• Yields rise. Near-term rate cut bets continue to be trimmed back. This pushed up European & US bond yields, with EUR a little firmer.

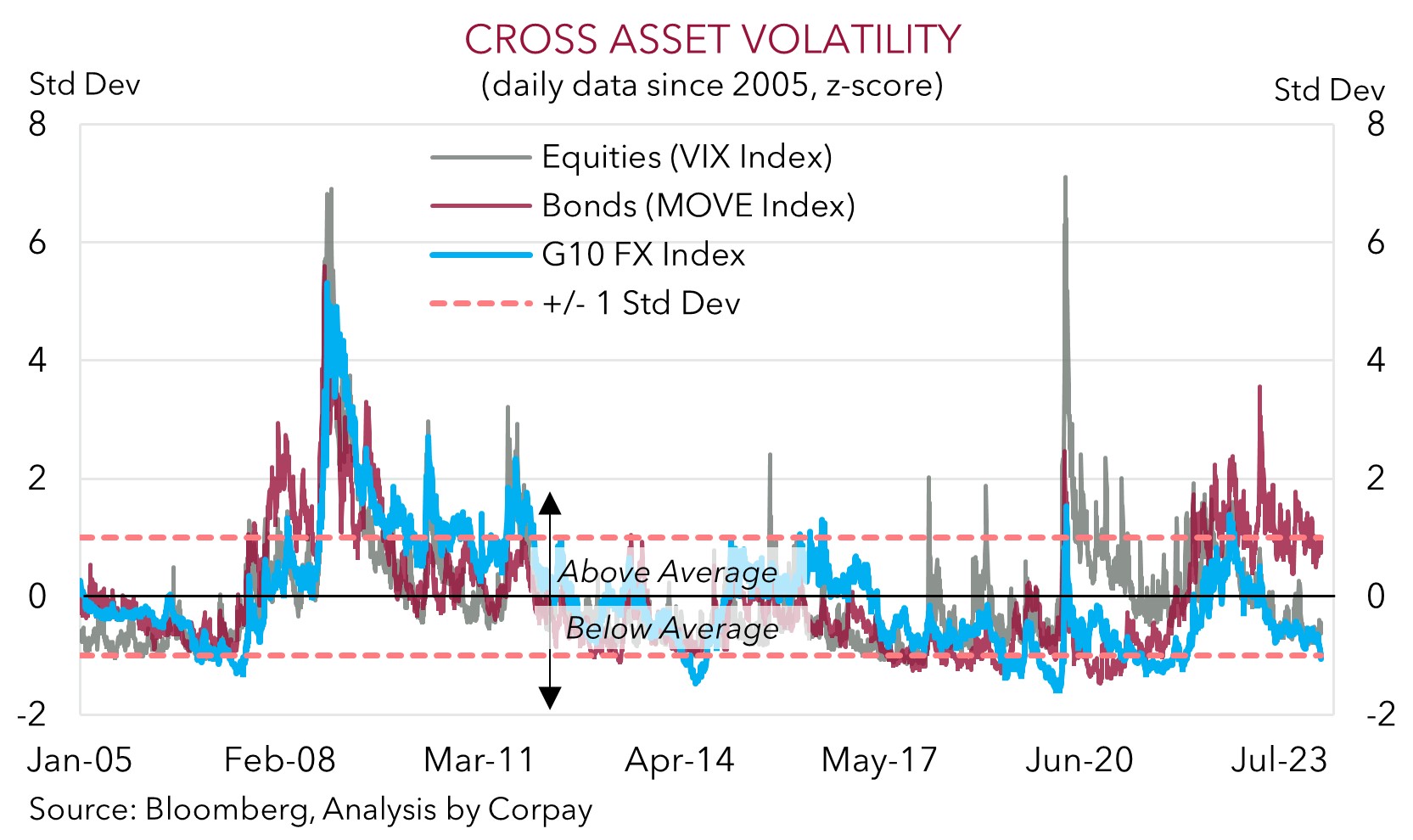

• Low vol. Outside of bonds, volatility across other major asset markets is below average. Japanese inflation, Fed speakers & US data in focus today.

