• Low vol. US/European equities consolidated, while bond yields nudged up. FX markets were well contained. AUD range traded over the past 24hrs.

• RBNZ decision. RBNZ meets today. Markets are assigning a ~21% chance they hike rates. No change could see the NZD fall & AUD/NZD snap back.

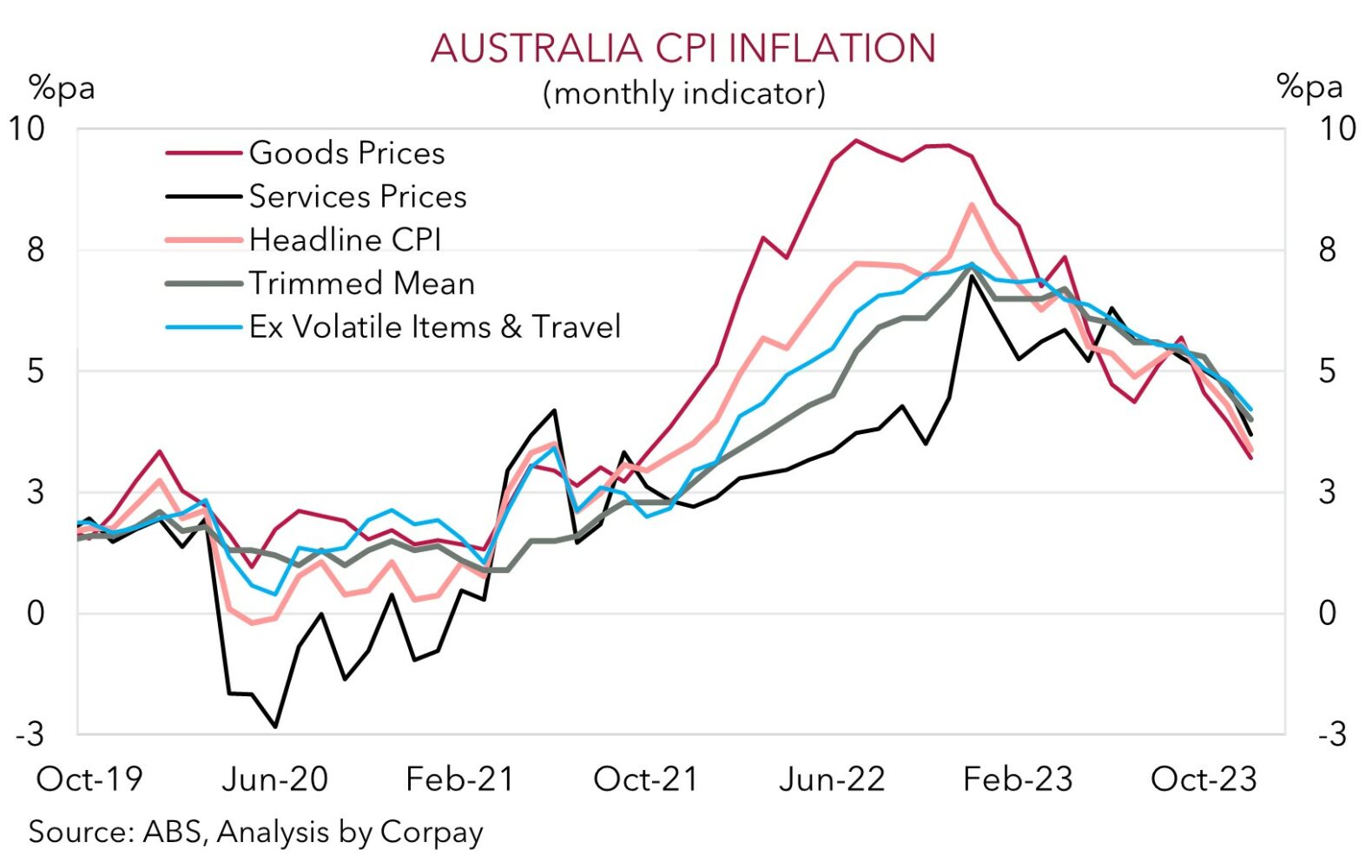

• AU CPI. January reading of the monthly CPI indicator due today. Annual inflation forecast to re-accelerate. This may catch the eye & give the AUD a boost.

