• Negative vibes. A slightly more bearish tone ahead of tonight’s US PCE deflator data. Equities & bond yields a bit lower. AUD & NZD underperform.

• RBNZ holds. RBNZ clipped the markets hawkish wings. Rates held steady & odds of another hike were watered down. NZD fell. This dragged on the AUD.

• AU CPI. Headline inflation failed to re-accelerate in January. But there was little new info on services prices. AU retail sales released today.

A slightly more bearish tone across markets overnight as traders gear up for the release of the US PCE deflator (the US Fed’s preferred inflation gauge) (tonight 12:30am AEDT). Equities slipped back (S&P500 -0.2%) and bond yields are a bit lower. The US 2yr rate fell ~5bps (now 4.65%) and the 10yr dipped ~4bps (now 4.27%). Oil prices lost some ground (WTI crude -0.4%), as did base metals (copper -0.4% and iron ore shed 1.5%, its third fall in the past four days). Across FX, the backdrop has given some support to the USD, although outside of the antipodean currencies the moves have been modest. EUR and GBP eased a little (now ~$1.0840 and ~$1.2660), and USD/JPY ticked up (now ~150.70). USD/SGD has edged up towards its 200-day moving average (~1.3475), while AUD (now $0.6497) and NZD (now $0.6098) underperformed.

Yesterday, the RBNZ clipped the markets hawkish wings. Leading into the decision markets were factoring in some chance of another RBNZ rate hike. But in the end the cash rate was held steady at 5.5%, and the underlying tone and updated forecasts watered down the prospect of further tightening (see below). The downshift in NZ interest rate expectations weighed on the NZD, and the AUD was caught in its slipstream as thoughts the RBA could follow crept into people’s thinking, particularly after the monthly Australian inflation indicator failed to re-accelerate as predicted.

