• US CPI. US inflation slightly higher than expected. But markets were more prepared. Equities rose, & while bond yields ticked up, USD strength was minimal.

• Details matter. Some of the US CPI strength likely to reverse. US Fed to remain cautious about rate cuts near-term, but that is already priced into markets.

• AUD & JPY. AUD dipped a touch, & USD/JPY rose. Japan’s Rengo wage outcomes will impact BoJ expectations, USD/JPY & the broader USD.

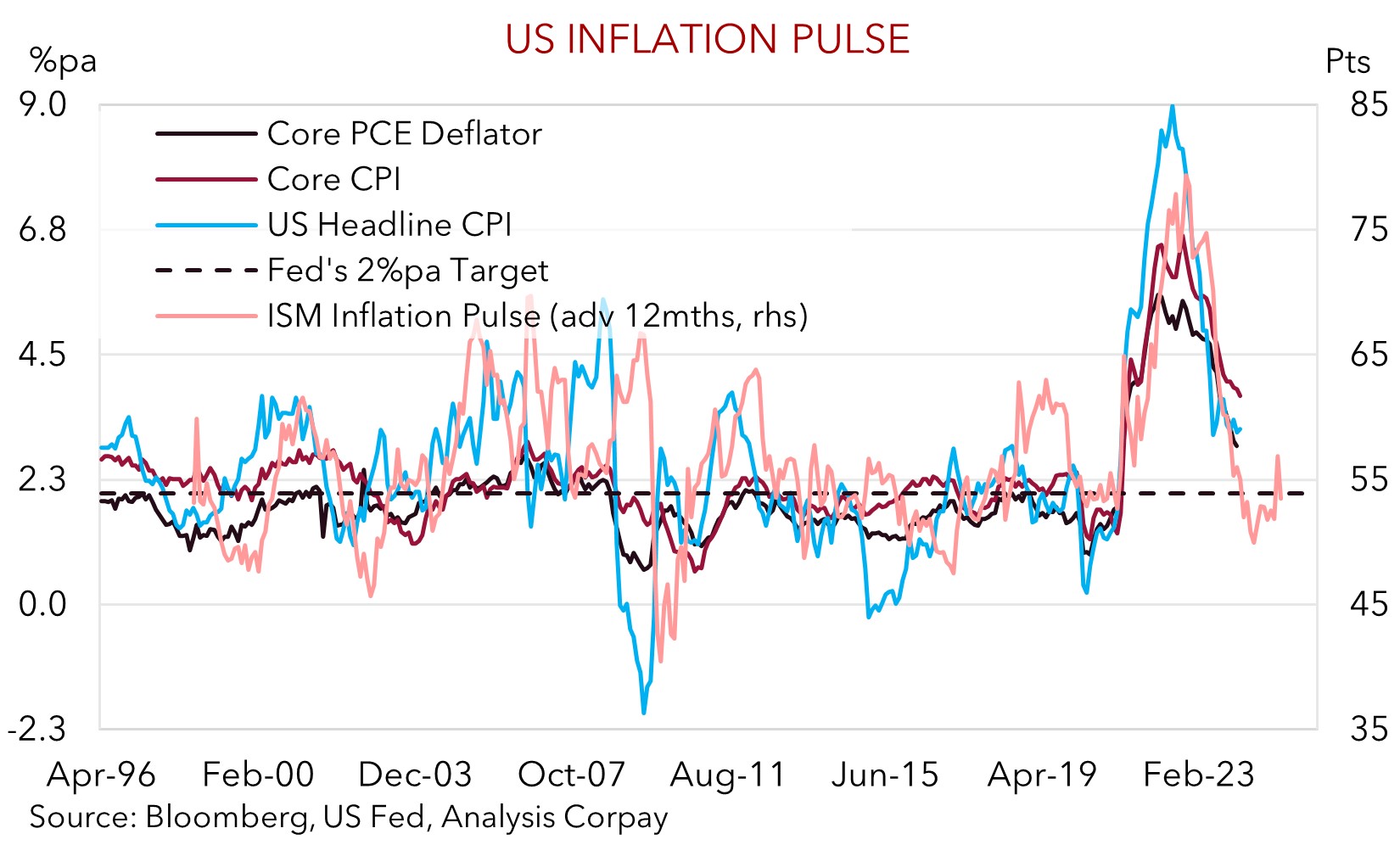

Market focus was on the latest US CPI inflation data overnight. US headline and core (i.e. ex food and energy) rose 0.4% in February which meant the annual run-rates eased a bit less than anticipated (core inflation edged down to 3.8%pa). However, unlike last month, the slightly higher print was largely taken in stride (see below). In our view this more sanguine reaction reflects a few factors: (i) Unhelpful rounding pushed the core inflation figures up (US core CPI actually rose 0.36% in the month); (ii) shelter and gasoline prices contributed over 60% of the increase in the monthly headline rate; (iii) last month’s large jump in Owners Equivalent Rents is moderating; (iv) a key booster of services prices in February was the volatile airfares component; (v) forward looking pipeline measures continue to point to a moderation in US inflation over the period ahead (see our chart); (vi) the US Fed’s preferred inflation gauge is the PCE deflator not CPI. The PCE has a much lower weighting to housing and other components that drove the February strength; and (vii) US interest rates had already adjusted meaningfully. Ahead of last month’s CPI surprise markets were factoring in ~50% chance of a US Fed rate cut by May. By contrast, prior to last night’s data odds of a move by May were less than 20%.

