• Consolidation. Partial reversal in some markets. US equities slip back while yields & the USD tick up. AUD eased but still near the top of its range.

• AU CPI. Monthly inflation due tomorrow. A lot of uncertainty due to electricity subsidies. A large drop in the annual headline rate could weigh on the AUD.

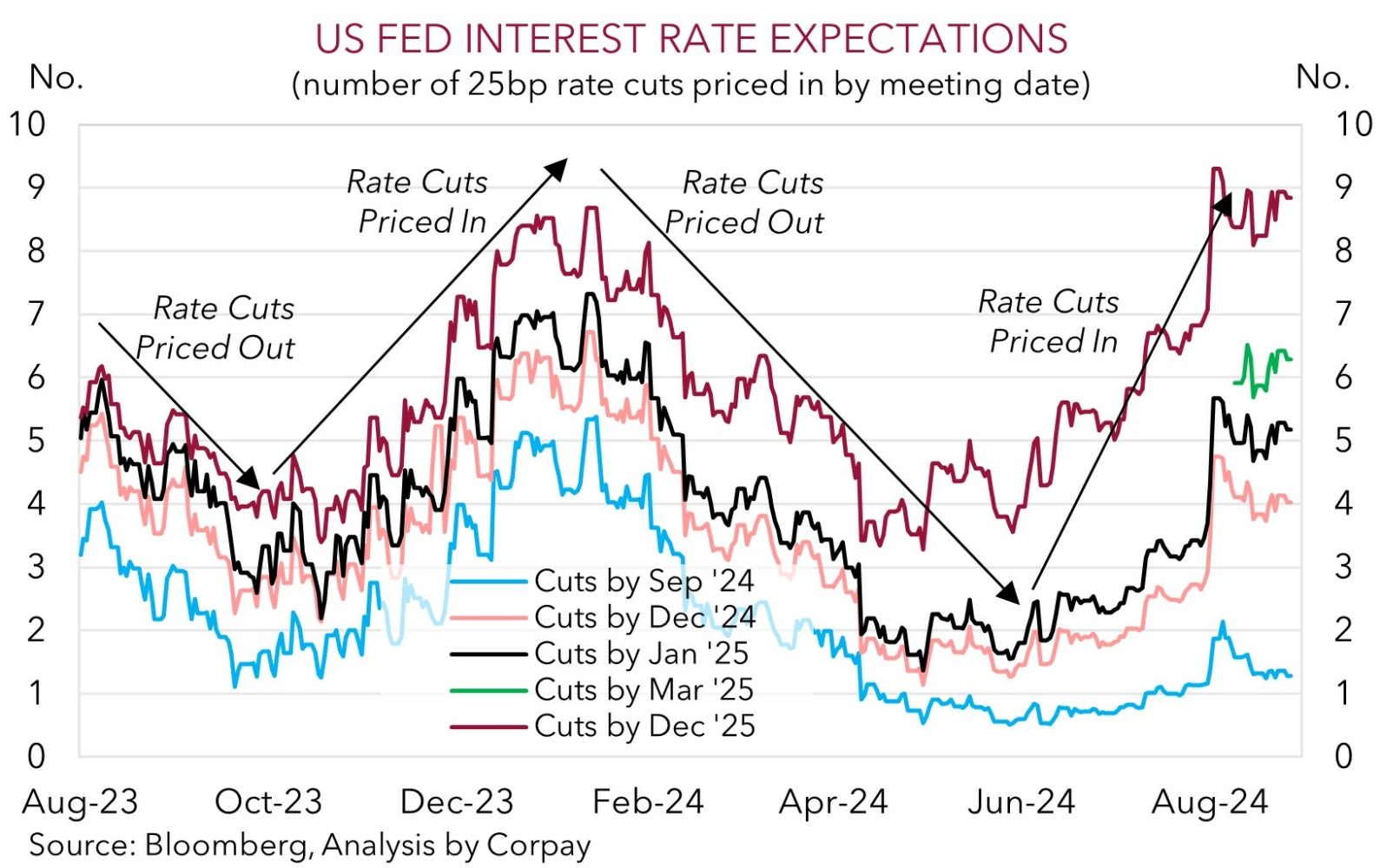

• Fed pricing. Markets grappling with whether the US Fed will cut rates by 25bps or 50bps at upcoming meetings. History & the data points to 25bp steps.

