• Mixed markets. Equities eased a little while bond yields nudged up overnight. Currencies were well contained. AUD consolidated near ~$0.6610.

• US CPI. US inflation data in focus tonight. Will the February US CPI data confirm or disprove the January reading as an anomaly?

• Expectations matter. Analysts look to be factoring in a greater chance of an upside surprise. This suggests a bigger market reaction could be to a lower print.

Markets have had a fairly subdued start to the new week with attention on tonight’s US CPI inflation data (11:30pm AEDT). Global sharemarkets have been mixed. The US S&P500 edged a bit lower (-0.1%), the EuroStoxx50 declined 0.6%, while yesterday the ASX200 fell 1.8% and Japan’s Nikkei shed 2.2% as expectations the Bank of Japan could soon jettison its ultra-accommodative stance continue to build.

Elsewhere, bond yields generally rose overnight with the US 2yr rate up ~6bps (now 4.53%) and the 10yr rate ~2bps higher (now 4.09%). Increased bond supply with the US Treasury auctioning a large amount of shorter-dated bonds and some trader nervousness ahead of the US CPI report look to have been at play. The US Treasury auction calendar is busy this week with more bond sales scheduled for Tuesday and Wednesday. In FX, the USD Index is a fraction higher, though most of the major FX remain within 0.1-0.4% of where they were this time yesterday. EUR is near ~$1.0930, USD/JPY is tracking just under ~147, USD/SGD is around ~1.33, and the AUD has consolidated (now ~$0.6614) despite another large fall in the iron ore price (-5.8% to ~US$108/tonne).

