• Holiday trade. Minimal moves with the US on holiday. European equities consolidated, while the major currencies remained range bound.

• USD trends. ECB wage indicator & Canadian CPI tonight. US Fed commentary in focus later this week with markets now pricing in little chance of a March cut.

• AUD drivers. February minutes released today & wage data due tomorrow. Signals from China suggest spending was positive during Lunar New Year.

With the US closed for Presidents Day and newsflow limited there were minimal market moves overnight. European equities consolidated with the EuroStoxx600 (+0.2%) making its way up towards its January 2022 record highs. Bond yields tread water, though curves did exhibit a slight steepening bias. At 2.41% the German 10yr yield is around its highest since early December. Markets are discounting a ~40% chance the ECB cuts rates in April, with the first of four moves over 2024 penciled in from June. This is a bit more than what markets now have priced for the US Fed, but the assumed lift off month is the same.

FX markets were stable with most of the major currencies oscillating in a +/- 0.4% range over the past 24hrs. EUR is hovering near ~$1.0780, USD/JPY is just above ~150 (~1.1% from its November cyclical peak), and GBP has drifted down to ~$1.26. While the NZD ticked up (now ~$0.6145), USD/SGD tracked sideways (now ~1.3460), as did the AUD (now ~$0.6540) and USD/CNH (now ~7.2125). This is despite the positive reopening of China’s stock market (Shanghai Comp. +1.6%) amid upbeat reports about spending and travel during the Lunar New Year holidays. As mentioned yesterday rail and other travel metrics, as well as things like box office ticket sales were up strongly, with some indicators at their highest in at least the past 5-years. Yesterday Premier Li called for “pragmatic and forceful” action to boost confidence in the economy. In our mind this is another signal further stimulus measures could be in the pipeline as authorities look to jumpstart the sluggish Chinese economy.

