• US markets. US equities lost ground, while global trends exerted pressure on US yields. USD generally softer with the AUD’s grind up extending.

• Yields fall. Lower Canadian inflation, ‘dovish’ BoE comments, & a cut to China’s 5yr lending rate weighed on global bond yields.

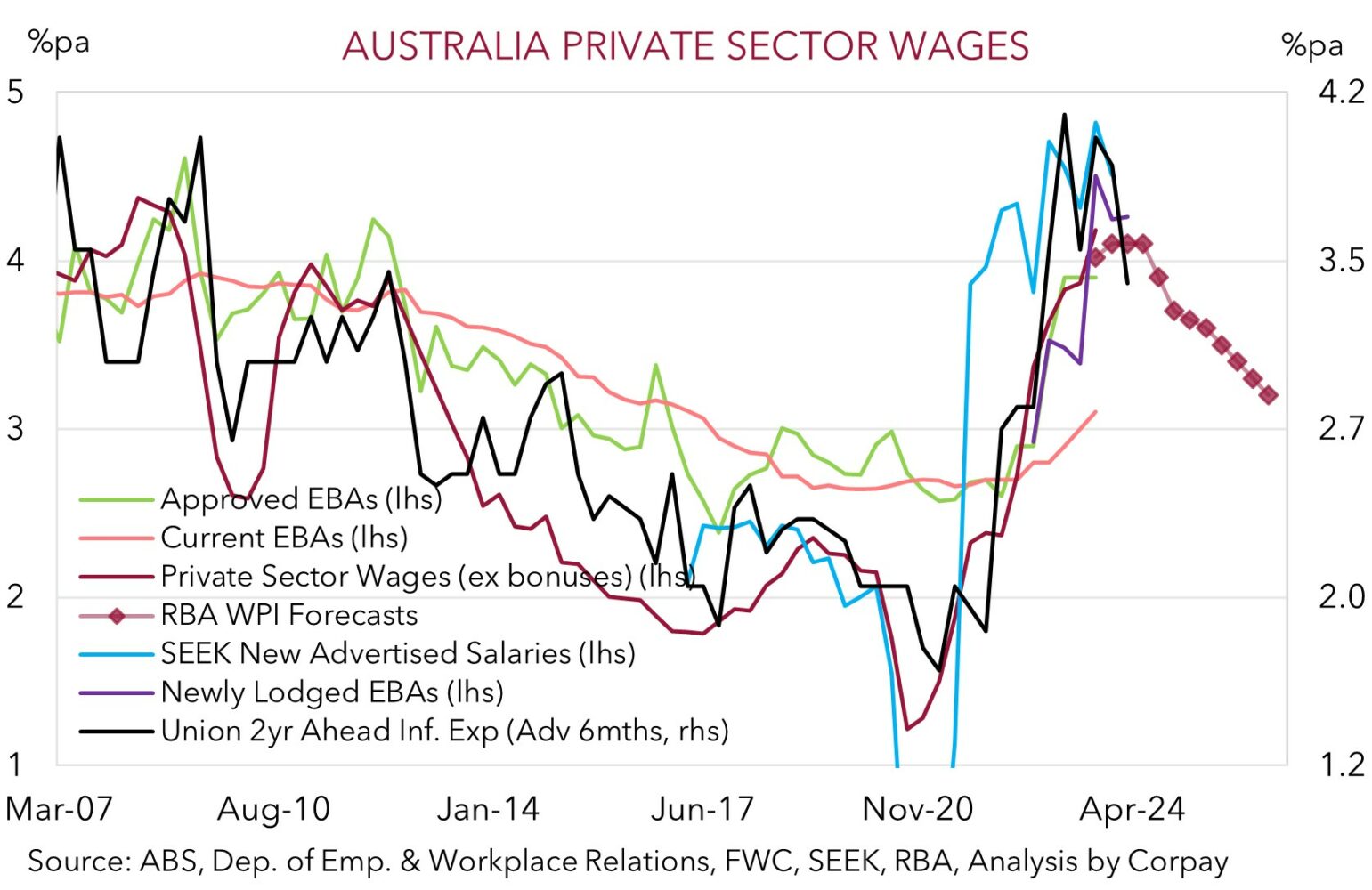

• AU wages. Q4 wages released today. Annual growth expected to tick up. Faster wages can keep services inflation high & the RBA on a different path to its peers.

