• Waiting game. Most markets consolidate ahead of tonight’s US CPI report. US bond yields a little lower, while the USD index tread water.

• AUD revival. Firmer base metal prices helped the AUD. The AUD’s recent rebound is inline with its seasonal pattern. Will the US CPI stop its upswing?

• RBNZ meeting. RBNZ meets today. It may not (yet) tweak its forward guidance. This may see AUD/NZD’s upturn temporarily stall.

Tonight’s US CPI inflation report (10:30pm AEST) is the key event for markets, and with it coming closer into view it isn’t surprising most of major asset classes consolidated overnight. In contrast to the modest falls across European equities (EuroStoxx50 -1.1%), the US S&P500 eked out a small gain (+0.1%) although this was due to a late session rally with the index tracking in the red most of the day. Bond yields gave back some ground with the benchmark US 10yr rate falling ~6bps after touching a fresh 2024 high yesterday (now 4.36%). There were similar falls in Europe with the UK and German 10yr yields now sitting at 4.03% and 2.37% respectively.

In FX, there have been small net moves over the past 24hrs. The USD index, which has drifted lower so far in April, tread water. EUR is hovering between its 200-day ($1.0833) and 100-day ($1.0874) moving averages, GBP is around its 100-day moving average ($1.2672), while USD/JPY remains within the tight range is has occupied over the past few weeks up near its cyclical highs (now ~151.75). With Friday’s quarterly Monetary Authority of Singapore meeting looming USD/SGD is at its 1-year average (now ~1.3454).

The NZD has nudged up to its highest level in ~3-weeks (now ~$0.6060) ahead of today’s RBNZ decision (12pm AEST). The RBNZ is expected to keep rates on hold at 5.50%. Given this meeting won’t provide updated economic projections we think that despite the sluggish NZ activity data the RBNZ may not (yet) tweak its forward guidance in a more ‘dovish’ direction. If that is the case this may give the NZD a bit more short-term support. The AUD (now ~$0.6625) has extended its upturn on the back of firmer industrial metals prices. Iron ore (now US$108/tonne) has rebounded further with prices now ~10% above last week’s low, while copper is up at levels last traded in mid-2022 as more positive signs for global demand continue to emerge.

