• Range bound. Limited moves across most markets. News flow has been light. USD drifted lower. AUD & NZD towards the top of their respective ranges.

• Iron ore. The revival has continued. Iron ore prices now over 11% above mid-August lows on the back of signs oversupply risks are easing.

• AU inflation. Monthly CPI due today. A lot of uncertainty because of electricity subsidies. A large drop in headline inflation could drag on the AUD.

‘Steady as she goes’ over the past 24hrs with consolidation the main theme across most major markets. News flow has been light. The major European and US equity indices edged up ~0.2% with the S&P500 hovering just below its record highs ahead of the earnings update from the megacap Nvidia which has been an important driver behind the overall market’s performance. US bond yields are little changed with a slightly steeper curve on the back of small falls in the 2yr rate (-4bps to 3.90%) and uptick in the 10yr rate (+1bp to 3.82%) coming through. Across commodities the iron ore revival has continued with prices up again yesterday. At ~US$102/tn iron ore is approaching its 6-month average and is over 11% above its mid-August low on signs oversupply risks are easing. Other industrial metals have gone along for the ride with copper and nickel ~2% higher. By contrast, oil prices have reversed course with yesterday’s increase largely unwound.

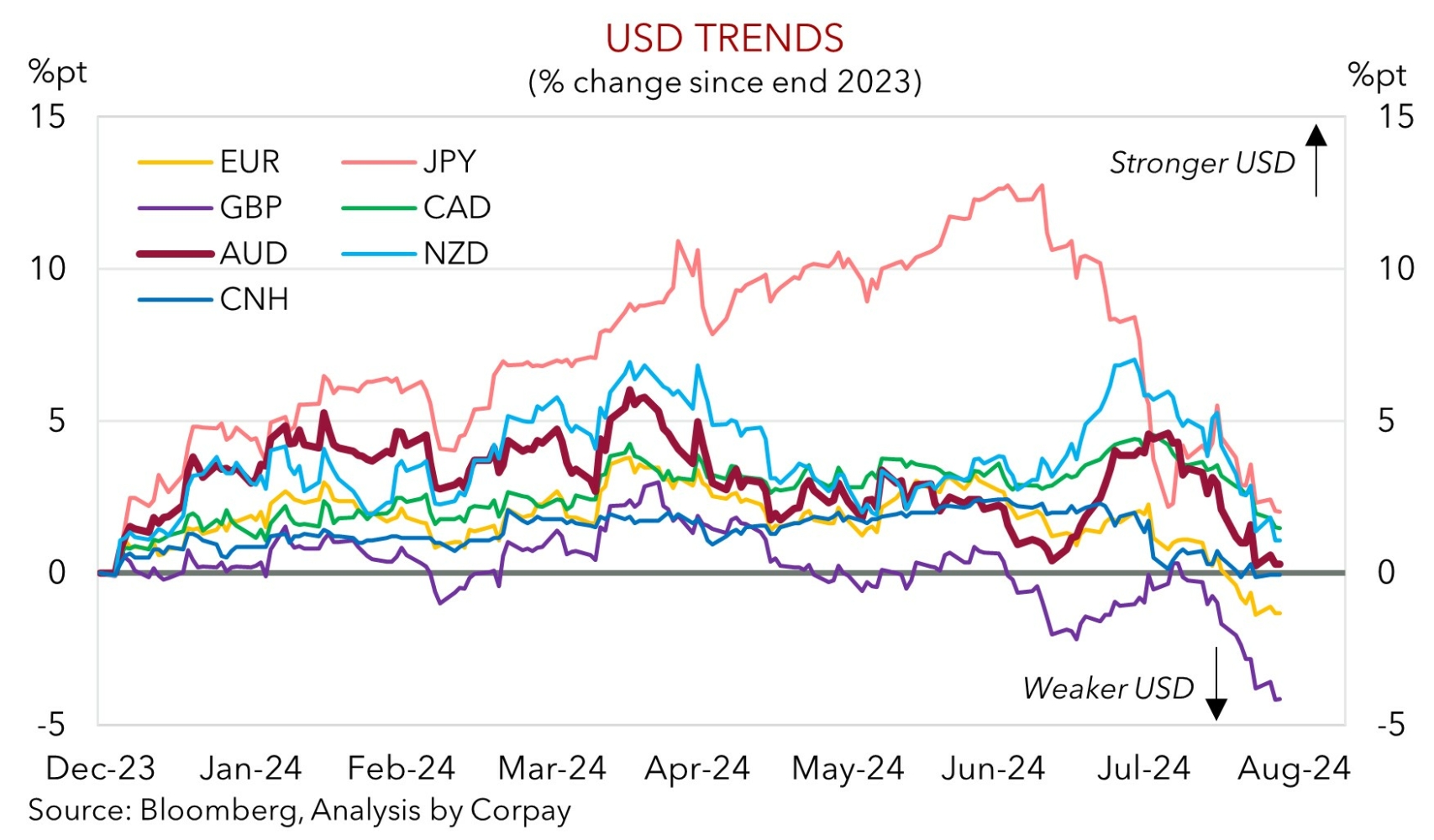

In FX, the USD index has drifted a touch lower. EUR has nudged back up (now ~$1.1185) towards the top of its 1-year range, GBP (now ~$1.3255) is at levels last traded in Q1 2022, and USD/JPY is tracking under ~144 (something it hasn’t consistently done