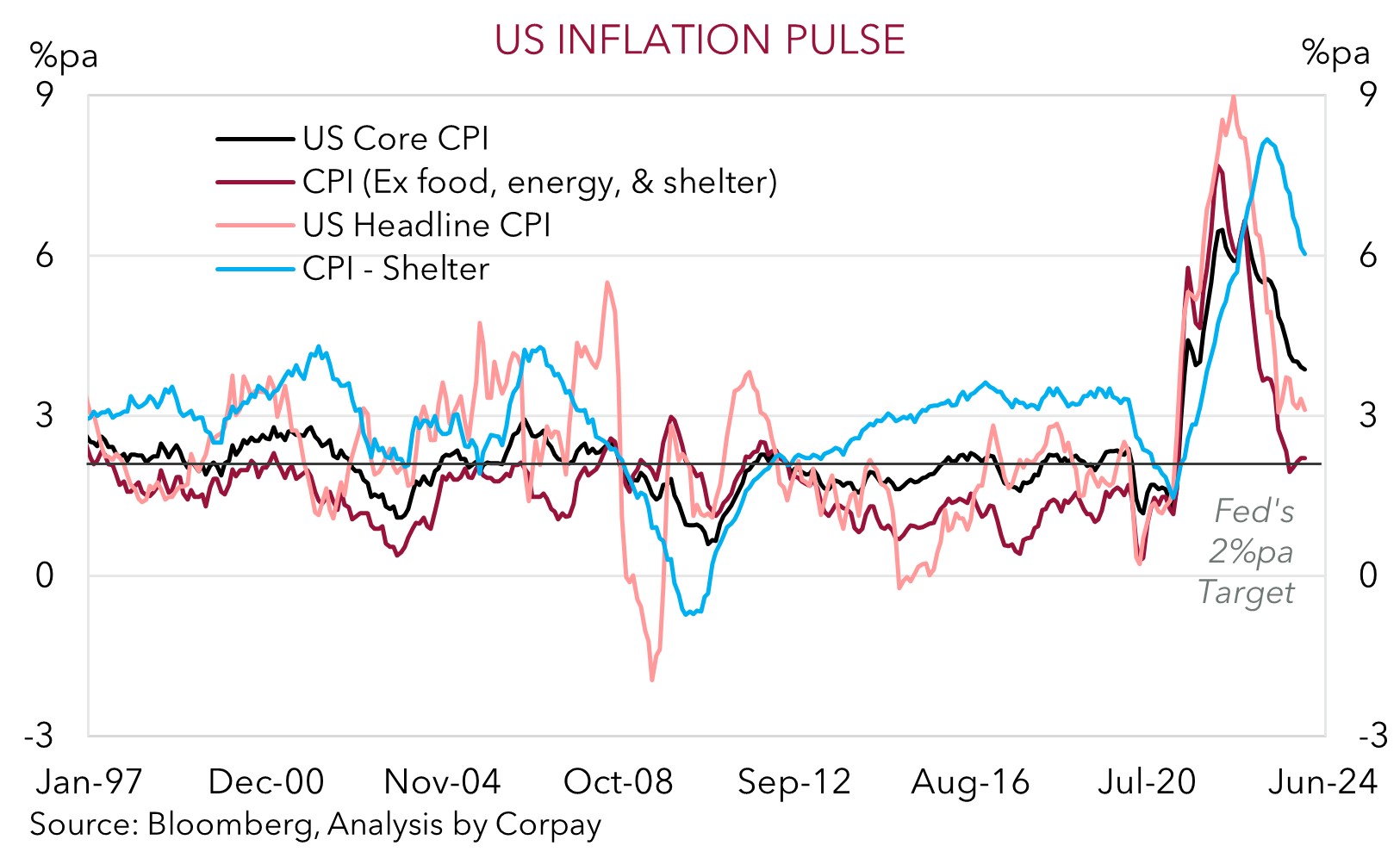

Tonight, the latest UK labour market stats are due (6pm AEDT), the ECB’s Holzmann speaks (7pm AEDT) as does the BoE’s Mann (10pm AEDT). That said, these will play second fiddle to the US CPI inflation report (11:30pm AEDT). After a strong rise in core CPI last month, the focus will be on whether the February data confirms or disproves the January reading as an anomaly. Market consensus is looking for a 0.3% rise in core CPI in the month, although within that we would note more analysts are thinking it could come in higher (i.e. 0.4%) than lower (i.e. 0.2%). Hence, based on the skew in expectations we think that there could be an uneven market reaction to the data whereby there could be a larger drop in US yields and the USD to a softer inflation print compared to the positive reaction in US yields/USD to an upside surprise. Irrespective, beyond the potential knee-jerk short-term volatility to the monthly result, we believe demand and supply is rebalancing and that the slowdown in the annual pace of US inflation should remain intact. The annual run rate of US core inflation is forecast to moderate to 3.7%pa. If realised this would be the slowest pace since early 2021. In our opinion the underlying disinflation trend should keep the door open to the US Fed starting to lower interest rates in coming months, and ultimately this (and a firmer JPY) is expected to keep the USD on the backfoot over the period ahead.

AUD corner

The AUD has tread water around ~$0.6610 over the past 24hrs as markets await tonight’s US inflation data (11:30pm AEDT). The consolidation in the AUD is despite the softness in global equities and another drop in the iron ore price (-5.8%). At ~US$108/tonne, iron ore is ~23% below its early-January highs as concerns about the outlook for the Chinese property market and steel demand linger. However, as pointed out previously (and shown again overnight) the day-to-day correlation between the AUD and iron ore prices has lessened significantly over the past few years. This reflects the different part of the mining/export cycle Australia is now in. Higher iron ore prices no longer generate a surge in mining investment and positive spillovers across the economy. Rather, its AUD impact is now felt via the volumes being shipped out and trade flows (iron ore export volumes equal ~5% of GDP).

Locally, an appearance by the new RBA chief economist (9:30am AEDT) and the latest business conditions reading (11:30am AEDT) are on the schedule today. While these events may generate some modest intra-day AUD gyrations we doubt they will be overly large with participants lasering in on tonight’s US CPI report (11:30pm AEDT). As discussed above, the skew within economists forecasts suggests expectations are tilted towards a greater chance monthly core US CPI again comes in hotter than predicted. In our mind this means there are uneven risks around the USD and the AUD to tonight’s result with a downside US CPI surprise likely to generate a larger negative USD/positive AUD reaction compared to the opposite moves stemming from another positive CPI surprise. Indeed, looking back, last month the reverse was true with more economists predicting a lower than average outcome. This helps explain why there was such a sharp jump in the USD a month ago when US CPI came in above forecast.