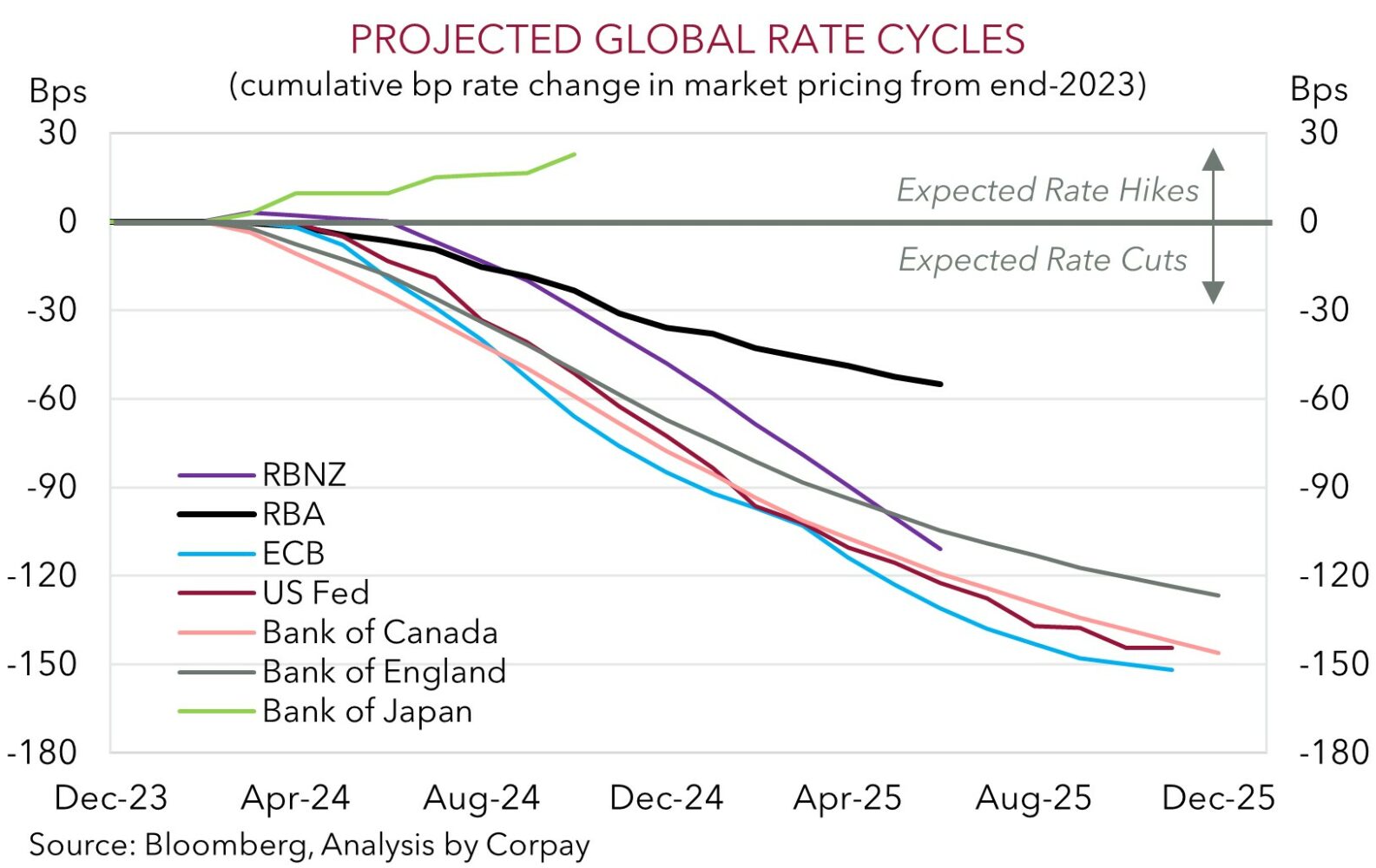

In the US a few US Fed members spoke, but they didn’t break new ground. NY Fed President Williams, one of the FOMC heavyweights, stated that although there is “a ways to go” to reach 2% inflation and the path forward “will be bumpy”, rate cuts “later this year” are still on the table. In his view, three rate cuts in 2024 is a “reasonable starting point”. This is broadly inline with market pricing. Interest rate futures are discounting the first US Fed rate cut in July, with another two factored in later this year.

Tonight, attention will be the US PCE deflator (12:30am AEDT). There are also a few US Fed members speaking (Bostic (2:50am AEDT), Goolsbee (3am AEDT), and Mester (5:15am & 7:30am AEDT), while in the Eurozone country level CPI data is due (France (6:45pm AEDT), Spain (7pm AEDT), and Germany (12am AEDT)). In terms of the US PCE deflator based on the positive surprises in the CPI and PPI, markets are anticipating a pick up in the monthly inflation pulse. However, the broader disinflation trend should remain when it comes to the important annual growth rates (mkt 2.8%pa for core PCE and 2.4%pa for headline PCE). If realised, this could sooth market nerves and exert some pressure on the USD, especially as temporary/seasonal forces look to be behind the early-2024 rebound in price pressure and US Fed officials haven’t appeared overly anxious about the January bounce.

AUD corner

The AUD has come under some downward pressure over the past 24hrs with the currency dipping below ~$0.65 for the first time since mid-February. The AUD also underperformed on most of the crosses with falls of ~0.6-0.7% recorded against the EUR, JPY, GBP, and CNH. The one exception has been AUD/NZD with the cross-rate rising ~0.5% to 1.0650.

A key catalyst for the AUD weakness (and bounce in AUD/NZD) was the more ‘dovish’ than anticipated RBNZ decision, with markets quickly assuming the RBA might follow the RBNZ’s lead. As outlined above, in contrast to market pricing looking for some chance of another rate rise, the RBNZ kept rates steady and pushed back on thoughts more tightening may be needed. The implied odds of another rate rise inferred from the RBNZ’s projections was trimmed rather than added to with the start of an easing cycle still penciled in from H1 2025. As Governor Orr noted demand now better matches supply and while risks remain NZ looks to be “in a disinflation period”. From our perspective, as it was a pillar behind the NZD’s recent outperformance (and fall in AUD/NZD), the rethink about the RBNZ outlook should generate renewed support for AUD/NZD, particularly as a range of fundamental indicators such as longer-dated interest rate spreads, commodity prices, and other macro trend gauges already suggest AUD/NZD is too low.

