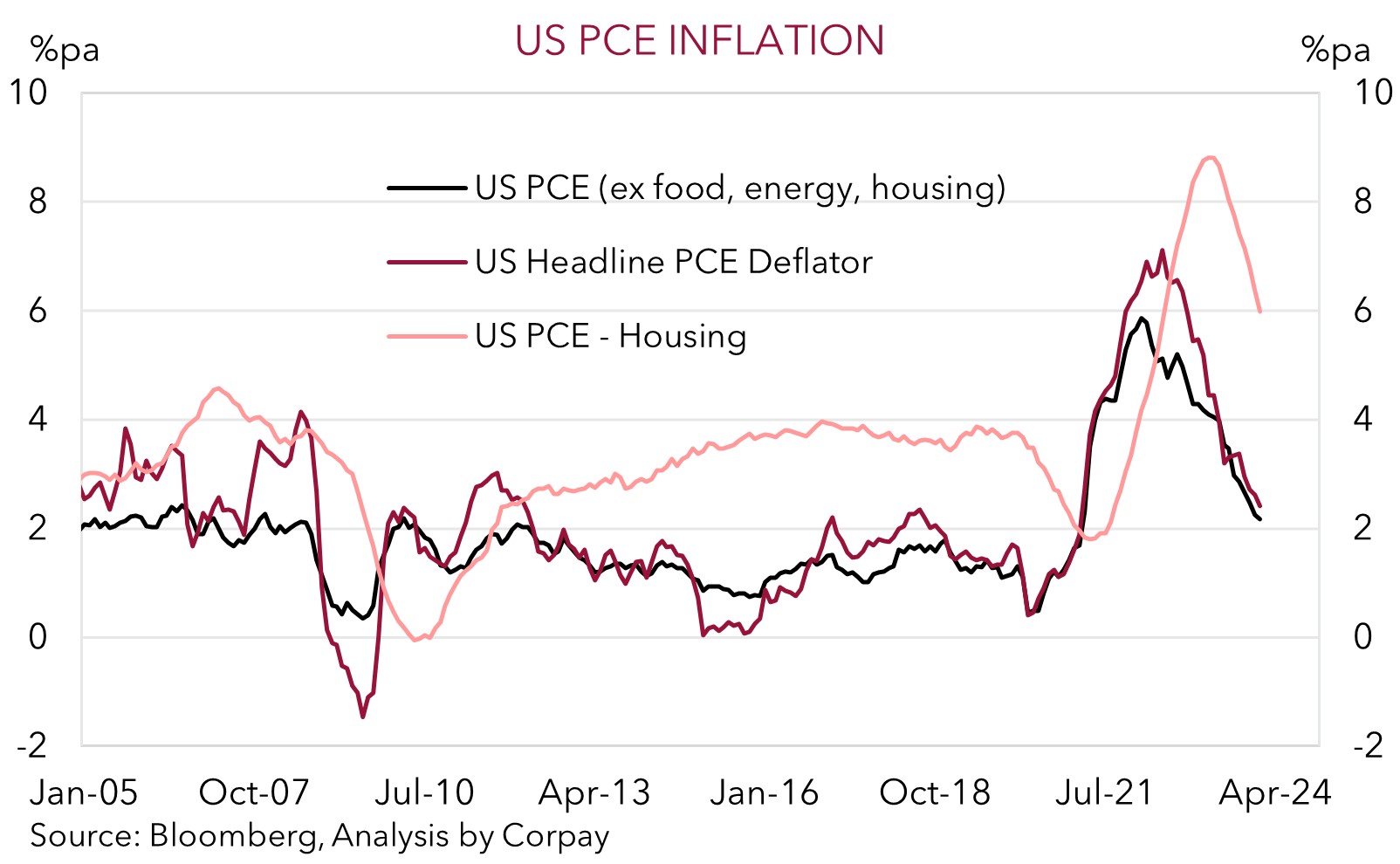

• Inflation focus. Strength in core inflation across Europe raised some concerns, but the US PCE deflator matched analyst predictions.

• FX swings. There was a modest burst of intra-day FX vol overnight. The USD recouped its post PCE dip with month-end rebalancing a factor.

