• US jobs. Mixed US jobs report. Payrolls stronger than expected in February, but the underlying detail and downward revisions worked in the opposite direction.

• FX trends. USD lost ground last week, with the JPY upswing due to increased BoJ rate hike pricing a factor. AUD had its best week (+1.5%) since mid-December.

• Event radar. Globally attention will be on the latest US CPI report (Tues) with retail sales due later in the week. BoJ policy expectations will also be in focus.

The latest read on the US labour market came and went on Friday night without generating too much additional market turbulence. After briefly rising to a fresh all-time high the S&P500 faded to close 0.7% lower. US bond yields also, on net, ended the day lower with the 2-year rate slipping back ~3bps (now 4.47%). While in FX the USD consolidated after being on the backfoot last week due to the general softening in the US data pulse, solidifying expectations the US Fed will start to lower rates in coming months, and with macro/policy trends giving other currencies a boost.

EUR is tracking near ~$1.0940, the top of the range occupied since mid-January. GBP is around ~$1.2860 (a high since last July) with markets factoring in relatively less easing by the BoE compared to the US Fed in 2024. And USD/JPY has fallen to ~147. USD/JPY’s ~2% drop last week was the biggest since July with odds the Bank of Japan could (finally) shift away from its ultra-accomodative stance ramping up following positive wage data and reports policymakers are toying with potential changes as soon as the 19 March meeting. We continue to favour an adjustment in late-April rather than next week but the initial results of Rengo (Japan’s largest labour union federation) wage talks due this week will be important. The broader backdrop helped the AUD post its best week since before Christmas with the currency up ~1.5% from this time last Monday (now ~$0.6628, levels last traded in mid-January).

