• US inflation. A positive US inflation surprise rattled markets. US bond yields jumped up, equities fell, & the USD strengthened. AUD back down near ~$0.6450.

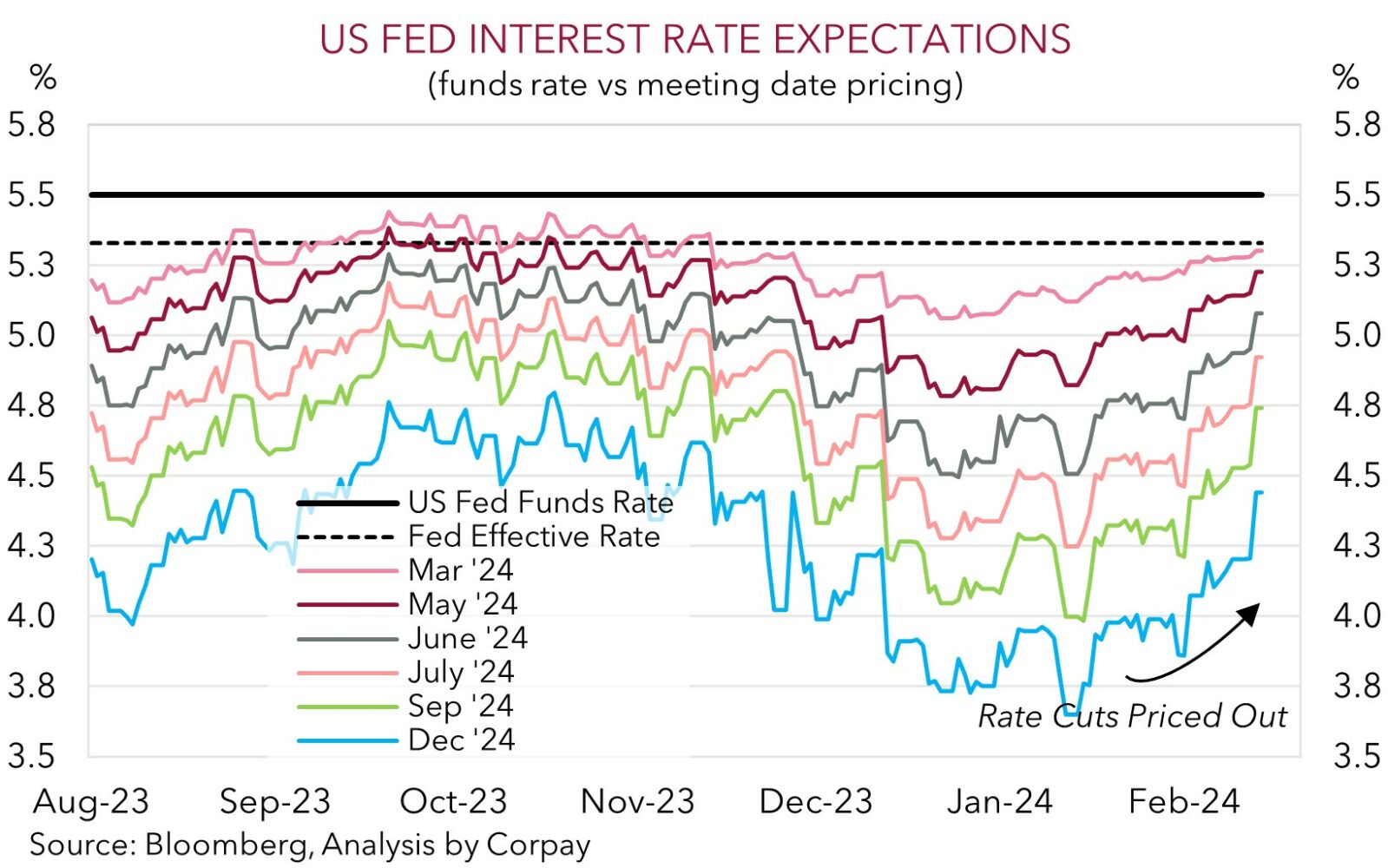

• Rate pricing. Odds of a Fed rate cut in March or May have tumbled. Markets are now (finally) factoring in a similar path forward to the Fed’s ‘dot plot’.

• AU events. The next AUD centric event is tomorrows labour force report. Will employment rebound from its December slump or will the cracks widen?