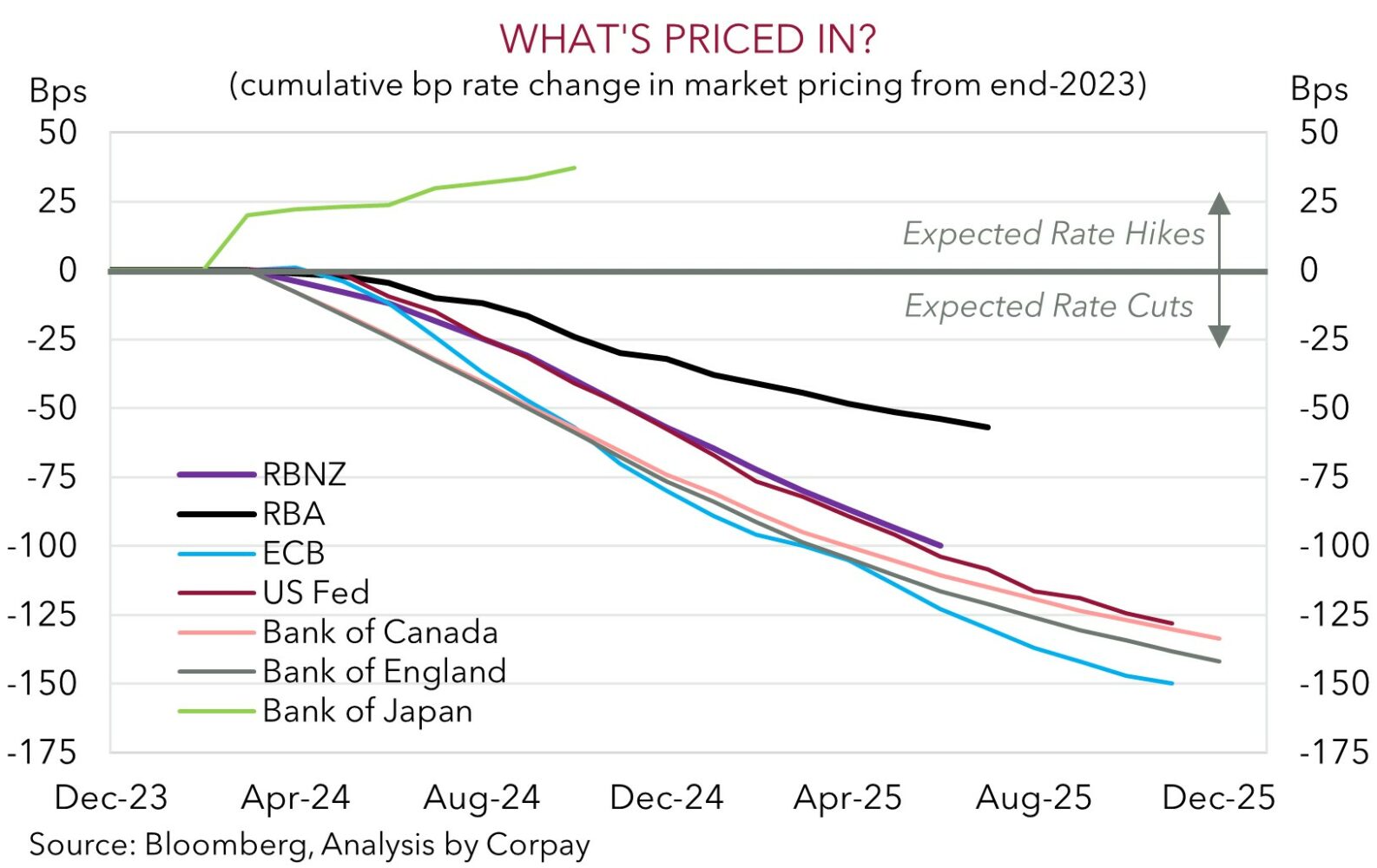

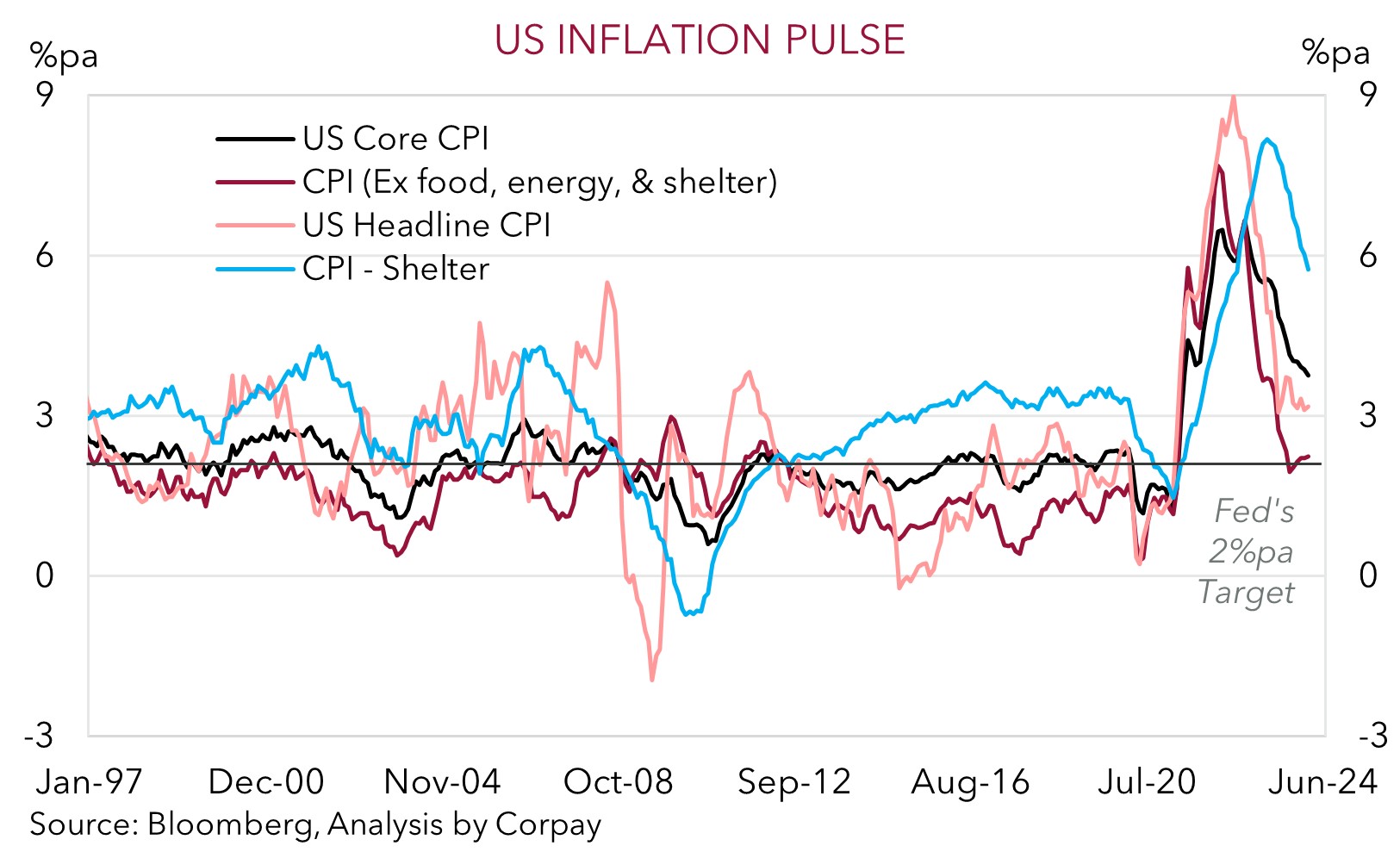

Market attention will be on US inflation (10:30pm AEST), particularly following last week’s bumper US jobs report, with appearances by the Fed’s Goolsbee and Barkin (2:45am AEST) and the minutes of the last FOMC meeting (4am AEST) also due. As Fed Chair Powell stressed in a recent speech the ‘disinflation’ process is bumpy and it looks like the March data should illustrate this. Rising energy prices may see annual headline inflation re-accelerate slightly (mkt 3.4%pa from 3.2%pa), however things like lower used car prices, goods ‘disinflation’, and a moderation in rents after a strong start to the year point to core inflation slowing (mkt 3.7%pa from 3.8%pa). Reaction to the data is likely to be binary with a higher (lower) US CPI print likely to lead to further pricing out (in) of near-term rate cuts and a stronger (softer) USD. Markets are assigning a ~50% chance of a Fed cut by June.

AUD Corner

The AUD’s April revival has continued with stronger base metal prices (see above) helping push the currency to ~$0.6625, towards the top-end of the range occupied since late-January. The AUD has also added to its gains against the EUR. The prospect of ‘dovish’ guidance at this Thursday’s ECB meeting and a diverging interest rate path with the RBA has compounded the commodity backdrop and has helped AUD/EUR edge up to its highest level since late-January (now ~0.6105). Similarly, AUD/GBP has also touched a multi-month high (now ~0.5229), while AUD/JPY (now ~100.58) remains at lofty levels. We continue to think that around current levels there are uneven medium-term risks for AUD/JPY with renewed bouts of market volatility, further BoJ policy normalisation, and/or a global rate cutting cycle potentially generating a meaningful reversal in the undervalued JPY.

