• Quiet start. Global equities mixed. Bond yields drifted higher. USD a little softer. AUD has clawed back a bit of ground over the past 24hrs.

• CNH & JPY. Authorities in China have pushed back on recent CNH weakness. Rhetoric from Japanese officials about JPY weakness has also ramped up.

• Data flow. US durable goods orders in focus tonight. Locally, the monthly CPI indicator is due tomorrow & retail sales are released on Thursday.

It has been a typically quiet start to the holiday shortened week with limited new news over the past 24hrs. Most of the major global equity indices are little changed with the EuroStoxx50 a bit higher (+0.3%) and the US S&P500 slipping slightly (-0.3%). That said, both remain historically high. Bond rates drifted up with UK, Germany, and US yields rising ~4-6bps across their respective curves. At ~4.63% the US 2-year yield is just below its ~6-month average with traders discounting a little more than 3 rate cuts by the US Fed over H2 2024. This is broadly inline with what markets are factoring in for the Bank of England, while ~3.5 cuts are penciled in for the ECB. By contrast, futures markets are pricing in less than 2 rate cuts by the RBA this year.

Members of the US Fed speaking overnight showed how wide the views on the committee are, highlighting that the incoming data will dictate the timing and size of the looming cycle. Fed Governor Cook said that although the risks to achieving their goals are “moving into better balance”, policymakers should take “a cautious approach”. Atlanta Fed President Bostic repeated comments that he is now forecasting just 1 rate cut this year (compared to 2 previously), while Chicago Fed President Goolsbee sees 3 moves in 2024. As a guide, in the latest Fed ‘dot plot’ 10 officials saw at least 3 rate cuts in 2024, while 9 others were forecasting 2 cuts or less.

In FX, the USD shed some ground ahead of tonights durable goods orders data (11:30pm AEDT). EUR has nudged up towards ~$1.0840, GBP is near ~$1.2640, while USD/SGD is slightly lower (now ~1.3457). Yesterday’s hotter Singapore inflation print (core CPI accelerated to 3.6%pa, a high since last July) raised the odds the Monetary Authority of Singapore will maintain a ‘hawkish’ bias over the period ahead. USD/CNH gave back slightly less than half of Friday’s lift (now ~7.2533) after the PBoC set the CNY reference rate much stronger than estimated, a sign it wasn’t necessarily seeking a weaker yuan. It was also reported that China’s state banks were aggressively selling USDs and Chinese institutions were less willing to offer short-term CNH funding, more signals markets may have been jumping at shadows on Friday. Given its tight correlation the firmer CNH (dip in USD/CNH) gave the AUD a boost (now ~$0.6540).