A few market gyrations overnight. A pull-back in ‘big tech’ ahead of some earnings announcements dragged the US S&P500 (-0.7%) a little further from its all-time highs. Bond yields in Europe and North America fell as a mix of soft data and ‘dovish’ central bank comments supported the medium-term outlook for lower interest rates.

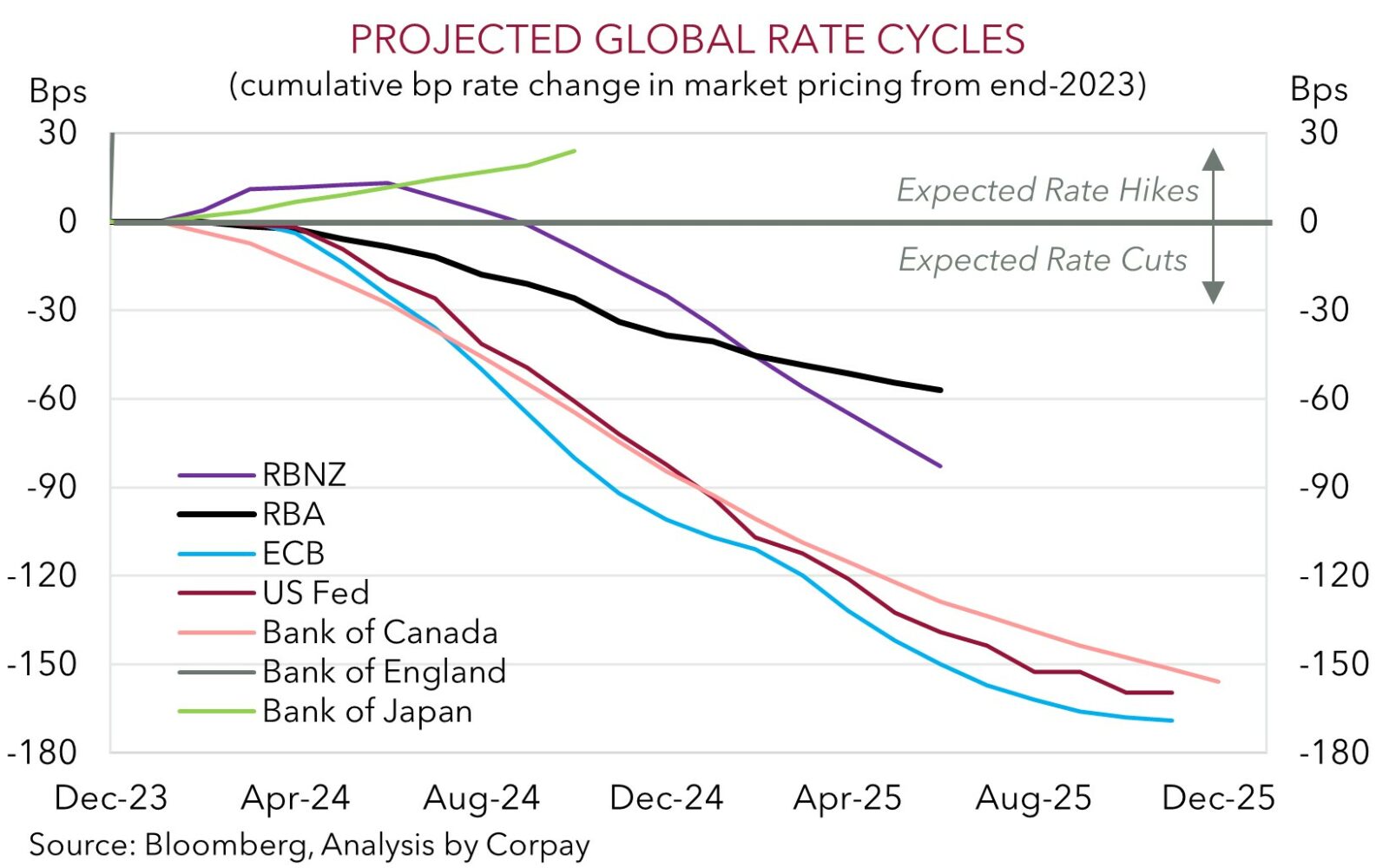

Yields in Germany dipped ~4bps across the curve. The Eurozone’s wage indicator slowed slightly in Q4 (from 4.7%pa to 4.5%pa) suggesting pressures may have turned the corner but with wage inflation still high the ECB will need more time/data before beginning its easing cycle. In Canada, in a break from the recent global trend, inflation undershot predictions with headline (now 2.9%pa) and core (now ~3.3%pa) CPI stepping down. Canadian 2yr yields tumbled ~14bps (now 4.16%) as markets brought forward expected Bank of Canada rate cuts. The first BoC move is factored in by July. UK yields declined ~7-8bps after Bank of England Governor Bailey reiterated inflation doesn’t have to come back to target before cuts can start, while he also added market pricing looking for a policy pivot this year was “not unreasonable” though the data will dictate the timing and size of the adjustments. Global trends, coupled with another fall in the US Conference Board leading index (a long run series that has a track record of picking US economic turning points), saw US yields slip with the 2yr rate down ~4bps (now 4.61%). Markets continue to discount the first US Fed rate cut by June.

In FX, the CAD underperformed on the back of the shift in BoC assumptions, but the lift in USD/CAD was modest (+0.2%) with the USD generally losing ground over the past 24hrs. Indeed, indicative of the softer USD environment, USD/CNH eased despite the People’s Bank of China announcing a surprise 25bp cut to the 5-year loan prime rate (an important drive of mortgage rates) as it tries to boost growth. EUR has edged back above ~$1.08, GBP (now ~$1.2625) is a bit higher, as is the AUD (now ~$0.6555), while USD/SGD drifted lower (now ~1.3435).

The pull-back in the USD over the past week has been inline with our post US CPI assessment (see Market Musings: Any juice left in the USD’s upswing?). Focus over coming days will be on US Fed commentary with the minutes of the January meeting (Thurs 6am AEDT) and speeches by a few key policymakers in focus (Jefferson (Fri 2am AEDT), Cook (Fri 9am AEDT), and Waller (Fri 11:35am AEDT)). Based on how far markets have corrected, a repeat of the view that a near-term rate cut (i.e. March or May) by the US Fed isn’t anticipated shouldn’t cause much of a stir. However, in our view, indications broader trends still suggest policy recalibration later in the year is still likely may see the USD remain on the backfoot.

