• Sentiment improved overnight. US equities rose, bond yields dipped, & the AUD outperformed. UK inflation failed to re-accelerate.

• The Fed’s Goolsbee also tempered the markets negative vibes by keeping the door open to a policy re-calibration later this year.

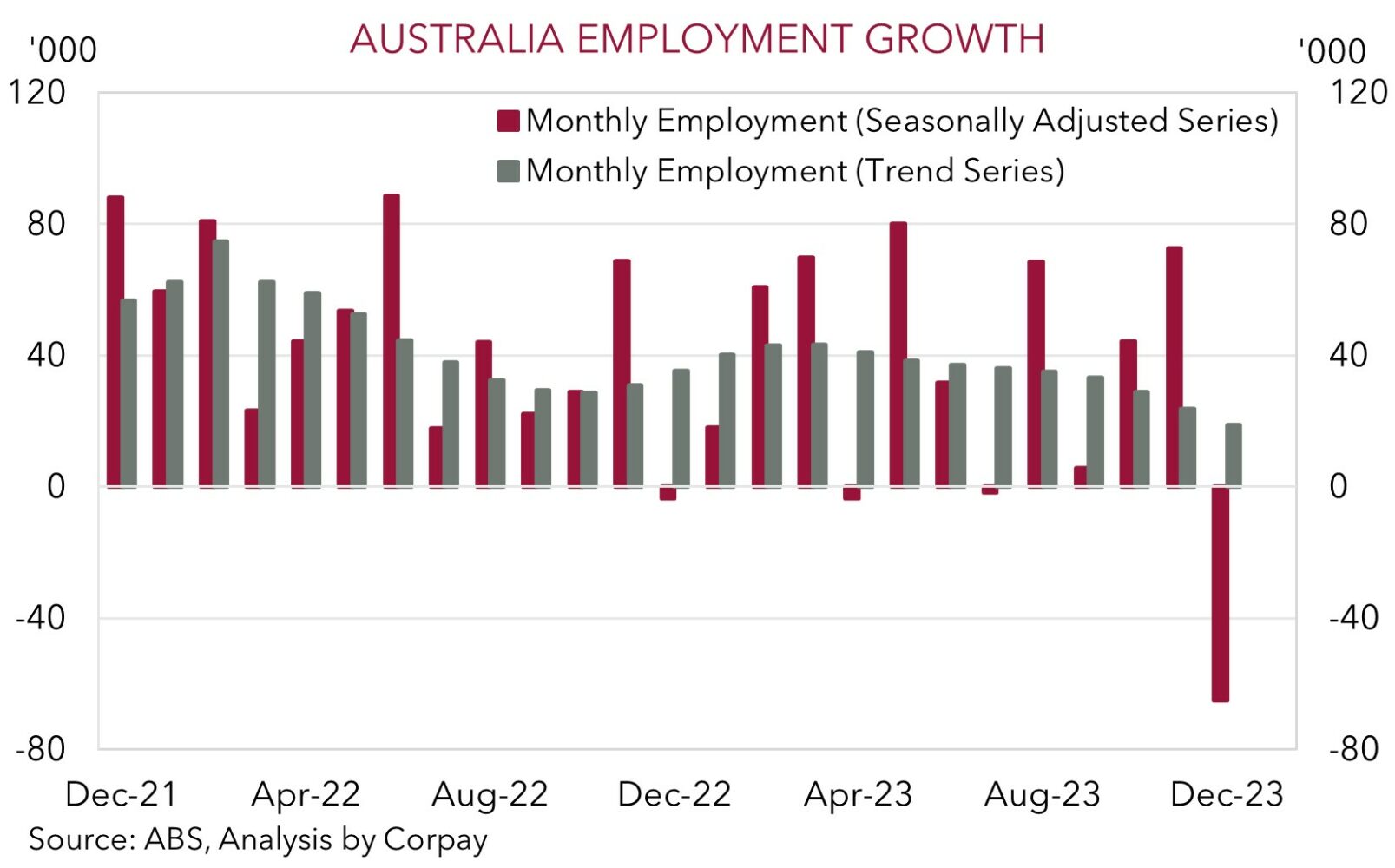

• Australian labour force data due today. Analysts are looking for jobs to rebound after the outsized December drop.

