• Improved sentiment. A soft US PPI report & ‘dovish’ ECB helped calm market nerves. US equities rebounded. The AUD clawed back some ground.

• ECB policy. The door to an ECB rate cut in June looks wide open. Diverging trends with the RBA can be AUD/EUR supportive.

• Data calendar. The MAS meets today, China trade data is also due, while in the US a few Fed members speak.

After the burst of volatility following the hotter than projected US CPI inflation data markets settled down overnight. US equities rebounded with the S&P500 (+0.7%) back up where it was earlier in the week. There were also small movements across US bond yields with a modest steepening in curve led by a slight rise in the 10-year rate (+4bp to 4.59%). In FX, the USD index consolidated with USD/JPY tracking in rarefied air (at ~153.25 USD/JPY is at levels last traded in mid-1990) and the EUR slipping back a touch (now ~$1.0730) after the ECB made more ‘dovish’ noises at its policy meeting (see below). Elsewhere, the improvement in sentiment helped the AUD and NZD recover some ground with the former now sitting just below its 200-day moving average (~$0.6543). Ahead of today’s quarterly Monetary Authority of Singapore meeting USD/SGD remains near the top of its multi-month range (now ~1.3530). We think the MAS will maintain its ‘hawkish’ stance and keep the “prevailing rate of appreciation” of the SGD NEER (i.e. 1.5%pa) in place.