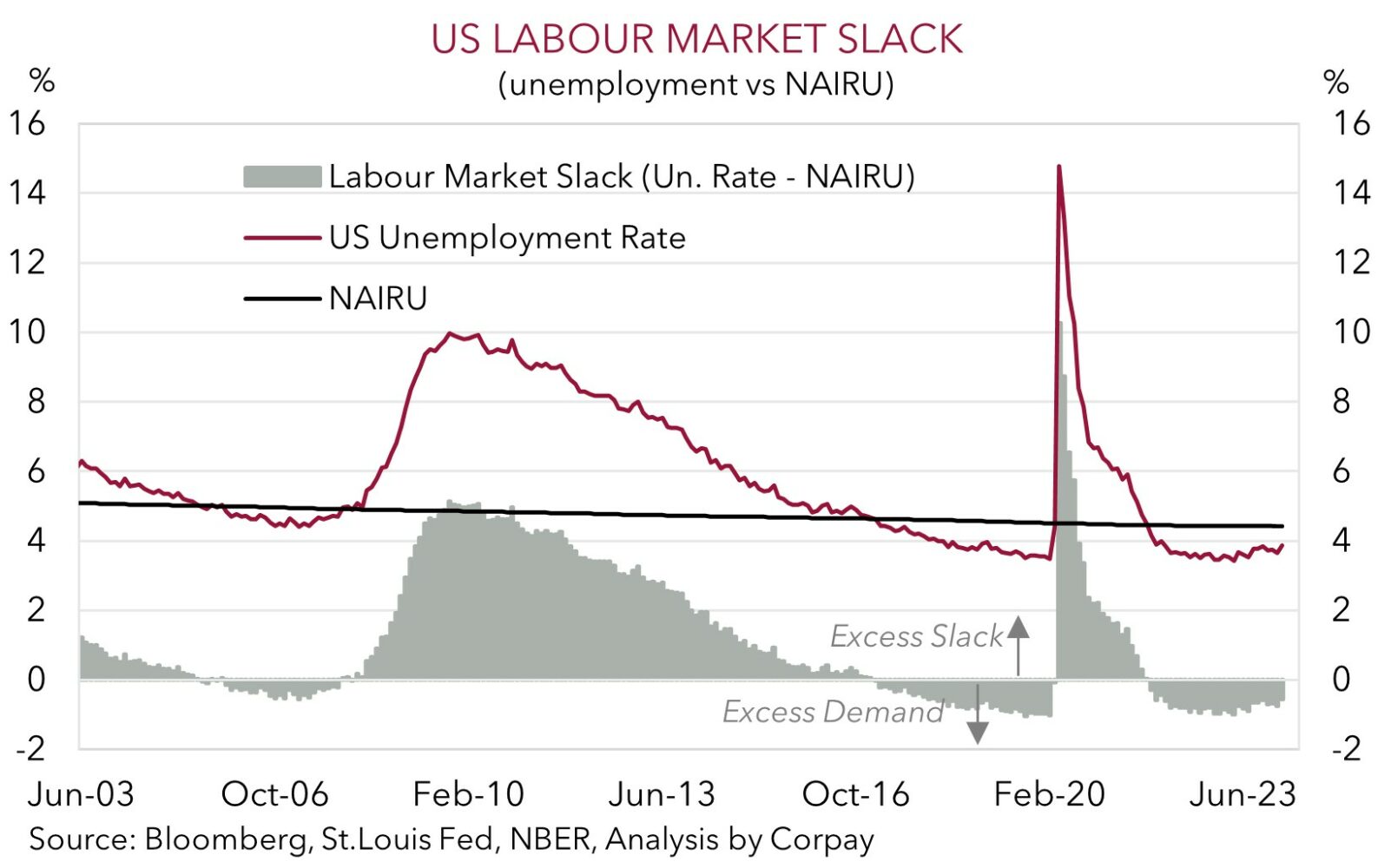

In terms of the US labour stats while non-farm payrolls were higher than predicted in February (+275,000 vs mkt +200,000) the underlying detail and large downward revisions to prior months took a lot of the shine from the topline result. The US unemployment rate edged up to 3.9%, its highest in two-years, and a range of leading indicators point to a further rise and slower wage growth down the track as demand and supply continue to rebalance. Indeed, last week other data showed hiring intentions across services have fallen, as have job openings (a gauge of labour demand), and the ‘quits rate’ (a measure of job churn) declined to pre-COVID levels.

Focus this week will be on US CPI (Tues 11:30pm AEDT), as well as retail sales and producer price inflation (Thurs 11:30pm AEDT). In our opinion, while US retail sales look set to rebound CPI trends should be more important given Chair Powell’s proclamation the Fed is waiting for more confidence inflation was headed sustainably to 2% and that that may not be “not far” away. The annual run rate of US core inflation is forecast to slow to 3.7%pa as seasonal pressures fade and as positive base effects kick in. If realised this would be the slowest pace since early 2021. We think this could keep the USD under downward pressure, particularly if the JPY also remains supported by a further discounting of a ‘hawkish’ BoJ turn.

AUD corner

The AUD’s upswing paused for breath on Friday with the currency giving back a little intra-day ground late in the session. Nevertheless, at ~$0.6628 the AUD is ~1.5% higher than where it was this time a week ago and is near levels last traded in mid-January. The AUD also recovered a bit of lost ground on some of the crosses last week. AUD/EUR has ticked up to its 200-day moving average (~0.6057), AUD/NZD is near ~1.0730 (~1.6% above its late-February low), and AUD/CNH has rebounded to ~4.77 (the top end of the range occupied since mid-January). By contrast, AUD/JPY has eased back with the pair down around its 50-day moving average (~97.41) as a ‘hawkish’ BoJ repricing has given the JPY broad based support (see above).

