• US inflation. A higher than expected US CPI generated a sharp repricing in US rate expectations. This supported the USD & dampened sentiment.

• AUD tumble. The shift in market pricing & stronger USD has push the AUD lower with the AUD’s April revival unwinding overnight.

• AUD crosses. The AUD also underperformed on the crosses. We think this looks a bit overdone. ECB meeting, US PPI, & Fed speakers in focus tonight.

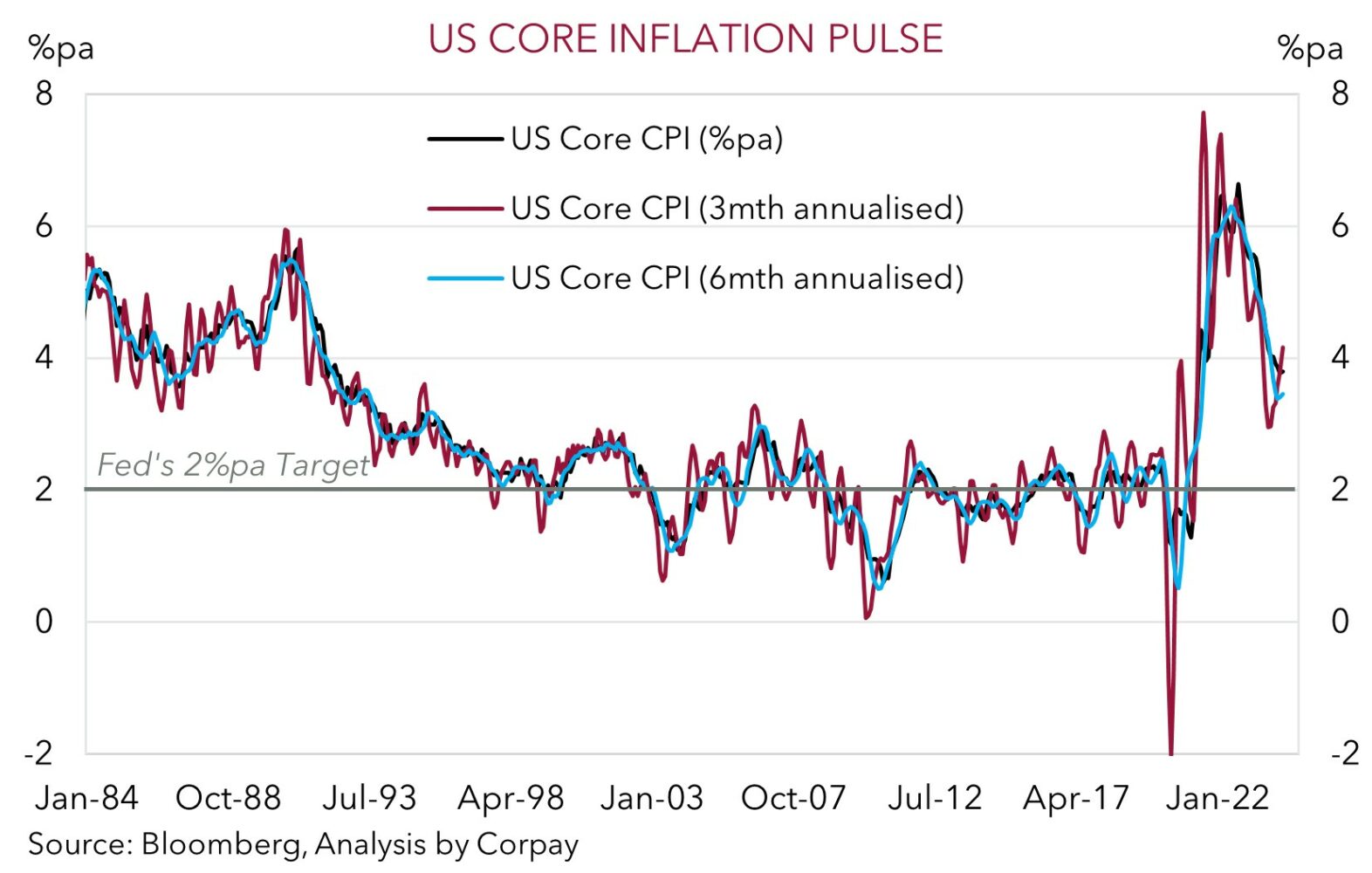

Another hotter than projected US CPI reading jolted markets overnight as it further challenged the US Fed’s view that inflation pressures are on a glidepath back down to target. Both headline and core (i.e. excluding food and energy) CPI rose by 0.4% in March. As a result, the annual run-rate for headline inflation re-accelerated by more than expected (from 3.2%pa to 3.5%pa), while core inflation remained at 3.8%pa with progress stalling. A deep dive shows that factors like the rebound in oil played a role, however for policymakers the stickiness across ‘services’ inflation is likely to reduce confidence regarding the path ahead. Rents continue to grow at an above average pace, and while some of the strength in a few services components may fade (nearly half the increase in core services prices ex-rents was due to auto insurance) the still solid US labour market and elevated wages remains a source of support for others.