After the outsized moves last week it isn’t surprising to see that some markets cooled their jets a bit overnight. US equities slipped back with the NASDAQ underperforming (-0.9% vs S&P500 -0.3%) ahead of the results from the megacap Nvidia in a few days time. By contrast, bond yields nudged up with US rates ~2bps higher across the curve. Although this follows sizeable falls last week. At ~3.82% the benchmark US 10yr yield is still near the bottom of its 1-year range. Across commodities, iron ore edged back over US$100/tonne, to now be ~9.5% above its recent low, following signs stockpiles in China are shrinking (a tentative sign oversupply conditions are easing).

Elsewhere, oil prices rose with brent crude up ~3% (now ~US$81.40/brl). There was a rather muted response to weekend news of a flaring up of Middle East tensions. Instead, reports Libya’s eastern government is looking to shut down oil production and exports has rattled nerves by raising global supply concerns. In FX, the USD’s sell off has paused with it ticking up a little over the past 24hrs. EUR and GBP have drifted back to ~$1.1160 and ~$1.3185 respectively, and USD/JPY is fractionally higher (now ~144.55). USD/SGD has consolidated near its multi-year lows (now ~1.3040), while NZD (now ~$0.6203) and AUD (now ~$0.6770) have eased.

Data wise, there was little new information to move the dial. The German IFO survey fell slightly in August and is at level consistent with economic activity continuing to stagnate in Q3. In the US, topline durable goods orders rebounded more than expected (+9.9% in July), but this was because of the volatile defense and transportation subcomponents. Core capital goods shipments, an input into US CAPEX, contracted for the second time in three months.

The global data calendar is quiet today with Eurozone CPI and US PCE deflator figures (the US Fed’s preferred inflation gauge) the key upcoming events (both released Friday). As outlined yesterday, in the wake of the recent lackluster US data and ‘dovish’ pivot from Fed Chair Powell that pointed to the start of the rate cutting cycle in September because of downside labour market risks, traders are grappling with whether the US will kick things off in 25bp or 50bp steps. There is now ~157bps of rate cuts factored in over the Fed’s next five meetings. As things stand, we think this is too aggressive. History, and the underlying landscape, suggests a steady stream of orderly 25bp moves is more appropriate. Hence, while we foresee a drawn-out Fed easing cycle on the horizon we believe a paring back of the outsized near-term rate cut expectations could give the beleaguered USD some short-term support. For more see Market Musings: Don’t fight the Fed.

AUD Corner

The AUD has drifted a little lower at the start of the new week with a modest uptick in the USD and softer US equity markets overpowering the firmer base metal and energy prices (see above). That said, at ~$0.6770 the AUD is still towards the upper end of the range it has occupied since early-January. On the crosses, the AUD has generally consolidated with moves of between -0.1% and +0.2% recorded against the EUR, JPY, GBP, NZD, and CNH over the past 24hrs.

