The dollar is holding steady, Treasury yields are inching higher, and equity indices are setting up for a positive open as the world’s worst reality show enters its final act. Elements of the ‘Trump trade’ are recovering after yesterday’s selloff, with many investors back to betting on the former president after the weekend’s polls suggested that markets were underestimating Kamala Harris’ electoral chances.

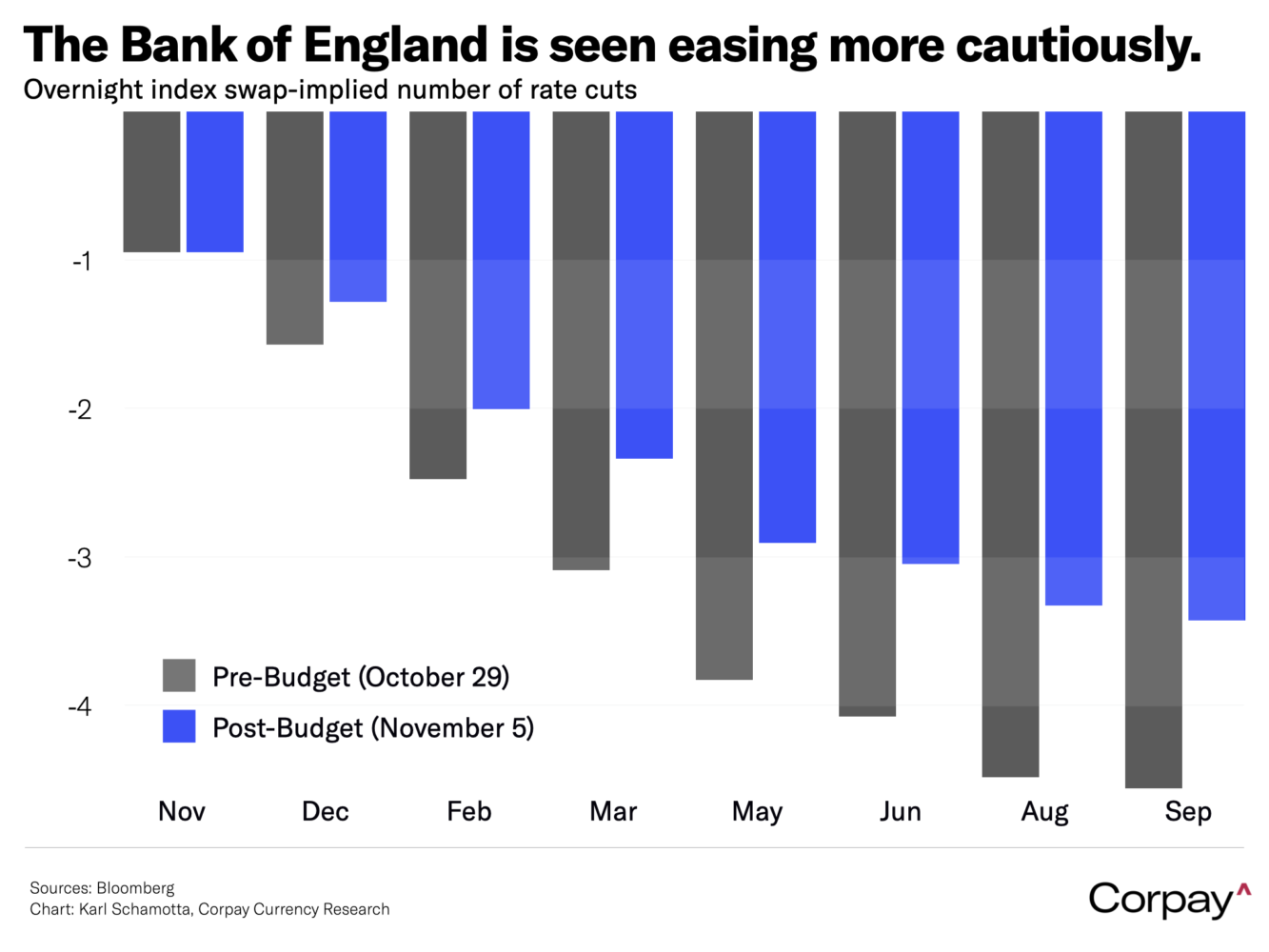

There are other event risks to consider. The Bank of England is expected to deliver another quarter-point rate cut on Thursday morning, with traders paying particular attention to how policymakers describe the impact of last week’s budget announcement. Later that afternoon, the Federal Reserve will almost certainly follow up with a quarter-point move of its own, slowing the pace of easing in response to a series of stronger-than-anticipated economic data releases, while maintaining a “balanced” view on the risk outlook. Statistics Canada will provide its latest jobs market numbers on Friday morning, helping investors calibrate expectations for the December Bank of Canada meeting – but traders will remain wary, given that another inflation report, and one more employment update are scheduled to land prior to the decision.

