• Diverging markets. US yields rose & the S&P500 dipped after US producer prices exceeded expectations. However the USD eased. AUD at ~$0.6530.

• Holiday data. High frequency data & reports suggest Chinese spending & travel exceeded pre-COVID run-rates. Is the tide finally turning?

• Event radar. Locally, Q4 wages is due (Weds). US Fed commentary in focus with several members speaking later in the week. Eurozone PMIs released (Thurs).

Markets consolidated on Friday night. In contrast to the Japanese Nikkei which touched another multi-decade high US equities unwound the modest gains from the previous day (S&P500 -0.5%) with higher bond yields a headwind. The US 2yr and 10yr rose 8bps and 4bps respectively. As a result, the benchmark US 10yr yield (now ~4.28%) is near the top of its ~2-month range. A positive surprise in the US producer price data, a leading indicator for consumer prices, provided another sign the path forward for inflation will be bumpy. US core producer prices (i.e. ex. food and energy) quickened slightly, rising by 2%pa. The data further tempered market expectations about the next US Fed easing cycle. Odds of a US Fed rate cut in March have dipped to ~11% (after being as high as ~90% at the turn of the year) with markets factoring in ~3.5 reductions this year (down from nearly 7 in mid-January).

That said, despite the rise in US yields spillovers beyond a bit of a drag on equities was minimal. US credit spreads were steady near their tightest in 2-years implying limited stress. And after a knee-jerk intra-session lift post the US PPI the USD ended the day lower. EUR is hovering around ~$1.0780, GBP is near ~$1.26, USD/JPY tracked sideways (now ~150.20) despite the higher US yields, and the AUD nudged up (now ~$0.6530) to actually be a little higher relative to where it started last week.