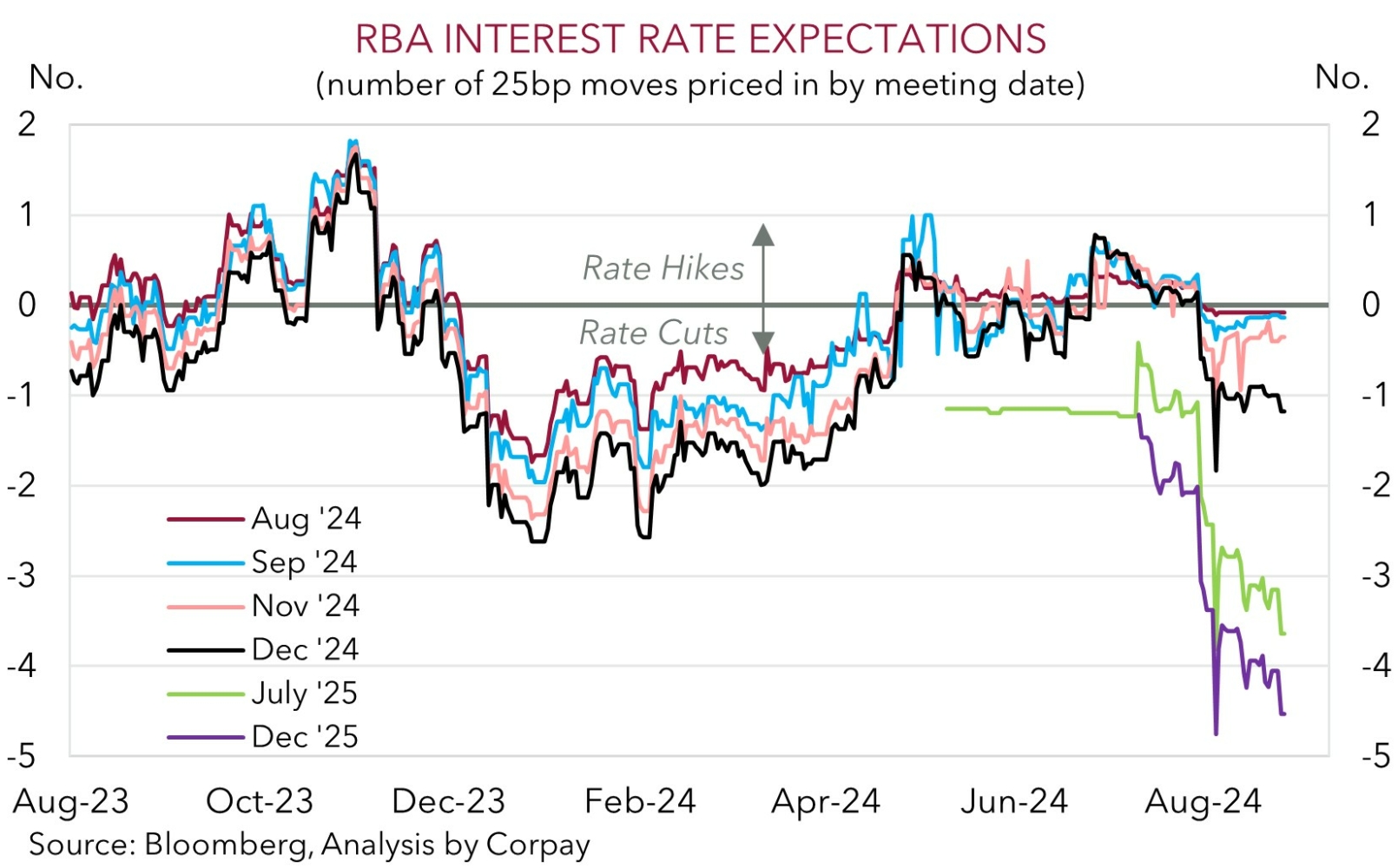

Locally, the next key data point is tomorrows monthly CPI figures for July. We think it might generate some ‘sticker shock’ and near-term headwinds for the AUD. As it is the first month of the quarter the July CPI data will be skewed towards ‘goods’ rather than sticky ‘services’ prices. Ongoing disinflation in goods, coupled with a drop in fuel prices, are factors that look set to drag annual headline inflation lower. On top of that the various Federal and State government electricity subsidies should also be starting to have a negative effect. These measures are designed to artificially lower headline inflation (though there should be no impact on core inflation).

There is considerable uncertainty around just how much and when exactly these subsidies will hit the numbers. Consensus expectations for the July CPI are wide (range 2.7%pa to 3.9%pa). Overall, we think there is a chance headline inflation slows more than the consensus median predicts (mkt median 3.4%pa from 3.8%pa in June). If realised, and the activity data released this week (including July retail sales (Fri)) indicates subpar momentum, markets may look to discount a greater probability of the RBA shifting away from its ‘hawkish’ bias. We believe this could weigh on the AUD over the near-term, particularly given it is still hovering around ‘overbought’ levels on some technical trading indicators, and our thoughts that the USD risks recouping lost ground.