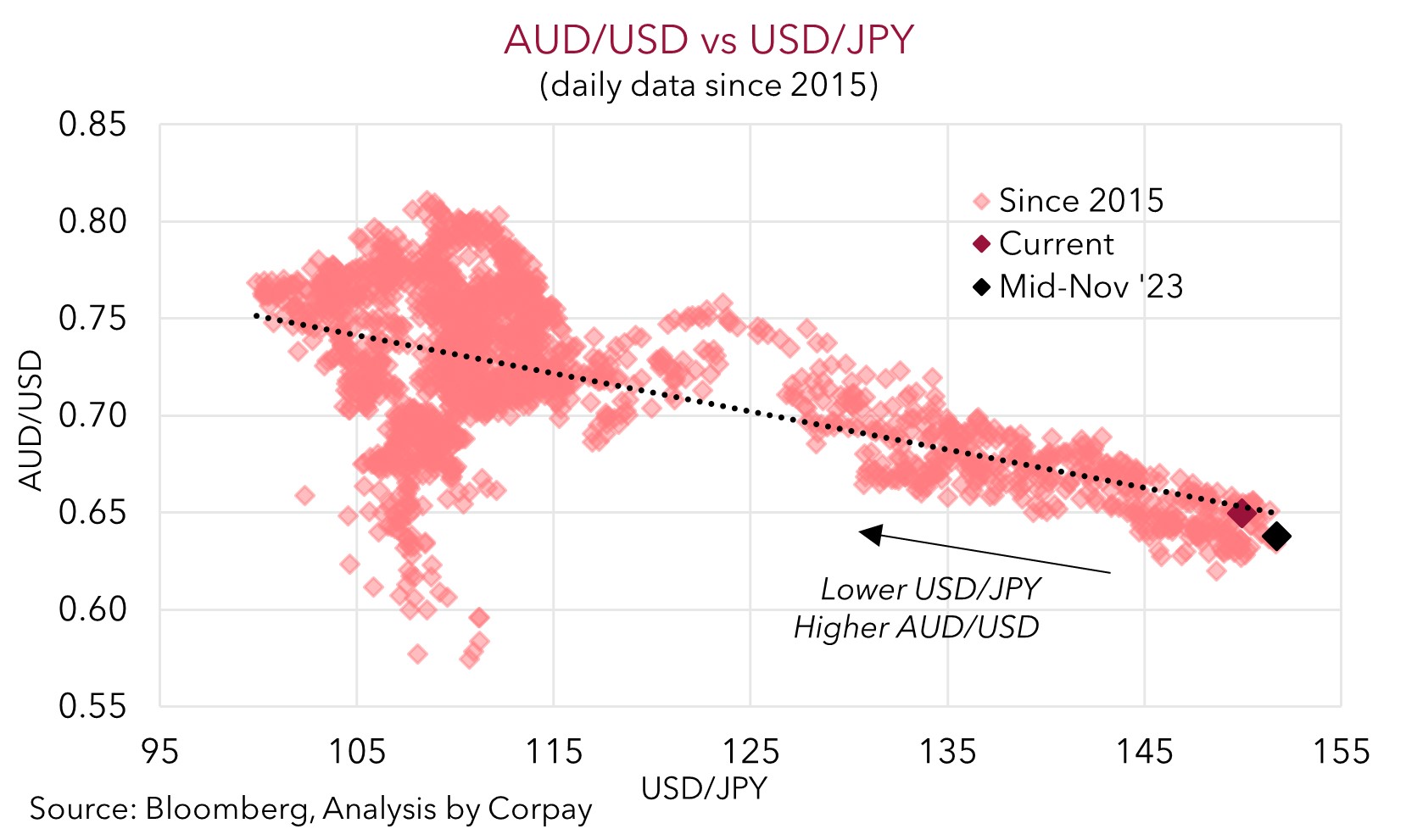

• AUD & JPY. On net, AUD is little changed. Yesterday’s ‘hawkish’ BoJ rhetoric could be positive factor. A lower USD/JPY normally translates to a higher AUD.

Inflation was in focus overnight with European country level readings and the US PCE deflator (the US Fed’s preferred gauge) released. The results generated a bit of intra-session volatility across asset classes. While headline inflation in Germany, France, and Spain slowed, strength in the underlying core measures generated some concern and this saw bond yields initially lift. However, with the US PCE deflator coming in inline with expectations markets breathed a collective sigh of relief. After the jump in the US CPI and PPI data analysts were anticipating a firmer monthly inflation pulse. But on an annual basis, headline and core PCE continues to slow. The US core PCE deflator is now running at 2.8%pa, its lowest since Q1 2021. And as our chart shows, when sticky housing related prices are stripped out, the run-rate is even lower. Speaking after the data Chicago Fed President Goolsbee said that one should be careful in extrapolating the January results forward. We share this view given seasonal/transitory forces look to be at play.

