• Firmer USD. US equities higher & bond yields a little lower. A higher USD/JPY has boosted the USD. AUD & NZD have shed some more ground.

• BoJ & RBA. BoJ hiked rates for the first time since 2007. But markets were underwhelmed. RBA tweaked its forward guidance to more ‘neutral’ language.

• US Fed. Focus tomorrow morning will be on the US Fed’s forecasts & guidance. No change to 2024 projections could disappoint ‘hawkish’ expectations.

Following a bit of volatility in yesterday’s Asian session after the Bank of Japan changes (and RBA meeting) asset markets were more subdued overnight as investors look ahead to the US Fed announcement and press conference (Thurs 5am/5:30am AEDT). US and European equity markets edged up 0.2-0.6% with the S&P500 back around record highs. UK and US bond yields slipped back with US rates 3-5bps lower across the curve.

In FX, the USD consolidated after strengthening yesterday on the back of the markets underwhelming take on the BoJ’s adjustments. USD/JPY has pushed up towards ~151, near the top of its 2024 range. EUR consolidated (now ~$1.0865), as has GBP (now ~$1.2720) prior to today’s UK CPI (6pm AEDT). USD/CAD is modestly higher (now ~1.3565) after another undershoot in Canadian inflation bolstered bets the BoC may start cutting rates from mid-year. USD/SGD is hovering up at ~1.3420, NZD touched its lowest level of 2024 (now ~$0.6050) with a weak NZ GDP report looming (Thurs 8:45am AEDT), and the AUD lost ground (now ~$0.6530) due to the BoJ inspired firmer USD and tweak by the RBA to its forward guidance (see below).

The BoJ finally took steps down the normalisation path. For the first time since 2007 the BoJ raised rates, with the target increased to 0-0.1%. The BoJ’s policy rate had been negative since 2016. The BoJ also ended its ETF purchases and the 10-year JGB target was jettisoned. The BoJ stated it will continue to buy bonds, though this will be aimed at safeguarding a rapid jump in yields. We are surprised by the JPY weakness given markets were only discounting a ~50% chance of change yesterday. We don’t believe the move higher in USD/JPY will last and we see the JPY turning course over coming months. Based on the core inflation/wages pulse in Japan more modest BoJ hikes are likely, and this will be occurring as other central banks are lowering rates. Yield spreads and capital flow/FX hedging trends by Japanese investors should, in time, shift in support of the JPY (see Market Musings: RBA wordplay, BoJ adjustment).

