• Consolidation. US equities edged higher, bond yields ticked up slightly, but the USD and other major currencies remained range bound.

• Fed speak. More Fed members spoke overnight. But reaction was limited. Market interest rates have adjusted with odds of a March cut whittled down.

• AUD turn? AUD tracking below our fair-value estimate. A lot of bad news looks factored in. US inflation, US retail sales, & AU jobs due next week.

Fairly subdued trade in most markets overnight. Given the lack of top tier data releases this is not a surprise. In contrast to European stocks which eased slightly (EuroStoxx50 -0.3%) US equities rose. A positive performance across the tech-sector has pushed the S&P500 (+0.8%) to within a whisker of the psychological 5000 level with ongoing ructions in the US regional banking sector not dampening the mood.

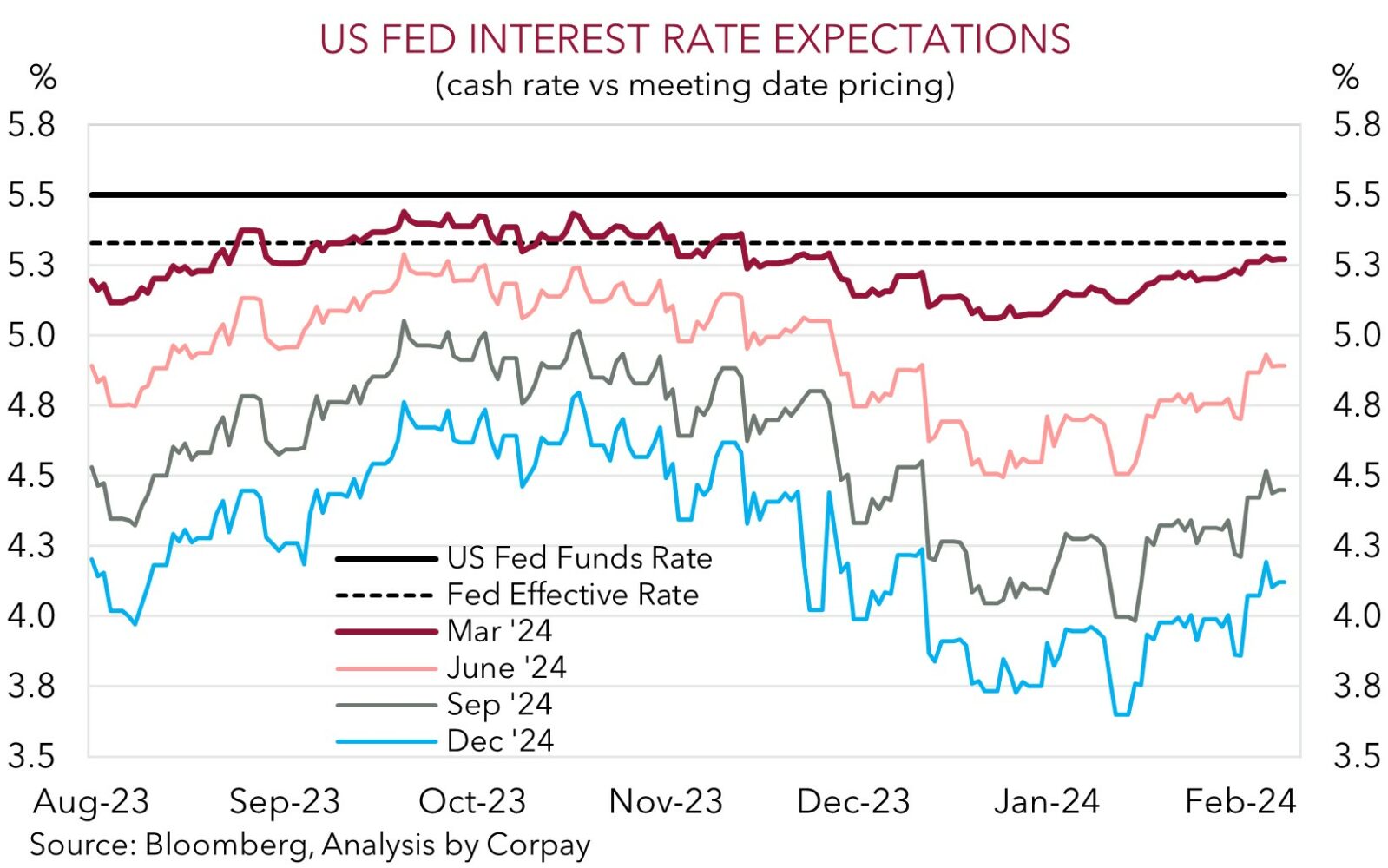

Elsewhere, bond yields are a bit higher with US rates up ~1-2bps across the curve. The US 10yr yield is now ~4.11% with the sharp rebound that has come through over the past week or so on the back of the US Fed’s efforts to lean against near-term rate cut expectations and a strong US jobs report starting to look like it is losing steam. Indeed, four Fed members (Kugler, Collins, Kashkari, and Barkin) spoke overnight with the central message once again being that they don’t see an urgent case for lowering rates but if inflation continues to slow the case for some easing later this year remains. Markets have heard this before and may be starting to become desensitized to the same old rhetoric. As our chart shows odds of a March Fed move have been whittled down to ~20% (from ~90% in late-December) with the first full rate cut now not discounted until June.

In FX the major currencies consolidated. EUR is treading water near ~$1.0775, GBP has nudged up (now ~$1.2627) and USD/JPY is hovering just over ~148. USD/SGD moved sideways (now ~1.3430), and despite a slight lift in USD/CNH (now ~7.2115) the AUD is tracking a bit under its 100-day moving average (~$0.6537) with this week’s more ‘hawkish’ guidance from the RBA and firmer oil (WTI crude +1.1%) and iron ore prices (+1%) helping the currency level off after a torrid spell.

