• Shaky sentiment. Middle East jitters were compounded by stronger US retail sales. Higher US bond yields weighed on equities & supported the USD.

• AUD lower. Yesterday’s modest AUD recovery unwound overnight. The AUD is near its 2024 lows. USD upswing is pressuring other currencies.

• China & Fed speakers. China Q1 GDP released today. Several US Fed members also due to speak. The list includes Fed Chair Powell.

After the market mood picked up during yesterday’s Asian trade sentiment soured overnight. The familiar forces of jitters about the situation in the Middle East after Israel vowed to respond and outlook for ‘higher for longer’ interest rates sapped sentiment. In the US, retail sales exceeded analysts’ forecasts. Headline sales grew 0.7% in March, the ‘control group’ which feeds into US GDP rose 1.1% (the strongest monthly result since January 2023), and prior months were revised up indicating a firmer underlying pulse of consumer spending.

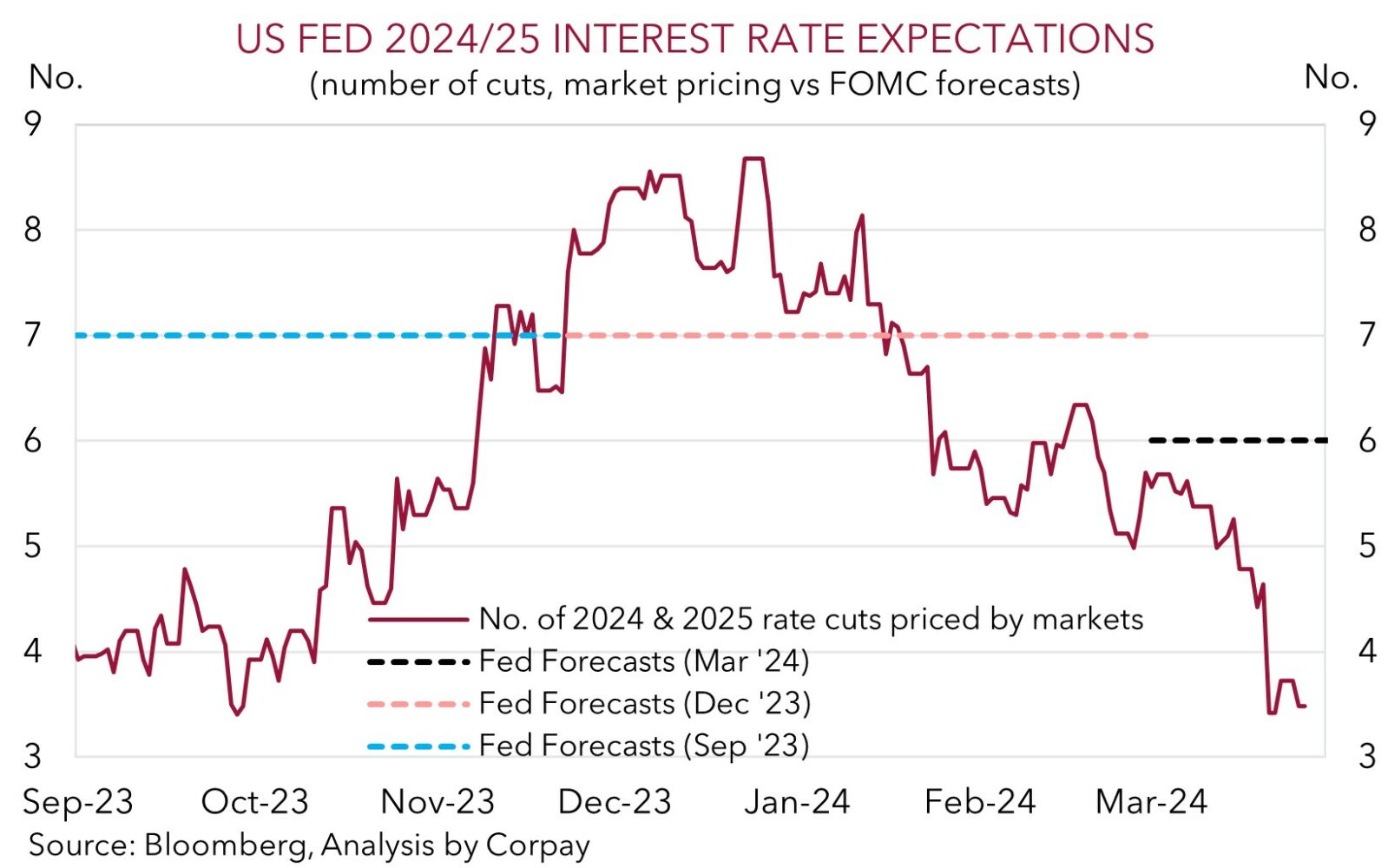

In response, participants watered down their US Fed rate cut bets. The first full rate cut is currently factored in by September, with the next one not discounted until January 2025. All up, markets are penciling in ~3.5 rate cuts by the US Fed by end-2025 compared to the FOMC’s prediction of ~6 moves over this period. US and European bond yields increased with the US curve steepening on the back of a larger rise in the 10yr rate (+8bps to 4.6% compared to the 2bp lift in the US 2yr (now 4.92%)). US equities fell with the tech-focused NASDAQ underperforming (-1.8% vs S&P500 -1.2%). Interestingly, despite the nervousness about the Middle East oil prices have been well behaved with brent crude flat (now ~US$90.40/brl), while industrial metals like copper (+2.8%) and iron ore (+1.3%) strengthened. In FX, higher US bond yields gave the USD a boost, although compared to where things started the week the net changes have been modest. EUR (now ~$1.0625) and GBP (now ~$1.2445) are lingering near their lowest levels since November, USD/JPY tracked the widening yield differentials to be at its highest point since April 1990 (now ~154.25), USD/SGD is a touch higher (now 1.3625), and the AUD unwound yesterday’s small revival to be around its 2024 lows (now ~$0.6443).

