• Negative vibes. Sentiment soured on Friday as Middle East concerns rose. Equities & bond yields lost ground. The stronger USD pushed down the AUD.

• Middle East. The situation in the Middle East remains fluid. Developments will be front of mind for investors at the start of the new week. Will oil prices spike?

• Event radar. US retail sales due tonight. Several Fed members speaking this week. Across the region, China GDP, NZ CPI & AU jobs report are due.

Risk sentiment ended last week on the backfoot, and geopolitical developments over the weekend point to further potential short-term turbulence. On the economic front, US Fed officials that spoke generally continued to downplay the prospect of near-term rate cuts. San Francisco Fed President Daly said there is “no urgency to adjust the policy rate”, the Boston Fed’s Collins noted that while the recent data didn’t materially change her outlook it did “highlight uncertainties related to timing”, and the Atlanta Fed’s Bostic repeated his expectation for only one cut later this year. With markets now not factoring in a full Fed rate cut until September, and a very modest easing cycle penciled in after that, we would argue that the “hawkish” repricing in US interest rates has largely played out.

Compounding the prospect for tighter monetary policy for longer were nerves of an impending Iranian attack on Israel. These forces sapped risk appetite on Friday. Equities declined (the US S&P500 fell 1.5%, its largest one-day fall since January), as did bond yields (US rates declined 6-7bps across the curve), while the USD extended its uptrend as safe-haven demand kicked into gear. EUR (now $1.0635) and GBP (now $1.2445) are down near their lowest levels since November, while USD/JPY consolidated as demand for the JPY also picked up. Cyclical currencies came under downward pressure with the AUD hovering around its 2024 lows (now $0.6465).

