• Mixed markets. Bond yields a bit higher as ECB & Fed officials continue to push back on near-term rate cut bets. USD firmer against JPY & AUD.

• RBA speak. Governor Bullock testifies to parliament today. A repeat of this week’s rhetoric expected. This may give the AUD some intra-day support.

• US CPI revisions. Revisions to seasonal factors for the US inflation data released tonight. This caused a stir across markets last year. Will it happen again?

A mixed performance across asset classes in what was generally another quiet night when it comes to market news flow. Central bankers hit the airwaves again and continued to push back on near-term rate cut pricing. The ECB’s Chief Economist Lane pointed out that the bank needed more confidence inflation is returning to target before it can consider lowering rates. In the US, the Fed’s Barkin flagged a patient approach by noting “no one wants inflation to re-emerge” and that based on the robust demand and strong labour market policymakers have time before they “begin the process of toggling rates down”.

European stocks are higher (Eurostoxx50 +0.7%) while the US S&P500 consolidated near record levels. US and European bond yields ticked up with curves steeper. The benchmark US 10yr rate rose ~6bps (now 4.16%) while the 2yr yield nudged up ~3bps (now 4.45%). Across commodities oil prices are firmer. WTI crude increased 3.5% to be back above US$76/brl for the first time in a week with a drop in US inventories and Israel’s rejection of a ceasefire offer factors at play.

In FX, the USD drifted up a little with a weaker JPY the driver. EUR (now ~$1.0780) and GBP (now ~$1.2620) have been range bound. By contrast USD/JPY has punched back through ~149 to be ~2.4% from last week’s low with rising offshore bond yields supportive. Added to that, unlike his US and European counterparts yesterday BoJ Deputy Governor Uchida retained a ‘dovish’ tone. Comments that he though it was hard to imagine the BoJ will be raising rates continuously and rapidly, even once negative interest rates had ended, dampened policy tightening bets. USD/SGD has edged back up towards the top of this week’s range (now ~1.3470), with USD/CNH also a touch higher (now ~7.2150) after data showed China’s CPI deflation deepened to -0.8%pa in January. The different timing of the Lunar New Year holiday this year compared to last had an impact on some food prices, but with core inflation running at a measly 0.4%pa the need for authorities to inject more stimulus so the economy can reach escape velocity is rising. AUD also lost some ground to be back under ~$0.65 with softness across the major Asian currencies exerting downward pressure.

