• Market reversal. The unwind of this week’s US inflation driven moves has continued. Equities higher, US yields eased a bit, & the USD lost ground.

• Sentiment vs reality. The positive tone has come through despite sluggish global data. Japan & the UK entered recession, US retail sales declined.

• AU jobs. The jobs report underwhelmed, but technical factors point to an unwind next month. AUD has clawed its way back to where it started the week.

Investors have been in a ‘bad economic news is good for markets’ frame of mind. The unwind of the US inflation driven bout of risk aversion earlier this week has continued with some gloomy global data supporting views that while central bankers may continue to talk tough on inflation, interest rate cycles have peaked and the next moves should be down. The only question is around the timing.

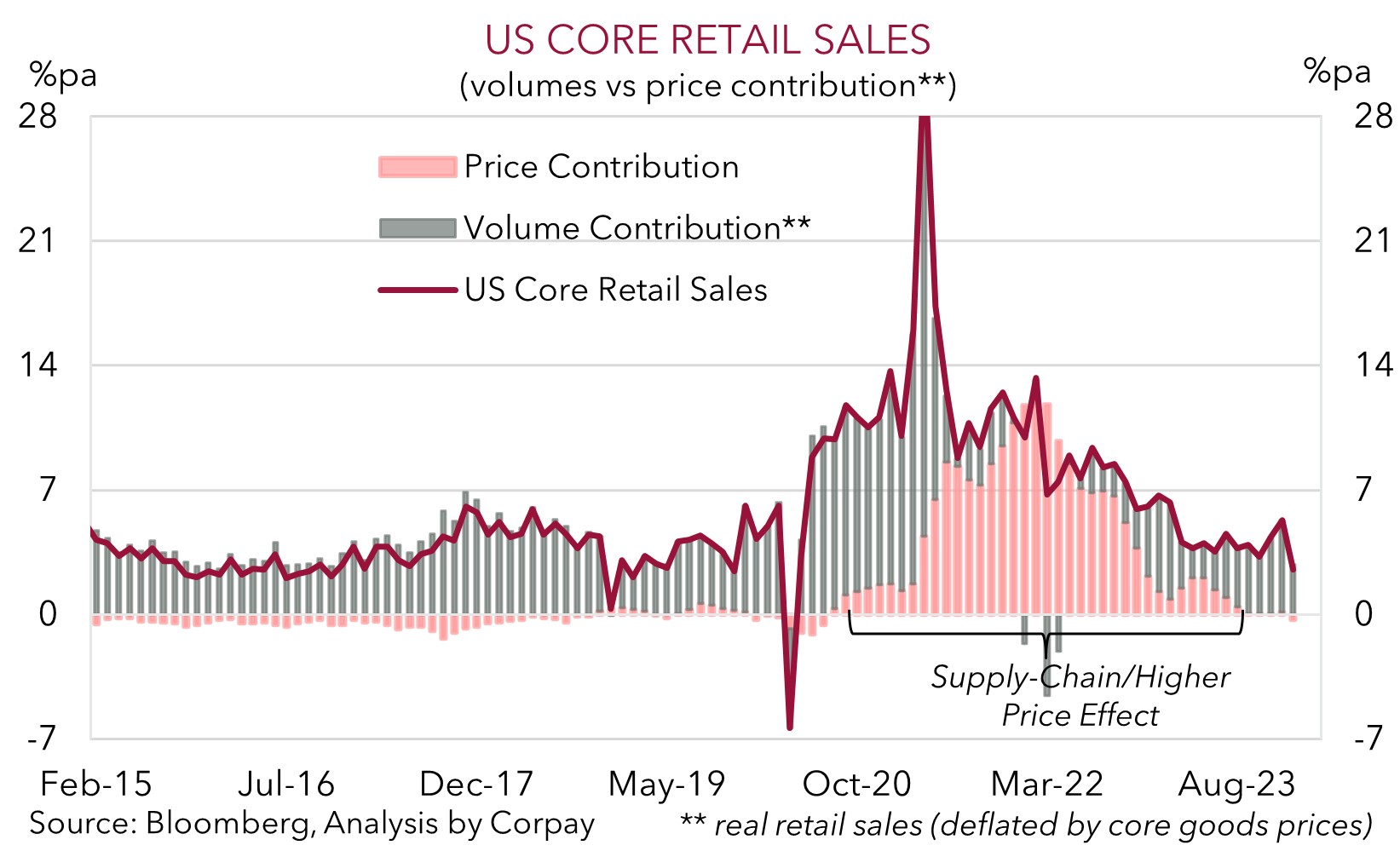

Data released over the past 24hrs showed that Japan and the UK entered a ‘technical recession’ at the backend of 2023. Japan’s economy contracted 0.1% in Q4, and given the early-2024 earthquake and disruptions in various sectors a 3rd straight quarterly decline is possible. The UK economy shrank by a larger than forecast 0.3% in Q4. In time weaker growth should generate greater slack in the UK labour market, slowing wages and inflation. In the US, industrial production weakened and retail sales significantly undershot consensus predictions. US retail sales fell 0.8% in January, the biggest drop in almost a year, with annual growth in the ‘control group’ (which flows directly into US GDP) running at its slowest pace since the initial COVID shock. Some payback of the Black Friday sales bump played a role, however weakness across interest rate sensitive sectors (i.e. cars, building materials etc.) suggests tighter conditions are biting particularly as US households have drawn down a lot of their COVID-era ‘excess savings’.