Markets settled down overnight with the burst of risk aversion following the hotter than expected US inflation data partially unwinding. US and European equities rose with the tech-sector outperforming (NASDAQ +0.9%, S&P500 +0.5%), while bond yields dipped. The US 2yr rate declined ~8bps (now ~4.57%), taking back a bit less than half of the previous days spike. There was a relatively larger move in the UK with yields ~10-12bps lower across the curve. In contrast to the US, UK inflation for January undershot consensus forecasts with headline, core, and services inflation failing to re-accelerate like analysts predicted. On the back of the result, the market raised their BoE rate cut expectations with odds of a move in June nearing ~40% and over 3 reductions priced in by year-end.

The more pleasant UK inflation surprise, coupled with stronger Eurozone industrial production, and central bank comments (see below) supported sentiment. In FX, the USD drifted a little lower. EUR nudged up to ~$1.0730 and USD/JPY consolidated near ~150.50. The weakness in the JPY (and higher USD/JPY) isn’t going unnoticed in Japan with Vice Minister Kanda firing a shot across the bow of markets. According to Kanda some of the rapid moves are “clearly speculative” and authorities are “ready to respond 24hrs a day, 365 days a year” if needed. GBP underperformed (now ~$1.2560) as interest rate differentials shifted against the currency. USD/SGD edged lower (now ~1.3480), and the more positive tone helped the AUD recoup ~1/2 of its post US CPI dip (now ~$0.6490).