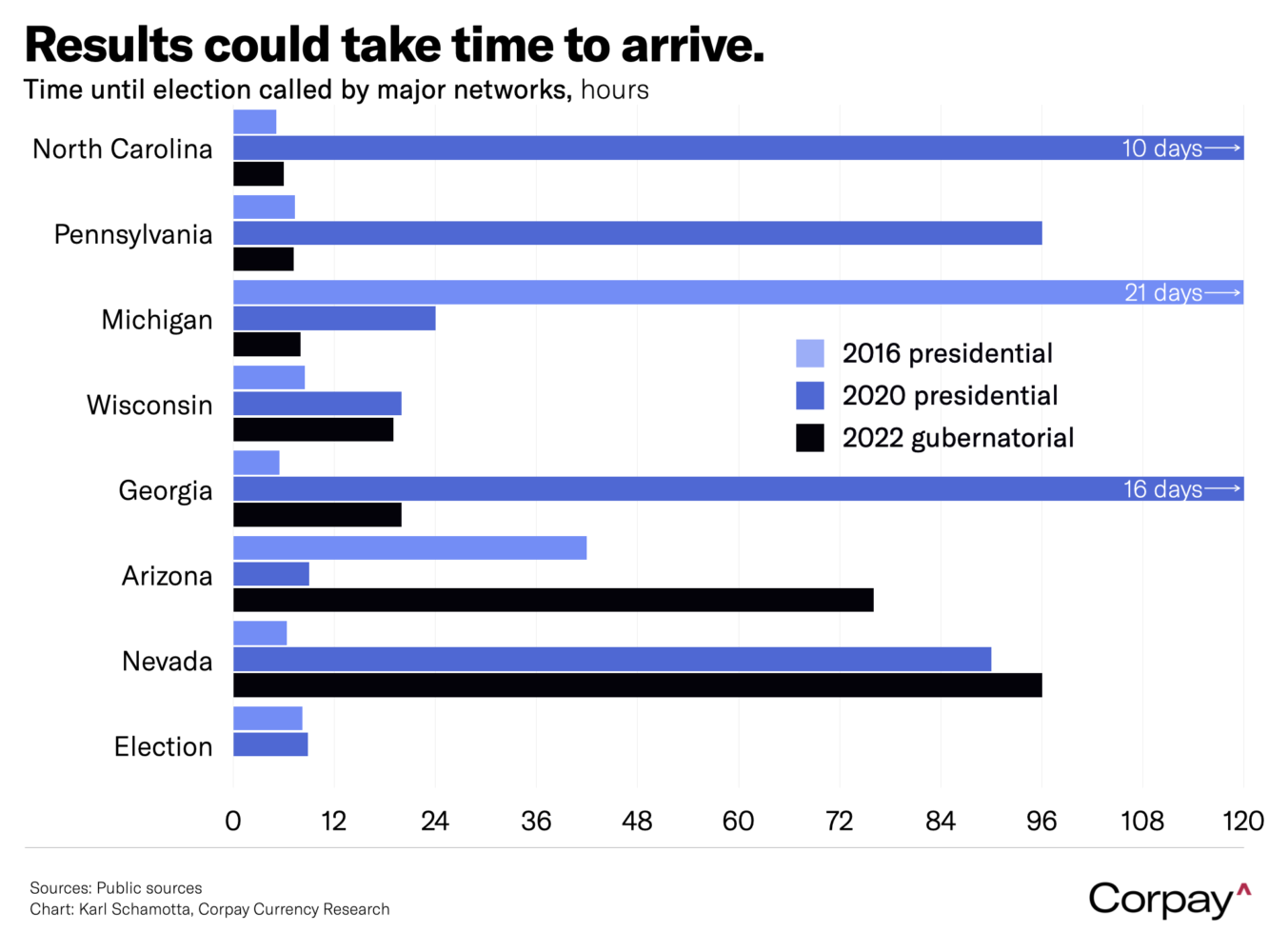

The US election nonetheless remains the dominant theme in markets. Polls will begin closing at 6 o’clock this evening, and networks will begin calling individual states in the hours afterward, but clarity on the election’s direction isn’t likely to come until early tomorrow morning, at the earliest. Swing states like Georgia, Michigan, North Carolina, and Wisconsin are set up to count quickly this year, and could be called shortly after midnight, but Arizona, Nevada, and Pennsylvania could take longer, potentially taking days to arrive at a result if races are tight. Kalshi, a prediction market, is offering one-in-six odds on the Associated Press not calling the election before Thursday.