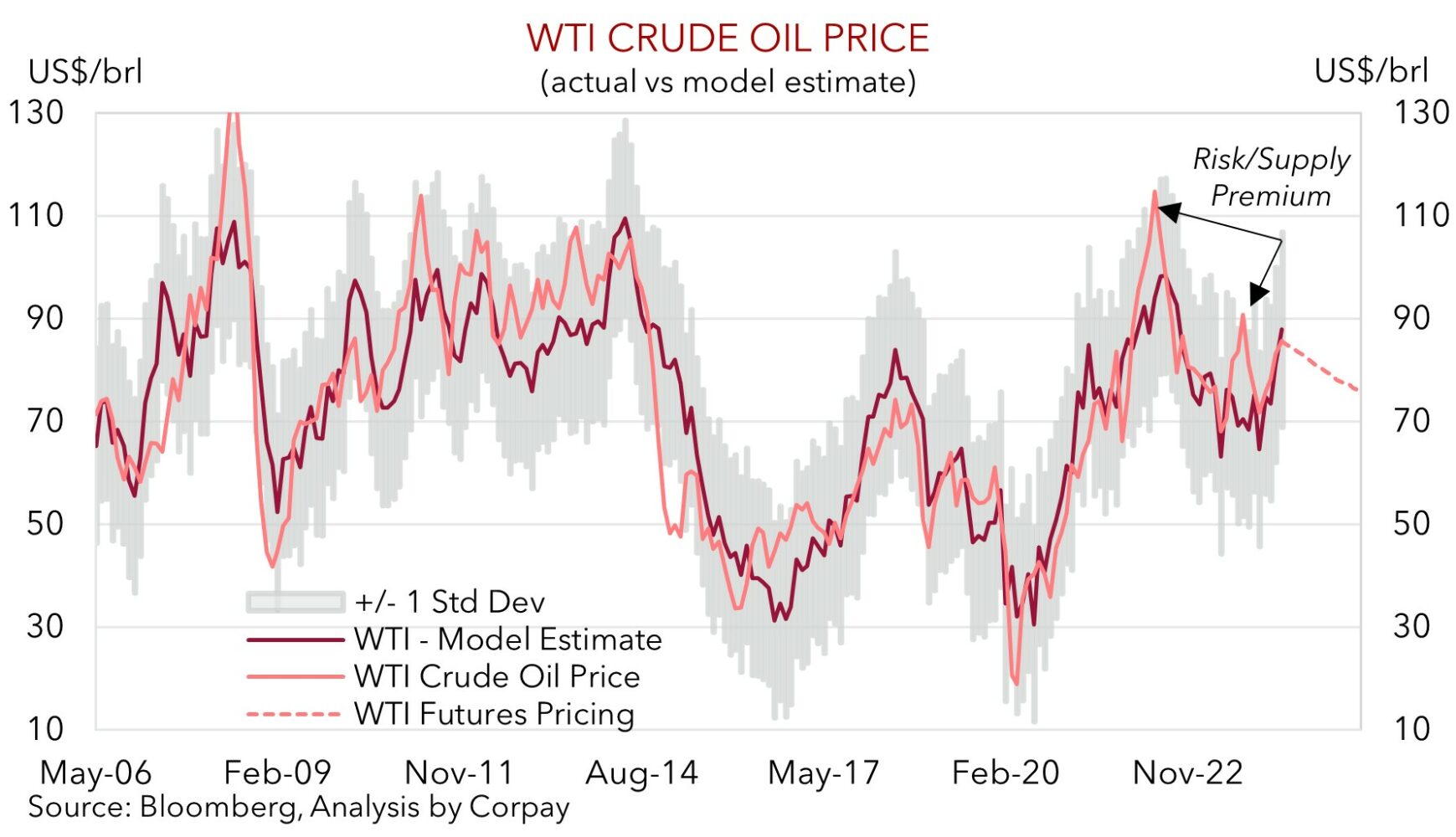

Geopolitical concerns crystallised over the weekend with Iran launching a drone and missiles attack on Israel. Over the start of the new week markets may fret about the prospect of retaliation and/or an escalation of the regional conflict. Oil prices, a barometer of Middle East tensions, have so far been well behaved (WTI crude is now ~$86/brl) and as our chart shows they are trading in line with fundamentals. However, supply worries might see oil prices spike higher as a risk premium is factored in. If this occurs, sentiment could deteriorate further, and this could see currencies like the USD and JPY outperform.

The situation in the Middle East remains fluid, and developments will remain front of mind for investors, however assuming cooler heads prevail, and tensions simmer down, we think the upcoming US and key global data and speeches could see the lofty USD lose ground. March US retail sales are due tonight (10:30pm AEST), the China data batch which includes Q1 GDP is released tomorrow, and there are several US Fed members speaking this week (including Chair Powell on Wednesday morning AEST). In our opinion, there is a chance things moved too far too fast with markets discounting a more “hawkish” outlook than the Fed (markets are assuming less than 4 rate cuts by end-2025 compared to 6 projected by the Fed). Softer US consumer spending, a pickup in momentum in China, and/or measured comments by Fed officials continuing to point to the start an easing cycle later this year could revive US rate cut bets and see the USD slip back.

AUD Corner

The bout of risk aversion stemming from concerns about the Middle East situation and the resultant USD strength weighed on the AUD on Friday (see above). At ~$0.6465 the AUD is tracking near the bottom of its 2024 range with the backdrop also seeing the AUD underperform on the crosses. AUD/JPY shed ~1.2% with the pair back down around ~99. AUD/CNH declined by ~0.9% to be back below its 1-year average (now ~4.70), while the AUD also dipped by a modest ~0.2% versus the EUR and GBP.