The US PCE report coupled with a modest pickup in weekly initial jobless claims and softer Chicago PMI saw US bonds reverse. Long end US yields ended the day a touch lower (10yr -2bps to 4.25%) while equities rose (S&P500 +0.5%, NASDAQ +0.9%). In FX, the USD Index more than recouped its post US PCE losses. Though the moves late in the session in a few of the FX major currencies suggest month-end window dressing/rebalancing by large global portfolio managers was a factor. On net, EUR is a bit below where it was yesterday (now ~$1.0810), as is GBP (now ~$1.2620). By contrast USD/JPY is sub ~150 with the JPY holding onto its gains stemming from yesterday’s more ‘hawkish’ rhetoric from the BoJ’s Takata who outlined the price target is “finally coming into sight” and they are “at a juncture for a shift”. This suggests policy normalisation steps are on the horizon. The late-April BoJ meeting still looks the most likely time, in our opinion, given it will follow the next Shunto wage negotiations round. Elsewhere, USD/SGD is on net little changed (now ~1.3455), and after trading in a ~0.7% range the AUD is where it was tracking 24hrs ago (now $0.6497).

Today, the China PMIs (12:30pm AEDT), Eurozone CPI (9pm AEDT), and US ISM (2am AEDT) are due. There are also several members of the US Fed speaking (Williams (12:10pm AEDT), Waller & Logan (2:15am AEDT), Bostic (4:15am AEDT), Daly (5:30am AEDT), Kugler (7:30am AEDT)). Based on Lunar New Year distortions the China PMIs may show sluggish momentum. While offshore, indicators point to upside risks to Eurozone core inflation and downside risks to the US ISM. This type of mix, coupled with comments by US Fed officials that the door to policy easing later in the year remains open, could see the EUR rebound and the USD lose ground.

AUD corner

The AUD endured some intra-session volatility over the past 24hrs as the global data and month-end rebalancing flows pushed and pulled the major currencies (see above). The AUD traded in a ~0.7% range, but in the end, it is where it was tracking this time yesterday against the USD (now ~$0.6497). On the crosses, the AUD was a bit more mixed. Modest gains were recorded against the EUR (+0.3%), GBP (+0.4%), and NZD (+0.2%), while AUD/JPY extended its recent pull-back (-0.5%). We think there is more to come for AUD/JPY with the JPY forecast to appreciate over the medium-term.

Locally, there was a mixed bag of data yesterday. The rebound in retail sales following the post Black Friday slump was lackluster (+1.1% in January). Households continue to feel the pinch from cost-of-living pressures and higher interest rates. Compared to a year ago retail turnover (excluding food) is pretty much unchanged and it is going backwards on per capita basis (the jump in the population is helping to prop up volumes). By contrast, business CAPEX plans for the remainder of FY24 were revised up and the first cut for FY25 is pointing to even greater investment. This can be a source of support for the broader economy and counteracts sluggish household consumption. These crosscurrents and still tight labour market conditions point to no real urgency for the RBA to lower interest rates, in our opinion. We believe odds of a near-term reduction are misplaced (markets are assigning a ~40% chance the RBA cuts rates by May). A paring back of these rate cut expectations can give the AUD a boost over time.

Overall, we continue to believe that down near current levels a lot of negatives are factored into the AUD and further downside should be limited. ‘Net short’ AUD positioning (as measured by CFTC futures) is already quite large; underlying flow support remains in place (Australia’s current account surplus is ~1.2% of GDP); the average across our suite of models suggest the AUD is trading ~2 cents below ‘fair value’; and as pointed out before, statistically the AUD is in somewhat rarefied air (since 2015 the AUD has only traded sub $0.65 ~6% of the time). Moreover, the winds of change are starting to blow in Japan. As discussed above, the BoJ’s Takata fired a ‘hawkish’ shot across the bow of markets yesterday. Policy normalisation by the BoJ remains a matter of when, not if, and a shift in its stance should see the ‘undervalued’ JPY re-strengthen. This will have spillover effects across FX markets. Given USD/JPY is the second most traded currency pair a lower USD/JPY should flow through and see other currencies like the AUD lift (see chart below).