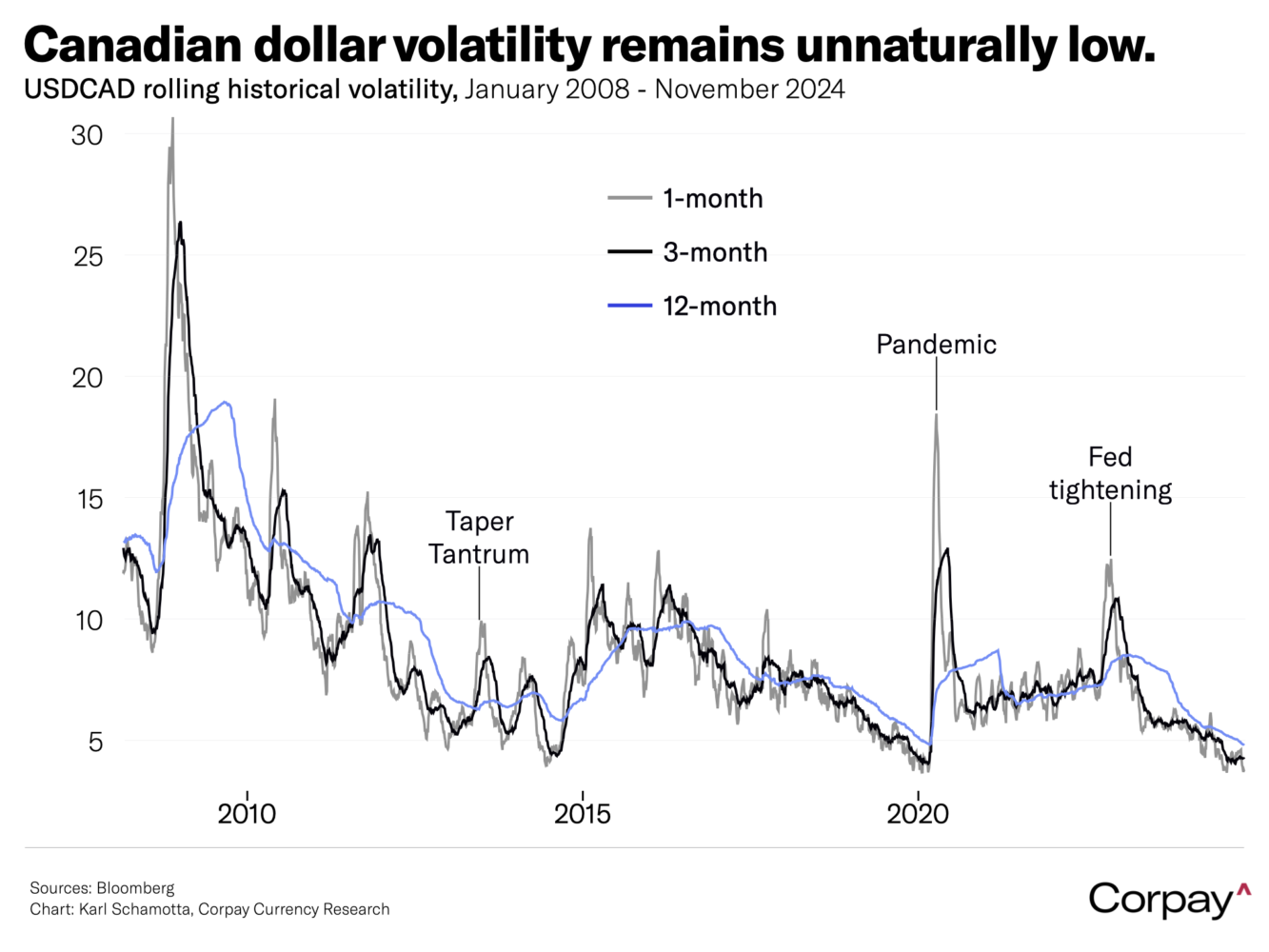

Currency markets could enter a dangerous state of limbo. Spot market liquidity will remain thin, interbank dealers might limit selling of short-dated options in highly-sensitive currencies, and price action could be jumpy as traders react to the rumours that tend to fly fast and furious on election night.

