• Higher for longer. The Fed meeting minutes reaffirmed a hawkish bias. Elevated US interest rate expectations are supporting the USD.

• AUD pressure. Weaker than expected wages data has seen RBA rate hike bets pared back. Relative differentials point to further AUD weakness.

• AUD crosses. European growth indicators continue to surprise, pointing to a lower AUD/EUR. AUD/NZD weighed down by a ‘hawkish’ RBNZ.

A mixed night across the major markets, with European and US equities consolidating and bond yields down a few basis points. After hitting a fresh 3-month high the US 10-year bond yield has eased back slightly, but at 3.92% it remains ~60bps above its early-February low. In FX, the USD remains firm, supported by elevated US interest rate expectations. EUR is inching down towards 1.06, USD/JPY is hovering just below 135, and the AUD is tracking around its 200-day moving average (0.6804).

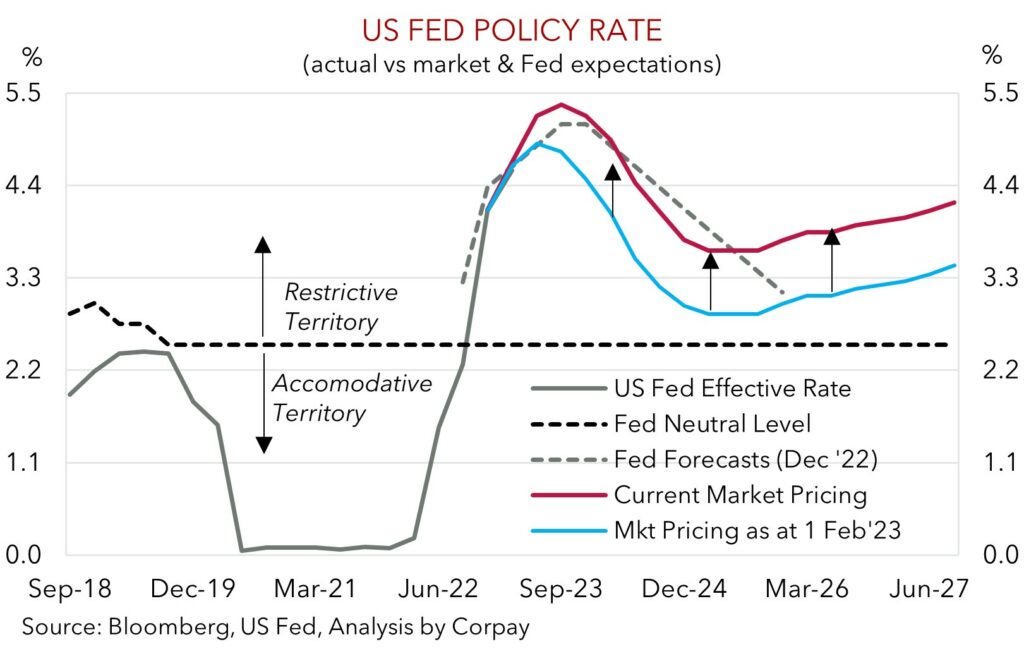

The minutes of the early-February US Fed meeting were released this morning. Policymakers continue to anticipate further rate increases would be necessary to bring down inflation towards the 2%pa target, and that “a restrictive policy stance would need to be maintained” until the data “provided confidence” things were on the right track, and this “was likely to take some time”. Higher interest rates for longer remains the key underlying message, in my view, with the Fed looking to keep at it until the job is done in order to avoid repeating the inflation and policy mistakes of the 1970s. It should also be noted that since the last Fed meeting there has been a run of positive US labour market and retail sales data, and another strong CPI inflation report. The flow of economic data over recent weeks supports the case for the Fed having to do even more than it was anticipating just a few weeks ago. Markets have adjusted since the start of the month and are now assuming the US Fed Funds Rate (currently 4.75%) will peak at ~5.4% by August. We think the Fed may play catch up when it updates its forecasts at the 23 March meeting. In December the Fed was penciling the policy rate to only reach ~5.125% this year.

The incoming US data is expected to show improvement, while we also think the Fed members that are speaking should continue to reiterate that there is more work to do to get on top of inflation. If realised, this should reinforce the markets interest rate pricing. We remain of the view that the upswing in US interest rate expectations should continue to underpin the USD over the near-term.

Global event radar: China PMIs (1st Mar), Eurozone CPI Inflation (2nd Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), US FOMC Meeting (23rd Mar).

AUD corner

AUD remains on the backfoot and has edged down to its 200-day moving average (0.6804). We think the pressure on the AUD is likely to remain, with a further fall towards the 100-day moving average (0.6718) on the cards. In addition to our positive USD bias (see above), we expect interest rate differentials to remain in the US’ favour. This should exert downward pressure on the AUD and limit any near-term rebounds.