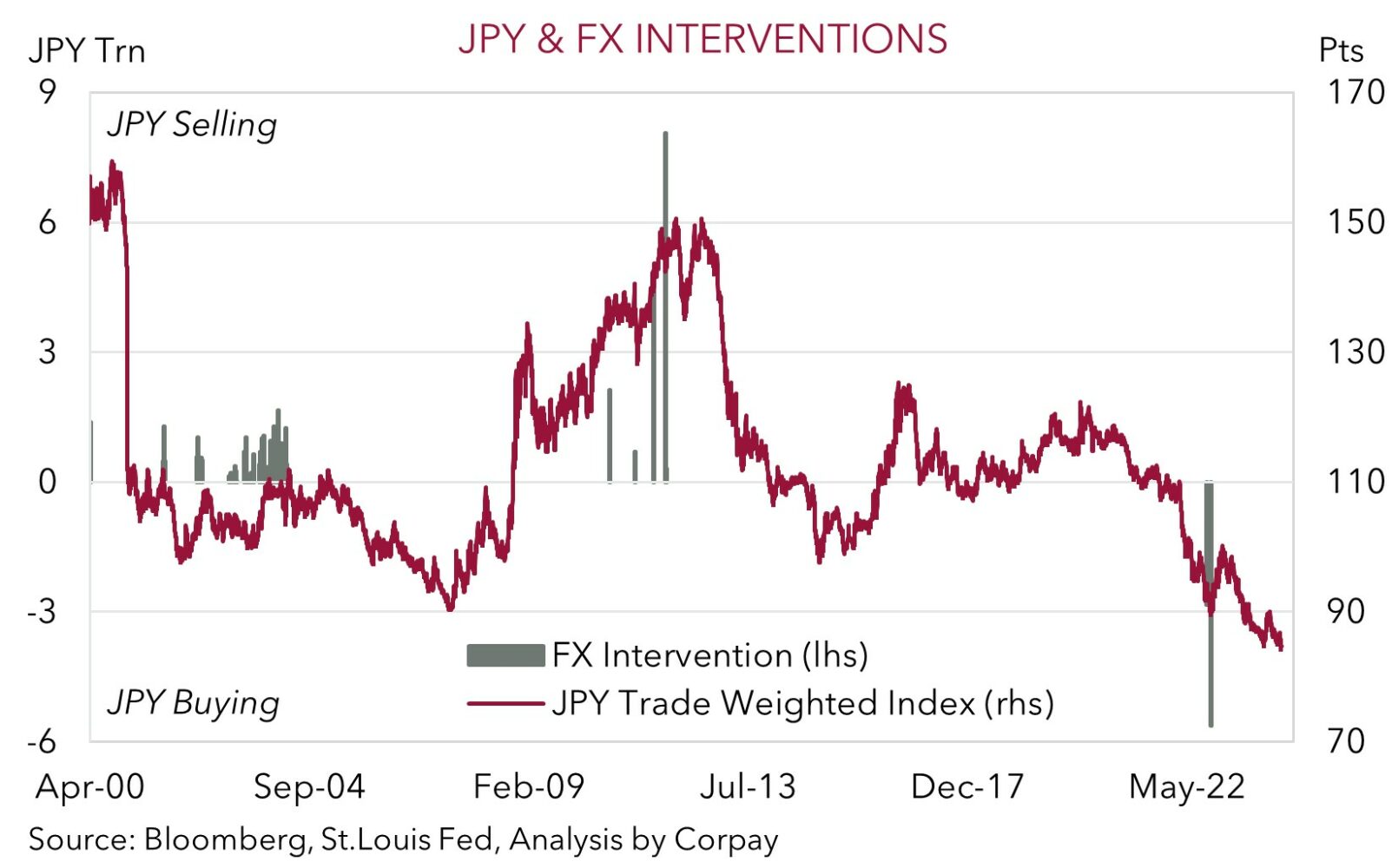

USD/JPY has tread water (now 151.40) despite Japanese officials ramping up their rhetoric about currency weakness. According to Vice Finance Minister Kanda, they are watching the JPY “with a sense of urgency” given recent moves “aren’t reflecting fundamentals” and they can have a “negative impact on the economy”. As our chart shows, Japan’s trade weighed index is lower than when they last intervened in September 2022 to prop up the JPY. Risks the Japanese step into markets to support the JPY are on the rise. If it occurs, this would have a cascading (albeit likely short-lived) impact on broader FX markets.

AUD corner

The AUD has regained some ground at the start of the new week. The pullback in USD/CNH has flowed through to give the AUD a little support (+0.3% to ~$0.6540) (see above). As a result the AUD is tracking just below its 50- and 200-day moving averages (both ~$0.6551). The AUD is also a touch firmer on most of the major crosses. The AUD has appreciated by ~0.4% against the JPY and NZD over the past 24hrs. AUD/NZD (now ~1.0892) is up around a ~4-month high and over 3% above its late-February low. The rebound in AUD/NZD over recent weeks has been in line with our thinking (see Market Musings: AUD/NZD bouncing back) and we believe the contrasting economic fundamentals between Australia and NZ should help the cross-rate remain supported and continue to grind up over the period ahead.

Push-pull factors might generate a bit of short-term AUD volatility over the next few sessions, though ultimately, we think the incoming information could see the AUD edge higher and outperform on crosses such as AUD/EUR, AUD/GBP, and AUD/NZD. On the one hand, a bounce back in US durable goods orders (11:30pm AEDT) may give the USD a small boost as this would illustrate that the US economy remains on firm footing. However, a further push back by authorities in China to the CNH weakness would be an offsetting factor for the AUD given the strong correlation between the currencies. As could the incoming Australian economic data. As outlined yesterday, the February reading of the monthly CPI indicator is released on Wednesday, and retail sales are due Thursday. Given the February CPI data will have greater coverage of services prices, we believe annual inflation risks re-accelerating by more than estimated (mkt 3.5%pa from 3.4%pa). Similarly, spending on merchandise and hospitality during the recent Taylor Swift and Pink concert tours, and the extra trading day due to the leap year, might see retail turnover exceed forecasts (mkt +0.4%).