In the end, US equities rose with the S&P500 (+1.1%) closing at a fresh record high. US bond yields ticked up ~5bps across the curve (the US 10yr rate is now 4.15%) and in FX the USD is marginally firmer, although that also looks to reflect currency specific news. EUR has tracked sideways (now ~$1.0925), while GBP slipped back a touch (now ~$1.2795) with cracks in the UK labour market bolstering Bank of England rate cut bets. The UK unemployment rate ticked up to 3.9%, and importantly for the UK inflation, wage growth cooled to its slowest pace since mid-2022. USD/JPY rose (+0.5% to ~147.70) with the slight lift in US yields compounding some cautious comments from Bank of Japan Governor Ueda that saw markets temper their policy normalisation assumptions. The upcoming Rengo wage rounds outcomes, due Friday, look set to make or break the case for a move by the BoJ at next week’s meeting. In our view, it remains a matter of when, not if, the BoJ acts, and ultimately this can give more support to the ‘undervalued’ JPY. Elsewhere, USD/SGD nudged up (now ~1.3325) and the AUD drifted a fraction lower (now ~$0.6605).

The US economic calendar is limited today with Thursday nights retail sales and PPI inflation releases the next focal points. The USD may hold onto its modest gains in the near-term. But in our view, confirmation Japanese wage growth is stepping up, which in turn should see BoJ policy normalisation expectations rebound, and/or an undershoot in the upcoming US data could see the USD lose ground later this week.

AUD corner

The AUD has drifted back a little over the past 24hrs (-0.1% to ~$0.6605), driven by the slightly firmer USD and modest lift in US bond yields following the latest US CPI report (see above). However, as mentioned, in contrast to last month markets have reacted fairly well with participants not looking overly phased by the latest upside inflation surprise given it is unlikely to alter the medium-term outlook for US (and global interest rates) to start to be recalibrated lower later this year. On the crosses, the AUD has been mixed. A small fall has been recorded against the EUR (-0.1% to ~0.6046), while the AUD has appreciated against the NZD (+0.2%) and JPY (+0.4%).