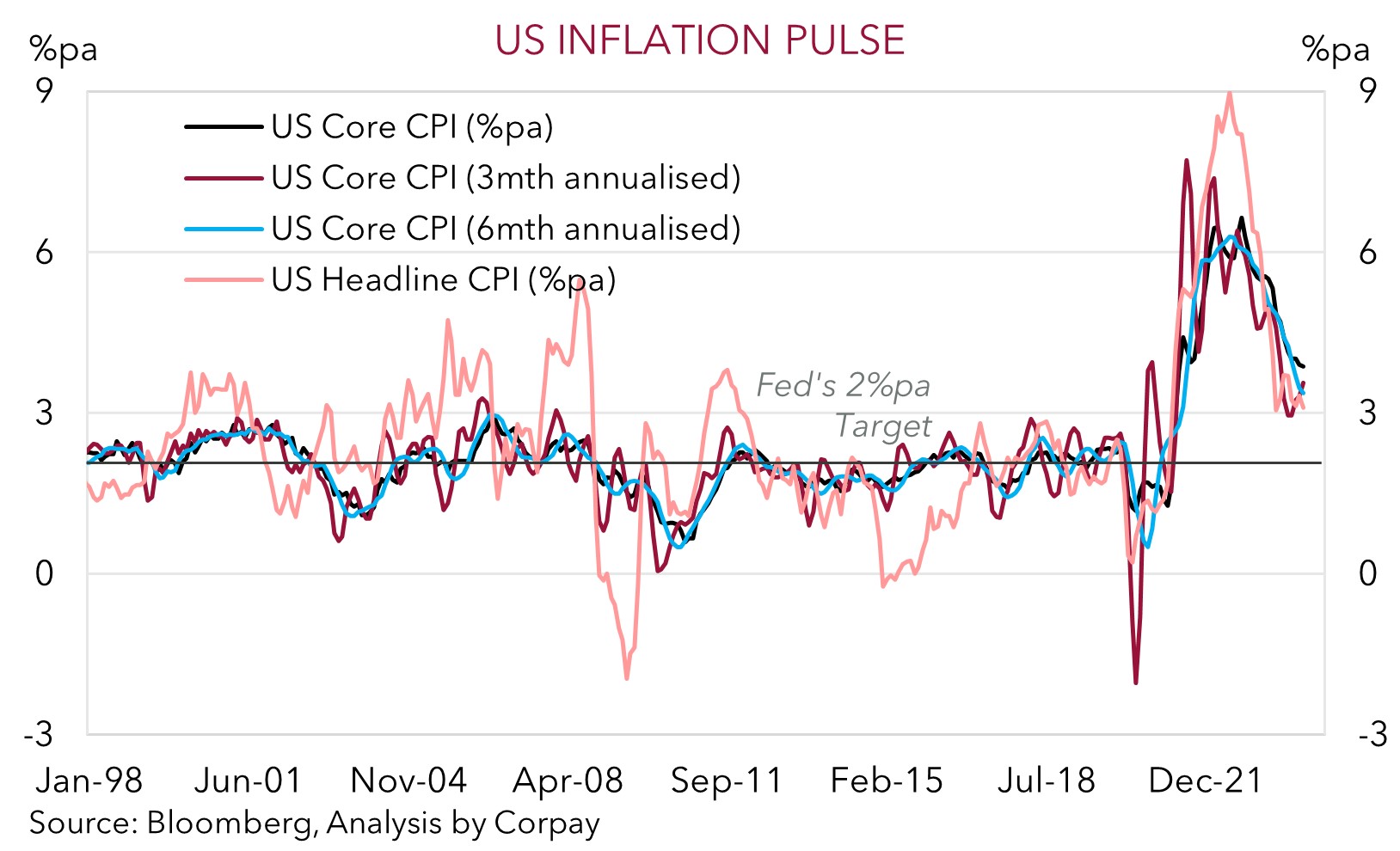

The latest read on US inflation rattled markets overnight. US CPI positively surprised pretty much all the analysts surveyed with headline inflation not slowing as predicted (from 3.4%pa to 3.1%pa vs mkt 2.9%pa) and core inflation (i.e. ex food and energy) holding steady at 3.9%pa. In response, markets adjusted their US interest rate expectations. As our second chart below shows, odds of a rate cut by the US Fed in March were whittled down to ~10%, with the chance of a move in May also tumbling (now ~28%). All up, the number of Fed rate reductions factored in for 2024 fell to ~3.5. Markets had been discounting nearly 6 Fed rate cuts over 2024 at the end of January.