Another uneventful session overnight. US and European equities consolidated (S&P500 +0.1%), with yesterday’s lift in Asia not flowing through (China’s CSI300 index rose 1.2%, its sixth gain in the seven sessions since the Lunar New Year). Bond yields ticked up, with UK rates rising ~3-4bps across the curve and US equivalents ~1-3bps higher. The US 10yr yield is near 4.31%, the top-end of the range occupied since December. Markets continue to fully discount the first US Fed rate cut in July, with a modest easing cycle (broadly inline with the Fed’s forecasts) anticipated over H2 2024. Interest rate markets shrugged off a batch of subpar US data. US consumer sentiment fell for the first time in 4-months as views about the outlook, especially towards the jobs market, deteriorated. This points to headwinds for the consumer spending, the engine room of the US economy. Durable goods orders also tumbled 6.1% in January. Even if the volatile and chunky transport orders are stripped out core orders were lower in the month, a sign business investment could be soft in Q1.

FX markets were well contained. The USD index oscillated in a 0.3% range over the past 24hrs. EUR drifted a touch lower (now ~$1.0845), GBP tread water around ~$1.2680, while USD/JPY ticked down slightly from where it was this time yesterday (now ~150.52). Japanese inflation was released yesterday, and an upside surprise kept alive expectations the Bank of Japan remains on a policy normalisation path. The Japanese 2yr yield hit 0.17%. These lofty heights were last traded in 2011. Japanese headline CPI didn’t slow as much as predicted (now 2.2%pa), neither did the ‘core-core’ measure monitored by the BoJ (i.e. ex fresh food and energy) which is running at a still historically high 3.5%pa. The upswing in sticky services inflation due to faster wages is occuring in Japan, albeit more timidly. The late-April BoJ meeting appears the most likely time for a policy shift. We remain of the view that based on where it is now tracking and the various economic and geopolitical issues still bubbling beneath the surface there are greater risks the JPY re-strengthens rather than weakens further over the medium-term.

Elsewhere, USD/SGD is hovering near 1.3440, AUD has swung around in a ~0.5% range centered on ~$0.6545, and ahead of todays RBNZ decision (12pm AEDT) the NZD is below its 50-day moving average (~$0.6180). As mentioned previously, we don’t see the RBNZ re-starting its hiking cycle today (traders are assigning a ~21% chance they will), rather we expect a “hawkish hold”. If the RBNZ keeps rates steady we think the NZD should lose ground. Tonight, attention will be on the handful of US Fed speakers (Bostic 4am, Collins 4:15am, and Williams 4:45am AEDT). In our view, a rehash that near-term rate cuts are off the table, but some policy loosening is still anticipated later this year may see the USD drift lower.

AUD corner

The AUD has oscillated in a ~0.5% range near ~$0.6545 over the past 24hrs. The low volatility (see above) coupled with a rebound in base metal prices (copper +0.4%, iron ore +2.4%) and firmer energy prices (WTI crude +1.2%) helped the AUD find support. Modest gains of 0.1-0.2% were also recorded against the EUR, GBP, NZD, CAD, and CNH. By contrast, AUD/JPY eased modestly after the positive surprise in Japanese inflation bolstered expectations the BoJ might soon shift away from its very accommodative settings. Based on where it is trading, we believe there are uneven medium-term risks around AUD/JPY (i.e. further upside may be limited, while a larger pullback is more likely). Indeed, in our judgement AUD/JPY already looks too high compared to levels implied by various drivers such as longer-dated yield spreads.

