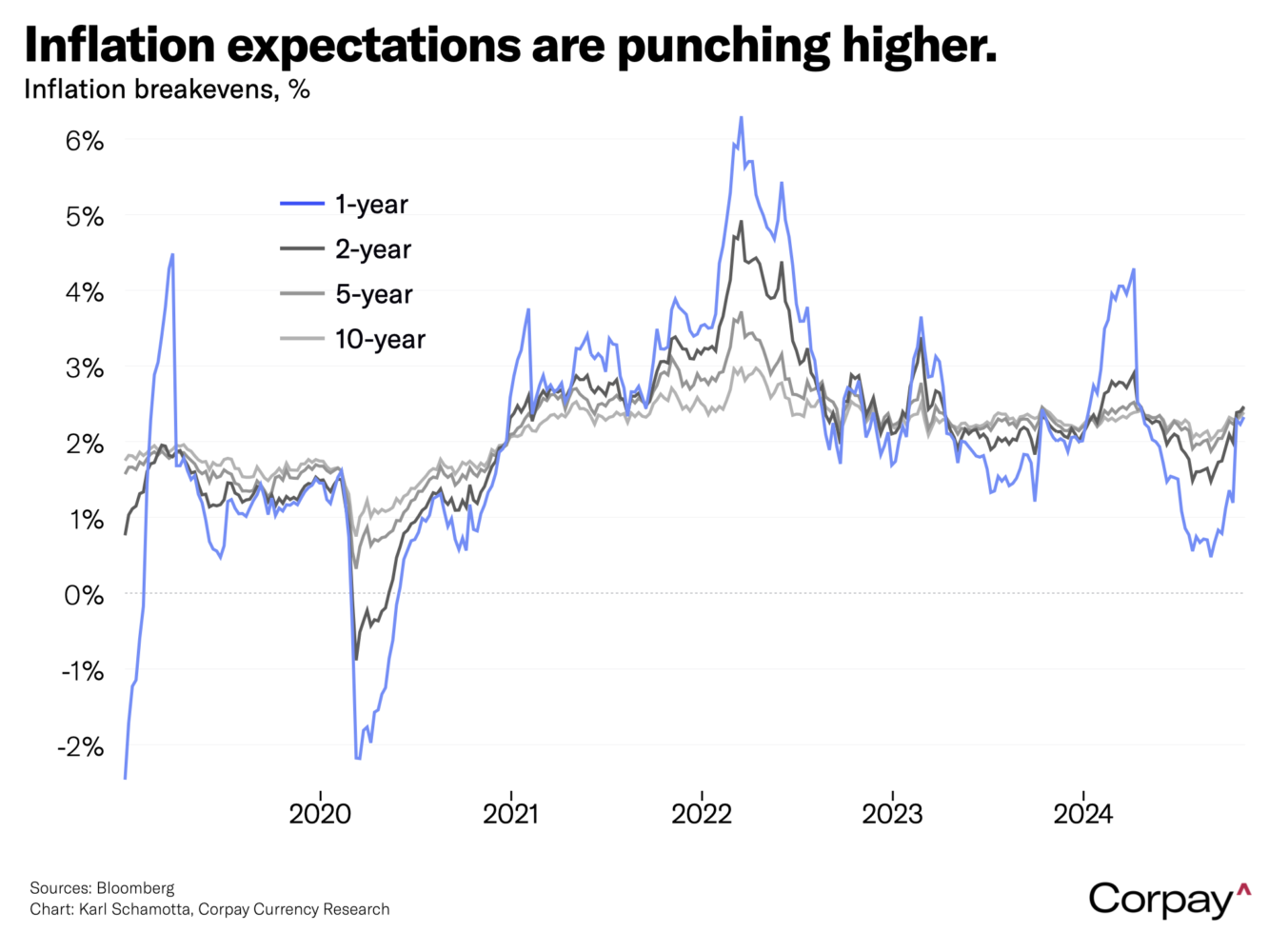

Financial markets, responding to an improved growth outlook while remaining wary of the fiscal and inflationary implications, have doubled down on key elements of the “Trump trade”. Inflation breakevens are trading at the highest levels since April, and ten-year Treasury yields – a benchmark for global borrowing costs – are up almost 20 basis points to 4.45 percent. North American equity futures are setting up for substantial gains at the open, Tesla shares are higher, and Bitcoin is trading in record territory.