since late last year). USD/SGD (now ~1.3015) is lingering around its cyclical lows, while the increase in commodity prices and lower volatility has seen NZD (now ~$0.6250) and AUD (now ~$0.6792) make their way back to the upper end of their respective multi-month ranges.

Outside of the monthly Australian CPI data (11:30am AEST) it is quiet on the global data front again today. The US Fed’s Bostic speaks on the outlook tomorrow morning (Thurs 8am AEST). Later in the week attention will be on Eurozone CPI and the US PCE deflator (the US Fed’s preferred inflation gauge) (both released Friday). As outlined over the past few days, on the back of the ‘dovish’ rhetoric from Chair Powell and focus on the downside employment risks, markets are toying with the idea the Fed delivers outsized rate cuts at the start of its cycle. There is now ~160bps worth of rate cuts priced in over the US Fed’s next 5 meetings. Based on history and a look across the underlying US economic landscape we feel this is too aggressive. 25bp steps appear more appropriate. Hence, we think a paring back of the substantial near-term Fed rate cut expectations might give the beleaguered USD some short-term support.

AUD Corner

The AUD has edged a bit higher over the past 24hrs with lower market volatility and upswing in base metal prices supportive (see below). At ~$0.6792 the AUD is hovering around the top of its ~7-month range. That said, the AUD has been more mixed on the crosses. Modest gains have been recorded against the EUR (now ~0.6073) and CNH (now ~4.8373), while the AUD has weakened slightly against the JPY (now ~97.80), GBP (now ~0.5125), and NZD (now ~1.0865, close to its 1-year average).