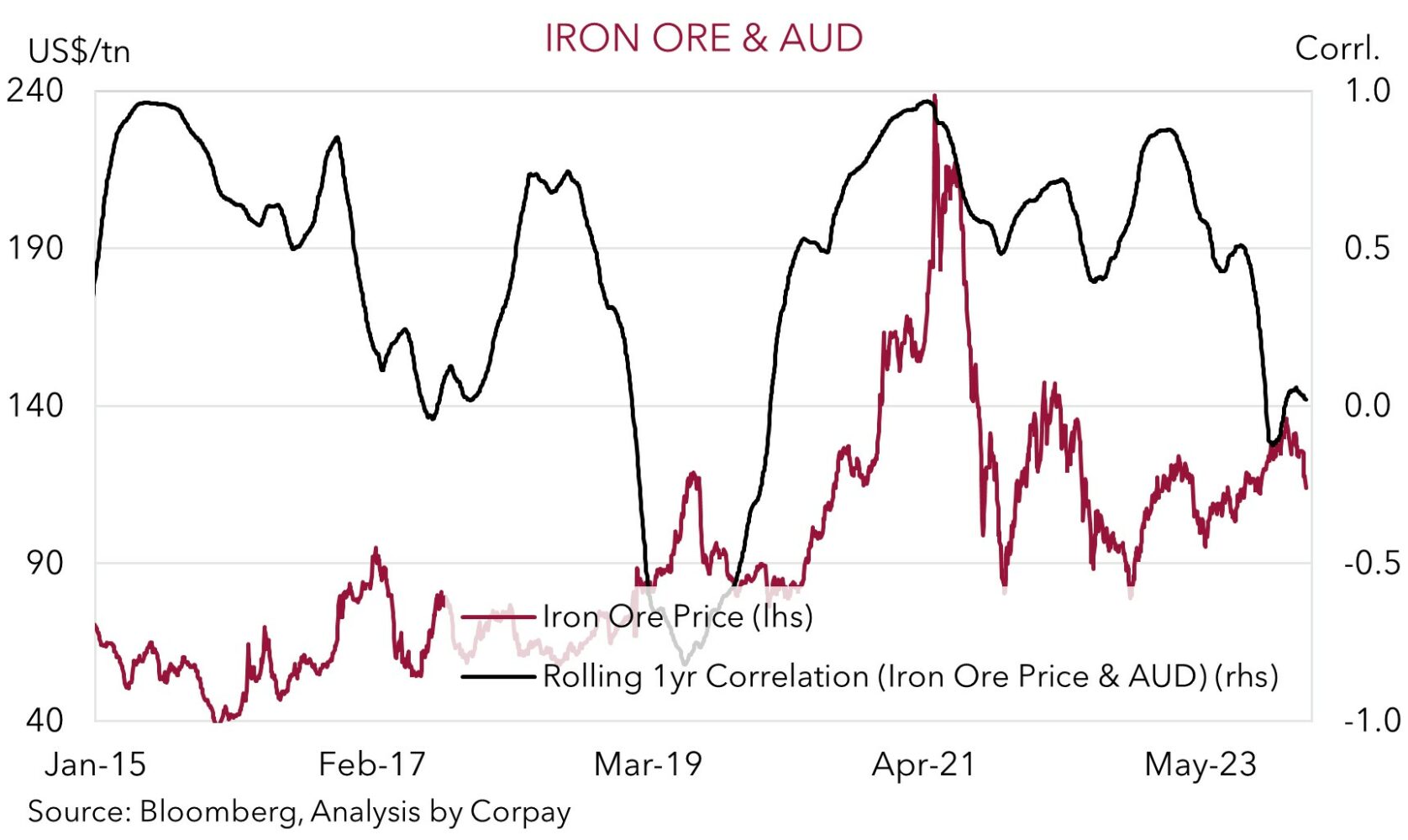

• AUD softer. Lower base metal prices have exerted a bit of pressure on the AUD. But correlations between the AUD & iron ore aren’t what they used to be.

The subdued market performance has continued with relatively modest moves across most asset classes at the start of the week. As our chart shows volatility measures for equities and the major currencies are well below average, with bonds still swinging around a bit more than average. This divergence was on show again overnight. Equities lost some steam (the US S&P500 slipped back 0.2%), while bonds yields rose across Europe and North America. In Germany yields lifted ~7-8bps, in the UK there was a ~6bps increase, and in the US yields edged up ~3-4bps with the benchmark 10yr rate now at ~4.28% and the 2yr rate at ~4.72%.