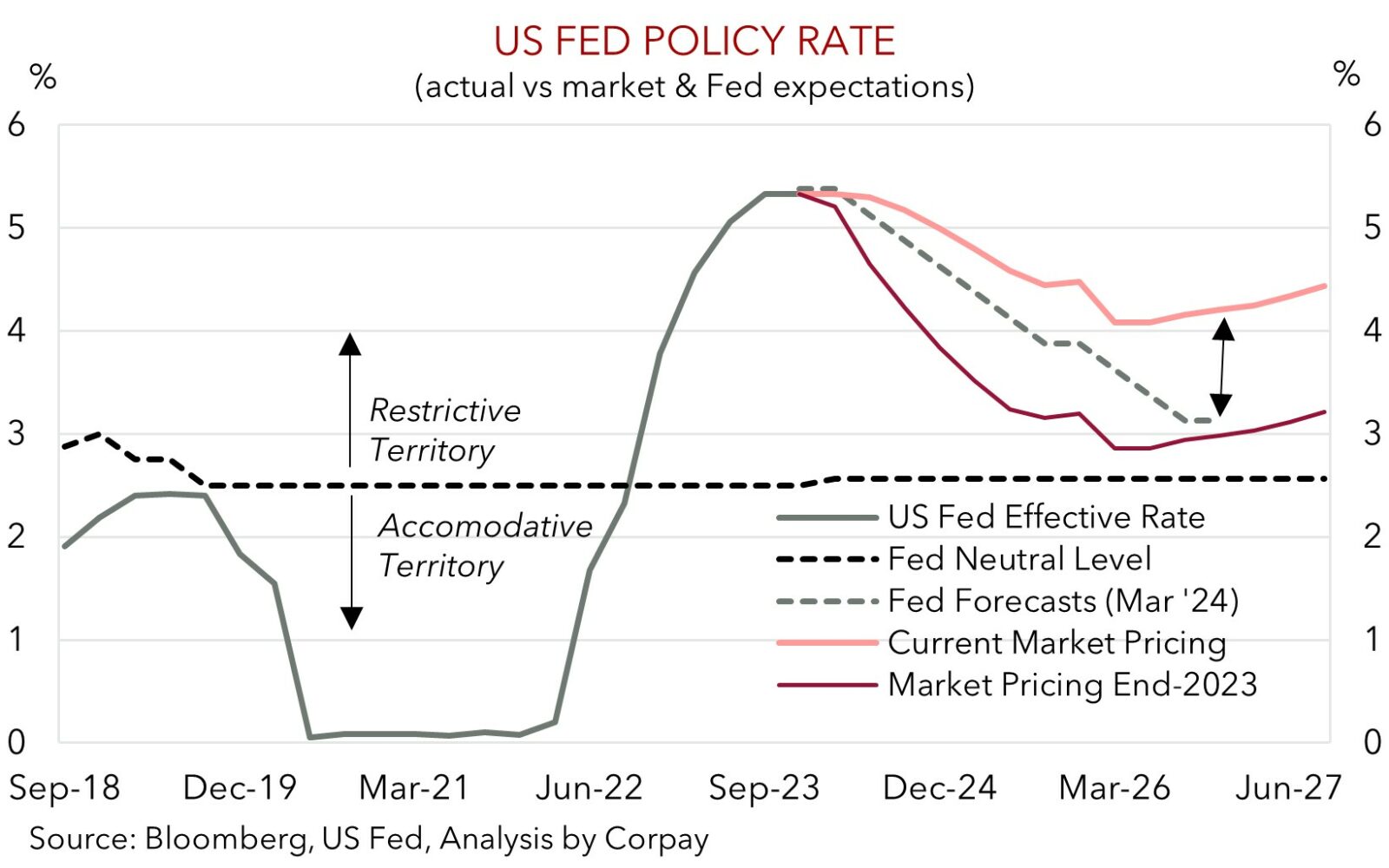

In response to the inflation data US interest rate expectations adjusted higher as markets trimmed their US Fed rate cut bets further. Odds of a Fed cut by June sank from ~53% to ~18% with the first full rate reduction now not factored in until November and a gradual easing cycle penciled in after that. This flowed through to bonds with the US 2-year rate rising by 23bps (now 4.97%, a high since mid-November) and the 10-year rate ~18bps higher (now 4.54%). The less dovish than anticipated tone from the RBNZ and Bank of Canada over the past 24hrs may also played a part with both central banks keeping rates steady and indicating they are in no rush to dial back their ‘restrictive’ settings.

The jump in yields sapped sentiment. The US S&P500 fell ~1%, however in the grand scheme of things this only puts the index where it was last Thursday. In FX, the shift in yield differentials boosted the USD. EUR slipped to ~$1.0744 (towards the bottom of its 2024 range), GBP touched its lowest level since early-February (now ~$1.2540), and USD/JPY hit its highest point since mid-1990 (now ~153). This won’t go unnoticed by officials in Japan with the speed of the moves likely to result in more verbal rhetoric about the weaker JPY and/or raise the odds of currency intervention. USD/SGD has tracked the upswing in the USD to be near a ~5-month high (now ~$1.3537), while the NZD and AUD tumbled. The AUD’s ~1.7% drop has pushed it down to near where it started April (now ~$0.6515).

Tonight the ECB meets (10:15pm AEST), while in the US Producer Price Inflation data is due (10:30pm AEST) and few Fed members speak (Williams 10:45pm, Barkin 12am, Collins 2am, Bostic 3:30am AEST). Based on the size of the overnight moves and how ‘hawkish’ US interest rate pricing now is (especially compared to the Fed’s view) we think the risks reside with the USD giving back some ground if the ECB isn’t as ‘dovish’ as anticipating and/or the US PPI shows upstream price pressures are moderating.

AUD Corner

The adage of the AUD walking up the stairs before going down in the elevator was on display once again overnight. The AUD’s April upswing hit a wall with the stronger than projected US inflation data and resultant lift in US bond yields and negative spillovers into risk sentiment supporting the USD (see above). At ~$0.6515 the AUD is back down just below where it started the month with the drop over the past 24hrs the largest (in percentage terms) in just over a year. The AUD also underperformed on the crosses with falls of 0.6-0.8% recorded against the EUR, JPY, and GBP.