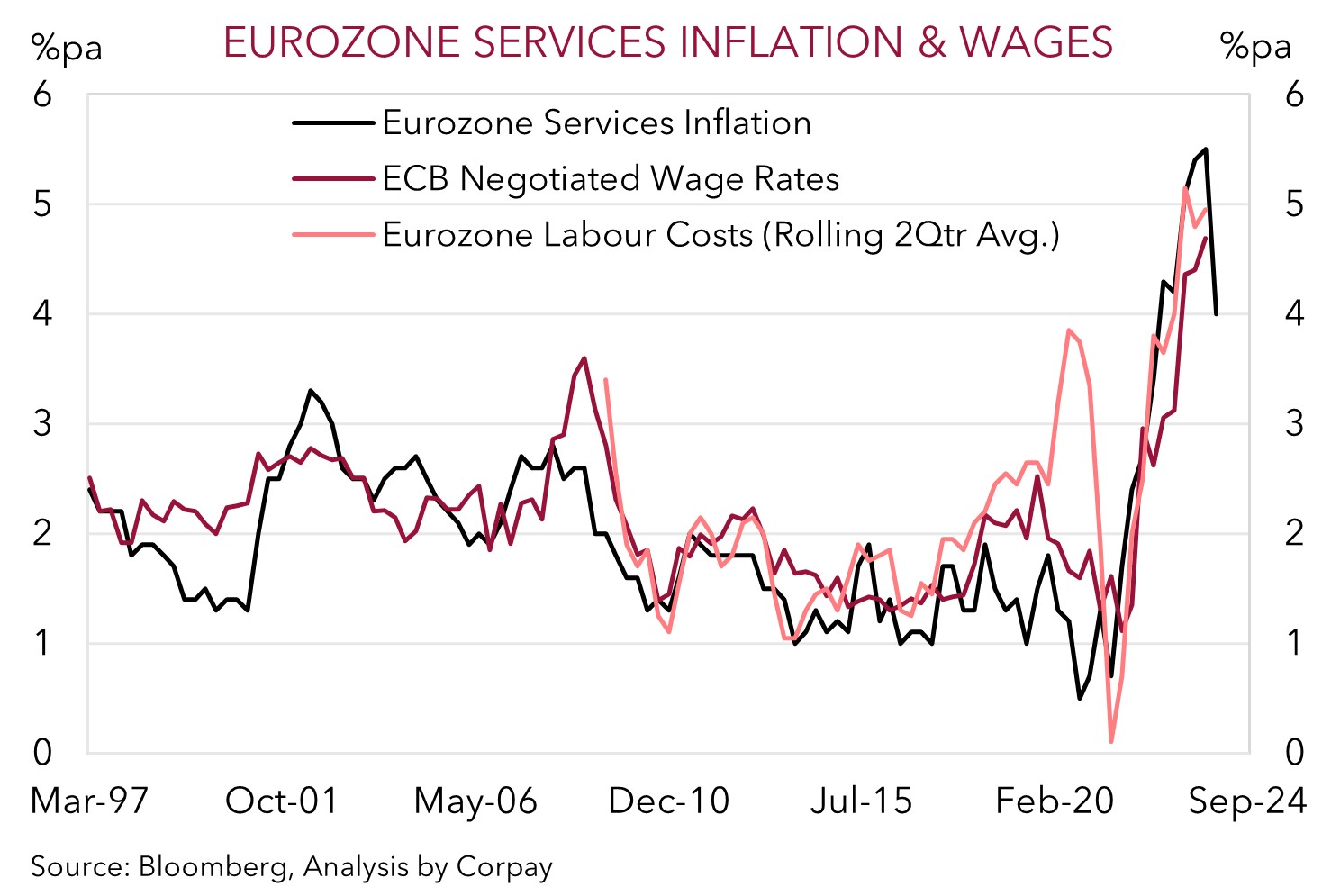

Tonight, the ECB’s indicator of negotiated wages is released (9pm AEDT). The ECB have flagged they are looking for signs of cooling wages before rate cuts are considered. As our chart shows, Eurozone wages and services inflation are still a long way from where they need to be. Continued strength in the ECB wage indicator may see markets push out the potential start date for ECB policy easing, a support for the EUR (and headwind for the USD). Beyond that, attention later this week will be on US Fed rhetoric with the minutes of the January meeting (Thurs 6am AEDT) and speeches by a few committee heavyweights in focus (Jefferson (Fri 2am AEDT), Cook (Fri 9am AEDT), and Waller (Fri 11:35am AEDT)). Given how far markets have adjusted, a repeat of the view that a near-term rate cut (i.e. March or May) by the US Fed isn’t anticipated shouldn’t be impactful. However, in our opinion, indications that broader trends still suggest some policy recalibration later in the year is likely may see the USD give back ground.

AUD corner

In light and uneventful US holiday impacted trade the AUD has tracked sideways just below its 100-day moving average (~$0.6546) over the past 24hrs. The AUD has nudged up slightly on most of the major crosses with gains of ~0.2% recorded against the EUR, GBP, CAD, and CNH at the start of the new week. By contrast, AUD/NZD (now ~1.0635) has slipped back a touch with the pair below its ~2-week average.

Locally, the minutes of the February RBA meeting are due today (11:30am AEDT). Going forward, based on the new structure and post meeting press conference, the potential impact of the RBA minutes is likely to be less than it was in the past. This time around, based on Governor Bullocks comment that another rate hike “cannot be ruled out” we will be on the lookout for comments about whether the option was genuinely considered by the Board. Overall, we continue to think that based on the support to aggregate demand from the larger population, and stickiness across domestic services inflation the RBA is likely to lag its global peers in terms of when it starts and how far it moves in the next easing cycle. Q4 wages data is released tomorrow. Wages are a key determinant of services inflation, and markets along with the RBA are looking for annual growth to edge up to 4.1%, the fastest since 2009.

