• Limited moves. Equities mixed, bond yields drifted back, & the USD is little changed. AUD is close to where it was this time yesterday.

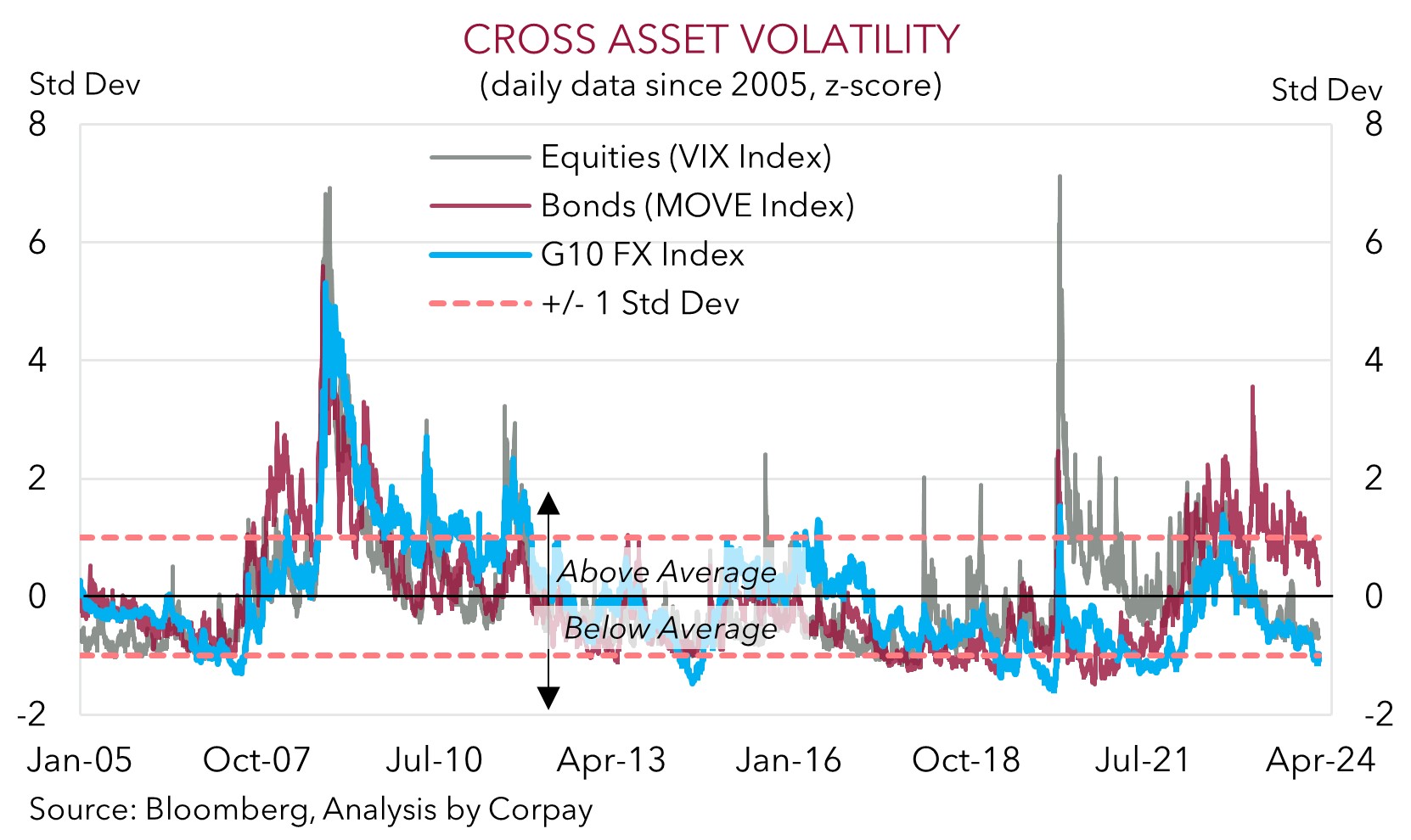

• Low vol. Measures of equity & FX volatility are now well below average. Markets could be complacent to the macro & geopolitical risks still lurking.