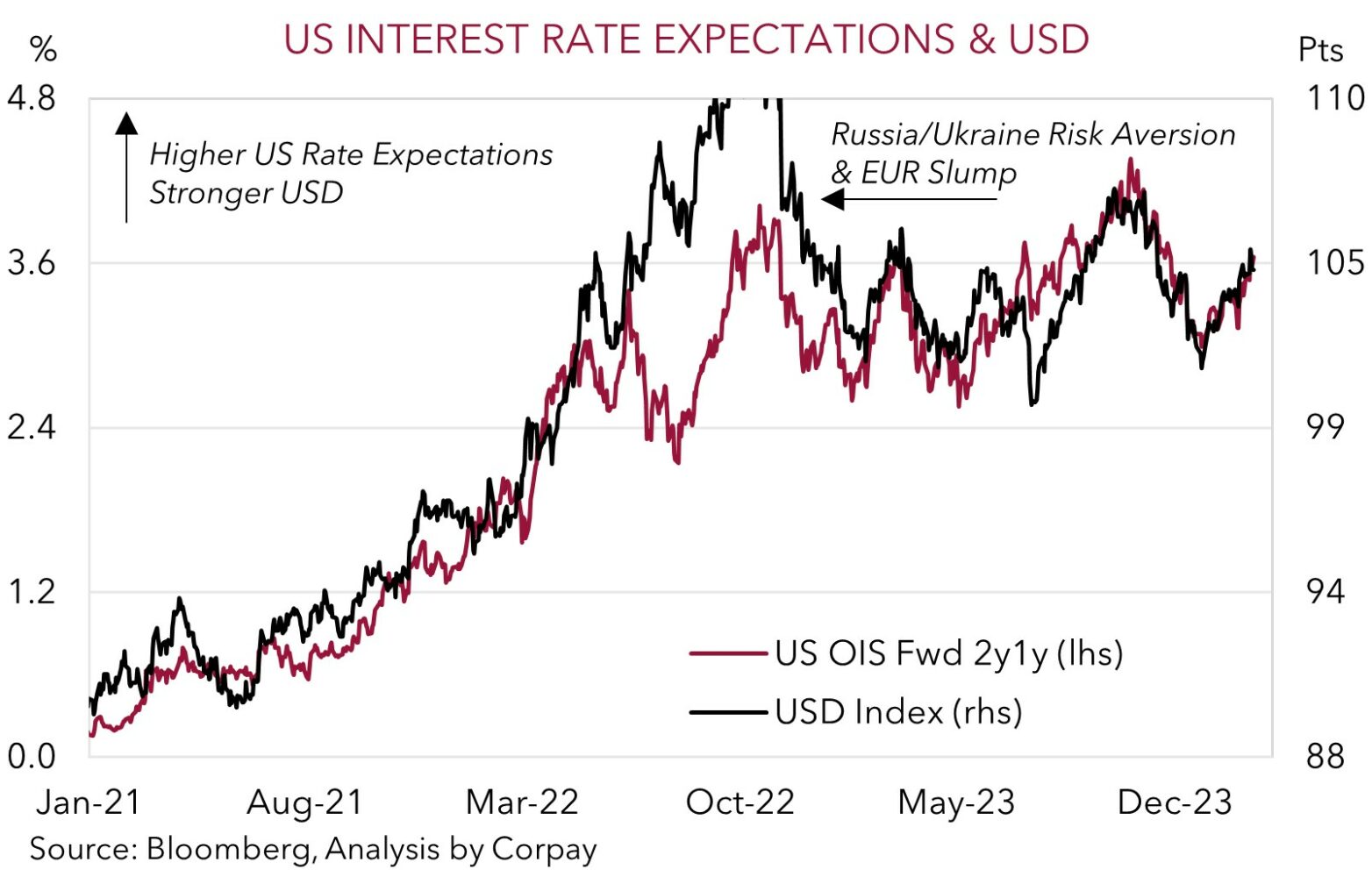

The FX moves over the backend of last week were inline with our thinking that with markets finally broadly aligned with the US Fed’s outlook the USD’s revival stemming from an upward repricing in interest rates expectations may have run its course (see Market Musings: Any juice left in the USD’s upswing?). Indeed, although the US PPI was above forecast, a closer look suggests that much like the US CPI a significant degree of the surprise was due to temporary seasonality. Many US inflation components tend to be volatile in January as businesses reset prices, and a fair amount of the PPI boost was in medical services that tend to see large one-off moves in October or January as reimbursement rates are reset.

In this holiday-shortened week in the US (President’s Day is today) attention will be on US Fed commentary. The minutes of the January FOMC meeting are due (Thurs 6am AEDT) and there are several Fed members speaking with speeches by Vice Chair Jefferson (Fri 2am AEDT) and Governors Cook (Fri 9am AEDT) and Waller (Fri 11:35am AEDT) in focus. In our opinion, a reiteration of the view that a near-term rate cut (i.e. March of May) by the US Fed isn’t on the table but broader trends still point to policy recalibration later in the year may see the USD continue to give back ground.

AUD corner

There was a bit of intra-session AUD volatility on Friday night around the release of the higher-than-anticipated US producer price inflation data. But the impact was fleeting with the AUD extending its recovery as the USD eased (see above). At ~$0.6530 the AUD is slightly above where it was this time a week ago, and ~1.4% from last Tuesday’s low. On the crosses, AUD/EUR is tracking near its 200-day moving average (~0.6064), AUD/GBP is little higher than its 1-month average (now ~0.5180), and AUD/NZD has slipped towards ~1.0660. By contrast, AUD/JPY has poked its head over ~98 for the first time since December. We think around current levels AUD/JPY is ‘priced for perfection’ and there are more medium-term downside than upside risks given the prospect of more bouts of market volatility, BoJ policy normalisation, and/or potential macro/geopolitical shocks. Indeed, since 2010 AUD/JPY has only traded above where it is ~2% of the time.

This week the return of Asian participants from their Lunar New Year holidays may see regional volatility lift. According to reports, the early data around holiday travel suggests the tide might be turning for the sluggish Chinese consumer. Over 61mn rail trips were made in the first few days of the holiday period, the highest in at least the past 5-years, and there have also been gains on spending across services. An acceleration in China’s activity pulse as the various stimulus measures injected by authorities gain traction and confidence improves is one of the pillars behind our medium-term outlook for the AUD to gradually appreciate over 2024.

