• Quiet start. Subdued markets with modest moves in equities, bond yields, & the major currencies. Firmer metals prices help the AUD a little.

• US inflation. January US CPI due tonight. Leading indicators point to US inflation continuing to slow. Will this see the USD lose ground?

• AUD crosses. Pairs like AUD/GBP, AUD/EUR & AUD/NZD look to be trading too low compared to levels implied by yield differentials and/or other fundamentals.

It has been a quiet start to the week, unsurprising given the limited news flow and with several Asian markets closed for the Lunar New Year. In contrast to the modest lift in European equities (EuroStoxx50 +0.7%), the US S&P500’s record run paused for breath. Elsewhere, bond yields ticked lower with US rates down 1-2bps across the curve. There were slightly larger moves in Europe with the UK yield curve flattening as the 2yr rate declined ~6bps as participants homed in on upcoming releases. UK labour market figures are due today (6pm AEDT) and they look set to show unemployment edged up and wage growth slowed at the end of 2023. Later this week, although UK CPI (released Weds) is predicted to quicken, higher utilitly prices that will unwind next month will be a driver, while Q4 GDP (released Thurs) should confirm the UK entered a ‘technical recession’.

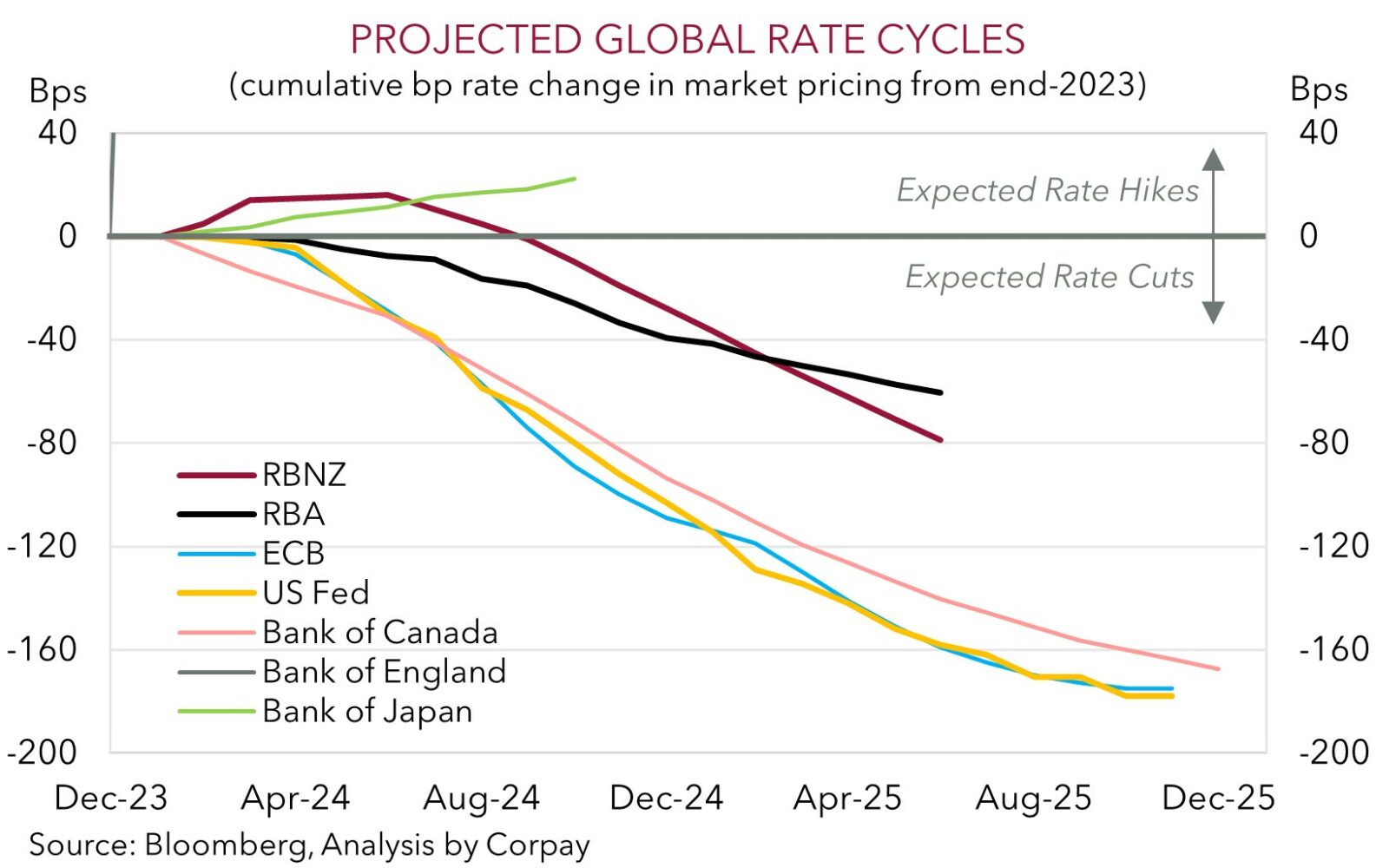

Currency markets have been range-bound. On net, EUR drifted down a bit (now ~$1.0775), GBP is treading water near ~$1.2630, USD/JPY (now ~149.35) is hovering around the top of its multi-month range, and USD/SGD is fractionally lower (now ~1.3445). AUD held its ground just under its 100-day moving average (~$0.6540) with the lack of volatility somewhat supportive. By contrast the NZD gave back a little ground after last week’s strong performance (now ~$0.6130). RBNZ Governor Orr spoke yesterday and although he noted the inflation battle still hasn’t been won (“inflation is still too high, we’re aiming for 2%”) he also flagged markets will have to wait for the 28 February meeting for updated views on its ‘restrictive’ stance and “the length which we have to be there”. The lack of a more forceful ‘hawkish’ tone has taken some of the heat out of the NZD. And we feel there might be more to come. As our chart shows, following last week’s positive jobs surprise and move by ANZ economists to switch to forecasting another two hikes, markets are factoring in a decent chance of further RBNZ tightening. While it is a risk, we don’t believe the RBNZ is likely to deliver another hike. If realised, we think an unwind of these rate rise bets may see the NZD underperform over coming weeks, particularly on the crosses.