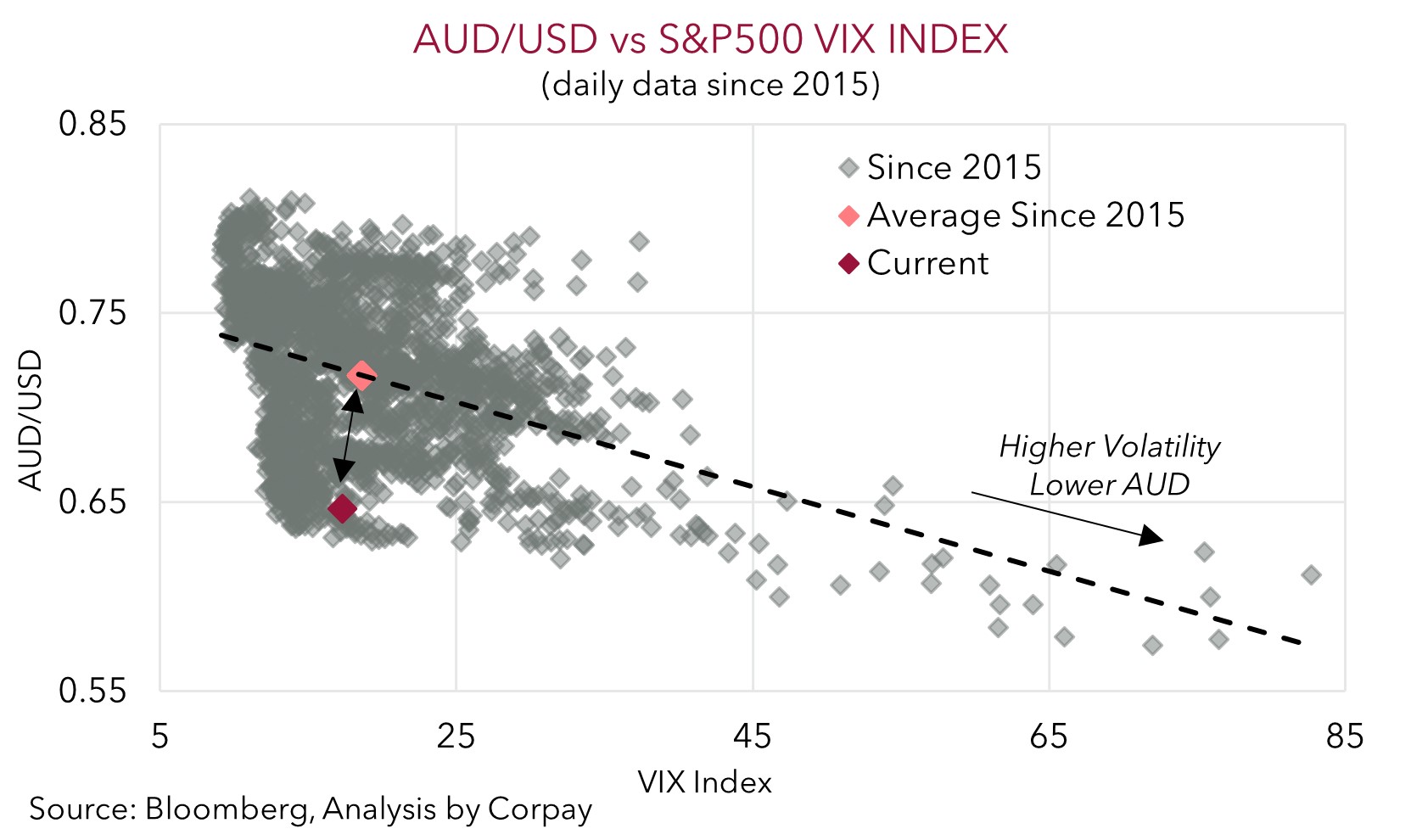

As discussed , the unfolding situation in the Middle East will dominate the headlines at the start of the new week and an escalation would further dampen sentiment and exert more pressure on cyclical currencies like the AUD. That said, we think the AUD may already be factoring in a lot of negatives down near current levels, and any further moves lower may not be overly large or last too long. As shown by our scatter plot, a wide gap has opened between where the AUD is trading and the level of the VIX volatility index. Moreover, market positioning already looks quite ‘net short’ the AUD with CFTC futures contracts (a commonly used FX positioning proxy) stretched. Statistically the AUD is also in rarefied air. Since 2015, when Australia’s capital flow dynamics turned more supportive, the AUD has only traded below ~$0.6450 ~5% of the time. And we believe Australia’s position as a net energy exporter should leave the AUD in relatively good stead, particularly against currencies such as the EUR and GBP, if oil prices spiked on supply concerns.

For the AUD, in addition to Middle East developments, there are a few economic releases and speeches on the radar that may generate volatility. In addition to the numerous US Fed members speaking this week, US retail sales are released tonight (10:30pm AEST), China Q1 GDP is due tomorrow, NZ CPI inflation (which can provide a guide to the upcoming Australian data) is due Wednesday, and the monthly Australian labour force report is on Thursday.

We see risks US consumer spending softens, the China data shows momentum picked up in early 2024, NZ domestic inflation remains sticky, and that the March Australian jobs report holds up better than feared and a large statistical payback doesn’t materialize. In our opinion, this type of mix could see RBA rate cut expectations watered down further. And assuming the Middle East situation doesn’t boil over, this could give the beleaguered AUD renewed support, especially on crosses such as AUD/EUR and AUD/GBP where their respective central banks may be nearer to the start of an easing cycle and/or their domestic economic environment is less favourable.