Equities are a sea of green with gains coming through across Asian, European, and US markets. The US S&P500 (+0.5%) is within striking distance of last Friday’s record high. US bond yields eased with rates ~1-2bps lower across the curve. At ~4.24% the benchmark US 10yr yield has given back ~1/2 of its post US CPI spike. Markets are factoring in the first US Fed rate cut in June, with a modest easing cycle discounted after that. In FX, the USD has extended its pullback, as per our thinking (see Market Musings: Any juice left in the USD’s upswing?). EUR (now ~$1.0770) is near where it was ahead of this week’s US inflation report, USD/JPY (now ~150) has tracked the dip in US yields, and GBP (now ~$1.2595) shrugged off the UK GDP news. USD/SGD has slipped to ~1.3455, while the AUD has also undergone a round trip over the past few sessions to be little changed from where it started the week (now ~$0.6523).

In the US, the Fed’s Bostic speaks today (11am AEDT) and producer prices, a leading indicator for CPI and another input into the PCE deflator (which is the Fed’s preferred inflation gauge) is released tonight (12:30am AEDT). A further moderation in annual growth in the PPI is looked for. If realised, we think this could exert more pressure on the USD as markets continue to question the signals from the CPI data and continue to refocus their attention on the medium-term outlook for lower US interest rates.

AUD corner

The AUD’s recovery has continued. The more upbeat market sentiment, in the face of sluggish global data (see above), skepticism about the Australian jobs report (see below), and the softer USD has helped the AUD claw its way back to where it started the week (now ~$0.6523, ~1.3% above its post US CPI low point). The AUD has also ticked up a little on most crosses. AUD/GBP has nudged up to ~0.5180, with the UK’s move into a ‘technical recession’ dampening sentiment towards GBP. AUD/EUR is near its 200-day moving average (~0.6064), while AUD/NZD is making its way up to ~1.07. RBNZ Governor Orr spoke this morning, and although he said they must bring core inflation back within the 1-3% target band he didn’t touch on the near-term policy outlook. As discussed recently, we believe the hurdle for the RBNZ to re-start its tightening cycle is quite high. A failure to crystalise the renewed RBNZ rate hike expectations should see AUD/NZD extend its rebound.