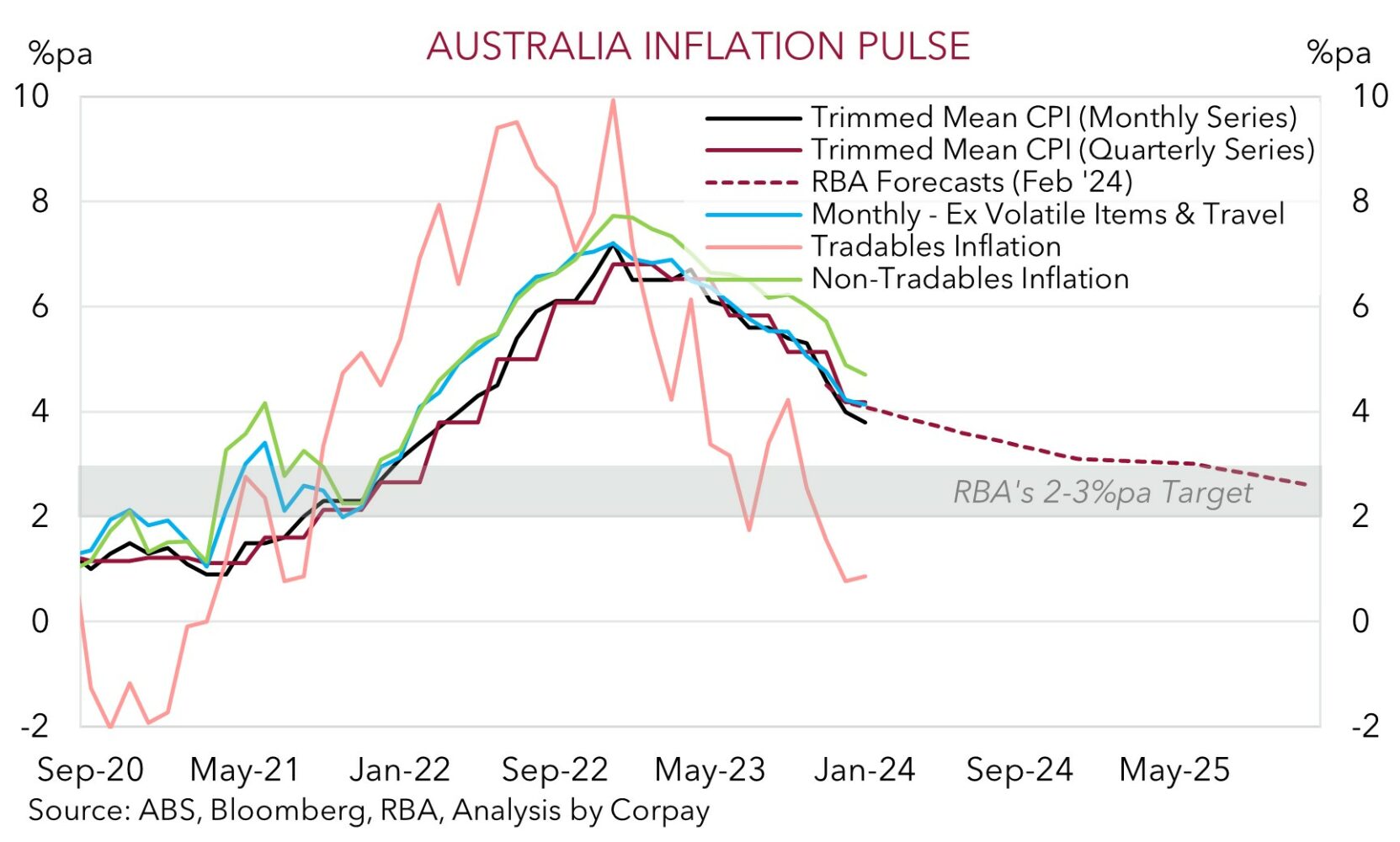

The flow through from the RBNZ decision compounded the softer than forecast monthly Australian CPI data. Inflation failed to re-accelerate in the year to January with headline CPI holding steady at 3.4%pa. A closer look shows that disinflation in ‘goods’ and ‘tradables’ inflation was a driver, while ‘services’ and domestic ‘non-tradables’ inflation (which are tied to wages) are still elevated. As our chart shows, the downshift in core inflation (now 3.8%pa) is slow going and broadly following the RBA’s forecasts. We would also note that giving it is the first month of the quarter, the CPI indicator is heavily skewed towards goods prices with limited new inflation on services provided. Similar inflation ‘head fakes’ have happened at the start of recent quarters. As such we doubt the RBA will be swayed by the January CPI, and think markets (and the AUD) might be factoring in too much risk of a possible near-term pivot.

Today, retail sales for January are due (11:30am AEDT). A rebound from the post Black Friday slump is anticipated (mkt +1.5%). Signs consumer spending rose over the new year may question the markets ‘dovish’ RBA leanings, giving the AUD a little boost. This could be added to if tonight’s US PCE deflator (12:30am AEDT) shows annual inflation continues to slow and the USD loses ground. Overall, based on where it is tracking we think further AUD downside should be limited. ‘Net short’ AUD positioning (as measured by CFTC futures) is already quite large, and the average across our suite of models suggest the AUD is trading ~2 cents below ‘fair value’.