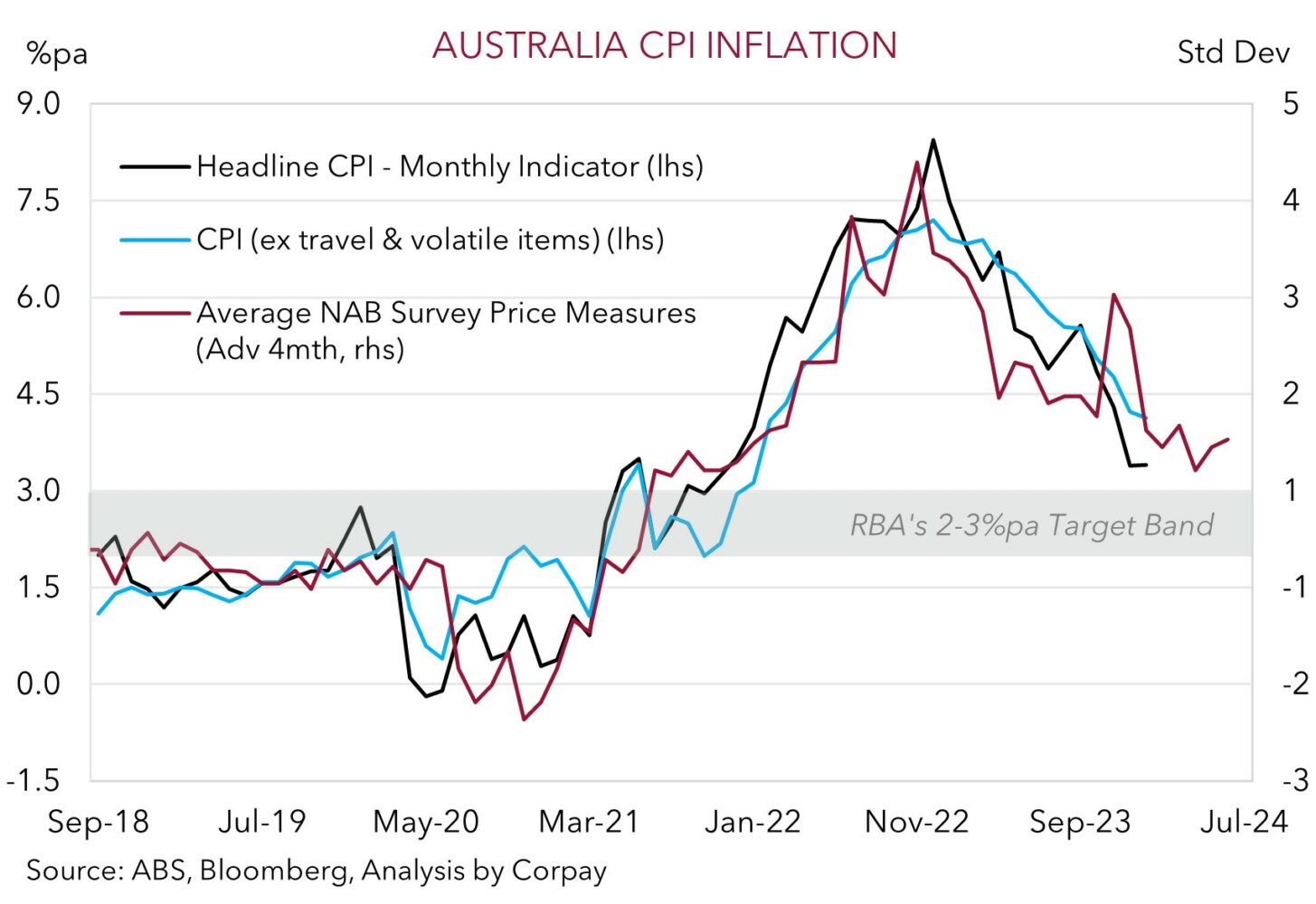

Locally, the latest read on business conditions was released yesterday. The data provides a good timely snapshot of the underlying state of the Australian economy. Business conditions rose slightly in February, suggesting some resilience in activity at the turn of the year, though the fall in forward orders (a leading indicator for private demand growth) points to subpar activity down the track. Elsewhere, the rate of improvement across the cost/prices measures looks to be slowing. As our chart illustrates, much like the US, while further improvement in inflation is anticipated over time it will be a bumpy gradual path down to the RBA’s 2-3% target. We think this will likely keep the RBA cautious about the prospects of starting its policy easing cycle too soon. And when combined with the income support from the incoming stage 3 tax cuts, likelihood of more relief measures being unveiled at the May Federal Budget, and boost to aggregate demand from a larger population, we continue to expect the RBA move by less than its peers during the next rate cutting cycle. Over time, we believe this divergence should see yield spreads move more in favour of a stronger AUD.

In the short-term, while the USD may hold on to its moderate post-US CPI gains, we don’t think the AUD should fall that far from current levels. Compared to the average across our suite of models the AUD still looks to be trading ~2 cents below ‘fair value’. A further pricing in of BoJ policy normalisation is likely to boost the JPY and given USD/JPY is the second most traded currency pair this potential drag on the USD should be AUD supportive. At the same time, market sentiment towards the AUD is already bearish (‘net short’ AUD positioning, as measured by CFTC futures contracts, is quite stretched), the AUD has positive seasonal tendencies in March/April, and signs China’s economy is rebounding should provide a helping hand.