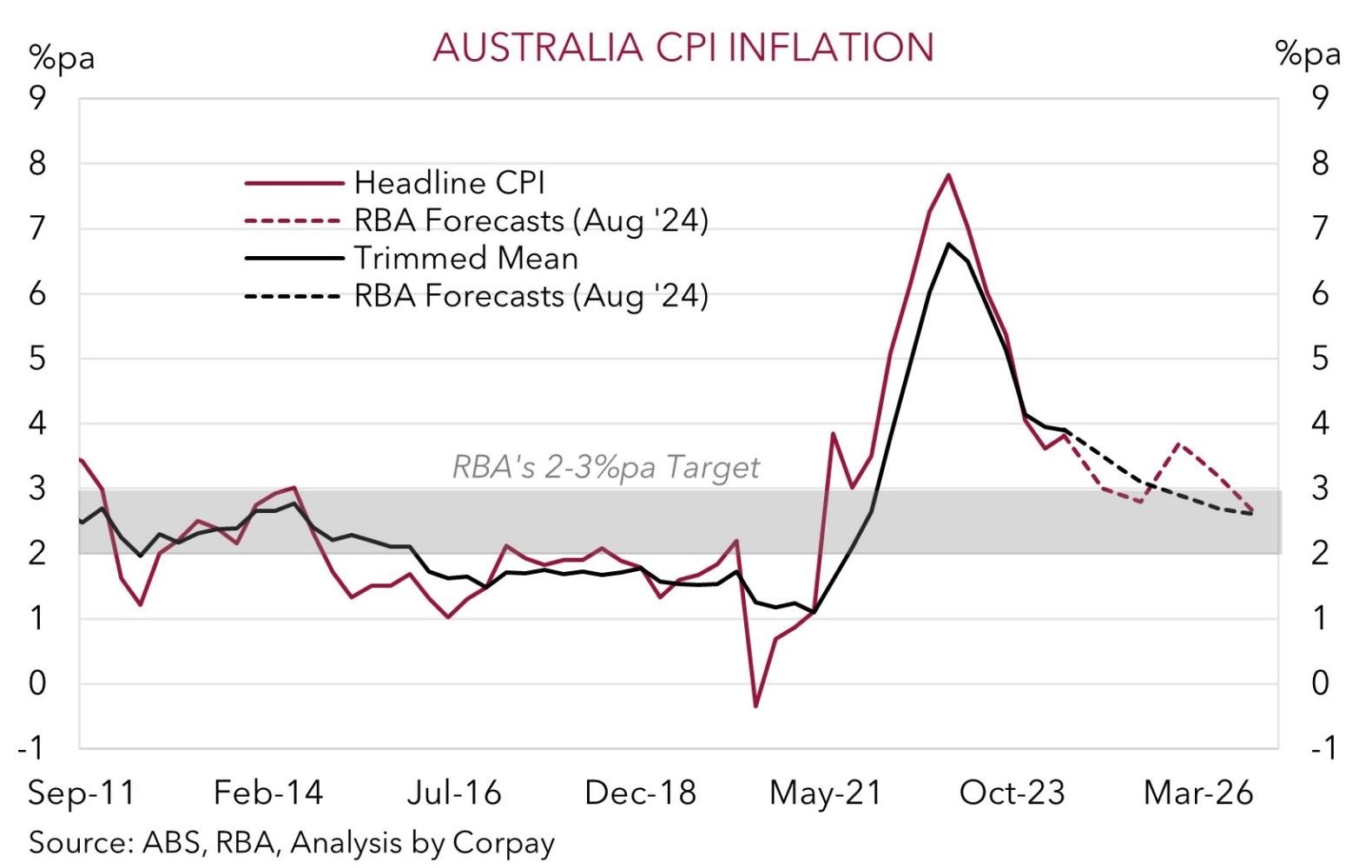

Attention today will be on the monthly Australian CPI data for July (11:30am AEST). The monthly data isn’t a perfect replication of the detailed quarterly series, and it has given false signals over the past year. Nevertheless, it is something markets and the AUD react to. In our opinion there is a chance the July figures generate ‘sticker shock’ and near-term AUD headwinds. As it is the first month of the quarter the July CPI will be skewed towards ‘goods’ rather than ‘services’ prices. Disinflation in goods, coupled with lower fuel prices, are factors that look set to weigh down annual headline inflation. In addition, various Federal and State government electricity subsidies will also be starting to have a negative effect. These relief measures are designed to artificially lower headline inflation (though there should be limited impact on core inflation).

There is a lot of uncertainty around when the subsidies will hit the CPI, and by how much. As a result consensus expectations for July are wide (range 2.7%pa to 3.9%pa). On net, we believe the various bit and pieces mean there is a possibility headline inflation decelerates more than the consensus median anticipates (mkt median 3.4%pa from 3.8%pa in June). If realised, and the incoming activity data released over the next few days (including July retail sales (Fri)) shows sluggish momentum, markets may look to factor in a higher probability the RBA moves away from its ‘hawkish’ bias. We think this could drag on the AUD over the short-term, especially as it is still tracking around ‘overbought’ levels on various technical trading indicators.