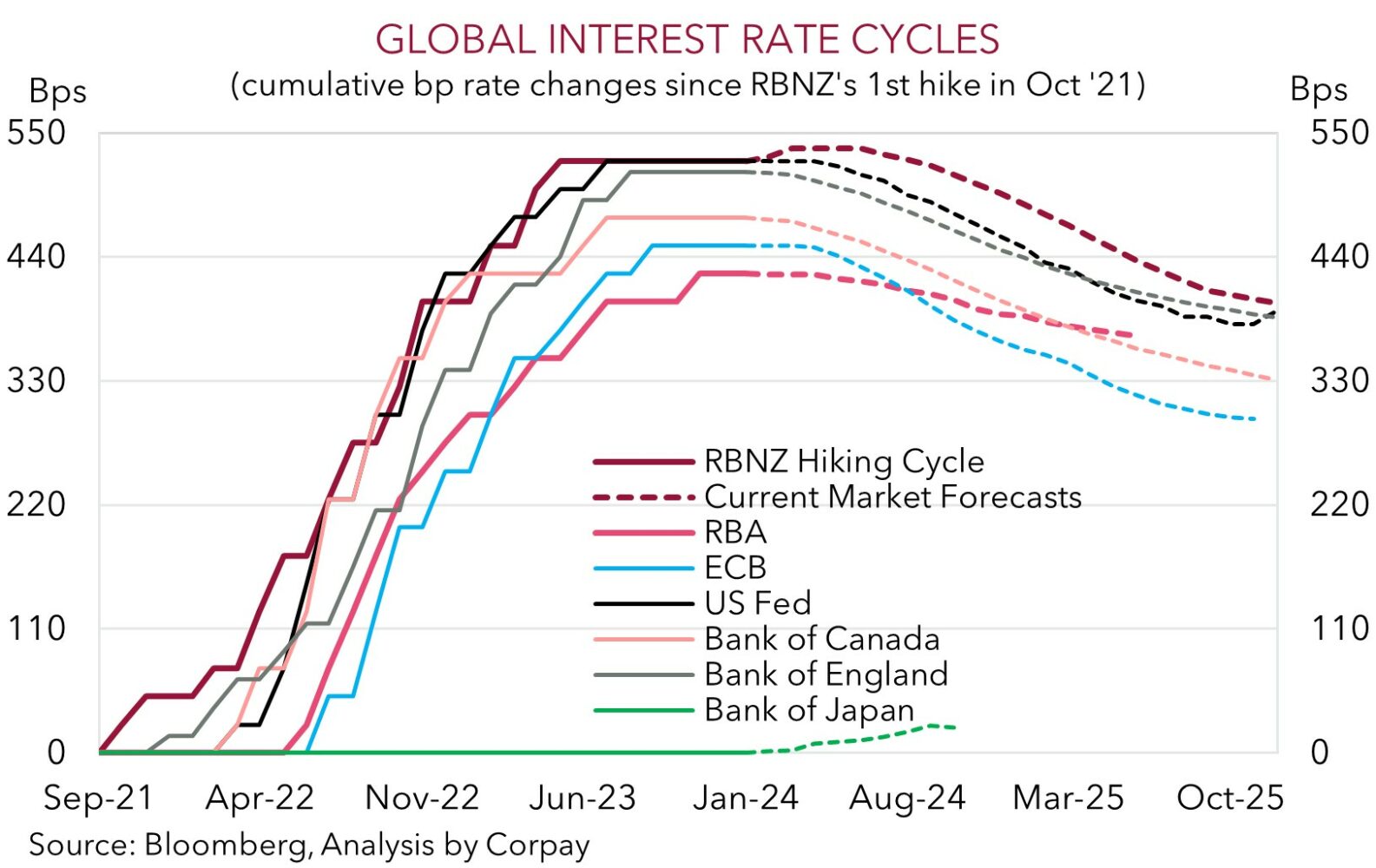

Today, AUD intra-day volatility may pick up. Locally, the monthly CPI indicator for January is released (11:30am AEDT) and this will be followed by the RBNZ decision (12pm AEDT) and RBNZ Governor Orr’s press conference (1pm AEDT). In a turn from the recent trend annual inflation is forecast to re-accelerate (mkt 3.6%pa from 3.4%pa) given renewed disruptions across goods prices and with some of the ‘relief’ measures that have been held down a few areas fading. Note, at this stage of the new quarter the CPI indicator is incomplete (only ~60% of the CPI basket is updated, and there is limited new information regarding ‘services’). Nevertheless, we feel that a lift in the annual inflation rate could catch the markets eye, and an upward adjustment in RBA interest rate expectations as a ‘higher for longer’ outlook is priced in might give the AUD a boost. We remain of the opinion that Australia’s underlying inflation pulse and support to aggregate demand from the larger population will see the RBA stay on a different path to its peers with the bank set to lag in terms of when it starts cutting rates and/or how many are delivered in the next cycle. This should be a medium-term support for the AUD and AUD-crosses.

In terms of the RBNZ (and AUD/NZD), after a few positive data surprises, markets are factoring in a ~21% chance the RBNZ hikes rates today after being on hold for some time. We feel the hurdle for the RBNZ to re-start its hiking cycle is high and that there are more arguments in favour of rates being held steady at 5.5% and the bank hammering home a ‘higher for longer’ mantra via is language/updated forecasts. If we are right and RBNZ holds fire the NZD is likely to fall back, while AUD/NZD, which already looks too low compared to a range of relative indicators, may snapback. At ~1.06 AUD/NZD is near the bottom of its 1-year range.