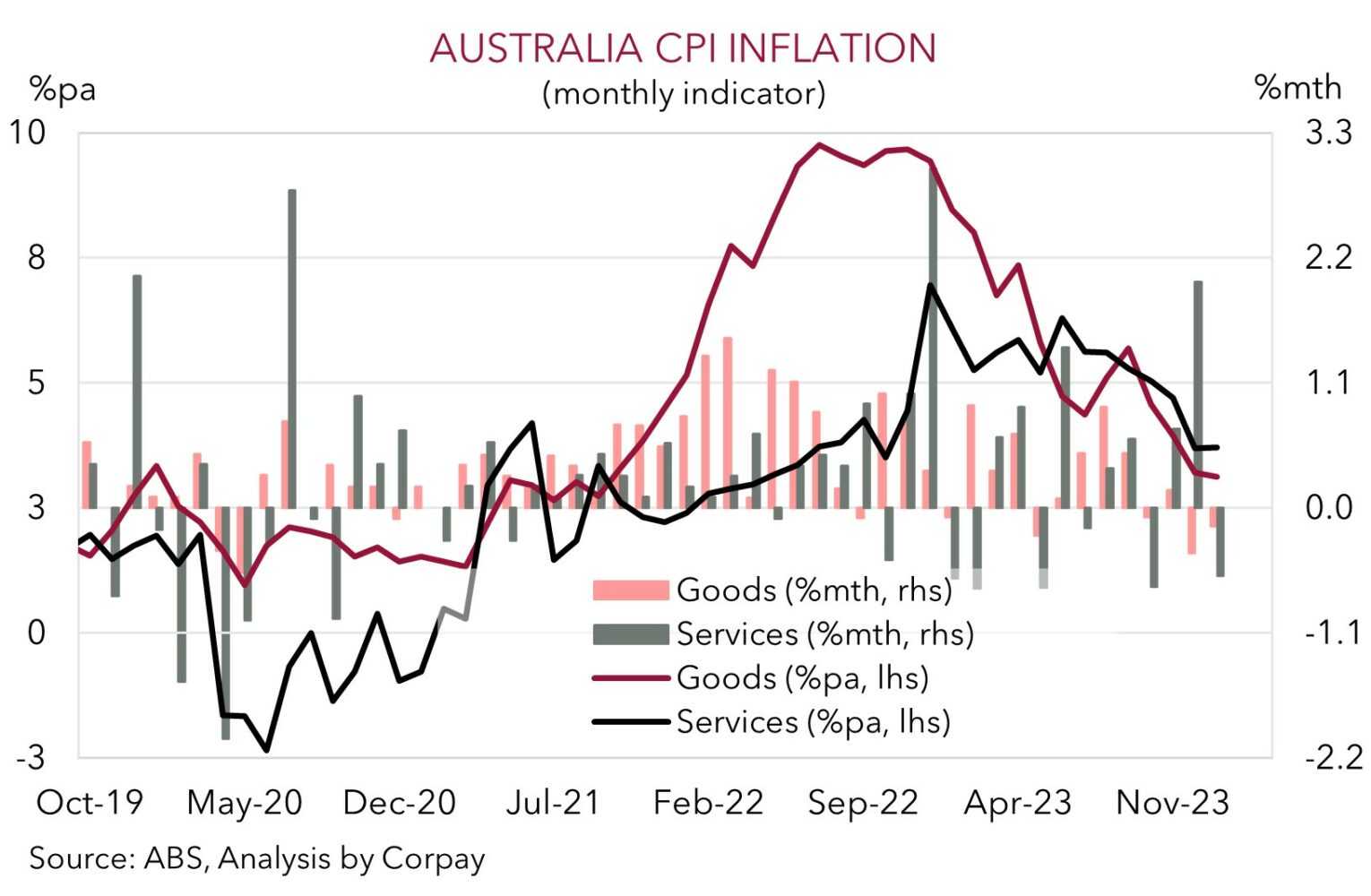

• AU CPI. The monthly CPI indicator due today. More info on services is provided. We think inflation could re-accelerate by more than expected.