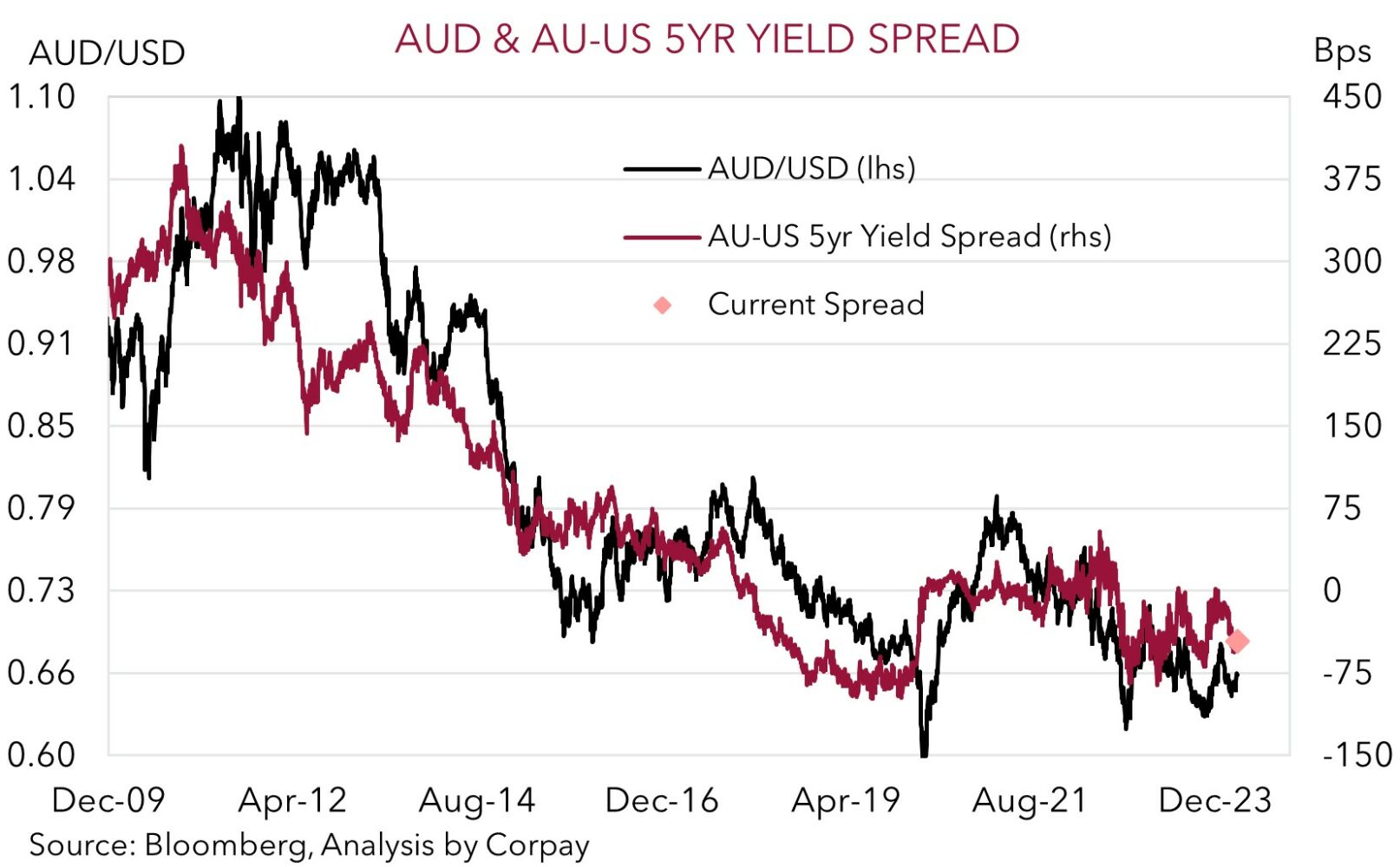

That said, beyond short-term volatility around the monthly US CPI data, we would note that if you take a step back the deceleration in annual core US inflation looks set to remain in place. This is something US Fed officials are monitoring. In our opinion, the prospect of the US Fed starting to lower interest rates before the RBA, and ending up doing more this cycle, should keep the AU-US 5yr yield spread in favour of a higher AUD (see chart below). As should a further pricing in of BoJ policy normalisation given USD/JPY is the second most traded currency pair, while we also feel the still bearish ‘net short’ AUD positioning (as measured by CFTC futures contracts) and the AUD’s positive seasonal tendencies in March/April should be downside supports.