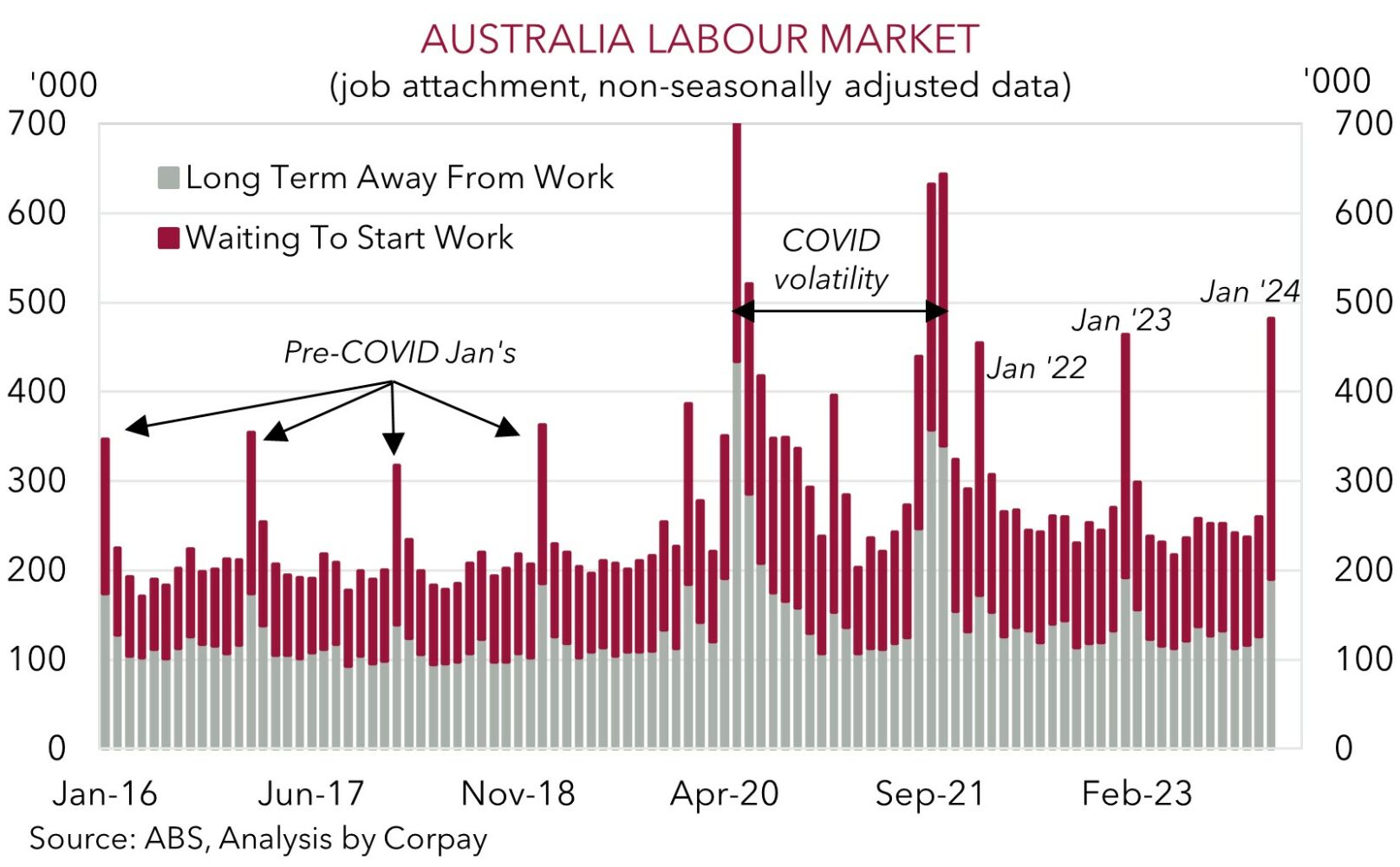

Locally, the latest addition of the Australian ‘labour force lottery’ was released yesterday. The headline result underwhelmed expectations. Employment rose just 500 in January, and the unemployment rate lifted to 4.1%, a ~2-year high. That said, while labour market conditions are cooling, inline with the slowdown in economic activity, we think the January results need to taken with a ‘pinch of salt’. According to the ABS, the increase in unemployment in January “coincided with a higher-than-usual number of people who were not employed but who said they will be starting or returning to work in the future”. So, people have worked lined up, they just haven’t started yet. As our chart shows, this pool of people was larger than normal for this time of year. This suggests some unwind in the unemployment rates lift is likely in February.

Stripping out the monthly noise, we judge that the Australian labour market is still generally tracking in line with the RBA’s outlook. Hence, we believe it is unlikely to pivot to a more ‘dovish’ footing for a while given its concerns about the stickiness in services inflation. With the RBA continuing to set itself on a different path to its global counterparts when it comes to the next easing cycle, we think relative interest rate differentials should continue to shift in a more AUD supportive direction over the medium-term. Shorter-term, we feel a further pull-back in the USD if tonight’s US PPI data underwhelms (12:30am AEDT) and/or Fed speakers (Bostic 11am EDT, Barr Sat 1:10am AEDT, Daly Sat 4:10am AEDT) flag that an easing cycle kicking off later this year is still on track should give the AUD a bit more of a boost.