AUD/NZD (now ~1.0935) is also near a 5-month high. The rebound in AUD/NZD since late-February has been in line with our thinking (see Market Musings: AUD/NZD bouncing back). And while we believe the contrasting economic fundamentals between Australia and NZ should help the cross-rate grind higher over the longer-term, we feel that the upswing may pause for breath in the short-term. As discussed, we think the RBNZ may not alter its forward interest rate guidance at today’s meeting (12pm AEST). If the RBNZ plays a straight bat this may give the NZD a bit of a lift and see AUD/NZD slip back slightly.

In terms of AUD/USD, as discussed above, the market will be fixated on tonight’s US CPI inflation data (10:30pm AEST). There are several moving parts to the US CPI report with annual run-rates of headline and core inflation set to diverge. For policymakers the trends in core inflation and sticky services prices are more important. And on these fronts, we believe a further modest slowing in price pressures is likely given our view that the pickup at the start of 2024 in some of these areas looks to have been driven by temporary seasonal factors. Indications that the underlying US inflation pulse is moderating would, in our view, see the USD come under some pressure and be a positive for risk sentiment and the AUD. By contrast, while a positive US inflation surprise may generate a short-term USD boost, as observed last week in the wake of the stronger than forecast US jobs report, the pull-back in the AUD may not extend that far based on the more upbeat trends coming through across commodities and the AUD’s positive seasonal tendencies at this time of the year. As noted previously since the float the AUD has appreciated in April more often than not (the AUD has risen in ~60% of April’s since 1986).