• Positive tone. The lack of meaningful revisions to the US CPI seasonal factors supported sentiment. US equities hit another record. The AUD edged up.

• US focus. US CPI & retail sales this week. Inflation projected to slow with headline CPI set to slip below 3%pa. This may take some of the heat out of the USD.

• Event radar. AU jobs report released Thursday with employment forecast to rebound. RBNZ Gov. Orr speaks. UK GDP & CPI also due this week.

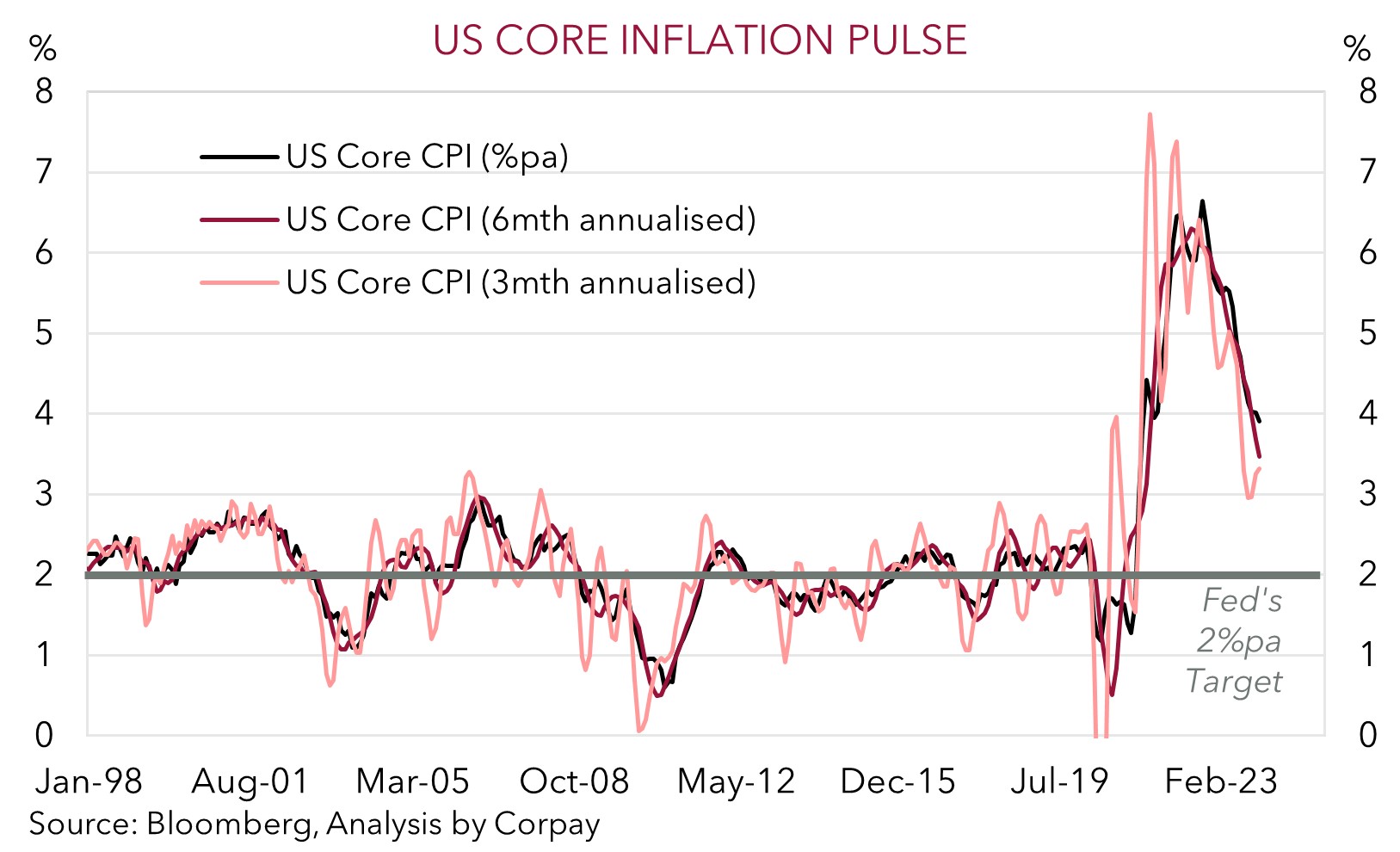

An upbeat tone across markets on Friday with participants and Federal Reserve policymakers breathing a sigh of relief that the annual revisions to US CPI didn’t spring an unhelpful surprise as they did a year ago. Given this was in the hands of the statisticians there was no real way of knowing how things could land. Importantly, the adjustments to the US CPI seasonal factors didn’t change the underlying picture with the late-2023 inflation downtrend still in place.

