• Higher bond yields. Stronger services PMI data in Europe and the US has seen interest rate markets adjust further. This has weighed on risk sentiment.

• USD firm. The lift in US yields is supporting the USD. AUD has drifted back. Locally, wages data is released today.

• AUD/NZD in focus. RBNZ announcement today. Will the RBNZ stay the course and hike by 50bps, or will it hold back given the cyclone impacts?

A negative night for markets with investor sentiment shaken by another jump in bond yields as positive economic data fueled expectations central banks, particularly the US Fed, have more work to do bring down inflation. Stronger than expected services PMIs in the Eurozone, UK, and US caught the eye. The services sector is generally a much larger and more important part of the economy. Notably, the surveys continued to show high inflation pressure across the services sector on the back of tight labour markets and pick up in wages. Central banks have repeatedly warned that it will be a long battle against inflation. Markets look to finally be realising this given it usually takes an extended period of very tight policy settings to generate the slowdown in growth needed to crack the labour market and bring down wages/services inflation.

Interest rate markets adjusted, with the US Fed Funds Rate (currently 4.75%) now projected to peak at ~5.4% by August. At the start of February markets were pricing in a peak of ~4.9%. US bond yields rose another 10-15bps across the curve, with the 10-year yield up at 3.95% (the highest since mid-November). The lift in bond yields has flowed through to other markets. US equity markets fell ~2%, and in line with our thinking the USD has remained firm. EUR has dipped back to ~1.0650, the interest rate sensitive USD/JPY is up near 135, and the AUD is down around 0.6950. GBP bucked the trend and outperformed as the bounce in UK PMIs saw markets quickly discount another 25bp hike by the Bank of England at its next meeting. AUD/GBP has slipped towards its 50-day moving average (0.5665).

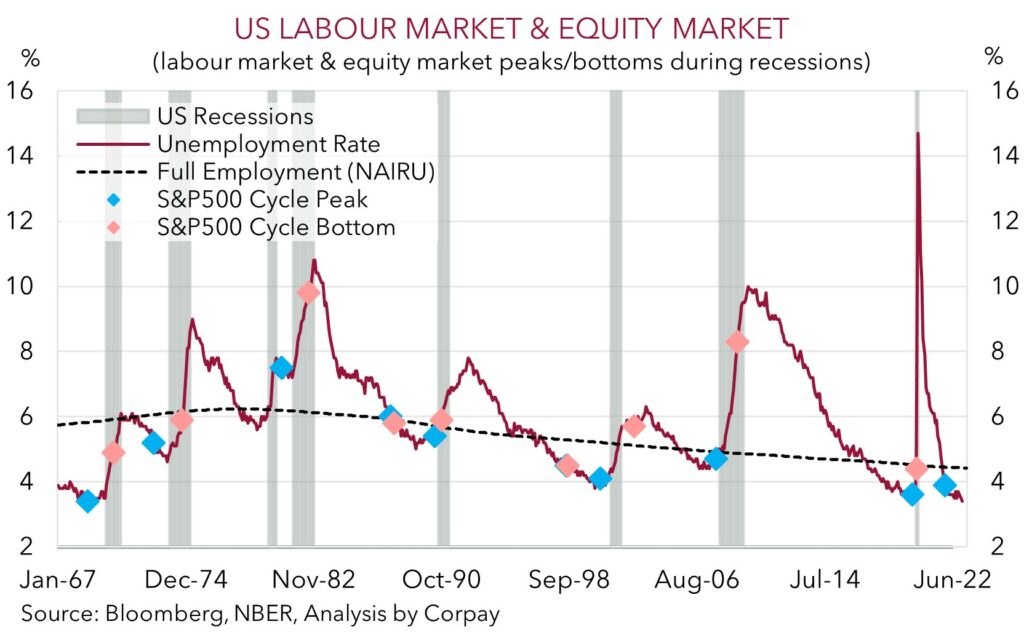

The minutes of the last US Fed meeting are released tomorrow (6am AEDT). We think the central message that further rate hikes are needed and/or a push back on the idea a rate cutting cycle may unfold soon is likely. We expect the upswing in US rate expectations to continue to support the USD. Added to that, we also remain of the view that volatility could re-ignite over coming months as central banks stay the course and optimistic markets begin to crash up against a harsher economic reality. As the chart below shows US equity markets tend to only definitively bottomed once a US recession has taken hold and the unemployment rate is trending up. This still looks to be some time away. A period of negative risk sentiment normally favours the USD, and creates headwinds for currencies like the AUD.

Global event radar: FOMC Meeting Minutes (tomorrow), China PMIs (1st Mar), Eurozone CPI Inflation (2nd Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), US FOMC Meeting (23rd Mar).

AUD corner

AUD has fallen back below its 50-day moving average (0.6891). The AUD has repeated its recent pattern, with domestic economic events providing a bit of intra-day support, only for this to be swamped by global/US developments. More specifically, yesterday’s hawkish comments in the RBA meeting minutes that a 50bp hike was discussed in February were quickly overshadowed by the spike in bond yields, pull-back in equities, and stronger USD.

