• Stagflation worries. US retail sales underwhelm while stronger producer prices raised concerns about the inflation outlook. US yields rose. USD a bit firmer.

• AUD slips. Higher US yields exerted pressure on the AUD. But the intra-day swing was below average. Focus today will be on Japanese wage outcomes.

• Upcoming events. BoJ, RBA, US Fed, & BoE meet next week. Will the BoJ finally move? On top of that the China activity data & AU jobs report are due.

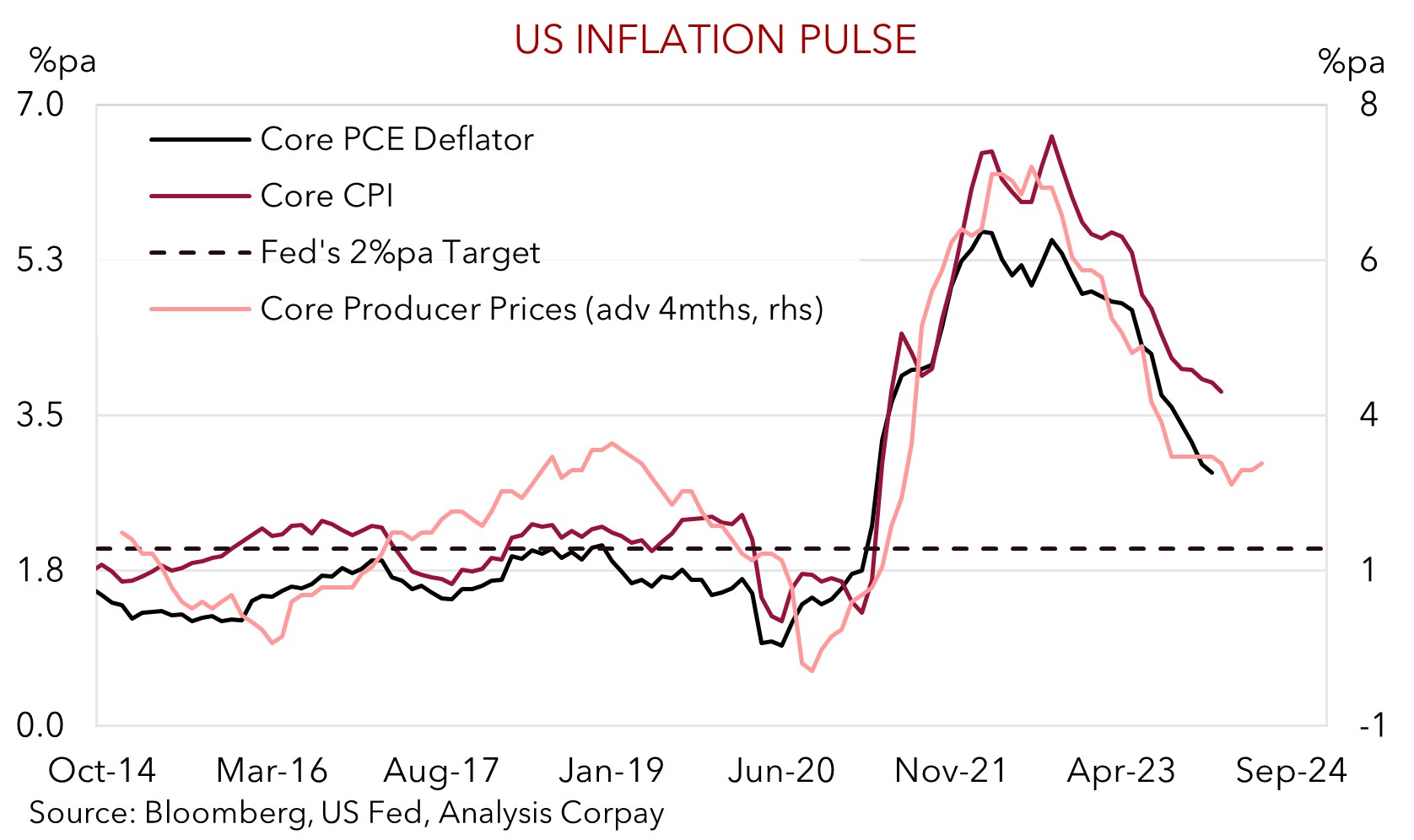

A few wobbles across risk markets overnight as “stagflation vibes” from the latest US retail sales and Producer Price inflation data rattled nerves. The rebound in US retail sales in February was more muted than anticipated (+0.6%) with downward revisions to the previous months falls also coming through. Household consumption (the engine room of the US economy given it equates to ~3/4’s of GDP) has gotten off to a slow start in 2024 as reduced ‘excess savings’, higher interest rates, and lower confidence hold back spending. At the same time US Producer Prices came in hotter than predicted. Thanks to a large jump in food and energy prices headline PPI inflation accelerated, as did the stickier core measure. As our chart shows this raises the odds that the improvement in US inflation may be stalling.