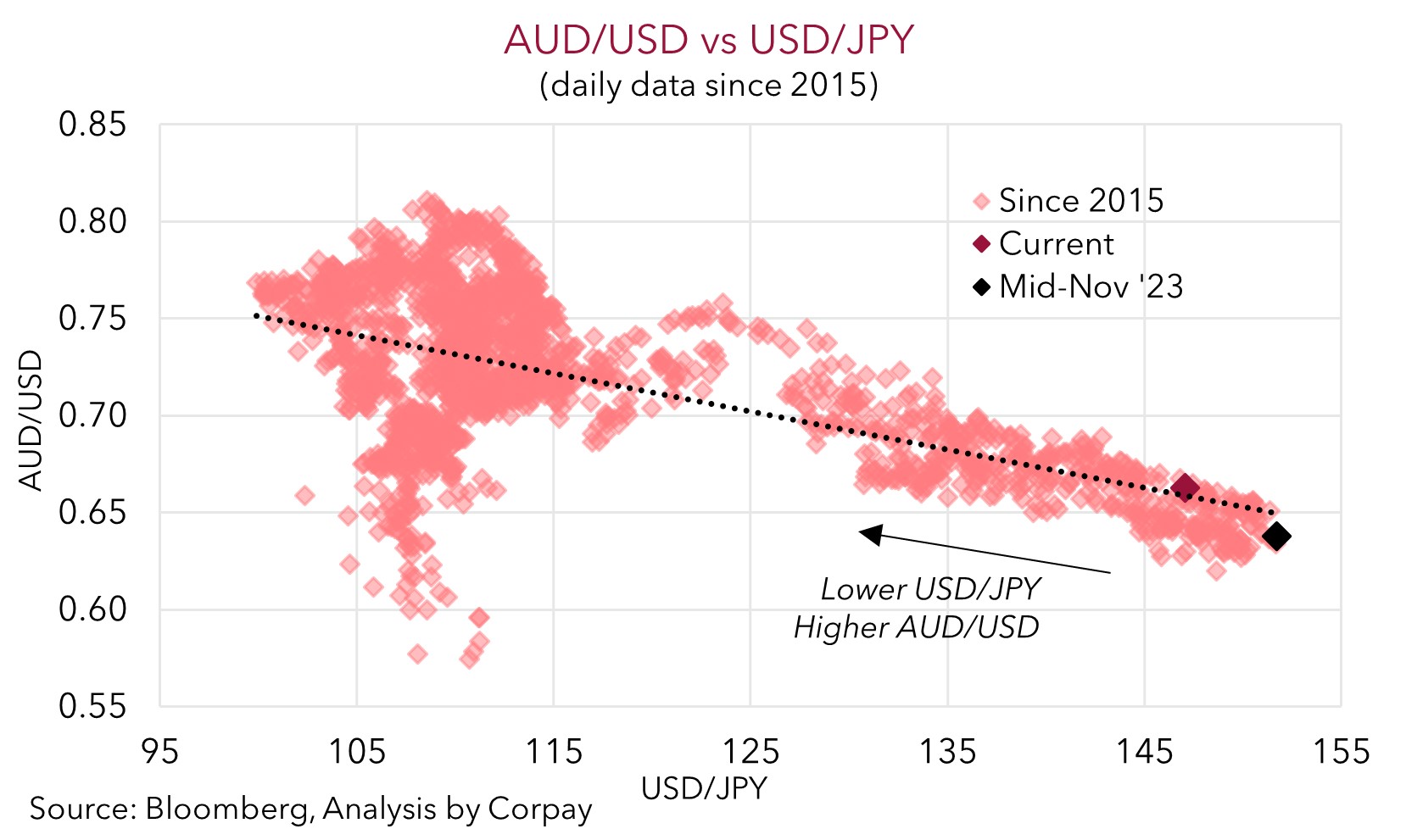

Running through the list of developments, offshore rather than domestic forces have been in the driver’s seat with a softer USD (and stronger JPY) underpinning the AUD’s revival. As our chart shows, given USD/JPY is the second most traded currency pair a lower USD/JPY typically flows through and sees other currencies like the AUD lift. Locally, Q4 2023 GDP was released last week and as anticipated, on the back of the cost-of-living squeeze and higher mortgage rates, activity was subdued. Annual growth is running at just 1.5%. Outside of the 2020 COVID shock this is the slowest pace since the early 2000s. Sluggish momentum should continue over the next few months, but over H2 we think some relative improvement is likely. The squeeze on real household incomes should lessen as inflation falls and wages hold up. Stage 3 income tax cuts will also be flowing, the Federal Government may provide more relief at the May budget, the RBA should be able to begin to gradually lower interest rates later this year, and China’s economy is expected to be on firmer footing due to its stimulus push. In our opinion, these trends should be medium-term positives for the AUD.

Near-term, the local and regional economic calendar is limited this week with an appearance by the new RBA chief economist (Tues 9:30am AEDT) and the latest business conditions reading (Tues 11:30am AEDT) the only things of note. Hence, much like last week, global developments will be the major influence on the AUD. And as discussed above, we think signs annual US core inflation (Tues 11:30pm AEDT) is continuing to cool, coupled with a further pricing in of BoJ policy normalisation may maintain the pressure on the USD (see above). In our view, this, still bearish ‘net short’ positioning (as measured by CFTC futures contracts), positive seasonal tendencies in March/April, and valuation support (the average across our suite of models suggests it is still trading ~2 cents below ‘fair value) can keep the AUD buoyant.

SGD corner

USD/SGD has fallen over the past week, in line with the weaker USD as the combination of softer US economic data, solidifying US Fed policy easing expectations, lower US bond yields, and a jump up in the JPY due to increased BoJ interest rate hike pricing flowed through. At ~1.3313 USD/SGD is down near its lowest since mid-January. On the crosses, EUR/SGD is consolidating between its 100-day (~1.4549) and 200-day (~1.4591) moving averages, while the stronger JPY has seen SGD/JPY dip lower (now ~110.52, ~1.5% below its cyclical peak).

As mentioned above, the global focus this week will be on US CPI (Tues night) as well as US retail sales and PPI inflation (Thurs night). As discussed, we believe that a further moderation in annual US core inflation may bolster expectations about future US Fed policy easing. This, combined with a firmer JPY could keep the USD (and USD/SGD) on the backfoot, in our opinion.