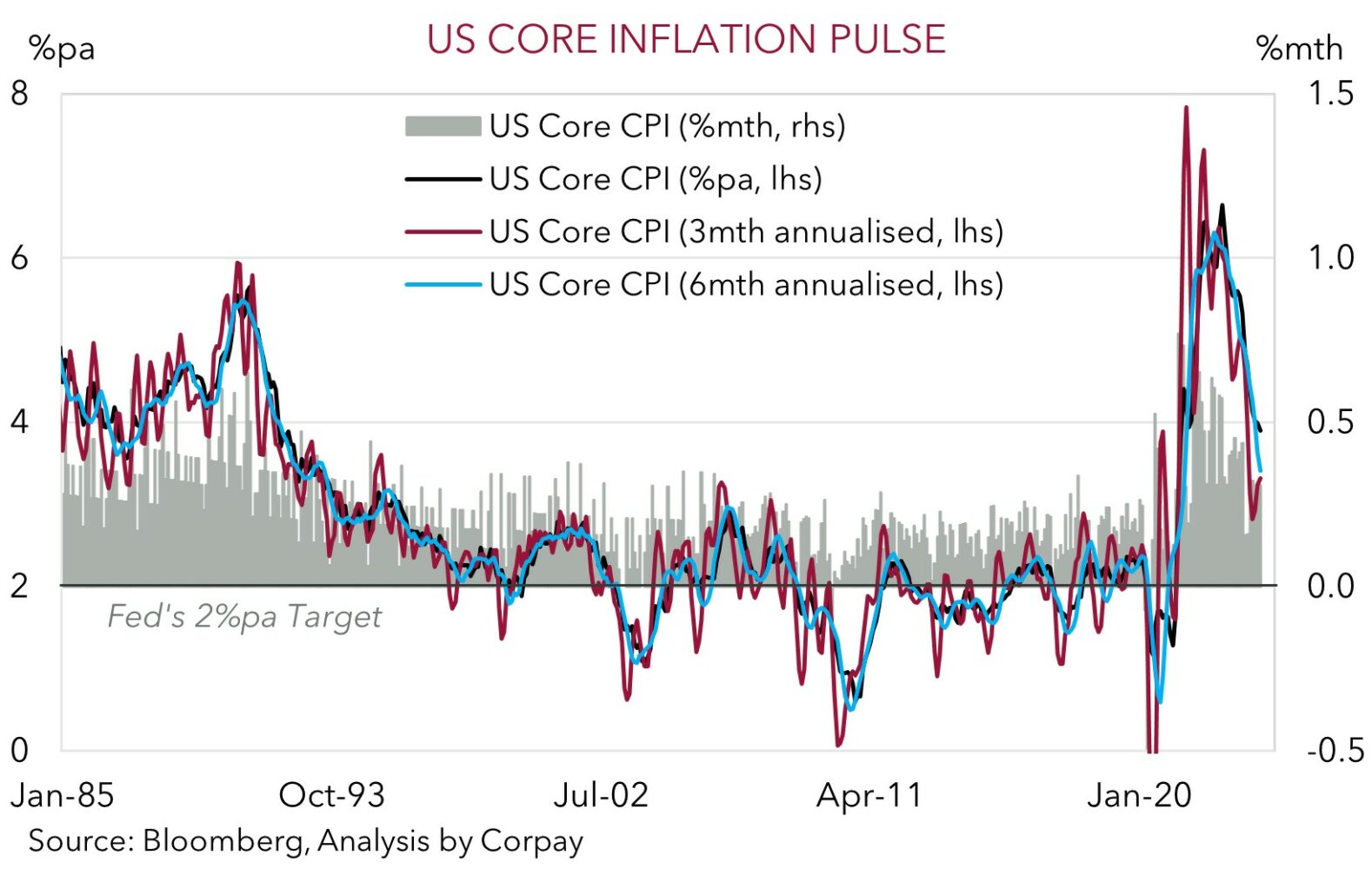

Tonight the US releases annual revisions to seasonal adjustment factors for its inflation data. It sounds like something only economics boffins are interested in but last year the revisions were big enough to make the US’ inflation momentum stronger than first thought. The perceived lack of progress on inflation caught markets by surprise and as a result US interest rate expectations and the USD got a boost. There is a risk this occurs again with tonight’s revisions. However, odds of it happening two years in a row appear low, in our view. If the revisions come and go without any meaningful changes to the US’ inflation pulse (i.e. the 3mth/6mth annualised rates) we think the USD may ease lower into the end of the week.

AUD corner

The AUD has drifted a bit lower to be back near the bottom of its recent range (now $0.6493). On the crosses, outside of the weaker JPY (see above), the AUD has also underperformed with falls of ~0.2-0.5% recorded against the CAD, NZD, EUR, and GBP over the past 24hrs. Higher offshore bond yields as officials from the ECB and US Fed continued to push back on near-term rate cut expectations and sluggishness across the major Asian currencies has exerted pressure on the AUD. While the larger drop in the JPY has seen AUD/JPY spring back up towards ~97.

In today’s Asian trade RBA Governor Bullock testifies to the Parliamentary Economics Committee (from 9:30am AEDT). Given the release of the more detailed Statement on Monetary Policy and press conference following Tuesday’s decision we don’t think Governor Bullock will deviate too much from the recent script. We expect the Governor to reiterate progress on inflation is being made, but it is still too high, hence “a further increase in interest rates cannot be ruled out” with the Board being guided by the data and alert to the lingering downside and upside risks (see Market Wire: RBA: A more balanced approach). This may give the AUD some intra-day support, particularly if Asian equities follow the positive lead from offshore markets.

