• Firmer USD. US equities consolidated, bond yields dipped, while the USD’s upturn continued despite some better than expected European data.

• Weaker CNH. A catalyst behind the USD strength was the weaker CNH. Given its tight correlation the lift in USD/CNH exerted more pressure on the AUD.

• Event radar. US durable goods orders & the PCE deflator are due. There are also a few Fed speakers. Locally, the monthly CPI indicator & retail sales are released.

After a run of positive days US equities consolidated on Friday near record highs (S&P500 -0.1%). That said, over the week the S&P500 still rose 2.3%, its best weekly performance since mid-December. Bond yields fell (US 2yr rate -5bps to 4.59% and the 10yr declined ~7bps to 4.20%), while in FX the USD extended its upswing. Despite a better-than-expected Germany IFO (touched its highest since mid-2023 suggesting growth may be turning the corner), and UK retail sales (flat vs forecasts for a fall) EUR (now ~$1.0809) and GBP (now $1.2602) remain around their lows.

USD/JPY also continues to hover near the top of its cyclical range (now ~151.35) with markets still sceptical last week’s first interest rate hike by the Bank of Japan since 2007 has opened the door to further tightening. Elsewhere, CNH weakened, pushing USD/CNH up to its highest since mid-November (now ~7.2754) with a weaker than anticipated daily fixing rate on Friday bolstering speculation that after months of pushing back authorities might be open to further currency weakness to help support China’s economic recovery. Market attention will be on today’s CNY fix to see whether Friday’s decision was a one-off or the start of a trend. The USD strength and CNH weakness exerted downward pressure on the NZD and AUD. The NZD (now ~$0.60) dipped to its lowest level in ~4-months, while the AUD (now ~$0.6520) is down close to where it started March.