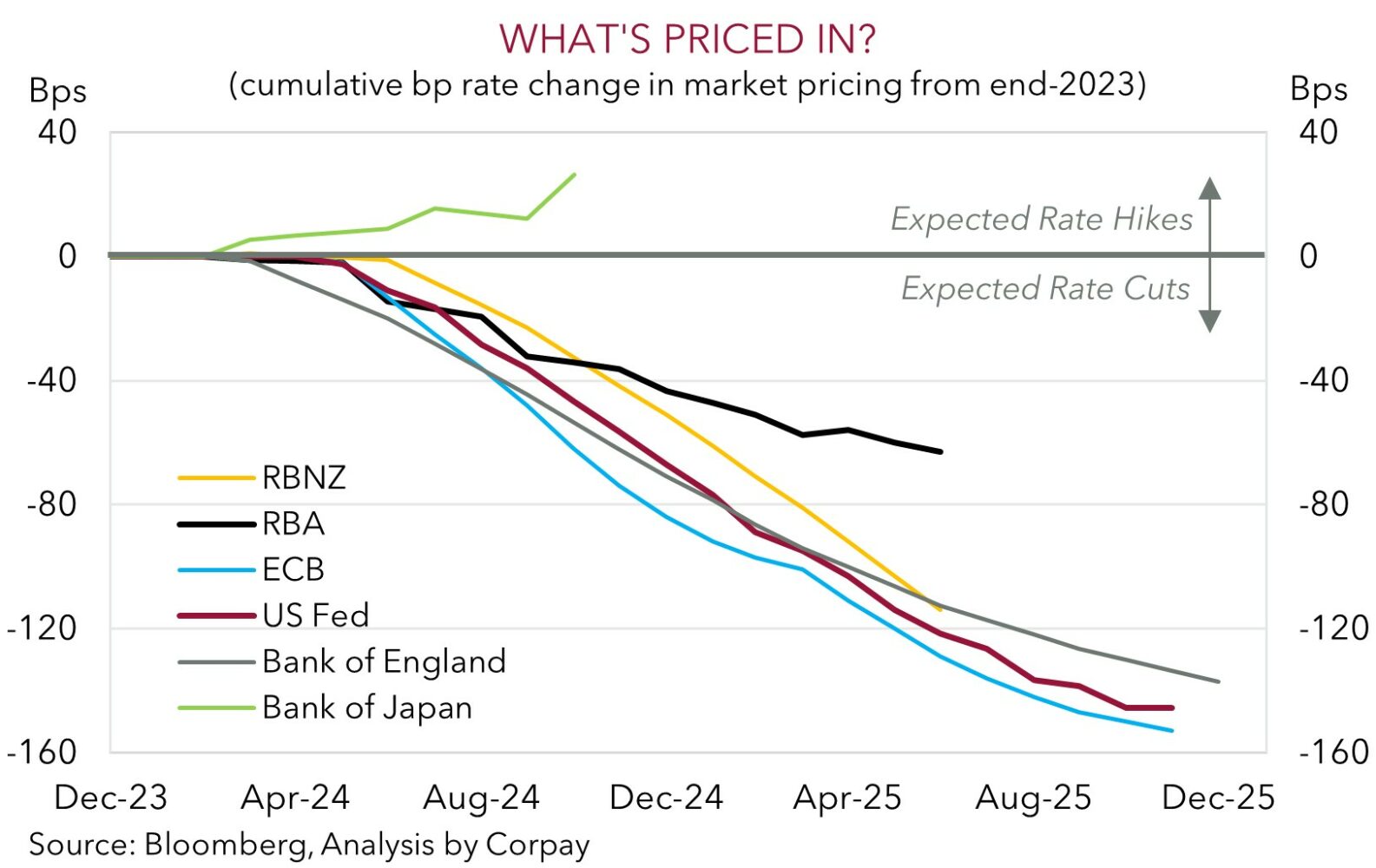

In response, bond yields rose as markets trimmed future rate cut expectations. The US 2yr rate increased ~6bps (now 4.69%) while the benchmark 10yr yield rose ~10bps (now 4.29%). This week’s US Consumer and Producer price data might see the US Fed revise up its near-term inflation projections which in turn could see policymakers reduce the number of rate cuts being forecasted for later this year. The US Fed’s ‘dot plot’ currently has ~3 rate cuts penciled in for 2024 as its central case, but on our figuring it will only take ~2 members to shift their thinking for that ‘dot’ to move to ~2 cuts. The US Fed meets next week (Thurs morning AEDT).

Elsewhere, the lift in US yields exerted a bit of pressure on US equities. After being down as much as 0.8% during the session the US S&P500 closed down 0.3%. In FX, the USD is firmer, although the 0.5% increase in the USD index is modest. And the excitement in markets to this type of move also shows how dull and contained FX markets have been over recent weeks. EUR has slipped down to ~$1.0885, GBP is lower (now ~$1.2750), USD/SGD has edged up to ~1.3360, and the AUD has dipped to ~$0.6580 (where it was trading last Thursday). USD/JPY is also a little higher (now ~148.30), though ‘hawkish’ BoJ policy expectations have helped the JPY hold its ground on the crosses. Japanese news agency Jiji reported the BoJ will make a final decision about paring back its ultra-accommodative stance at next Tuesday’s meeting after reviewing the latest wage deals. Rengo, Japan’s largest union federation, unveils the results from annual wage rounds later today (no set time). As a guide, last year’s outcome for overall wages was 3.8%. Media reports indicate the BoJ wants to see wage gains ‘significantly’ exceeding this. The Japanese wage outcomes the main focus for FX markets today. In our view, confirmation of a step up in Japanese wages would reinforce BoJ policy tightening bets and resultant JPY strength could see the USD drift back a little (USD/JPY is the second most traded currency pair).

AUD corner