AUD corner

The AUD has continued its slow rope climb higher over the past 24hrs with the softer USD and lower front-end US bond yields providing a helping hand (see above). At ~$0.6555 the AUD is ~1.7% above last week’s post US CPI low with the 200-day moving average (~$0.6565) in its sights. Outside of AUD/CAD, which rose by ~0.5% over the past 24hrs thanks to downshift in Canadian interest rate expectations following the lower than forecast Canadian inflation print, the other major AUD crosses have consolidated.

Locally, the minutes of the February RBA meeting were released yesterday. The minutes didn’t contain many surprises with the very mild ‘hawkish’ bias evident in recent commentary repeated. Notably, the Board still only considered two options (hiking by 25bps or keeping rates on hold) with no real inclination rate cuts will be on the table for a while given still high inflation and thoughts it could take “some time” to have sufficient confidence inflation would be on a sustainable track to the mid-point of its target band. Today, Q4 wages data is released (11:30am AEDT). Wages are a key determinant of services inflation, and markets along with the RBA are looking for the annual run-rate to edge up to 4.1%pa, the fastest since 2009. In our opinion, confirmation of faster wage growth (which we feel could linger into 2024 due to the slow moving dynamics caused by the prevalence of multi-year enterprise bargaining agreements) should reaffirm that the RBA is on a different path to its peers and may give the AUD more support ahead of the release of the US Fed minutes (Thursday 6am AEDT) and speeches by several FOMC members on Friday.

More broadly, based on the boost to aggregate demand from a larger population, and stickiness in domestic services inflation we think the RBA will lag its global counterparts in terms of when it starts and how far it moves in the next easing cycle. Over time we expect this to shift short-dated yield differentials more in the AUD’s favour. Importantly, we believe this could occur at a time stimulus measures in China are gaining traction and activity is improving (a tailwind for regional growth and commodity demand). These factors underpin our positive medium-term AUD bias, particularly as we remain of the view that down near current levels a lot of negativities are priced in. The AUD remains ~2 cents under the average ‘fair value’ estimate from our suite of models, with various relative fundamentals and rate spreads also suggesting pairs like AUD/EUR, AUD/GBP, and AUD/NZD have scope to move higher.