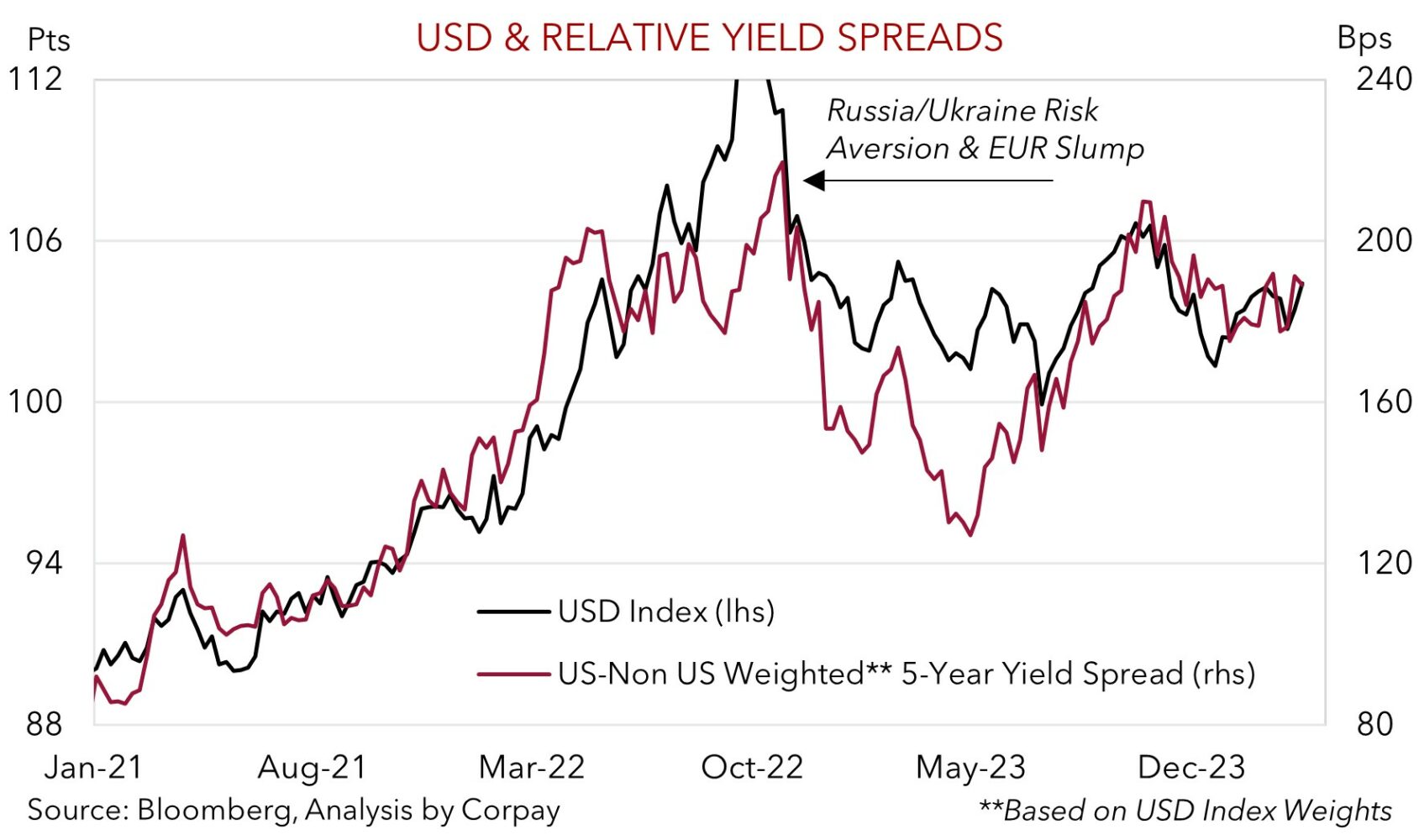

After last week’s busy central bank heavy period, things are a bit quieter on the economic front. It is a holiday shortened week with the Easter break on the horizon. Offshore, the economic highlights in the US are the latest read on durable goods orders (a guide to business capex) (Tues 11:30pm AEDT) and the PCE deflator (the US Fed’s preferred inflation gauge) (Fri 11:30pm AEDT). There are also a few US Fed members speaking, with attention likely to be Governor Waller’s outlook speech (Thurs 9am AEDT) and comments by Chair Powell (Sat 2:30am AEDT). Governor Waller is a leading voice on the FOMC. Comments that he hasn’t been swayed by the recent uptick in inflation and still foresees steady ‘policy recalibration’ later this year may take some of the heat out of the USD, especially as market reaction to the PCE deflator data and Chair Powell’s comments won’t fully come through until early next week due to the holidays. However, given the recent widening in US-non US bond yield differentials (see chart below), we don’t see the USD falling back too far near-term.