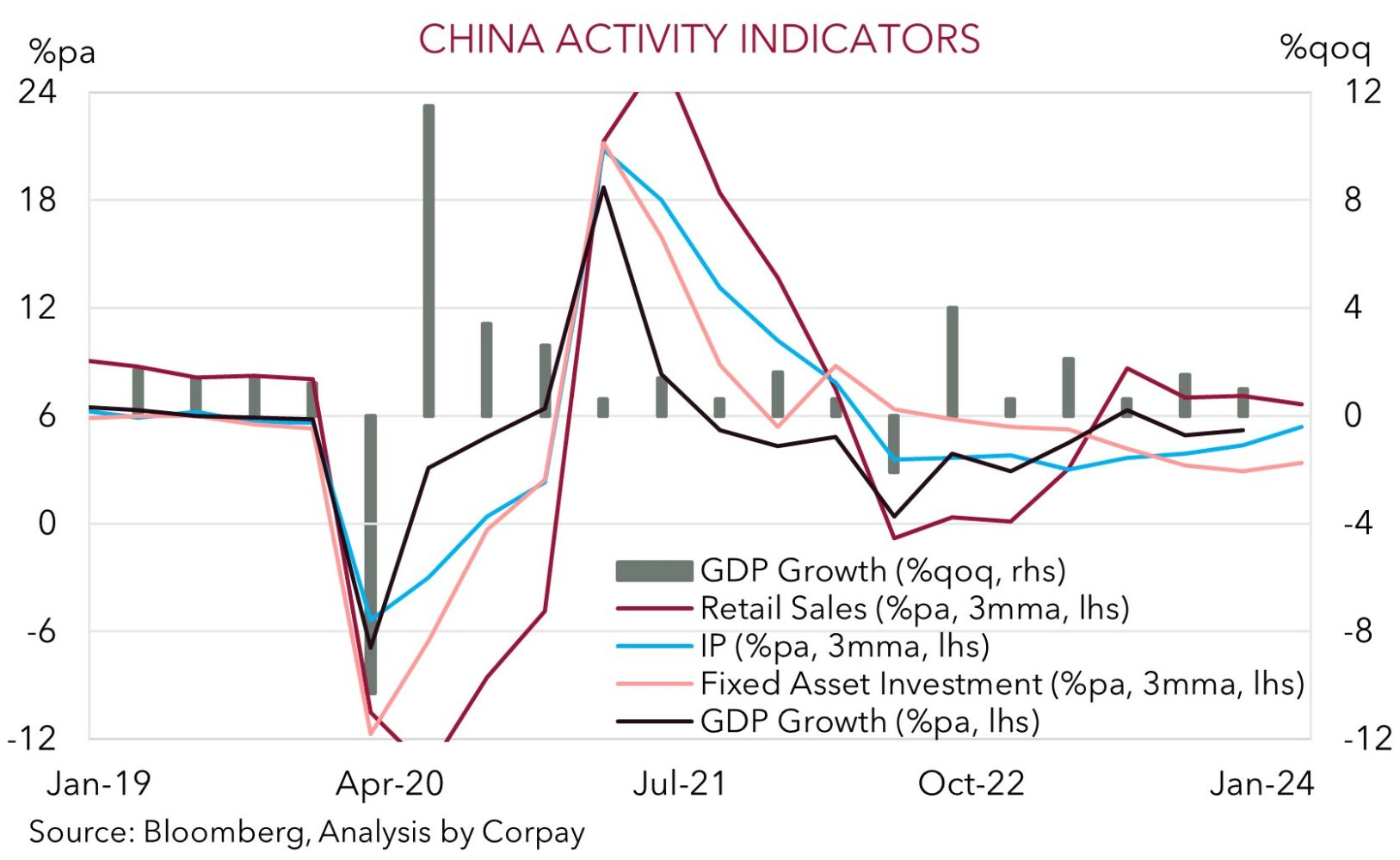

Today the China data batch which includes Q1 GDP is released (12pm AEST). High base-effects from last years post COVID bounce could make it difficult to interpret the topline results. But in the main we think the data should show momentum improved. If realised, this could be an intra-day support for risk sentiment and cyclical currencies. On top of the China data several US Fed members will be hitting the wires. Over the next 24hrs Daly (10am AEST), Jefferson (11pm AEST), Williams (2:30am AEST), Barkin (3am AEST), and Collins (6:30am AEST) speak, but more interest will be on Fed Chair Powell’s appearance (3:15am AEST).

In his last outing, which was before of the latest US inflation data, Chair Powell argued that the disinflation story hadn’t changed given improvements in supply may support growth and lower inflation. Focus will be on whether this view has changed. While we think Powell might note caution about near-term rate cuts is needed, this already looks priced in. Hence thoughts from Powell that the Fed is still on a path to re-calibrate policy later this year could revive some longer-dated rate cut bets, taking some of the heat out of the lofty USD.

AUD Corner

Yesterday’s modest Asian session recovery in the AUD unwound overnight as shaky risk sentiment (as illustrated by the drop in US equities) and higher bond yields following the stronger US retail sales report supported the USD (see above). At ~$0.6443 the AUD is just above its 2024 lows and ~3% below last week’s peak. However, it has been a more mixed performance on the crosses with the AUD strengthening against the JPY (+0.4%) and NZD (+0.2%), while it has slipped back versus the EUR (-0.3%, GBP (-0.4%), and CNH (-0.5%). AUD/CNH (now ~4.68) is within striking distance of its year-to-date lows.