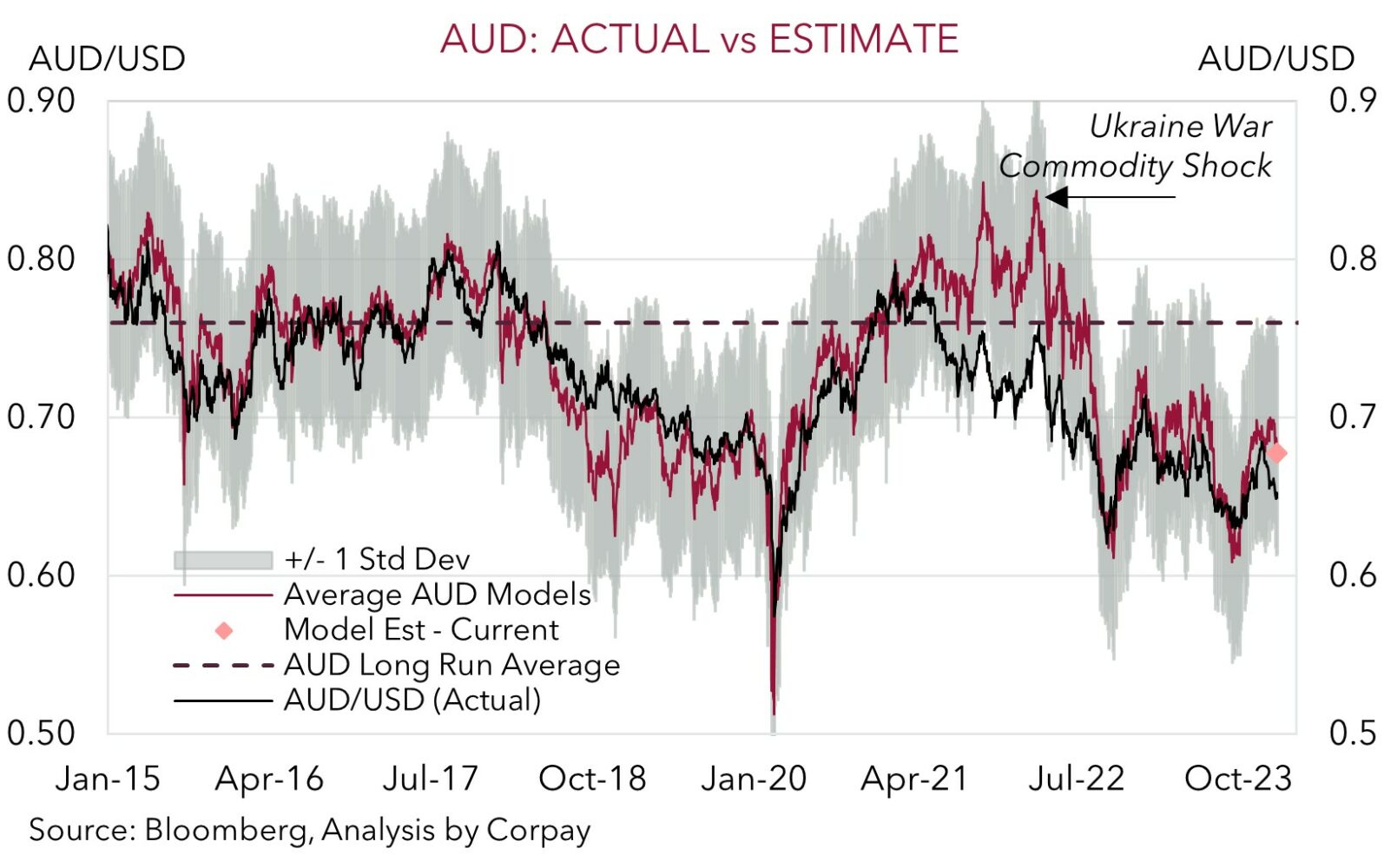

More broadly, as discussed recently we believe a lot of negatives are priced into the AUD down around current levels (note, since 2015 the AUD has only traded sub $0.65 ~6% of the time, and the bulk of this small pool has been during bouts of market stress). As our chart shows, a ~2 cent gap has opened between the AUD’s current spot rate and the average ‘fair value’ estimate from our suite of models. Barring another surprising revision to the US CPI seasonal factors which makes the US inflation pulse look stronger than it has been (see above), we see the AUD levelling off and beginning to grind up over the period ahead. Next week the January US inflation (Weds AEDT) and retail sales (Fri AEDT) data bookend the Australian jobs report (Thurs AEDT). As things stand, we think the US releases will show annual inflation is continuing to slow and retail sales moderated after a late-2023 flurry. If realised this may see the USD soften as markets focus more on the medium-term outlook for lower US interest rates. At the same time, Australian employment looks set to rebound after some negative statistical noise last month. This combination could see short-dated yield differentials move in favour of a higher AUD.

AUD levels to watch (support / resistance): 0.6400, 0.6450 / 0.6560, 0.6620