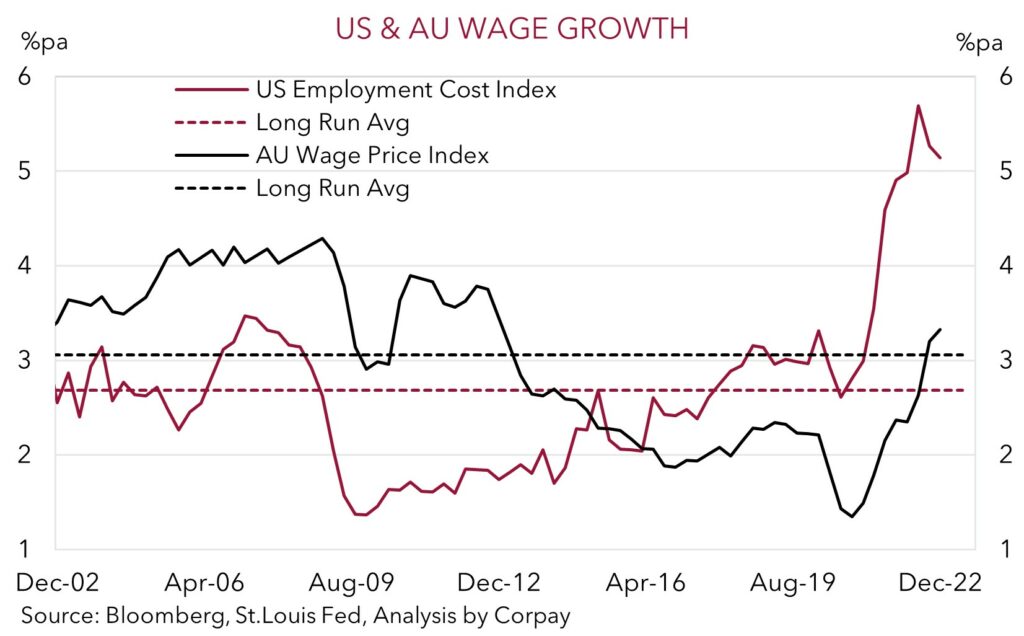

The weaker than anticipated Australian wages data, released yesterday, supports our view that while the RBA has a bit more work to do in the near-term a cash rate peak of ~3.85-4.1% is more likely than not given the impact on the indebted household sector from the jump up in mortgage rates and relatively more contained wage pressures in Australia compared to the US. In our mind, markets had become too aggressive in their thinking about how high the RBA could end up raising rates, and there is scope for these lofty expectations to be pared back further. Aggregate wage growth nudged up to 3.3%pa. The market and RBA were looking for ~3.5%pa. While the labour market has tightened, there is a lot of inertia in the wage setting process in Australia given a large share of workers are on multi-year enterprise agreements. This means conditions need to stay tight for a long time to move the dial. But the ground is starting to shift, suggesting odds of a wage-price spiral in Australia remain low and that the RBA won’t need to be as forceful as markets were anticipating. Softer economic conditions should weigh on labour demand, at a time supply is bouncing back due to reopened international borders.

On the crosses, AUD/EUR is trading just above its 100-day moving average (0.6439). Another month-on-month lift in the German IFO survey feeds into our view that consensus growth expectations for Europe can continue to be revised up, albeit from low levels. While at the same time, Australian growth is likely to slow as the RBA’s actions gain traction across the broader economy. We see AUD/EUR moving down towards ~0.60-0.62 over coming months. For more see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations.

AUD/NZD has fallen back towards 1.0940 as the combination of weaker Australian wages data and another 50bp rate rise by the RBNZ and forecasts pointing to further hikes generated an adjustment in relative rate differentials. While a further pullback in AUD/NZD looks likely in the near-term, we think it should be modest with the region around the 100-day (1.0886) and 50-day (1.0845) moving averages expected to provide downside support. Our bigger picture view is still for the NZD to underperform over coming quarters, and for AUD/NZD to push higher (up towards ~1.15) as 2023 rolls on. Central to this outlook is our thinking that the RBNZ, who remains laser-focused on bringing down inflation will end up overdoing it, triggering a steep downturn and sharp rise in NZ unemployment. By contrast, the RBA is looking to navigate a narrow path to a ‘soft landing’. For more see Market Musings: Cross-Check: AUD/NZD – Re-Entry Point.

AUD event radar: AU Retail Sales (28th Feb), AU GDP (1st Mar), China PMIs (1st Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6718, 0.6804 / 0.6916, 0.7050

SGD corner

USD/SGD remains up near 1.34, the top of its multi-week range and nearly 3% above its early-February cyclical low. We continue to think that the lift in US bond yields should support the USD (and USD/SGD) in the near-term, with any pullbacks predicted to be modest. The minutes of the recent US Fed meeting continue to stress that further rate hikes are anticipated, and that the Fed remains committed to doing what it takes to bring down inflation. This underlying bias and the positive US data flow should keep US interest rate expectations elevated, in our view.

Singapore CPI data (released today) is forecast to show annual inflation accelerated in January. While the data may generate some intra-day SGD volatility, we don’t expect it to have a lasting impact given the USD’s larger influence on recent USD/SGD trends.

SGD event radar: Singapore CPI (today), China PMIs (1st Mar), Eurozone CPI Inflation (2nd Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), US FOMC Meeting (23rd Mar).

SGD levels to watch (support / resistance): 1.3210, 1.3325 / 1.3445, 1.3590