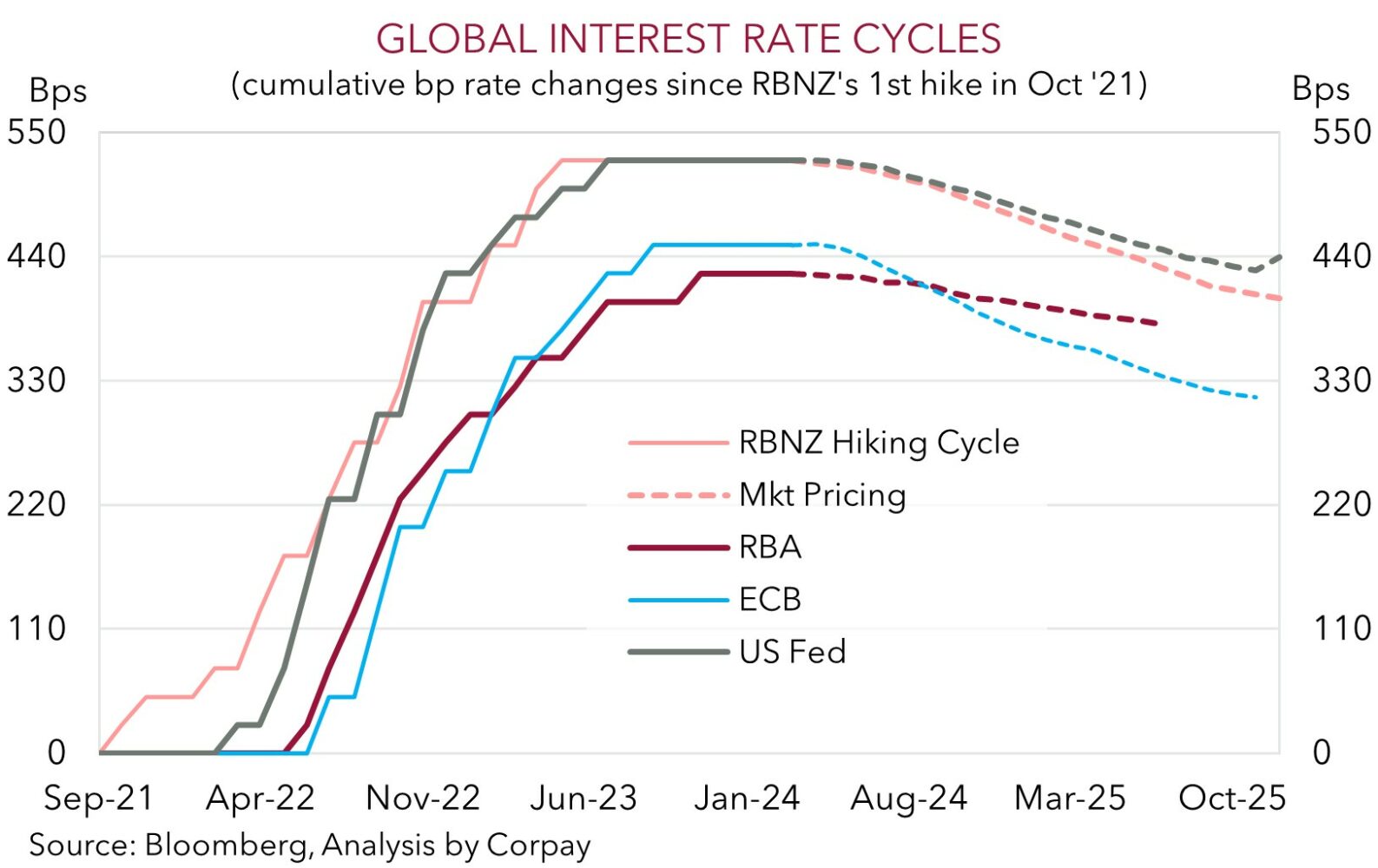

Helping to calm nerves was a softish US Producer Price Inflation report. Producer prices rose slightly less than forecast with the bits and pieces that matter for US PCE inflation such as airfares, medical services, and portfolio management fees underwhelming. Recall, while CPI inflation gets the attention the US Fed’s preferred inflation gauge is the PCE deflator. The various components that flow into the PCE deflator suggest the annual run-rate of the core measure is still slowing. The PCE deflator is released on 26 April. That said, the bumps along the inflation path and resilience in the labour market still point to little urgency for the US Fed to cut rates in the near-term. This was the message from a few policymakers speaking overnight, though influential NY Fed President Williams did note that if things pan at as anticipated it still makes sense to “dial back policy restraint” later this year. Markets are now factoring in less than 2 rate cuts by the US Fed over H2 2024.

By contrast, the ECB appeared to lay the groundwork for an earlier kick off with strong suggestions that if the data continues to confirm inflation is heading down to target a rate cut at the 6 June meeting is probable. Indeed, President Lagarde stated that “a few” members were pushing for a move yesterday. The policy outlook between the ECB and US Fed is diverging. However, markets are driven by outcomes relative to expectations and we think a lot of this narrative now looks priced in. Hence, while we believe an earlier start by ECB will be a EUR handbrake and support the USD, further large moves from current levels aren’t likely without a fresh catalyst.

AUD Corner

After being battered and bruised in the wake of the stronger than predicted US CPI inflation report, the AUD clawed back a little ground over the past 24hrs. At ~$0.6540 the AUD is sitting just below its 200-day moving average with the partial reversal stemming from the improved risk appetite following a soft US Producer Price Inflation report and ‘dovish’ rhetoric from the ECB which has opened the door to an interest rate cut at the June meeting (see above).

The backdrop has also helped the AUD rebound on the crosses with gains of ~0.5% recorded against the EUR and JPY. At ~0.6095 AUD/EUR is within striking distance of touching its highest level since late-January. We continue to believe that the diverging policy paths between the ECB and RBA should see AUD/EUR, which still looks too low compared to relative long-term yield differentials, edge higher over coming months. That said, we continue to feel that around current levels there are uneven risks for AUD/JPY (now ~100) with renewed bouts of market volatility, further BoJ policy normalisation as it battles its inflation problem, and/or a global rate cutting cycle potentially generating a meaningful reversal in the undervalued JPY.