The US S&P500 (+0.6%) closed above the psychological 5,000 level for the first time. Not to be outdone Japan’s Nikkei edged above 37,000 for the first time in 34 years and is now less than 5% from its late-80’s boom time peak. US bond yields nudged up ~3bps across the curve with the benchmark 10yr rate (now ~4.18%) near the top of its year-to-date range. Markets are assigning a ~20% chance of a rate cut by the US Fed in March (this is down from ~90% at the turn of the year), with the first move fully discounted by June. This is roughly inline with when markets see the ECB also beginning to lower interest rates, with others such as the Bank of England and Reserve Bank of Australia forecast to be a few months behind.

In FX, the USD index drifted a touch lower with EUR (now ~$1.0785) and GBP (now ~$1.2629) marginally firmer, and USD/JPY tracking sideways around its multi-month highs (now ~149.30). The backdrop and a bit of relative outperformance on most of the major crosses helped the AUD claw back ground with Thursday’s pull-back largely unwound (now ~$0.6520). NZD extended its positive run (now ~$0.6140) with the watering down of NZ rate cut bets post last week’s better than anticipated jobs report compounding the positive sentiment.

Given the Lunar New Year Holidays Asian trading is likely to be more subdued than normal, particularly over the start of this week. In terms of the global focal points attention will be on the January readings of US inflation (Weds 12:30am AEDT) and retail sales (Fri 12:30am AEDT). In our view, based on a drop in used car prices and other things like the deceleration in rents annual growth in US headline and core inflation should continue to step down with the former projected to slip below 3%pa for the first time since Q1 2021. We think this type of result would help Fed officials gain “greater confidence” on the inflation outlook, and if combined with a moderation in retail sales following the late-2023 flurry we believe the USD may come under some renewed downward pressure as markets refocus their attention on the outlook for interest rates to fall later this year. It won’t be March, but a first cut by the US Fed around mid-year followed by a series of moves still looks probable, in our opinion.

AUD corner

Helped along by firmer US equity markets as the lack of meaningful revisions to the US CPI seasonal factors supported risk sentiment the AUD recouped some lost ground on Friday (now ~$0.6520) (see above). The environment also helped the AUD outperform on most crosses with gains of 0.3-0.5% recorded against the EUR, JPY, GBP, CAD, and CNH at the end of last week.

AUD/NZD has been an exception (-0.4%), and at ~1.0610 it is near its lowest since May 2023. The upward repricing in NZ interest rate expectations following last weeks better than forecast labour market report and move by ANZ economists to switch to forecasting another two rate hikes by the RBNZ in H1 has boosted the NZD. RBNZ Governor Orr speaks today (11:30am AEDT) and again on Friday. This will be a test for the markets newfound ‘hawkish’ RBNZ predictions. Given how swiftly things have moved we think markets may have gotten a bit ahead of themselves, and the risks reside with AUD/NZD bouncing back, particularly with pair already trading too low compared to levels implied by various relative fundamentals.