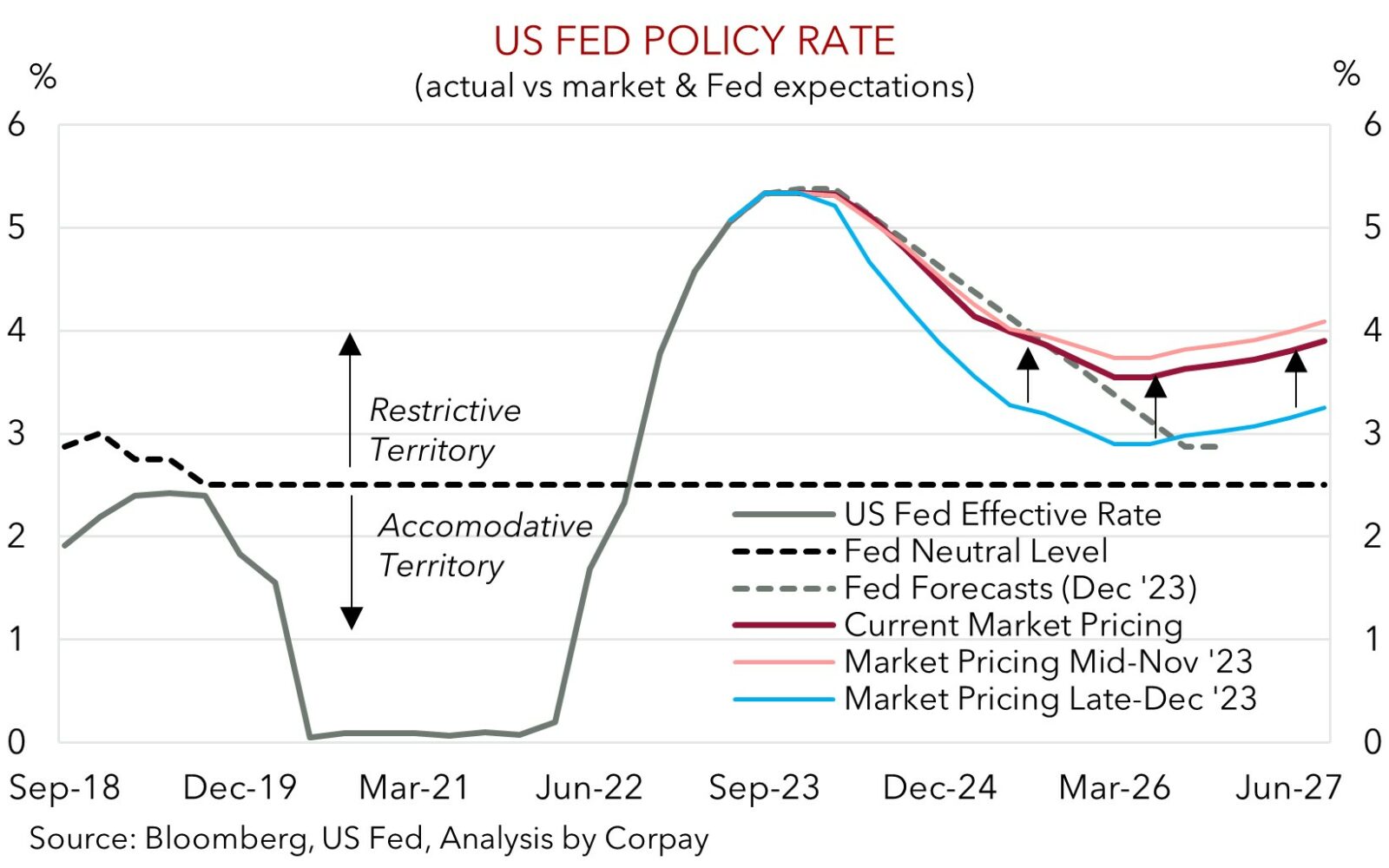

The US Fed’s Goolsbee was on the wires, and he made a few interesting observations. Goolsbee noted that even if inflation comes in “a bit higher for a few months” it would still be consistent with being on a path back to target, and policymakers shouldn’t wait until it hits 2%pa before cutting rates. He also pointed out that given settings are “quite restrictive” if they were to stay that way for too long policymakers would have to begin worrying about “unemployment rising too much”. Goolsbee also emphasized that the Fed’s inflation goal is based on the PCE deflator, not CPI. We flagged these points in a note released yesterday post the US inflation data (see Market Musings: Any juice left in the USD’s upswing?).

With markets now factoring in a similar path forward to the US Fed (see chart below), barring a risk aversion driven boost, we feel that the USD’s revival stemming from an upward repricing in US interest rates has now largely run its course. January US retail sales are due tonight (12:30am AEDT). After the late-2023 flurry retail spending is expected to moderate with a post-holiday pull-back and colder weather constraining consumption. If realised, we think this could see the USD give back more ground.

AUD corner

The AUD has perked back up a bit. The more positive tone across markets overnight has helped the AUD recover ~1/2 of its post US CPI pull-back (now ~$0.6490). The backdrop, as well as some currency specific developments like a softer UK CPI report has also seen the AUD outperform on the crosses over the past 24hrs. AUD/EUR (+0.5%) is approaching its 200-day moving average (~0.6064), AUD/GBP (+0.8%) has rebounded up towards its ~1-month average, and ahead of tomorrow mornings speech by RBNZ Governor Orr (Fri 5:40am AEDT) AUD/NZD has ticked up to ~1.0670 with last weeks dip unwound. We still believe the hurdle for the RBNZ to re-start its tightening cycle is quite high, and while Governor Orr should continue to talk tough on inflation failure to support the built-up rate hike expectations could see NZD give back more ground against the AUD.

Today, the local focus will be on the monthly jobs report (11:30am AEDT). The Australian ‘labour force lottery’ is known for generating surprises, and the large drop in jobs in December was the latest example. However, after being impacted by negative statistical noise, we see Australian employment rebounding in January (mkt +25,000). Outside of the COVID disruptions back-to-back monthly job losses haven’t occurred in Australia since 2016. That said, based on the surging population/labour supply this may not be enough to prevent the unemployment rate nudging up (mkt 4%). That said, this would be a good mix and is the type of outcome the RBA is striving for. We think signs the Australian economy is still generating jobs should help reinforce the RBA’s cautiousness around lowering interest rates too quickly and its open mind to the prospect of another potential rate rise, and this could give the AUD some more support, particularly on the crosses. This could be compounded if US retail sales (tonight 12:30am AEDT) underwhelms and the USD eases (see above).

More broadly, as outlined over recent days, we believe a lot of negativities are discounted in the AUD near current levels, and there are asymmetric risks building given the USD’s resurgence may be starting to top out (i.e. we see more upside than downside potential in the AUD from where it is). ‘Net short’ AUD positioning (as measured by CFTC futures) is quite stretched, the AUD is ~2-3 cents under the average ‘fair value’ estimate from our suite of models, and statistically the AUD has only been sub-$0.65 ~6% of the time since 2015 with most of this small sample occurring during bouts of market stress.