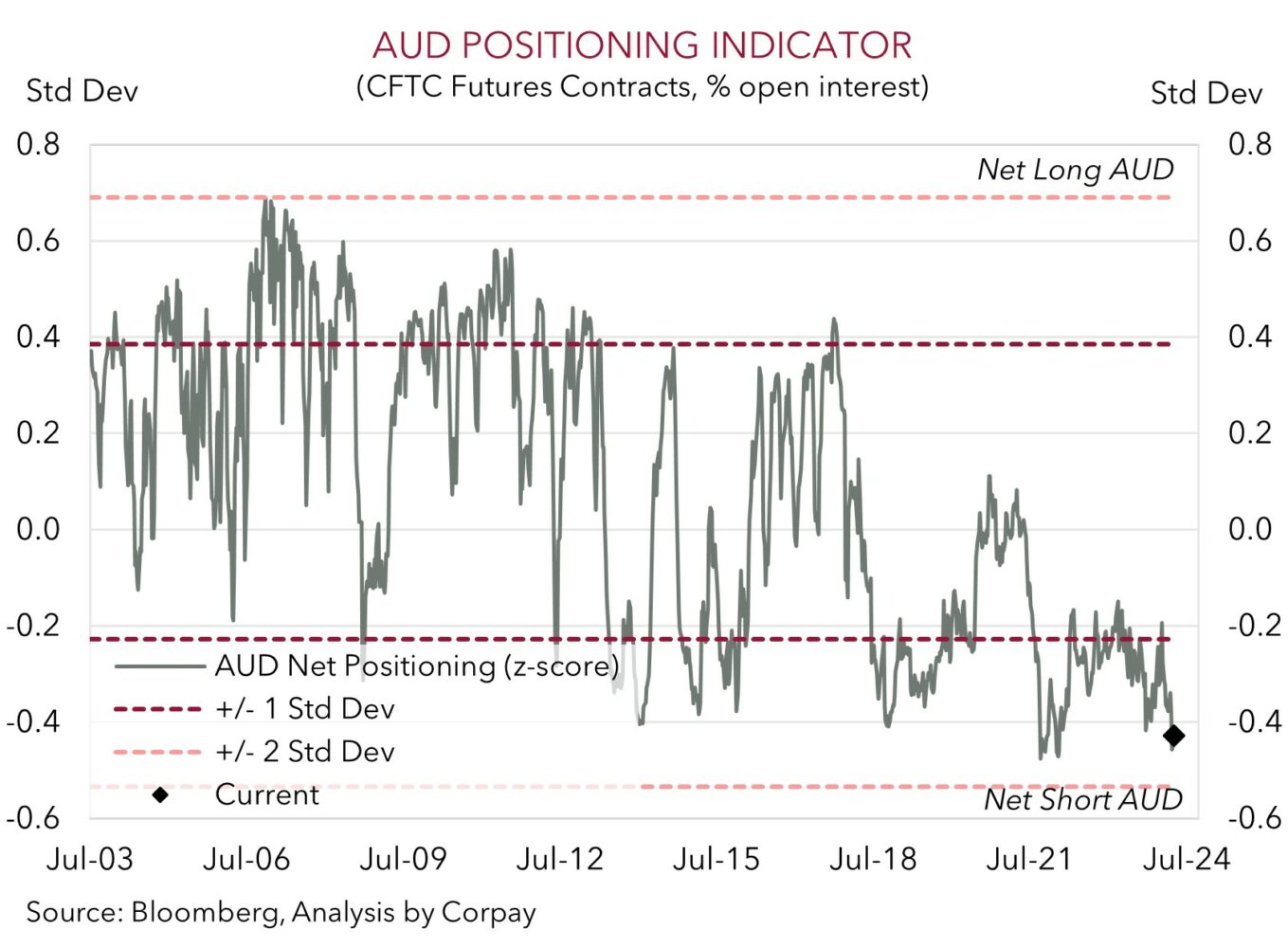

More generally, as outlined yesterday, while the upward adjustment in US interest rate expectations should keep the USD firm, we don’t want to be overly bearish the AUD down near current levels given: Australia’s still positive capital flow/trade dynamics (since 2015 when these supports kicked into gear the AUD has only traded below ~$0.65 ~6% of the time); signs China’s economy is beginning to turn the corner as various stimulus measures gain traction; the AUD’s positive seasonal tendencies at this time of the year (since the mid-80’s the AUD has appreciated in April ~60% of the time); the favourable shift in short-dated yield differentials if we are right and the RBA lags its peers in terms of when it starts and how far it goes during the next easing cycle due to Australia’s still tight labour market and stickiness in domestic inflation; and with market positioning already ‘net short’. As our chart shows, CFTC futures contracts (a commonly used proxy for FX positioning) are quite stretched and suggesting a lot of negative sentiment may already be factored in to the AUD.