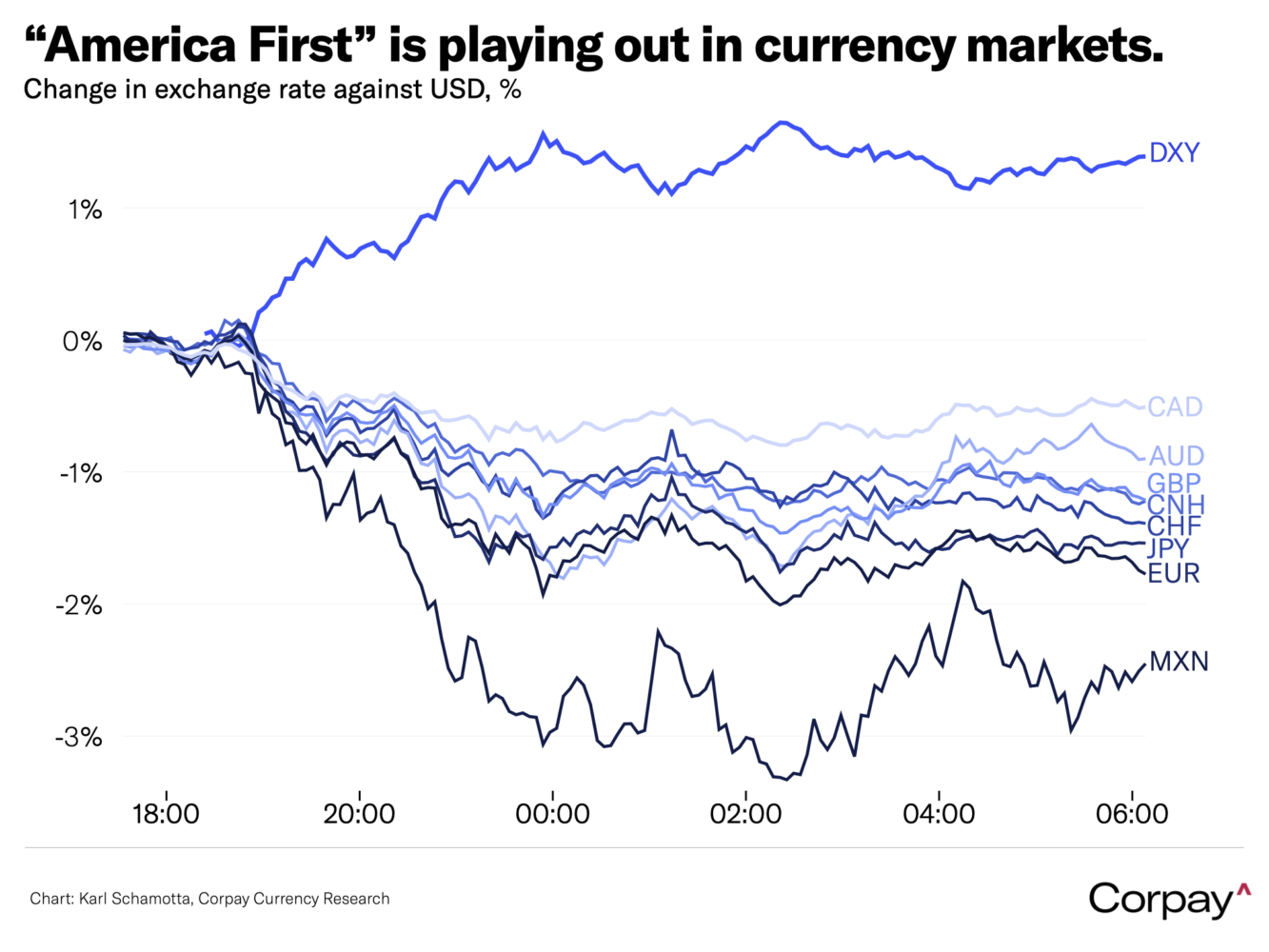

Exchange rate movements have been more nuanced, with widening interest differentials generally exerting more influence than direct trade exposures in determining spot market performance levels across most majors. The Canadian dollar – extremely vulnerable to tariffs but also blessed with a sympathetic yield curve and a defensive posture ahead of the election – is down just a little over half a percent, while the British pound, offshore Chinese renminbi, Swiss franc, Japanese yen, and euro are all around 1.5 to 2 percent weaker. The Mexican peso is trading more than 3 percent lower, reflecting its clear vulnerability to an immigration clampdown and overturning of long-standing trade agreements with the United States.

Volatility expectations in foreign exchange markets will probably remain elevated for several days as traders work to assess the likely trajectory of US policy under Trump’s leadership, but may begin to slip as a range of somewhat-benign scenarios are priced in.

This could prove to be a mistake. If Republican control over all three branches of government is confirmed in the coming days, Trump will have the latitude to overturn the worldwide financial and economic order in ways arguably not equalled since the ‘Nixon shock’ of 1971. Whether the policy changes outlined by him and his associates are justified or not, we suspect that global economic policy uncertainty levels should ratchet substantially higher – and underlying volatility assumptions in currency markets should do the same.

*As we went to print, a Democratic flip remained possible, but was considered unlikely.