AUD/NZD has also fallen under ~1.09 after the RBNZ played a straight bat yesterday and stressed it is “confident that maintaining the OCR at a restrictive level for a sustained period” will return inflation to the 1-3% target range “this calendar year”. We think AUD/NZD may remain under a little more downward pressure over the very near-term, however a change in the RBNZ’s viewpoint and bias looks to be a matter of time based on the weakness across the NZ economy and moderating inflation pulse. Over the longer term this should see the NZD underperform the AUD as various economic fundamentals remain in Australia’s favour.

In our opinion, the size of the moves in the AUD, particularly on some of the crosses, in the wake of the US inflation data look to be a bit overdone. While the AUD may remain under some downward pressure today as Asian markets react to the overnight macro news we don’t want to be overly bearish down around current levels. Market positioning (as measured by CFTC contracts) is already quite ‘net short’ the AUD, and Australia’s positive capital flow/trade dynamics remain in place. Since 2015, when these forces kicked into gear, the AUD has only traded below ~$0.65 ~6% of the time. And as outlined above, we see risks the USD loses some ground into the end of the week if the ECB fails to crystallise ‘dovish’ expectations (10:15pm AEST), the US Producer Price Inflation data doesn’t confirm the signals from the CPI report (10:30pm AEST), and the now overly ‘hawkish’ US interest rate assumptions are trimmed back.

Moreover, fundamentally, improving signs out of China are starting to emerge as various stimulus measures gain traction and confidence turns the corner. This should be a positive for commodity demand and regional growth down the track. Domestically, growth has slowed, however the larger population should continue to help soften the blow on aggregate demand stemming from higher mortgage rates. And given the stickiness in domestic services prices and resilience in the labour market, we see the RBA lagging its peers in terms of when it starts and how far it goes during the next easing cycle. In our opinion, this should be AUD supportive on the crosses over time.