- Higher for longer sinking in. Risk sentiment soured in the US session. Higher US bond yields have exerted downward pressure on equities.

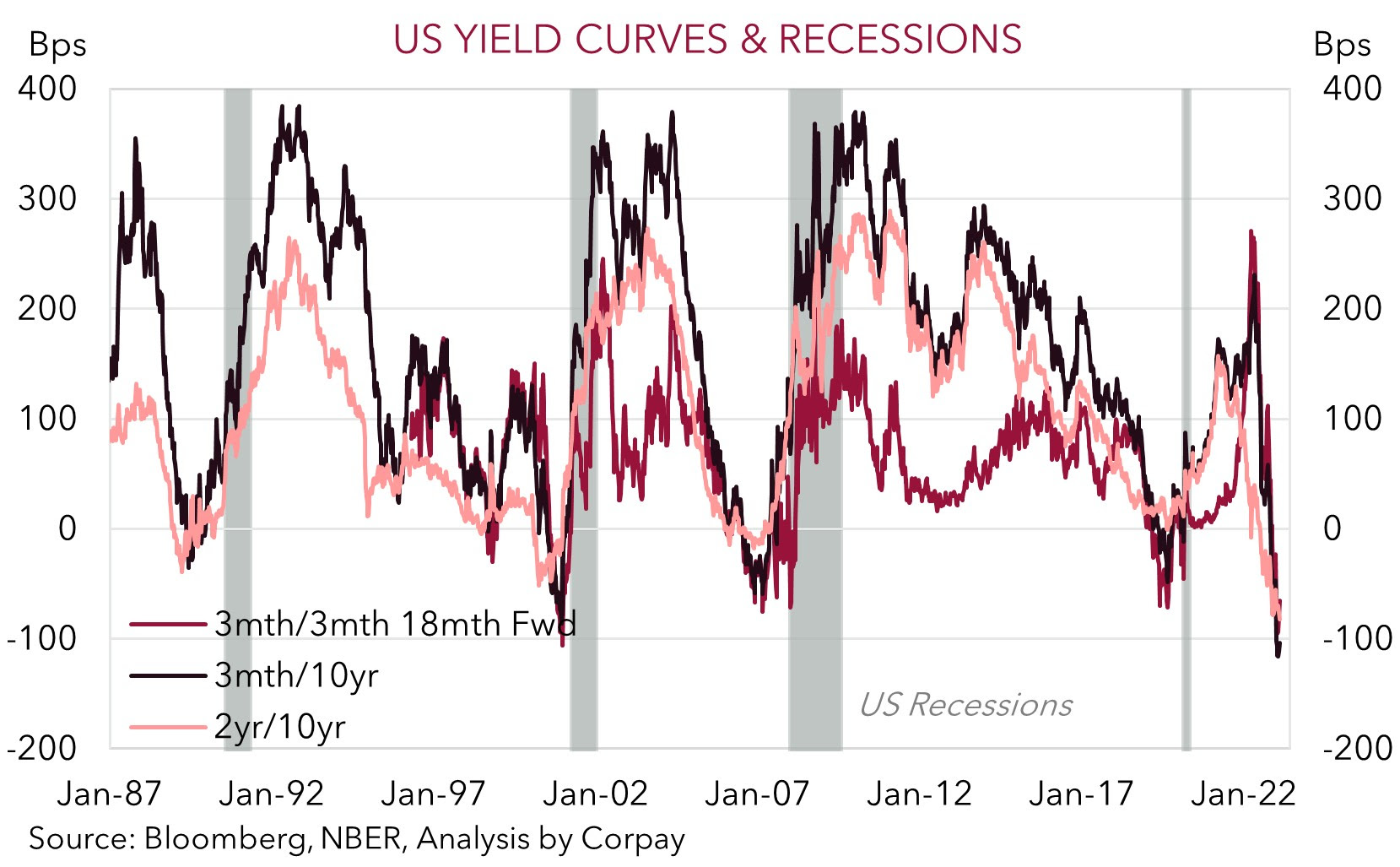

- US yield curve. The adjustment in rate expectations has pushed the US yield curve further into negative territory, typically a signal of a future US recession.

- AUD fades again. AUD failed to hold early gains, as sentiment turned in the US. RBA’s detailed Statement on Monetary Policy released today.