Tonight, markets will be focused on the January reading of US inflation (12:30am AEDT). Based on a drop in used car prices and other things like slowing rents annual growth in US headline and core inflation should decelerate with the former forecast to dip under 3%pa for the first time since Q1 2021. In our opinion, this type of outcome would help Fed officials gain “greater confidence” about the disinflation trend and could see the USD come under downward pressure as markets refocus their attention on the outlook for interest rates to fall later this year.

AUD corner

The AUD has ticked up with the lack of volatility and firmer metal prices (copper +1.1%, iron ore +1.2%) somewhat supportive during an otherwise quiet start to the week. The AUD is tracking just below its 100-day moving average (~$0.6540) with gains of ~0.2-0.4% also recorded against the EUR, GBP, NZD, and CAD over the past 24hrs.

Locally, consumer confidence (10:30am AEDT) and business conditions (11:30am AEDT) are released today. Price pressure measures and hiring intentions will be looked at by economic analysts to assess how Australia’s inflation/labour market pulse is evolving, but we doubt the data will generate any large AUD moves. Rather, the next AUD event risk is tonight’s US CPI report (Weds 12:30am AEDT). As discussed above, due to a mix of factors we see annual US inflation continuing to slow, with headline CPI set to move sub-3%pa for the first time in a few years. In our mind, a continuation of the US’ disinflation trend may see the USD weaken as markets focus on the looming Fed rate cutting cycle. This in turn is likely to weigh on bond yields, and support risk sentiment and cyclical currencies like the AUD. As mentioned over the past few days, we believe a lot of negatives appear factored into the AUD down near current levels. The AUD is trading ~2 cents below the average ‘fair value’ estimate from our suite of models, and statistically it hasn’t tended to trade where it is (or lower) for too long over the past decade. Since 2015 the AUD has only been sub-$0.65 ~6% of the time.