Limited moves across markets overnight with not much new information coming through to shift the dial. In contrast to the small rise across European equities US stocks slipped back with a dip in the megacap NVIDIA dragging on the tech sector and overall index (NASDAQ -0.4%, S&P500 -0.3%). Long-end bond yields drifted lower, with 10yr rates in the UK, Germany, and the US finishing the day down ~2bps. There were no meaningful changes in interest rate expectations. Markets are factoring in ~79bps worth of rate cuts by the US Fed over H2, the Bank of England is assumed to provide a fraction less relief (~75bps by year-end), while the European Central Bank is projected to do a bit more (~86bps by end-2024). Across the Tasman the RBNZ is forecast to lower rates by ~67bps by its last meeting of the year, and the RBA is set to lag its peers with only ~44bps worth of easing penciled in over 2024.

In FX, the USD is little changed. The second tier US data released overnight was mixed. Although durable goods orders rebounded in February (+1.4%), this only partially unwound the large fall the prior month. The business investment outlook in the US remains cloudy, unsurprising given the higher cost/rate environment and patchy momentum in various sectors. US consumer confidence consolidated at a below average level in March suggesting headwinds for household spending remain.

The major currencies traded in tight ranges and are all within +/- 0.1% of where they were this time yesterday. The EUR is near ~$1.0830, USD/JPY is up around its cyclical peak (now ~151.55) despite more rhetoric yesterday from Japanese Finance Minister Suzuki who warned that they “won’t rule out any options” against excessive FX moves, and GBP is tracking at ~$1.2625. USD/SGD is treading water (now ~1.3457), as is the AUD (now ~$0.6532). This is inline with the consolidation in the USD and USD/CNH over the past 24hrs. Yesterday the PBoC once again set the CNY reference rate much stronger than estimated, a further sign that it isn’t actively seeking a weaker yuan. In our view, given the strong correlation between the pairs, steps to put a cap on USD/CNH should also help put a floor under the AUD.

As our chart shows, volatility measures for equities and currencies have fallen sharply over recent months with both now well below average. Bond market volatility is trailing, but it has also moved back to more normal levels. Given the limited offshore event calendar heading into the Easter holiday period, barring an exogenous shock, the calmness across the major asset markets may persist near-term. However, over coming months, we believe volatility could lift as the major central banks actually start to move interest rates at different speeds, growth/inflation deviates from analysts thinking, and geopolitics gets more attention. The late-2024 US Presidential Election could become more of a market focal point over the period ahead.

AUD corner

The AUD has been range bound over the past 24hrs with limited new information coming through to shake things up (see above). At ~$0.6532 the AUD is ~0.1% from where it was tracking this time yesterday. Indeed, yesterday’s 0.4% intra-day range was less than half of what it has typically traded going back to the mid-80s. The AUD also consolidated on the crosses. AUD/EUR is hovering near ~0.6030, AUD/JPY is around ~99, and AUD/NZD is just below ~1.09.

The incoming Australian economic data may breathe some more life into the AUD. As outlined over the past few days, the February reading of the monthly CPI indicator is due today (11:30am AEDT) and retail sales are released tomorrow. The February CPI data will have greater coverage of services prices. This is a focus for the RBA, and in our view things like rising rents, firmer wages, and lift in education costs at the start of the new year means there are risks annual inflation re-accelerates by more than forecast (mkt 3.5%pa from 3.4%pa). ‘Swiftonomics’ might have also played a role with upward pressure on airfares and hotel prices due to tours by Taylor Swift and Pink possible, while less discounting across ‘goods’ could also mean its disinflationary impulse wanes. Likewise, we believe spending on merchandise and hospitality during the recent concert tours, and the extra trading day due to the leap year, may see retail sales exceed consensus estimates (mkt +0.4%).

In our opinion, a positive run of Australian economic data could reinforce views that the RBA is on a slightly different path to its offshore counterparts and that rate cuts in Australia could be slower and more limited in the next global easing cycle. The diverging policy outlooks between the RBA and others, and adjustment in short-dated yield differentials, should be AUD supportive over time, especially on crosses like AUD/EUR, AUD/GBP, and AUD/NZD. As would signs China’s economy is improving, with steps by authorities to limit CNH weakness also AUD supportive given the tight correlation between the currencies.