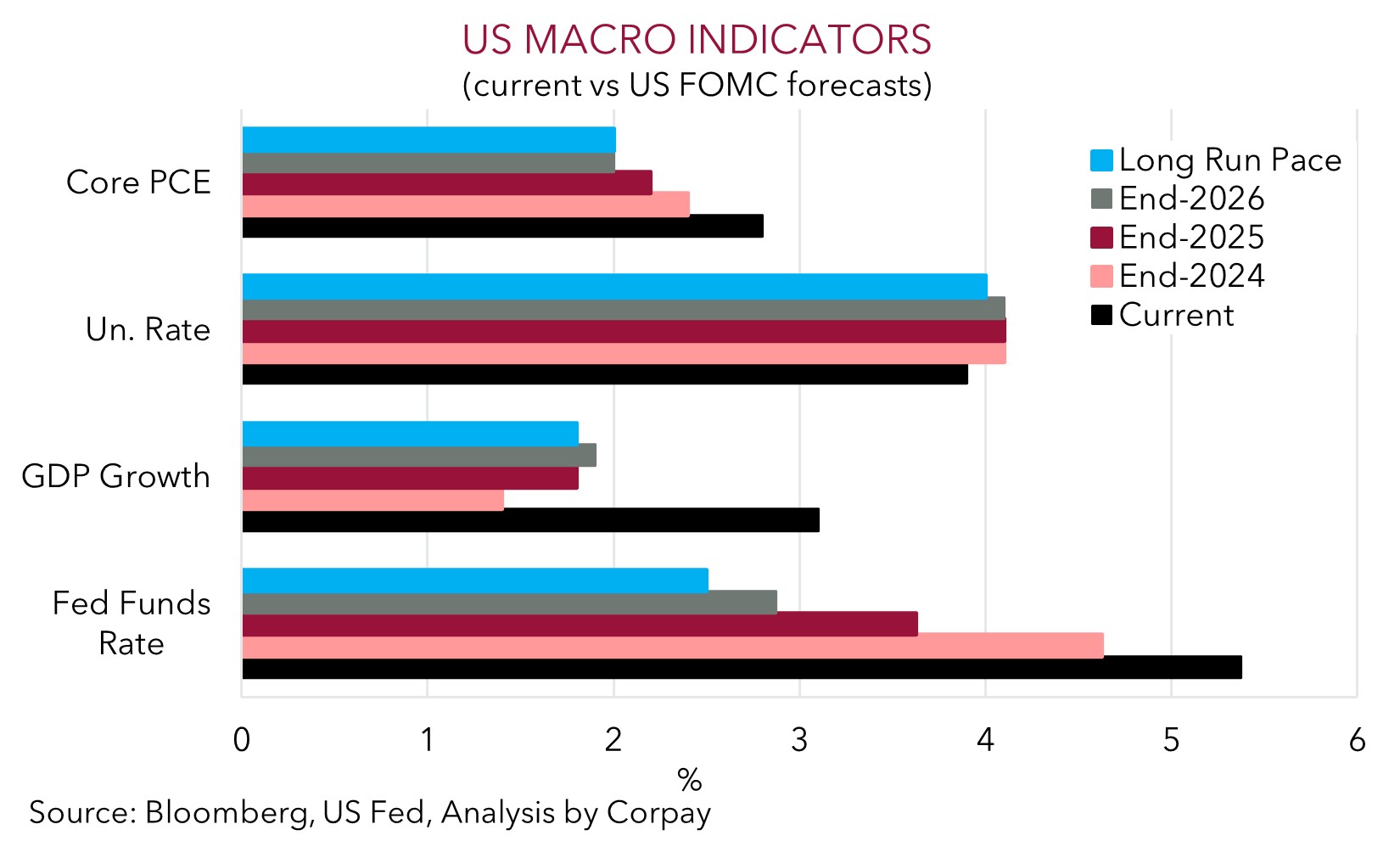

Tomorrow morning markets will be fixated on the US Fed. No policy moves are expected, rather focus will be the projections and Chair Powell’s guidance. Stronger inflation in early 2024 has seen some assume the Fed could forecast fewer cuts in 2024 (it only takes 2 members to change their mind to move the median ‘dot’ up). It should be a close call, but we think small inflation revisions may not be enough for the Fed to signal less easing this year. While Chair Powell is likely to stress there is little tolerance to more surprises, things were assumed to be bumpy, and slower growth/labour market slack still points to lower inflation over time. This type of rhetoric and no change in the Fed’s forecasts could disappoint ‘hawkish’ expectations and see the USD soften.

AUD corner

The AUD has remained on the backfoot, shedding another ~0.4% over the past 24hrs to be down near ~$0.6530. The firmer USD stemming from the markets lukewarm take on yesterday’s BoJ changes and weaker JPY (see above) has been a factor. The broader based underperformance in the JPY has seen AUD/JPY rise to ~98.50 (its highest level since late February and just ~0.6% below its cyclical peak). The AUD also lost a bit of ground on most of the other crosses, though moves have been modest with the AUD ~0.2-0.3% lower versus the EUR, GBP, CAD, and CNH compared to this time yesterday.

Also exerting some pressure on the AUD was yesterday’s RBA rhetoric. Unsurprisingly the RBA kept the cash rate at 4.35%. In its view, while there are “encouraging signs” inflation is coming down it “remains high” and “the economic outlook remains uncertain”. As such the path forward for interest rates is also “uncertain” and as a result “the Board is not ruling anything in or out” from here. While this is different to the previous post meeting statement when the Board noted “a further increase in interest rates cannot be ruled out” it is in line with what RBA Governor Bullock outlined in public appearances over the past 6 weeks.