There are a few more appearances by US Fed members scheduled over the rest of this week. Push-back on near-term rate cut pricing is likely to continue, but given the scale of the adjustment that has taken place we believe that without a fresh catalyst potential upside in the USD looks limited from here. The gap between the markets interest rate views and the Fed’s central case has narrowed, and given data released next week appears set to show US inflation has slowed further and US retail sales moderated after a late-2023 flurry a refocus on the medium-term outlook for US rates to decline could return. We feel this may see the USD lose ground.

AUD corner

The AUD has consolidated with the sideways move in the USD and other push-pull factors such as the lift in US equities, higher energy prices, and softer CNH keeping the currency in a tight range centered on ~$0.6530 over the past 24hrs. On the crosses, the largest move has been in AUD/NZD (-0.5%) with yesterday’s better than anticipated Q4 NZ labour force report tempering views about the possibility of a ‘dovish’ turn by the RBNZ at the policy meeting later this month. This has seen the NZD outperform and pushed AUD/NZD to the bottom of its ~2-month range (now ~1.0675). While the data is a short-term positive for the NZD, we don’t see AUD/NZD fallen back much further given the pair is already trading below levels implied by various relative fundamentals.

In today’s Asian session China PPI/CPI inflation is released (12:30pm AEDT). Tonight the Fed’s Barkin speaks again, and US weekly initial jobless claims are due (both 12:30am AEDT). Tomorrow, RBA Governor Bullock testifies to the Parliamentary Economics Committee (Fri 9:30am AEDT). In our judgement, the AUD should hold its ground, and continue a slow rope climb higher over the period ahead as the sizeable pool of ‘net short’ AUD positioning (as measured by CFTC futures) is scaled back. As discussed above, we believe next week’s US inflation and retail sales data risks underwhelming, which if realised may see the USD soften. At the same time, next Thursday’s Australian jobs report should rebound after some negative statistical noise last month. This type of mix could see short-dated yield differentials move in favour of a higher AUD, particularly as it would reinforce our thoughts that the RBA is charting a different course and is likely to lag its global peers in terms of when it starts and how far it moves in the next easing cycle based on the support to demand from the larger population, Stage 3 tax cuts, and stickiness across domestic ‘services’ inflation (see Market Wire: RBA: A more balanced approach).