AUD corner

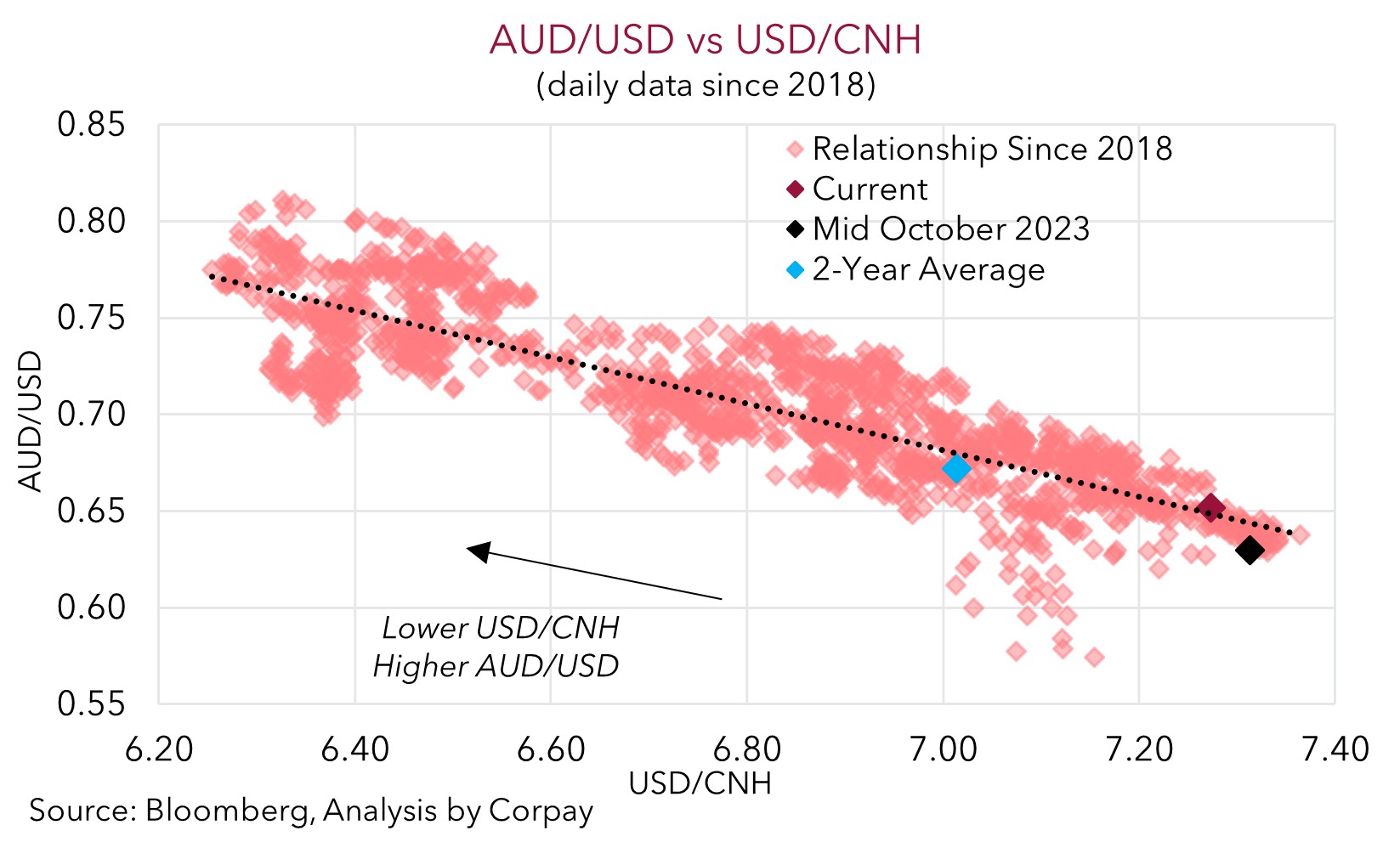

The AUD remained heavy into the end of last week with the firmer USD and weaker CNH (see above) exerting a bit more downward pressure. As outlined previously, the AUD and CNH have a fairly tight (inverse) correlation with a higher USD/CNH typically translating to a lower AUD/USD (see scatter chart below). At ~$0.6520 the AUD is ~1.8% below last Thursday’s post US Fed peak and back around where it started March. The AUD also slipped back on the major crosses, however outside of AUD/JPY (-1%) the net moves against the EUR, GBP, NZD, and CAD ranged from 0.2-0.4%. And despite Friday’s dip, crosses like AUD/GBP, AUD/NZD, AUD/JPY, and AUD/CNH still appreciated over the past week.

In addition to watching how authorities in China react to the weakness in CNH, and whether the daily fixing is used to push back on newfound ‘bearish’ speculative behaviour, this week there are a couple of local data points of interest. The February CPI indicator reading is due on Wednesday, and retail sales are released Thursday. As February is the second month of the quarter the CPI indicator it will have better coverage of the services side of the inflation basket. This is a focus for the RBA, and things like rising rents, firmer wages, and lift in education costs at the start of the new year could see the annual inflation rate re-accelerate by more than predicted (mkt 3.5%pa from 3.4%pa). ‘Swiftonomics’ may have also played a role with upward pressure on airfares and hotel prices due to tours by Taylor Swift and Pink possible. Similarly, spending on merchandise and hospitality during these concert tours may have given retail trade a boost, as would the extra trading day because of the leap year (mkt +0.4%).

In our opinion, a positive run of local economic data could reinforce thinking the RBA is set to lag its peers in terms of when it starts and how far it goes during the looming global interest rate cutting cycle. We think this diverging policy outlook between the RBA and others, and favourable shift in short-dated yield differentials, could help crosses such as AUD/GBP, AUD/NZD, and AUD/EUR grind higher, and also help the AUD claw back a little ground versus USD. Although, as mentioned, over the near-term a lot will depend on USD/CNH’s direction of travel and the reaction by Chinese policymakers to the currency weakness.