Concerns about the greater bond supply, with the US holding a few large auctions this week, was pointed to as a factor, as was the further paring back of near-term rate cut expectations. ECB President Lagarde spoke and reiterated policymakers need to see more evidence inflation is heading sustainably back down to target before acting, while another member (Stournaras) repeated his view that given new information on wages won’t be available until late April he’d wait until June to cut. Just under a full 25bp rate cut by the ECB is now factored in by June. Much like the pricing for the US Fed there has been a sharp reassessment recently. At the turn of the year, markets were discounting ~3 rate cuts by the ECB by June.

In FX, the larger lift across Eurozone yields helped the EUR nudge up (+0.2% to ~$1.0850). The interest rate sensitive USD/JPY also ticked up slightly (now ~150.70). NZD (-0.4%, now ~$0.6175) and AUD (-0.3%, now ~$0.6540) lost a little ground with participants possibly trimming positions ahead of Wednesday’s RBNZ meeting and as industrial metal prices declined (iron ore shed ~4.9% and copper fell ~1.6%).

Today, Japanese inflation is released (10:30am AEDT) and the US Fed’s Schmid speaks on the policy outlook (11:40am AET). Tonight US durable goods orders are due (12:30am AEDT). Base effects look set to drag headline Japanese inflation back under ~2%pa for the first time since Q1 2022, however the core and services measures should continue to remain elevated. The latter is important for the BoJ as it gauges inflation’s persistence. While lower headline Japanese inflation may exert more pressure on the JPY in the short run, we believe over the medium-term there are asymmetric risks building given how high USD/JPY and other crosses like AUD/JPY now are (i.e. there are more chances the JPY re-strengthens than continues to depreciate). More broadly, we continue to think that signs of a weakening US growth pulse and comments by US Fed officials noting that although near-term rate cuts are off the table policy easing later this year is still anticipated could see the USD soften.

AUD corner

The AUD has drifted back a little over the past 24hrs to be down near ~$0.6540. The AUD also weakened a bit on most of the major crosses. On the AUD side of the ledger lower base metal prices have exerted some pressure, but the extent of the moves illustrates that past strong correlations that participants often point to have weakened (i.e. iron ore prices declined by ~4.9% yet the AUD is only ~0.3% lower compared to this time yesterday). As our chart shows, the correlation between iron ore and the AUD has been minimal over the past year. The step down in AUD’s sensitive to swings in iron ore prices reflects the different stage of the mining boom Australia is now in, with the impact from commodity prices felt economically and in the AUD via monthly trade flows rather than mining investment and its flow on effects on domestic macro conditions.

The softer AUD combined with a lift in Eurozone bond yields (see above) has seen AUD/EUR slip towards the bottom-end of the narrow range it has occupied over the past ~6-weeks (now ~0.6030). Elsewhere, AUD/JPY is still at high levels (now ~98.60). Japanese inflation is due today (10:30am AEDT). And while a lower headline CPI print may see the JPY weaken a little as markets question whether the BoJ will look to normalise its policy stance any time soon, we would not be looking to chase AUD/JPY higher from current levels. Indeed, as discussed above, we think there are more medium-term downside than upside risks for AUD/JPY based on where it is now trading (note: since 2010 AUD/JPY has only traded above 98.60 ~2% of the time) and the various economic and geopolitical risks that continue to bubble away under the surface.

Locally, the January reading of the monthly inflation indicator (Weds AEDT) and retail sales (Thurs AEDT) are this weeks main releases. A bounce back in retail sales is looked for after the December post Black Friday decline (mkt +1.6%), while CPI may re-accelerate as some of the ‘relief’ measures that have held down inflation fade (mkt 3.6%pa from 3.4%pa). If this occurs this may see the AUD claw back ground as Australian interest rate expectations adjust higher, and as data and events on the other side of the story also flow through. As mentioned above, we continue to think the USD’s pull-back can extend further if the US economic data underwhelms and members of the US Fed continue to keep the door open to rate cuts later this year. On the crosses, AUD/NZD may also snap back from low levels (now ~1.0590) if we are right and the RBNZ holds fire and doesn’t deliver another rate hike at tomorrow’s meeting (markets are assigning a ~25% chance the RBNZ lifts rates tomorrow).