As mentioned, focus during today’s Asian session will be on an appearance by the US Fed’s Daly (10am AEST) and the China data batch (which includes Q1 GDP) (12pm AEST). Tonight, attention will remain on US Fed speakers with Chair Powell (3:15am AEST) the pick of the bunch which includes members Jefferson (11pm AEST), Williams (2:30am AEST), Barkin (3am AEST), and Collins (6:30am AEST).

In our opinion, signs that stimulus measures are gaining traction and activity in China is improving, especially across the commodity-intensive industrial side should give the AUD some support, particularly on crosses such as AUD/EUR and AUD/GBP which we think look a bit low compared to relative longer-dated yield differentials. For AUD/USD the US Fed speakers will also be important as their comments, particularly those of Chair Powell, can influence US interest rate expectations and the USD.

That said, as discussed over recent days and above, outcomes relative to expectations are what matter and markets are now factoring in a more ‘hawkish’ outlook for the future path of US interest rates than the US Fed. We feel the ‘higher for longer’ narrative is already largely baked into the USD. Hence, we believe the risks reside with the USD giving back a bit of ground if US policymakers keep the door open to policy ‘recalibration’ later this year and markets revive some of their longer-dated easing bets. In the main, we remain of the view that down near current levels a lot of negatives are priced into the AUD. In addition to the stretch USD, bearish AUD position (as measured by CFTC futures contracts) is high, the AUD is trading at a discount to industrial metals prices, and Australia’s supportive capital flow/trade position remains in place. Since 2015, when these flow dynamics turned more positive, the AUD has only traded below ~$0.6450 ~5% of the time.