- Limited moves. A quiet start to the week with the US celebrating President’s Day. The data calendar heats up over coming sessions.

- USD holding. Positive US data later this week and ‘hawkish’ Fed speak should keep US yields elevated and be USD supportive.

- AUD firmer. No news is good news with the AUD up slightly. RBA minutes released today, with wages data due tomorrow.

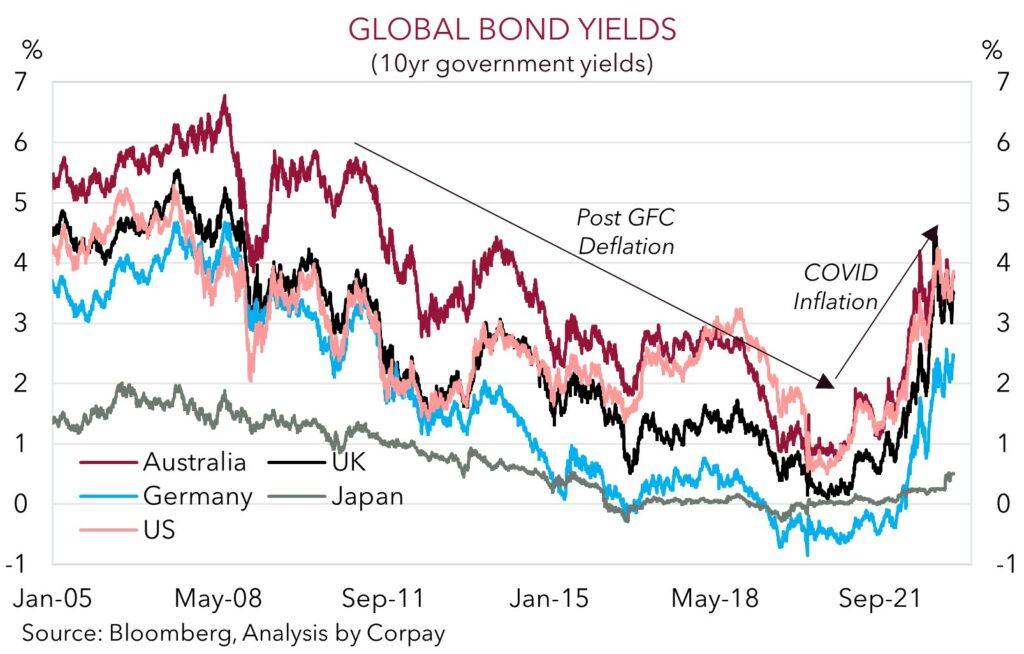

Unsurprisingly, with the US President’s Day holiday and no major news across the other regions, it has been a quiet start to the week. European equities eased back slightly, tracking the modest falls in US S&P500 futures (now -0.3%) with the US Fed’s higher-for-longer interest rate outlook continuing to sink in. European bond yields ticked up 2-5bps across their respective curves, with some ‘hawkish’ comments from the ECB’s Rehn playing a role. According to Rehn inflation is “excessively high”, further rate hikes by the ECB beyond March seem “logical”, and the bank shouldn’t rush to start discussing rate cuts. The German 10-year yield is now 2.46%, just below its highest level since mid-2011. A little over a year ago the German 10-year yield was in negative territory. In FX the USD has consolidated, with EUR holding below 1.07 and USD/JPY still up above 134. The AUD edged modestly higher to be a touch over 0.69, with yesterday’s strong lift in the Chinese equity market providing some support.

The global data calendar heats up over the next few days. Tonight, the European and US PMIs for February are released. Month-on-month improvement is expected across the manufacturing and services sectors. Stronger European PMIs may give the EUR a bit of an intra-day lift as relatively brighter economic prospects are factored in. That said, we don’t expect the data to change the underlying trends that are driving markets currently. The focus remains on the US, and in particular the outlook for US interest rates. There are several US data points, Fed speakers and the minutes of the last FOMC meeting scattered over the rest of the week. In our view, a positive run of US data (PMIs, existing home sales, personal income and spending, PCE inflation), combined with comments in the FOMC minutes and by Fed speakers reiterating the US central bank still has more work to do to be sure inflation is on a path back down to target and/or that an easing cycle isn’t likely any time soon, can keep US interest rate expectations elevated and be USD supportive.

Global event radar: Eurozone PMIs (tonight), FOMC Meeting Minutes (23rd Feb), China PMIs (1st Mar), Eurozone CPI Inflation (2nd Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), US FOMC Meeting (23rd Mar).

AUD corner

AUD has nudged back above 0.69 and outperformed on the crosses during the quiet start to the week, with yesterday’s large lift in Chinese equities (the CSI300 rose ~2.5%) providing a slight tailwind. Based on the upcoming data/event calendar we think the AUD could follow a similar pattern to the past few weeks, with domestic factors overshadowed by global forces as the week rolls on.