Fairly modest moves across markets overnight, though the underlying themes of participants reassessing the outlook for how high interest rates could go, how long central banks may need to keep them there to squash inflation, and concerns about what the economic impacts could be continuing to bubble to the surface. The US S&P500 drifted back again (-0.9%) as US bond yields rose ~6bps across the curve. The USD index has range traded over the past few sessions, but in level terms it is still up near a 1-month high. EUR is down near 1.0730, USD/JPY is up around 131.60, and the AUD again failed to hold on to European session gains to be back down at 0.6940.

We continue to pay close attention to the signals coming from the US bond market given it has a strong track record of picking future macro trends. The US 2-year yield (now 4.50%) is edging back up towards its cyclical highs, with markets continuing to adjust their thinking towards the US Fed’s higher-for-longer interest rate view. Weekly initial jobless claims (one of the timeliest reads on the US labour market) remain low, another sign the labour market is still very tight and that the Fed will need to keep at it for a while yet to ensure wages and inflation come down. This was the message repeated by yet another Fed member (Governor Barkin).

The rebound in US 2-year yields (and the front end of the yield curve more generally) has outpaced the bounce back in 10-year yields. As a result, the US 2s10s yield curve has continued to invert. The 2s10s spread (now -82bps) is at its most negative since the early-1980s. A range of other US yield curves are in a similar position. As the chart below shows, such deep US yield curve inversions have tended to foretell future US recessions, although the lead time has been mixed. In our view, the jump up in US interest rate expectations should continue to be USD supportive near-term. Over the next few months, as per the signal from the yield curve and other leading indicators, we also think that the effects of the rapid policy tightening could start to show up meaningfully in the economic data. This is typically a recipe for renewed volatility, a headwind for risk assets, and can be a positive backdrop for the USD.

Global event radar: China CPI/PPI (today), US CPI (15thFeb), US retail sales (16th Feb), Eurozone PMIs (21stFeb), FOMC meeting minutes (23rd Feb).

AUD corner

Rinse and repeat in terms of the AUD’s intra-day swings over the past 24hrs. As per the moves earlier in the week the AUD’s gains during yesterday’s late-Asia/European session unwound as the US session unfolded and risk sentiment soured. After poking its head briefly back above 0.70, the AUD is now effectively back where it started the week.