The AUD has lost a little ground over the past 24hrs. The quickening in US producer prices has raised concerns about the inflation trajectory, with the dampening in US rate cut expectations and higher US yields giving the USD some support (see above). At ~$0.6580 the AUD is back where it was last Thursday. In our opinion, excitement over a ~0.6% dip (or the ~0.9% intra-day range in the AUD) illustrates how subdued FX volatility has been. It shouldn’t be forgotten that the AUD is a volatile currency. Since the late-80s the AUD has, on average, traded in a ~1.1% intra-day range. The AUD has also eased back on the crosses, but the moves have been modest. AUD/EUR has tread water around ~0.6050, with the AUD shedding ~0.1-0.2% against the JPY, GBP, NZD, and CAD over the past day. AUD/CNH has slipped ~0.5% with the pair tracking near its 100-day moving average (~4.7395).

As mentioned, global focus today will be on the outcome of Japan’s Rengo (the largest union federation) wage round (no set time). The results will make or break the case for a Bank of Japan rate hike at next Tuesday’s meeting. A strong result should be a JPY positive, and a pullback in USD/JPY could give AUD/USD a boost, while the reverse is likely should Japan’s wage pulse underwhelm. Given USD/JPY is the second most traded currency pair its movements have a cascading impact on broader FX markets.

Looking further ahead, based on the event calendar, further bursts of AUD volatility are probable next week. In addition to the BoJ (Tues), the RBA (Tues), the US Fed (Thurs morning AEDT), and the BoE (Thurs night AEDT) meet. On top of that the monthly China activity data is due (Mon), as is the Australian jobs report (Thurs). There are several possible combinations of how things pan out. But in our central view, we believe the China data should show improvement in momentum and the Australian labour market is likely to unwind some of the ‘statistical’ weakness at the turn of the year. On the policy front, a rate hike by the BoJ is looking more likely than not, in our opinion. We also see the RBA holding firm and reiterating its very mild tightening bias. And when it comes to the US Fed, while it will continue to stress the inflation risks, we think it may not crystallize the markets newfound ‘hawkish’ thinking by noting that policy recalibration later this year is still on the table. There will be bumps along the way, but in our view, if realised this type of mix should see the AUD grind higher.