• Waiting game. Ahead of this week’s key events FX markets consolidated on Friday. USD index tracked sideways. AUD near its 200-day moving average.

• Event radar. BoJ, RBA, US Fed, & BoE decisions due this week. China data released today, while NZ GDP & AU jobs due on Thursday.

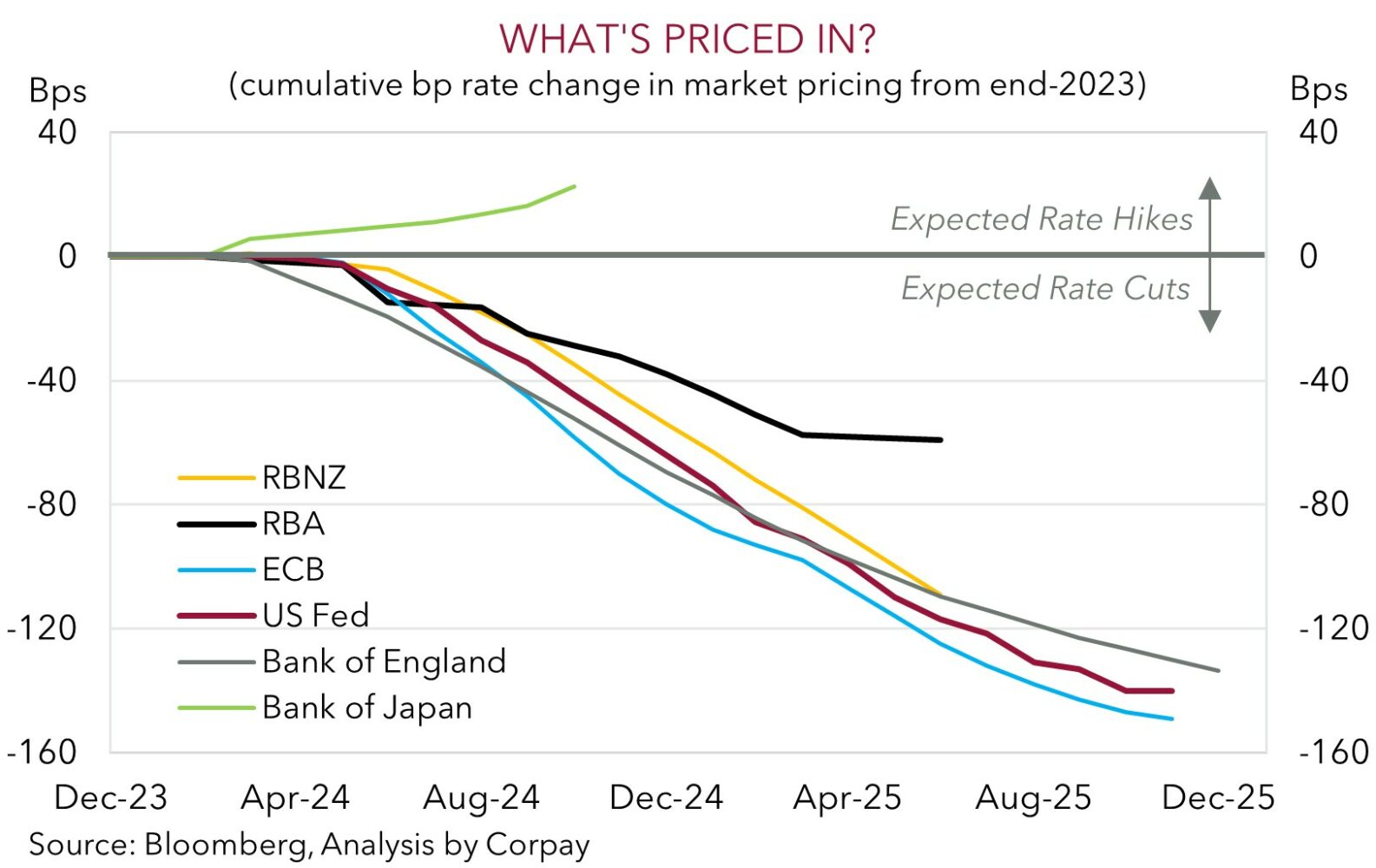

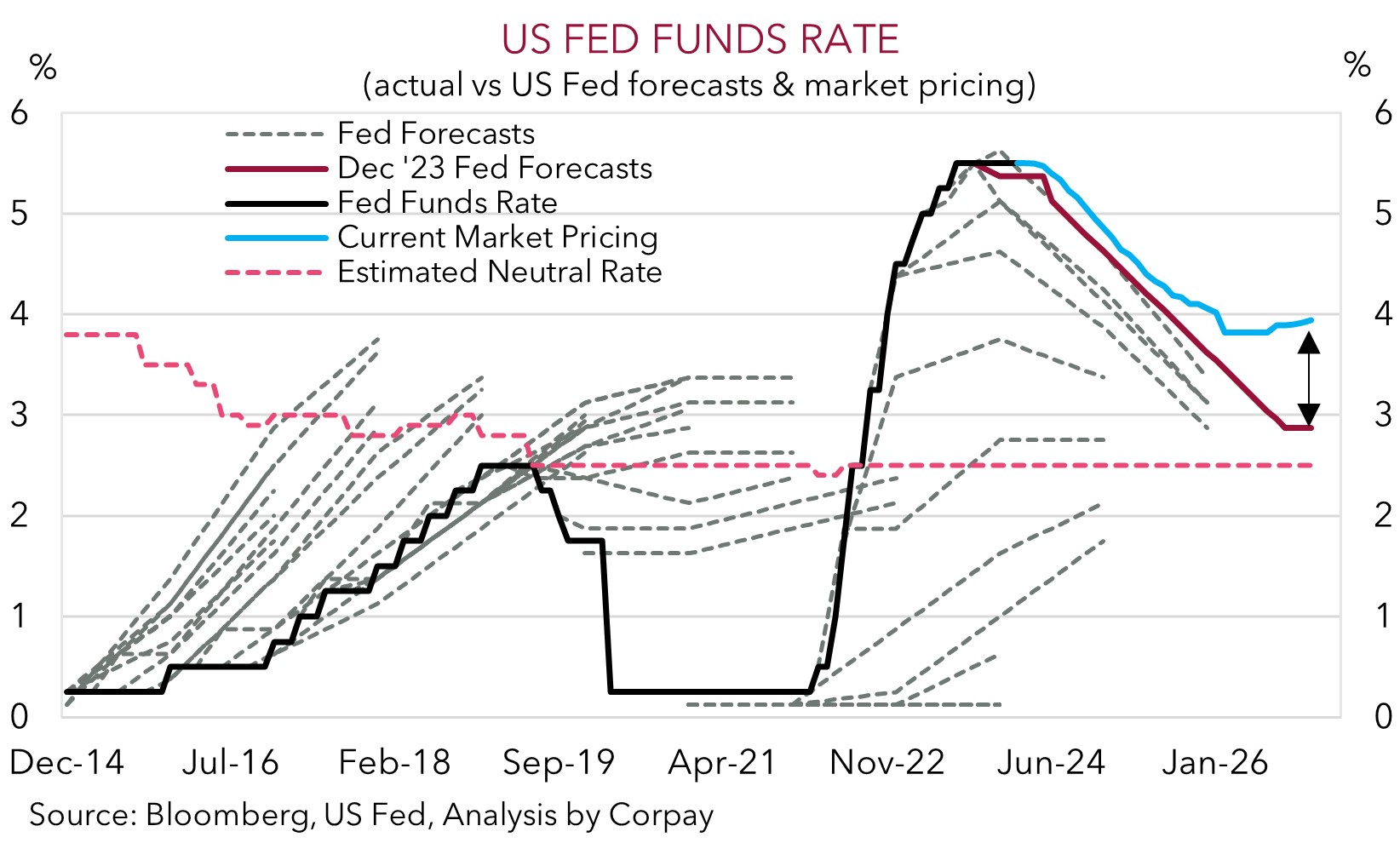

• Central banks. Further bursts of volatility probable. Will the BoJ hike rates for the first time since 2007? Will the US Fed continue to forecast 3 cuts in 2024?

With one eye on this week’s central bank meetings global markets largely consolidated on Friday. US bond yields ticked up slightly (the 2yr rate rose ~3bps to 4.73%), while the major equity indices slipped back. The S&P500 declined 0.7%. As a result, the S&P500 recorded its second straight, albeit modest, weekly fall. This is the first time the US stockmarket has declined in consecutive weeks since late-October, although even after its dip it is still historically high. In FX, the USD tracked sideways. Last week’s upward repricing in US interest rates following positive inflation data has been USD supportive. EUR is sub $1.09, GBP is around ~$1.2735, the AUD is hugging its 200-day moving average (~$0.6560), and ahead of tomorrow’s Bank of Japan meeting USD/JPY is at ~149.