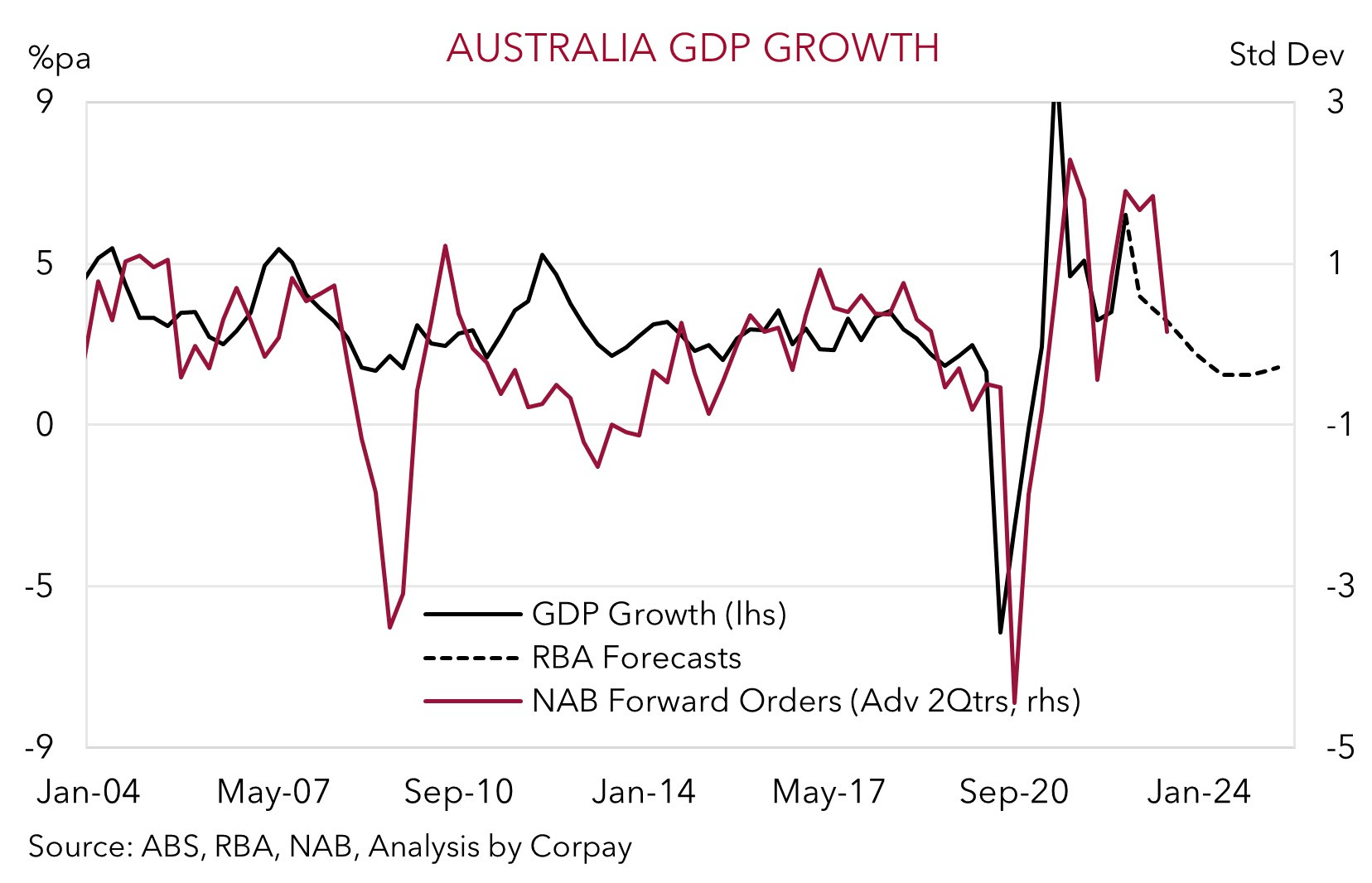

Today the RBA’s detailed quarterly Statement on Monetary Policy is released (11:30am), with CPI/PPI data from China following later (12:30pm). The SoMP shouldn’t provide many surprises given the RBA’s main economic projections and ‘hawkish’ interest rate guidance were contained in Tuesday’s post-meeting statement. Hence we doubt the SoMP will generate any meaningful moves in the AUD. After expanding rapidly last year, on the back of the aggressive policy tightening that has been put into the system (with a bit more to come based on the RBA’s rhetoric), the RBA is forecasting Australian growth to decelerate to a sub-trend 1.5% pace over 2023 and 2024. And in time, below trend growth should see unemployment drift higher, helping to lower inflation back down to the target band.

We are looking for the RBA to raise the cash rate to 3.85% by April/May. This is a touch below the market’s updated terminal rate pricing of ~4%. But in broad strokes we think the RBA’s hiking cycle is now well priced. In our view, market expectations could struggle to get much higher from here, given our thinking that the jump up in mortgage rates may soon start to meaningfully constrain activity across the indebted household sector. Based on the heightened sensitivity to rising rates, with every RBA hike we believe the odds a ‘soft landing’ unfolds declines. In our opinion relative interest rate differentials should remain in the US’s favour, acting as an AUD headwind, and limiting near-term upside.

AUD event radar: RBA SoMP (today), China CPI/PPI (today), US CPI data (15th Feb), AU jobs data (16th Feb), US retail sales (16th Feb), RBA Gov. Lowe speaks (17thFeb), AU wages (22nd Feb), RBNZ meeting (22nd Feb), AU retail sales (28th Feb).

AUD levels to watch (support / resistance): 0.6806, 0.6867 / 0.7050, 0.7172

SGD corner

Steady as she does for USD/SGD, with the pair continuing to oscillate around 1.3250. The data/event calendar is light. China PPI and CPI is released today, and may generate a bit of market volatility if the data shows inflation is re-accelerating on the back of China’s reopening. This is the second order effect that many still haven’t focused on, with the growth impulse stemming from China coming out of its COVID hibernation getting the attention over early-2023.

The rebound in the USD (and USD/SGD) over the past month has been on the back of the lift in US interest rates as markets adjust their Fed rate expectations. In our opinion, the Fed’s work still isn’t over, and we continue to think the Fed could keep rates higher for longer than markets anticipate. We expect higher US yields to continue to provide near-term support for the USD (and USD/SGD). Next week’s US CPI and retail sales reports are the major upcoming events that could see the market’s Fed pricing meaningfully change.

SGD event radar: China CPI/PPI (today), US CPI (15th Feb), US retail sales (16th Feb), Eurozone PMIs (21st Feb), FOMC meeting minutes (23rd Feb).

SGD levels to watch (support / resistance): 1.3050, 1.3110 / 1.3290, 1.3358