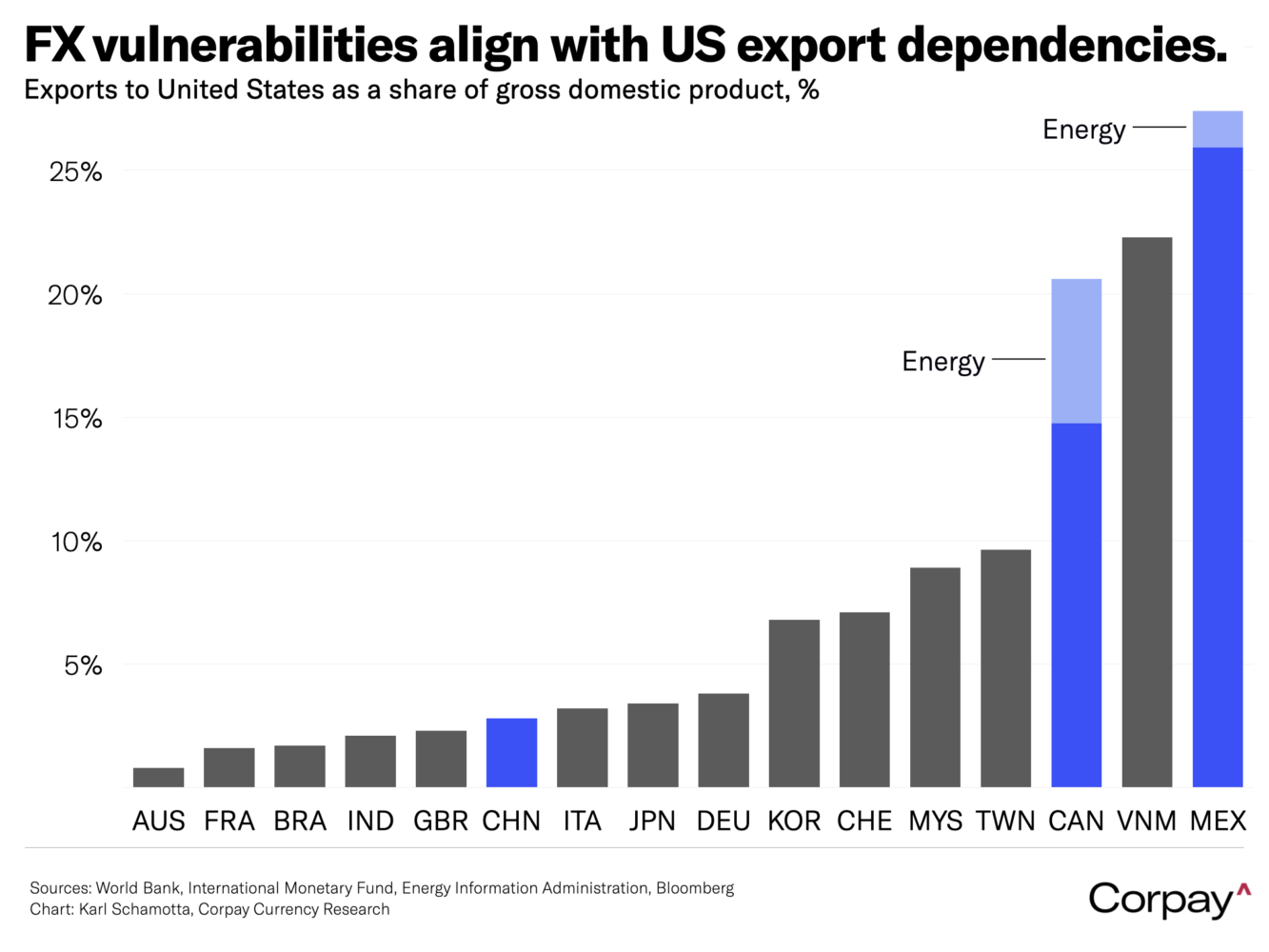

But big moves are likely once the underlying momentum becomes clear. As outlined in yesterday’s missive, we expect the biggest rate adjustments to hit in currencies with significant export sensitivities to US demand, with the Mexican peso, Chinese yuan, and Canadian dollar seemingly the most exposed to volatility – particularly in the event of a Republican sweep of the Oval Office and both houses of Congress.

Mexico’s vulnerabilities are clear, but the peso’s losses should face limits. The bulk of the country’s exports go to the United States, and the country relies on substantial remittance flows from Mexicans working north of the Rio Grande, meaning that a significant share of gross domestic product could take a hit if Donald Trump follows through on yesterday’s threat to stop immigration and apply tariffs against the country’s products. A five-to-eight percent plunge in the peso can’t be ruled out, but this isn’t Banxico’s first rodeo – after Trump was elected in 2016, the central bank stepped into markets to defend the exchange rate, and demonstrated a willingness to keep interest rates well above their US equivalents for a prolonged period of time, helping stem the bleeding. We think a knee-jerk move down could lose momentum fairly quickly.

China is also a complex case. The country’s exchange rate is, to all intents and purposes, stage-managed by the People’s Bank of China to achieve domestic policy objectives. A sharp increase in selling pressure on the yuan is likely to be met by a slow-walking process from authorities and their allies in the state-controlled banking system, minimising the extent to which the currency drops over the short term. Beyond that, with the government expected to step up its stimulus efforts between now and December, there are good reasons to suspect that offsetting pressure could come from investors before the 7.30 threshold is breached.

We think the Canadian dollar will suffer a fairly-substantial circa-3-percent hit if a “red sweep” scenario plays out. This could trigger a sharp spike in volatility – the currency has been remarkably stable for a remarkably long time – but might also reverse over time as the Bank of Canada slows its rate-cutting trajectory and the true shape of Donald Trump’s protectionist agenda becomes clear. The country is heavily exposed from a nominal export perspective, but when energy shipments – which are likely to enjoy exclusions – are removed, vulnerabilities are proportionally smaller.