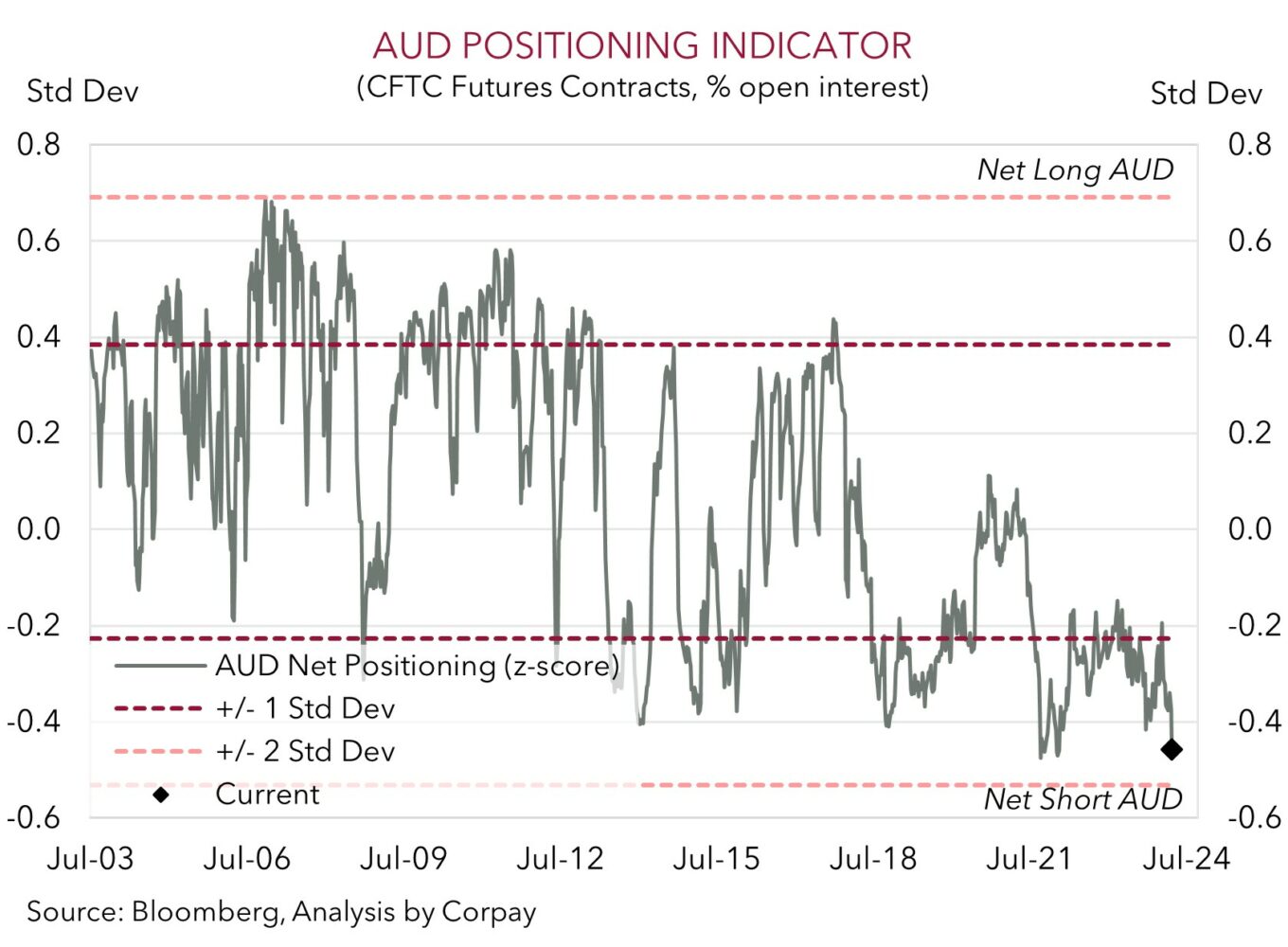

In our judgement, a positive batch of Australian data could bolster expectations the RBA is set to lag its peers in terms of when it starts and how far it goes during the looming global interest rate cutting cycle. We believe the diverging policy outlook between the RBA and others, and shift in short-dated yield differentials, should be AUD supportive over time. Particularly as sentiment towards the AUD and market positioning remains quite negative. As our chart shows, ‘net short’ AUD positioning (as measured by CFTC futures contracts) is elevated, suggesting a lot of negative news and views may already be baked into the AUD at current low levels.