Further bursts of volatility appear probable near-term. In addition to the BoJ (Tues, no set time) and RBA (Tues 2:30pm AEDT), the US Fed hands down its decision (Thurs 5am AEDT), as does the Bank of England (Thurs 11pm AEDT). On top of that the China data batch is due today (1pm AEDT). In terms of China, we think the data should show activity stabilised rather than deteriorated in early 2024. Signs momentum is turning the corner could support sentiment. But in terms of the major FX events the BoJ and US Fed will be center stage.

With respect to the BoJ, after years of ultra loose policy, the time for a shift is here. The Japanese Trade Union Confederation’s first tally of this year’s wage rises, released last Friday, found an overall increase of ~5.3%. This is the highest since 1991. In our view, the wage and inflation pulse not only back a policy change this week (or at the latest next month) but a faster rate hike path thereafter. Traders are assigning a ~50% chance of a small rate rise on Tuesday. Hence, the way things land will generate a jolt. A BoJ hike, which would be the first since 2007, may see the undervalued JPY lift. Given it is the 2nd most traded pair a lower USD/JPY would cascade across FX.

For the US Fed, rates should remain on hold with its updated guidance and projections the focal points. Stronger US inflation in early 2024 has seen some assume the Fed could forecast fewer rate cuts this year and next. It is likely to be a close call, but we think modest upward revisions to near-term inflation may not be enough for the Fed to signal less easing this year. While Chair Powell is likely to stress there is little tolerance to more surprises, things were assumed to be bumpy, and that slower growth and more labour market slack still suggests inflation should trend down over the medium-term. This type of rhetoric and no change in the Fed’s 2024 projections could disappoint ‘hawkish’ expectations and see the USD soften.

AUD corner

AUD consolidated near its 200-day moving average (~$0.6560) at the end of last week, in line with the broader USD trends as markets await this week’s central bank meetings (see above), and the mixed performance across commodities. While iron ore remains on the backfoot and has fallen below US$100/tonne for the first time since August, copper’s positive run has continued. The copper price is near a ~1-year high. Copper is a widely used industrial metal, and its jump mirrors the improvement in a range of forward indicators we track, suggesting global industrial activity should relatively improve over coming months. The China data batch for Jan/Feb is due today (1pm AEDT). Indications activity is stabilising could, in our view, be supportive for risk sentiment and growth linked assets such as industrial metals and cyclical currencies like the AUD.

Locally, the RBA meets (Tues), and the February jobs report is due (Thurs) this week. The RBA is widely expected to keep rates steady. We also see the RBA retaining its very mild tightening bias by reiterating “a further increase in interest rates cannot be ruled out” to maintain some optionality if inflation surprises. Data wise, after two weak prints, jobs growth is forecast to have bounced back. A deep dive indicates recent weakness may have been because of seasonal changes in hiring patterns. There was a larger than usual number of people deemed to be unemployed but set to start a job soon in last month’s figures. Some statistical payback in February appears likely with risks tilted to job gains exceeding consensus estimates (mkt +40,000) and the unemployment rate falling to 4%.

If realised, these types of domestic outcomes could give the AUD some renewed support (particularly on the crosses, see below) as RBA rate cut pricing is watered down. This would be compounded if we are right, and the USD loses some ground due to: (i) the BoJ coming through and raising interest rates for the first time since 2007. This in turn could see USD/JPY fall back; and (ii) our expectation the US Fed fails to crystallise the more ‘hawkish’ thinking that has crept in following recent upside US inflation surprises by reiterating policy ‘recalibration’ later this year is still on the table with ~3 rate cuts over H2 still its central case.

On the crosses, when combined with the prospect NZ Q4 GDP (Thurs) shows the economy stalled or even contracted again, a positive Australian labour force report and the RBA holding the line may see AUD/NZD’s recent upswing extend. We believe AUD/GBP might also lift if the Australian/Chinese data improves, and the vote split among the BoE monetary policy committee shifts to show little appetite for further hikes and/or more votes for cuts given weaker UK growth, inflation, and wage data.