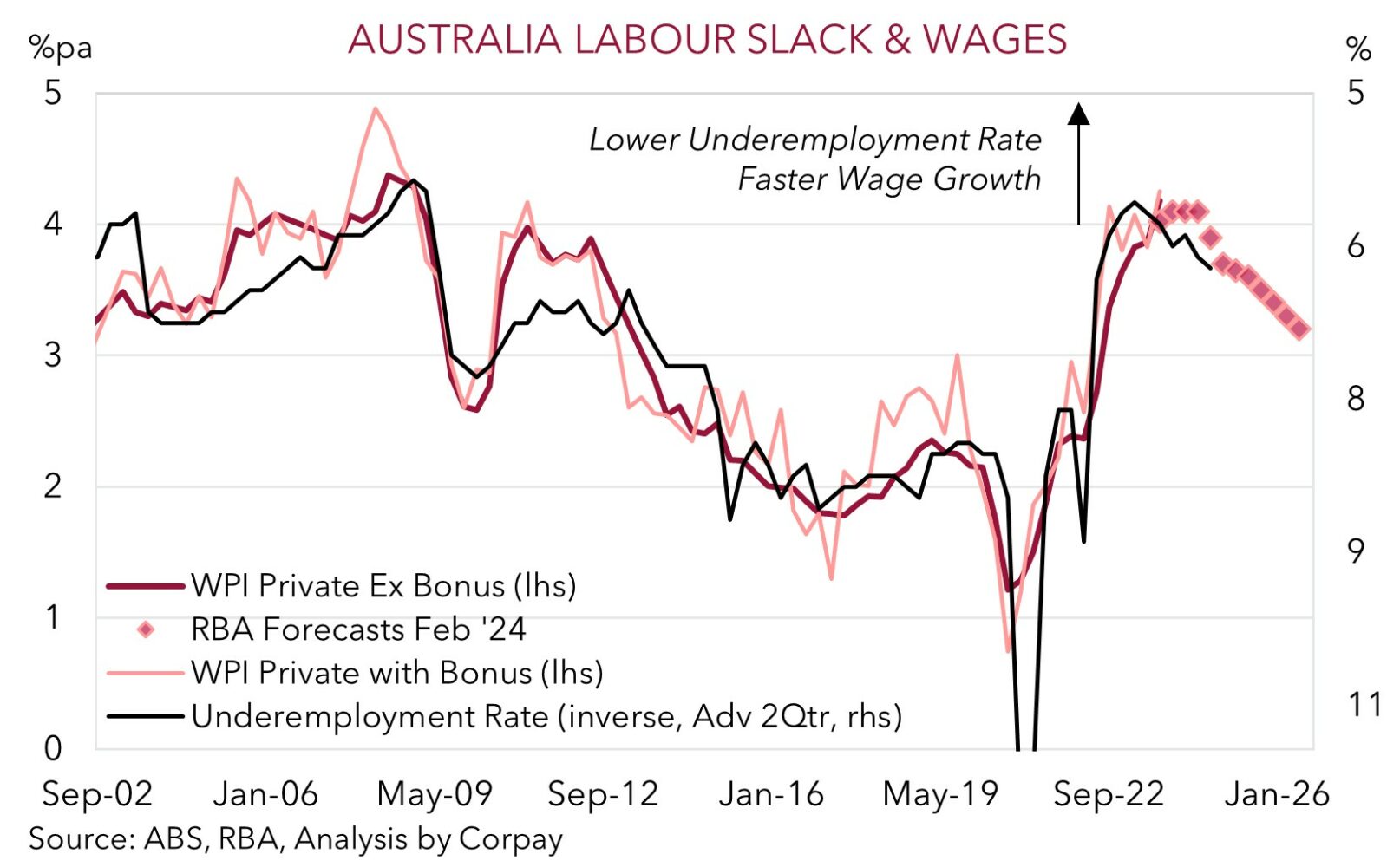

Another factor is our view that due to the support to aggregate demand from the larger population and stickiness across domestic services inflation the RBA is likely to lag its global peers in terms of when it starts and how far it moves in the next easing cycle. The diverging paths should in time see short-dated interest rate differentials move in favour of a firmer AUD. This week the local focus will be on Q4 wages data (Wednesday). Consensus is looking for a similar outcome to the RBA with annual growth predicted to nudge up to 4.1%, its fastest pace since early 2009. Wages are a key determinant of services inflation and based on the high use of multi-year Enterprise Bargaining Agreements in Australia the pressures could persist for a while. If realised this may see markets continue to factor in a more cautious RBA interest rate trajectory, which in turn can help the AUD grind up, particularly if the key US Fed members speaking later this week (Jefferson (Fri 2am AEDT), Cook (Fri 9am AEDT) and Waller (Fri 11:35am AEDT)) keep the door open to rate cuts later this year and the USD drifts lower. In our opinion, the AUD remains undervalued near current levels with our suite of models still signaling that ‘fair value’ is ~2 cents higher than current spot.

SGD corner

USD/SGD whipped around over the past week as US interest rates and the USD initially reacted strongly to the upside surprise in US inflation before the FX moves unwound over subsequent days. On net, at ~1.3470 USD/SGD is only marginally higher than where it was trading this time last week. On the crosses, EUR/SGD also recouped its post US CPI dip to be back near its 100-day moving average (~1.4532), while the rise in yields and recovery in risk sentiment has pushed SGD/JPY (now ~111.54) to within ~0.6% of its mid-November cyclical peak.

As mentioned above, we believe that with markets now assuming a similar outlook to the US Fed, the upswing in the USD (and USD/SGD) from the interest rate repricing may have played out. The minutes of the last US Fed meeting are due on Thursday and there are several Fed policymakers set to speak towards the end of the week. Overall, we think that barring an exogenous shock, indications from the Fed that the broader US disinflation trend is still unfolding, and hence some policy adjustment is still on the cards later this year could see the USD (and USD/SGD) drift lower.