This shift saw US bond yields jump up. The US 2yr rate spiked ~17bps higher to 4.64%, its highest since mid-December, while the 10yr rate rose ~13bps (now 4.31%, a high since late-November). The outlook for less interest rate relief as the Fed continues its inflation fight dampened risk sentiment. US equities declined with the S&P500 (-1.7%) recorded its biggest 1-day drop since last March. That said, some perspective is needed. The S&P500 is still ~19% higher compared to this time a year ago. In FX, the reduction in US Fed rate cut bets and higher US bond yields gave the USD a boost. EUR has dipped to ~$1.07, the interest rate sensitive USD/JPY has risen back over ~150 for the first time in ~3-months, and GBP (now ~$1.2586) gave back its earlier gains stemming from stronger than expected UK labour market data. The backdrop pushed USD/SGD higher (now ~1.3513), while the NZD (now ~$0.6055) and AUD (now ~$0.6450) both shed ~1.2%.

Central bankers have been banging the drum that the last leg of the inflation downturn could be tricky and drawn out. The US data reinforces this message. That said, a closer look at some of the details of the US CPI suggests a few transitory/statistical factors may have been at play in January. Shelter/rents, medical care, and airfares drove much of the upside surprise. Owners equivalent rent accelerated by the biggest amount since last April, with the increase moving counter to the signal from other timelier rent measures. Added to that it is worth remembering that the US Fed’s preferred inflation gauge is the PCE deflator not CPI. The PCE (due 1 March) has a much lower weighting to housing, and other services components that rose sharply in the January CPI so the overnight result may not be replicated.

For the USD, the upswing in US yields recent weeks as markets trimmed their ‘dovish’ Fed rate cut expectations has been supportive. And while the USD should remain firm near-term in response to the data, we think the jolt from the rates repricing may have now played out. Notably, market interest rate pricing is now broadly inline with the US Fed’s outlook that has baked in ~75bps worth of cuts in 2024.

AUD corner

The AUD has tumbled to levels last seen in mid-November (now ~$0.6450) with the positive US inflation surprise and resultant upward adjustment in US interest rate expectations supporting the USD and dampening risk sentiment (see above). The negative risk backdrop, as illustrated by the fall in US equities, has also seen the AUD underperform on the crosses, albeit to a smaller extent than the moves against the USD. AUD/EUR has slipped down towards ~0.6025 (the lower end of its 2024 range). AUD/GBP has lost ~0.9% over the past 24hrs (now ~0.5125, around its lowest point since last September) with an positive surprise in the UK labour market report compounding the reaction to the US inflation data. Elsewhere, in thinner Lunar New Year holiday impacted trade AUD/CNH (-1%) has declined to a ~3-month low.

There are no major macro releases scheduled in today’s Asian session. Hence, as mentioned above, in the very short-term we think the USD is likely to remain supported (and the AUD weighed down) as the impact from the US inflation data and interest rate repricing washes through markets. That said, we also don’t want to be overly bearish the AUD down near current levels with a lot of negativity appearing discounted, in our view. ‘Net short’ AUD positioning (as measured by CFTC futures) is already quite large, the AUD is ~2-3 cents under the average ‘fair value’ estimate from our suite of models, and statistically the AUD has only been below ~$0.6450 ~5% of the time since 2015 with the bulk of this small sample occurring during bouts of acute risk aversion. And from the USD side of the ledger, as discussed, with markets now assuming a similar path forward to the US Fed, further upside potential stemming from an uplift in US interest rate expectations may be hard to come by.

The next AUD-centric event is tomorrow’s Australian labour market report. As flagged over the past few days, after the December decline, we see employment recovering in January. Signs the Australian economy is still generating jobs should help reinforce the RBA’s cautiousness around lowering interest rates and its open mind to the prospect of another potential rate rise. If realised, we feel this may give the beleaguered AUD some support, particularly on the crosses, in the lead up to the US retail sales (Fri 12:30am AEDT) and PPI inflation (Sat 12:30am AEDT) data.