Today, the minutes of the February RBA meeting are released (11:30am). Given the release of the detailed Statement on Monetary Policy, and multiple Parliamentary appearances by Governor Lowe last week we doubt the minutes will contain any fresh insights. That said, the core message that to combat inflation interest rates look set to go higher in the near-term should be repeated. These short-term rate hike expectations should be reinforced by tomorrow’s wages data, with annual growth predicted to quicken to its fastest pace since 2012. While this should be AUD supportive, as discussed above, in our opinion the run of US data and Fed commentary over coming days could solidify the upswing in US interest rates. Based on recent trends this could dampen risk sentiment, boost the USD, and exert some renewed downward pressure on the AUD.

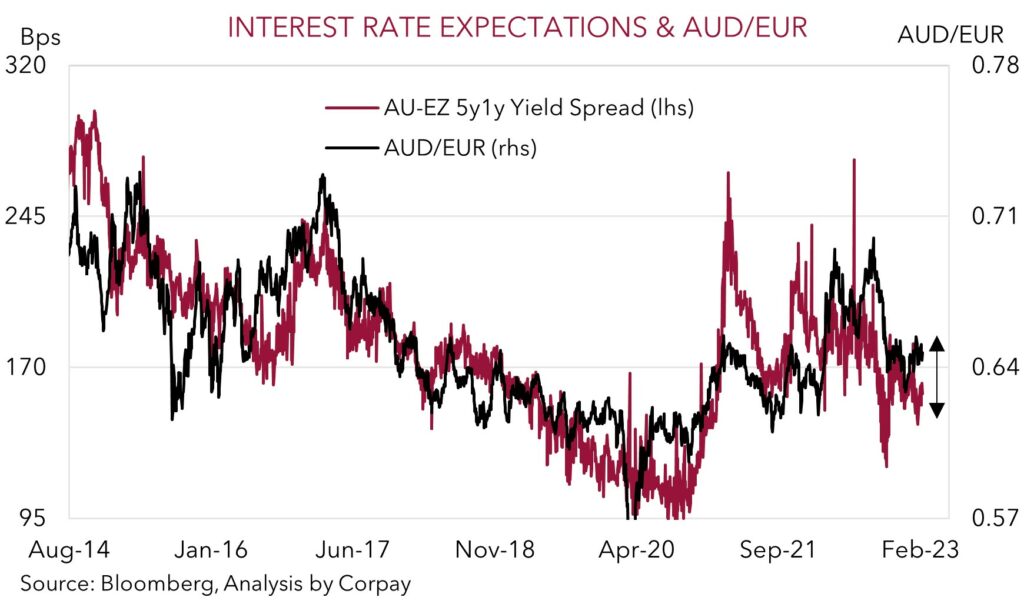

On the crosses, AUD/EUR has edged back above its 100-day moving average (0.6441). We think the evolving fundamental backdrop should mean any moves above 0.65-0.66 aren’t sustainable, and we see AUD/EUR edging down towards 0.60-0.62 over coming months. On the growth-front, measures put in place across the Eurozone to counteract the squeeze on the private sector from the energy crisis has unwound a lot of the acute downside growth fears. Positive European PMI data, released tonight, would be another sign the outlook is improving. At the same time, ongoing rate hikes by the RBA are raising the odds of a sharper domestic slowdown given the cashflow hit to the indebted household sector. Similarly, relative yield differentials, which in our mind, are already pointing to a lower AUD/EUR (see chart below), may become relatively more supportive for the EUR. We think the ECB is more likely to cyrstalise the markets lofty interest rate expectations than the RBA given the local economies heightened sensitivity to rate changes.

AUD event radar: AU Wages (tomorrow), RBNZ Meeting (tomorrow), AU Retail Sales (28th Feb), AU GDP (1st Mar), China PMIs (1st Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6711, 0.6805 / 0.6980, 0.7050

SGD corner

Steady as she goes for USD/SGD with the pair holding around 1.3350 over the past 24-hours. USD/SGD remains ~2.5% above its early-February cyclical low, with the uptrend in US bond yields underpinning the USD.

Our view remains that near-term pullbacks in the USD, and USD/SGD, should be limited, with the 50-day moving average (1.3327) providing support. After the US President’s Day holiday, the economic calendar picks up over upcoming sessions. Based on recent trends, we think a run of positive US data (PMIs, existing home sales, personal income and spending, PCE inflation), and comments in the FOMC minutes and by Fed speakers reiterating there is still more to do to win the battle against inflation should keep US interest rate expectations and the USD near recent highs.

SGD event radar: Eurozone PMIs (tonight), FOMC Meeting Minutes (23rd Feb), Singapore CPI (23rd Feb), China PMIs (1st Mar), Eurozone CPI Inflation (2nd Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), US FOMC Meeting (23rd Mar).

SGD levels to watch (support / resistance): 1.3210, 1.3327 / 1.3445, 1.3590