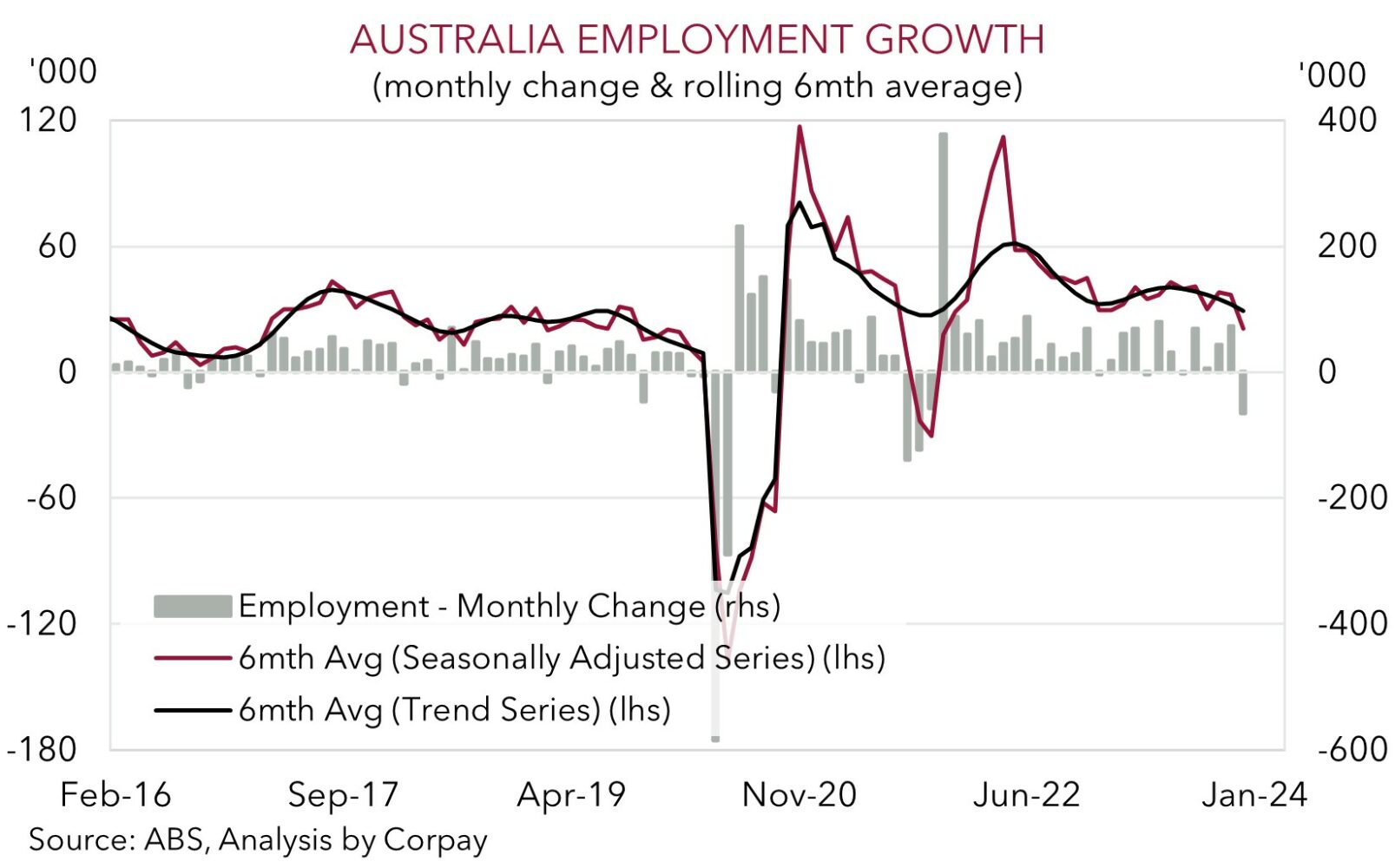

Locally, the monthly jobs data is this weeks focal point (Thursday AEDT). The Australian ‘labour force lottery’ is known for generating surprises, and last month’s large drop in jobs was the latest example. However, after being impacted by negative statistical noise in December, Australian employment looks set to rebound in January (mkt +30,000). Although given the surging population/labour supply this may not be enough to prevent the unemployment rate nudging up a little (mkt 4%). That said, we believe signs the Australian economy is still generating jobs should help reinforce the RBA’s cautiousness around lowering interest rates too quickly and its open mind to the prospect of another potential rate rise. As such, we think a positive Australian jobs report should be AUD supportive, particularly if we are right and softer US inflation (Weds AEDT) and/or retail sales (Fri AEDT) exerts pressure on the lofty USD as markets focus more on the next Fed easing cycle rather than whether or not the rate cuts might start in March.

Moreover, as mentioned late last week, we feel that a lot of negatives are factored into the AUD down around current levels. The AUD is currently trading ~2 cents below the average ‘fair value’ estimate from our suite of models, ‘net short’ AUD positioning (as measured by CFTC futures) is still quite large, and statistically the AUD hasn’t sustainably trading much below where it is (since 2015 the AUD has only been sub $0.65 ~6% of the time).

AUD levels to watch (support / resistance): 0.6450, 0.6490 / 0.6540, 0.6570