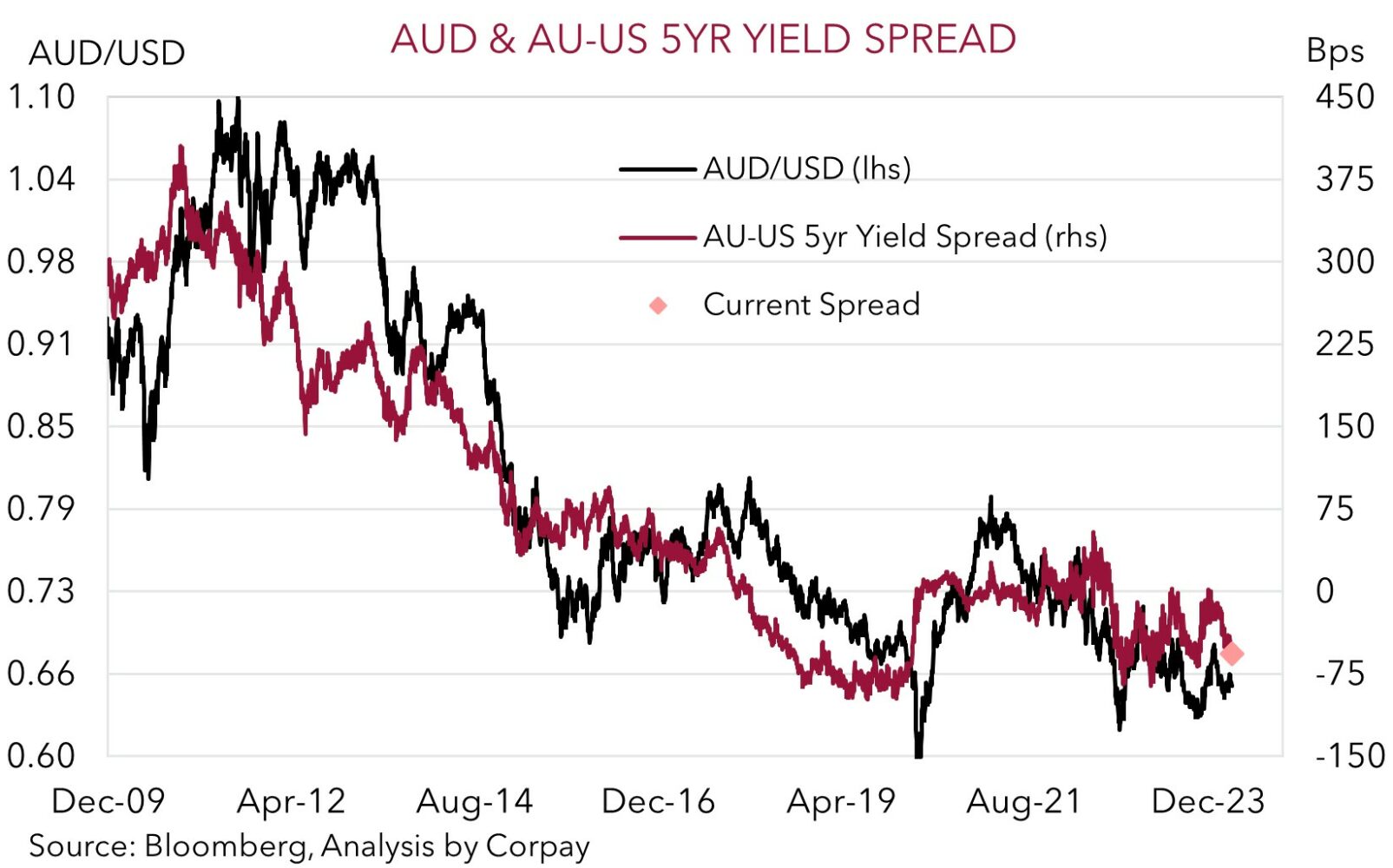

Short-term market traders often get caught up with semantics. In a practical sense the RBA is reiterating it is watching how the data unfolds. Despite its prior rhetoric, further rate hikes weren’t genuinely on the table, but at the same time rate cuts still look some time away due to factors like the income support from incoming tax cuts, possibility of fiscal relief at the May Federal Budget, still elevated wages and labour market conditions. We continue to think this mix, coupled with signs momentum in China’s economy is turning the corner, could see the RBA lag its peers in terms of how fast and how far it moves during the next rate cutting cycle. A slower moving RBA relative to other major central banks will, in our judgement, see bond yield differentials become more AUD supportive over time. As our chart shows, the Australia-US 5-year yield spread is already suggesting the AUD should be a higher than where it now is.

Today’s data calendar is light, although things pick up tomorrow with the US Fed decision and press conference (5am/5:30am AEDT) and the Australian labour market report due. As discussed above, ‘hawkish’ expectations look to have built up for the US Fed meeting given inflation surprises. In our opinion, the risks are tilted to the US Fed not crystallising the markets views. If that occurs, the USD may fall and the AUD could rebound. This in turn might be compounded if Australian jobs growth bounces back strongly (mkt +40,000). There was a larger than usual number of people deemed to be unemployed but set to start a job soon in last month’s figures.