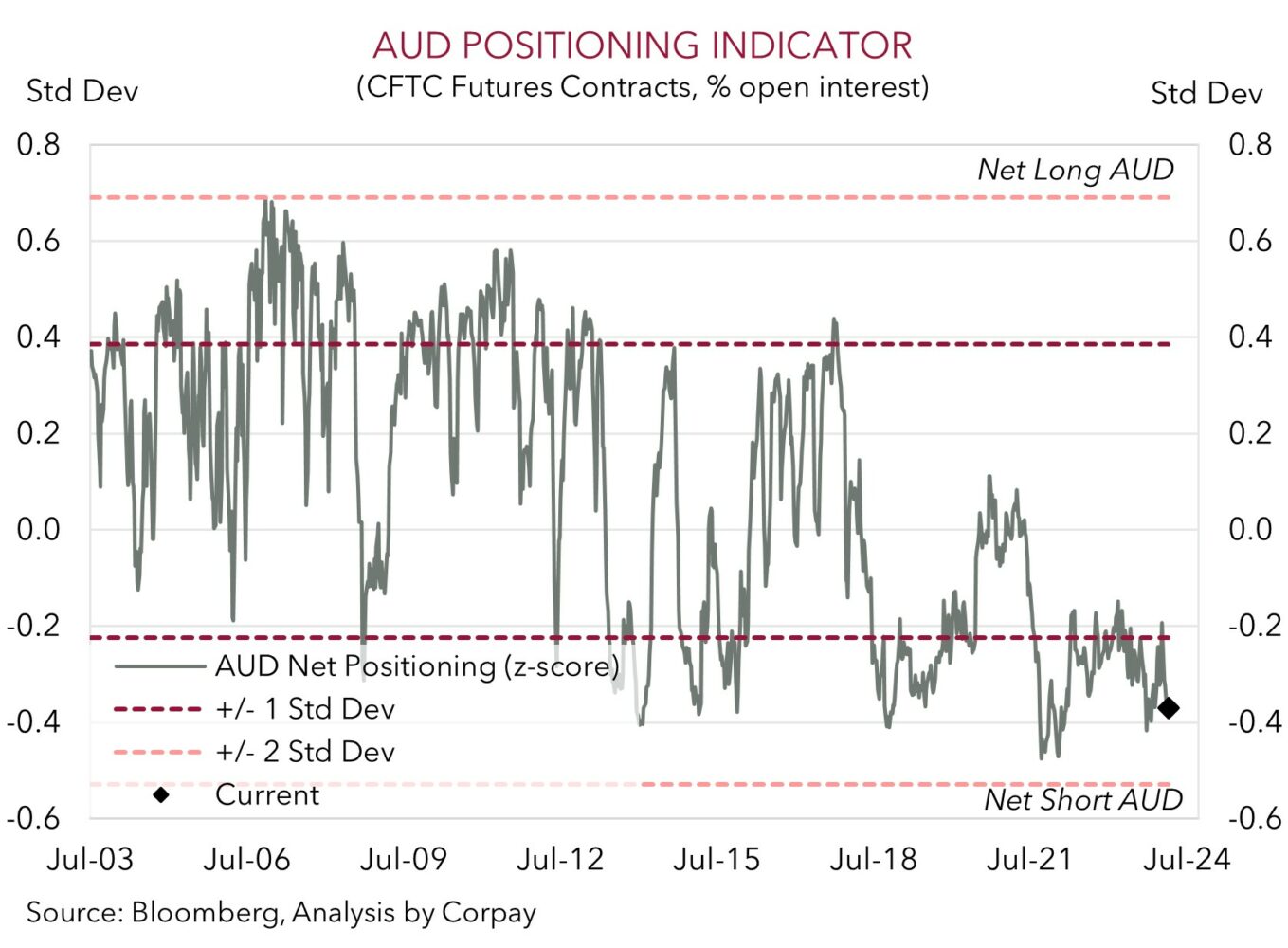

Over time, the diverging paths between the RBA and others should see short-dated interest rate differentials move more in the AUD’s favour. We believe this could be occurring at a time stimulus measures in China are gaining traction and momentum is improving, which would be a tailwind for regional growth and commodity demand. All up, as outlined over the past week, we think a lot of negativities are priced into the AUD at current levels. The AUD is still ~2 cents under the average ‘fair value’ estimate from our suite of models; statistically, outside of bouts of acute market stress, the AUD hasn’t tended to trade much below where it is over the past decade (since 2015 the AUD has only been sub $0.6540 ~7% of the time); capital flow support remains (Australia continues to run a current account surplus equal to 1.2% of GDP); and ‘net short’ AUD positioning (as measured by CFTC futures) is quite stretched. As our chart shows, ‘net short’ AUD positioning is near the bottom end of its historic range.