We think something similar could occur again today. We remain of the opinion that near-term rebounds in the AUD aren’t likely to be sustainable given the evolving global backdrop. Locally, the wage price index is released today (11:30am AEDT). Given the tight labour market forecasts are for wages to quicken to ~3.5%pa, the fastest pace since 2012. Such an outcome should reinforce expectations for further near-term RBA rates hikes, and may give the AUD some support. However, FX is a relative price. We continue to have a positive USD bias (see above). US interest rate expectations have moved further, and we think differentials should remain in the US’ favour, at a time risk sentiment is looking shaky, limiting AUD rebounds.

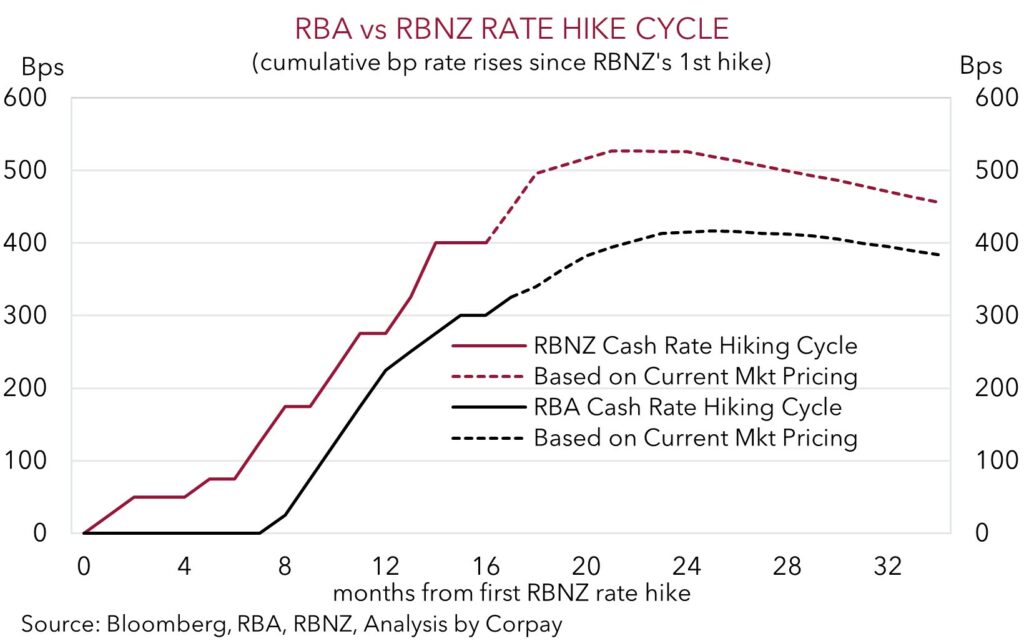

On the crosses, AUD/NZD is in focus, with the RBNZ announcement (12pm AEDT) and Governor Orr’s press conference (1pm AEDT) following the Australian wage data. AUD/NZD (which is tracking near its 200-day moving average (1.1004)) is likely to be volatile over the next 24hrs. Consensus is looking for a 50bp hike by the RBNZ, taking rates up to 4.75%. While our central case is for a 50bp increase given NZ’s high inflation, we think there is a chance the RBNZ delivers a smaller hike due to the hit to growth stemming from the devastation wrecked by cyclone Gabrielle. If realised this ‘surprise’ would see AUD/NZD spike higher. Taking a step back from today’s announcement, our bigger picture view is for a range of relative trends, like growth momentum and commodity prices, to remain in the AUD’s favour and for AUD/NZD to trend up to ~1.15 over coming quarters. As the chart below shows, the RBNZ moved earlier and has acted more aggressively than the RBA this cycle. This should mean the economic impacts are larger and felt sooner in NZ.

AUD event radar: AU Wages (today), RBNZ Meeting (today), AU Retail Sales (28th Feb), AU GDP (1st Mar), China PMIs (1st Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6715, 0.6804 / 0.6980, 0.7050

SGD corner

The lift in US and European bond yields on the back of the stronger than predicted services PMI data (see above), and modest bout of risk aversion has supported the USD. USD/SGD has edged up to ~1.34, near the top of its 6-week range and ~2.9% above its early-February cyclical low.

We think USD/SGD’s upswing can continue, given our thinking the adjustment in interest rate markets may have further to run and our positive USD views. The minutes of the recent FOMC meeting are released tomorrow. In our opinion, comments in the minutes and/or by Fed speakers over coming days are likely to reiterate that there is more work to do on the policy-front to get on top of inflation. We believe this type of message should keep US interest rate expectations elevated. This in turn may continue to weigh on risk appetite, and is expected to be USD supportive.

SGD event radar: FOMC Meeting Minutes (tomorrow), Singapore CPI (tomorrow), China PMIs (1st Mar), Eurozone CPI Inflation (2nd Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), US FOMC Meeting (23rd Mar).

SGD levels to watch (support / resistance): 1.3210, 1.3326 / 1.3445, 1.3590