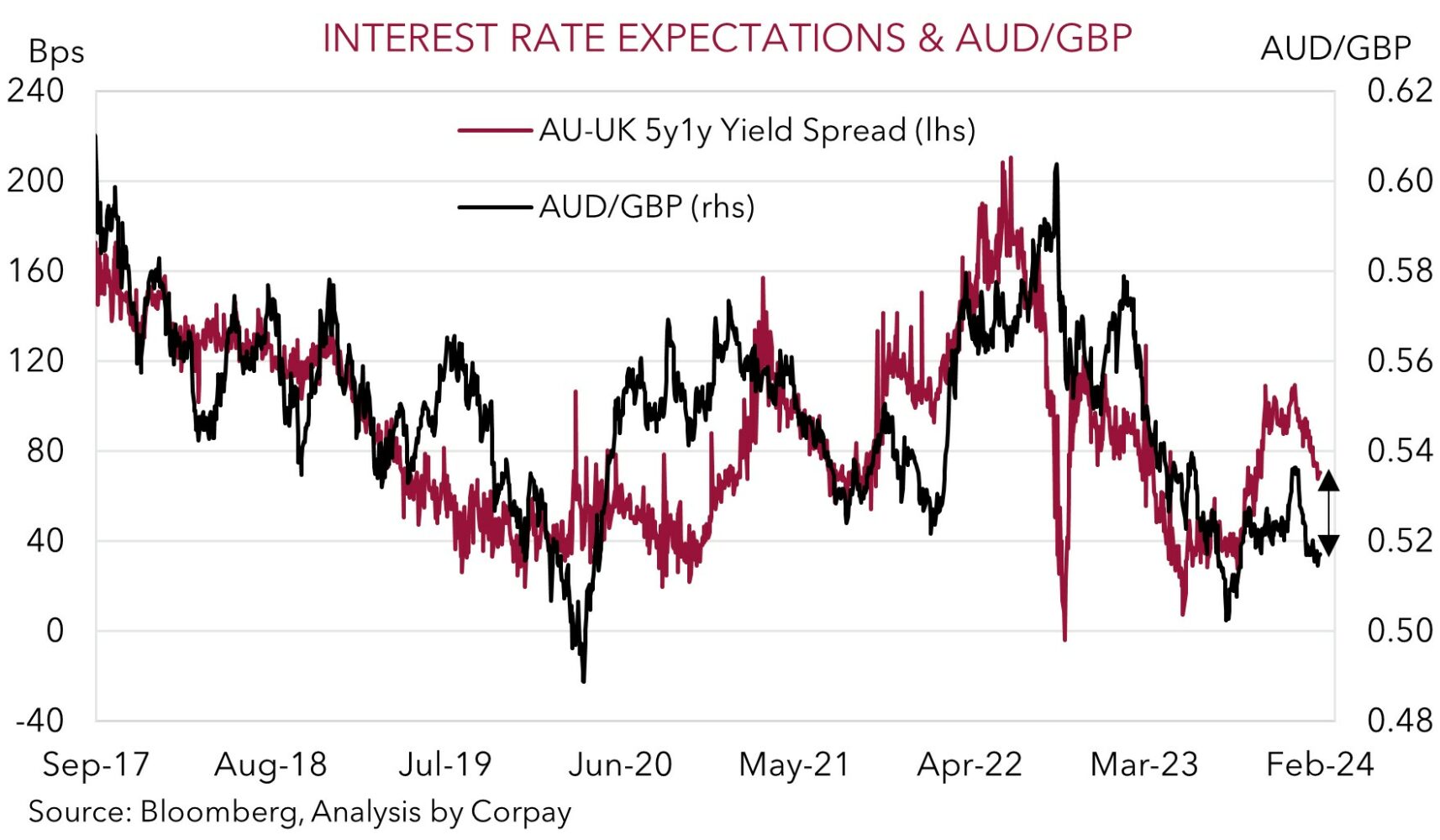

Beyond the US inflation data, the Australian jobs report is due later this week (Thursday AEDT). As discussed yesterday, after the December drop we see employment recovering in January. Signs the Australian economy is still generating jobs should help reinforce the RBA’s cautiousness around lowering interest rates and its open mind to the prospect of another potential rate rise, boosting the AUD, particularly on the crosses. As our chart shows, AUD/GBP looks to be trading too low compared to the level implied by interest rate differentials and/or other relative fundamentals. In our judgement, the same can also be said for other pairs like AUD/EUR and AUD/NZD. We feel the mix of a rebound in the Australian labour market, coupled with some sluggish UK data (today’s jobs report (6pm AEDT) is set to show unemployment rose, while Q4 GDP (released Thurs) should confirm the UK slipped into recession), or in NZ’s case a paring back of newly built up RBNZ rate hike expectations could see AUD/GBP and AUD/NZD bounce back.

AUD levels to watch (support / resistance): 0.6450, 0.6490 / 0.6560, 0.6620