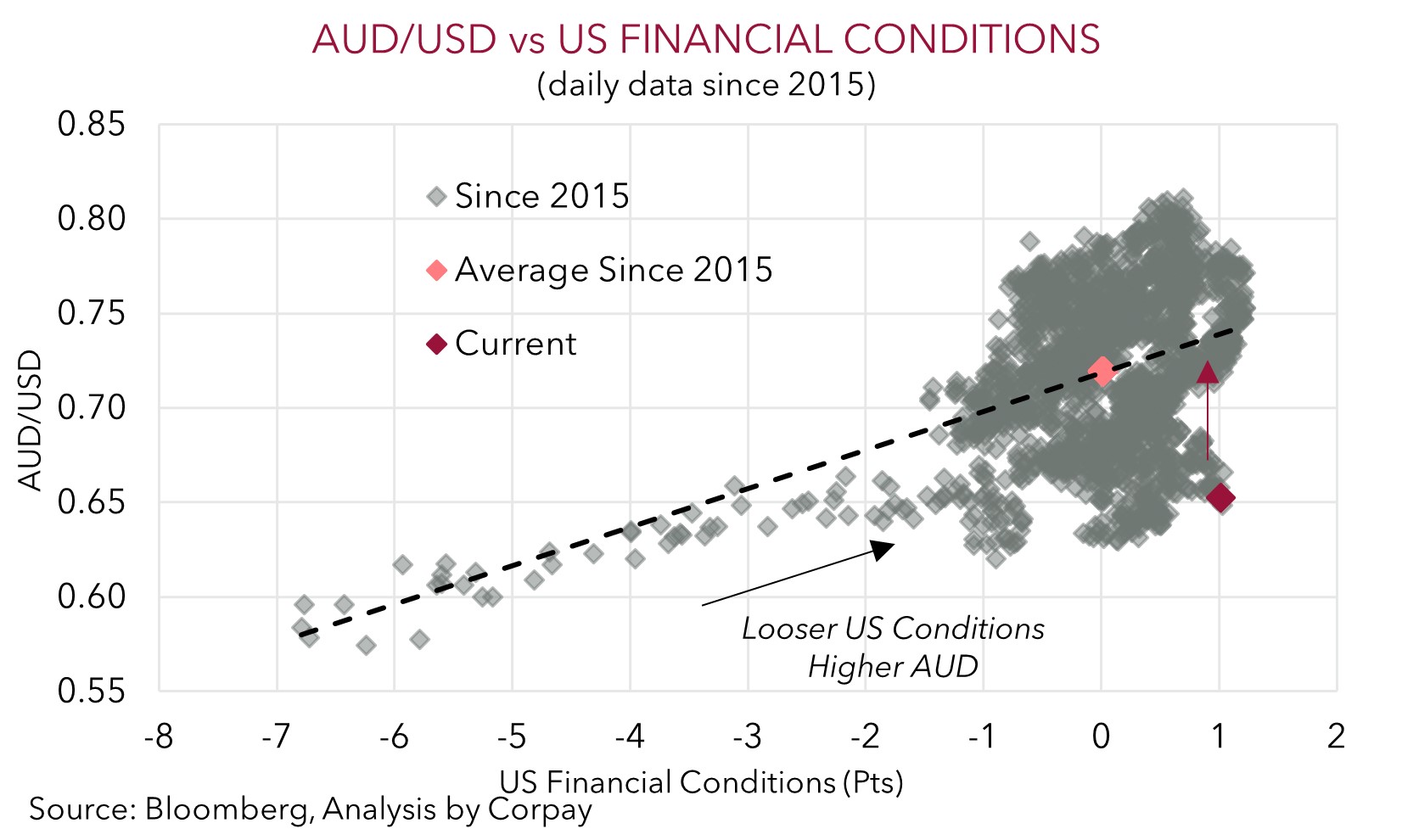

All up, we think a lot of negatives are priced into the AUD down around current levels. The AUD is currently trading ~2 cents below the average ‘fair value’ estimate from our suite of models. As our chart shows, a gap has opened between where the AUD now is and where it usual trades given the level of inputs such as US financial conditions. Statistically, the AUD is also in somewhat rarefied air having only been below current levels ~7% of the time since 2015, and a large share of this small sample was during bouts of acute market turbulence such as the start of COVID.

AUD levels to watch (support / resistance): 0.6400, 0.6450 / 0.6560, 0.6620