• Dovish Powell. US Fed Chair gave strong signals the start of the rate cutting cycle is approaching. Focus now on downside labour market risks.

• Market jolt. Equities & commodities jumped, bond yields & the USD declined. AUD at the top of its 7-month range. EUR highest since mid-2023.

• Event radar. Locally, July CPI (Weds), CAPEX (Thurs), & retail sales (Fri) are due. Offshore, Eurozone inflation & US PCE Deflator (Fri) are released.

Markets ended last week on a positive note with the more dovish than anticipated message from US Fed Chair Powell boosting risk sentiment (see below). US equities rose with the ~1.2% lift in the S&P500 putting the index within a whisker of its record highs. The early-August panic sell-off is long forgotten with the S&P500 now over 10% from its recent lows. Base metal and energy prices also increased with lower bond yields supporting cyclical assets. The US 2yr rate fell ~9bps to 3.92% while the benchmark 10yr rate shed ~5bps to 3.8%, towards the bottom of its 1-year range, due to reinforced Fed rate cut bets. This also exerted more downward pressure on the already faltering USD. EUR (now ~$1.1192) touched its highest point since July 2023, GBP (now ~$1.3214) is at levels last traded in Q1 2022, and the interest rate sensitive USD/JPY (now ~144.13) is back around the lower end of its multi-month range. The backdrop also generated a positive jolt for the NZD (now ~$0.6230, heights it last reached in mid-January) and the AUD (now ~$0.6794, the top of its ~7-month range).

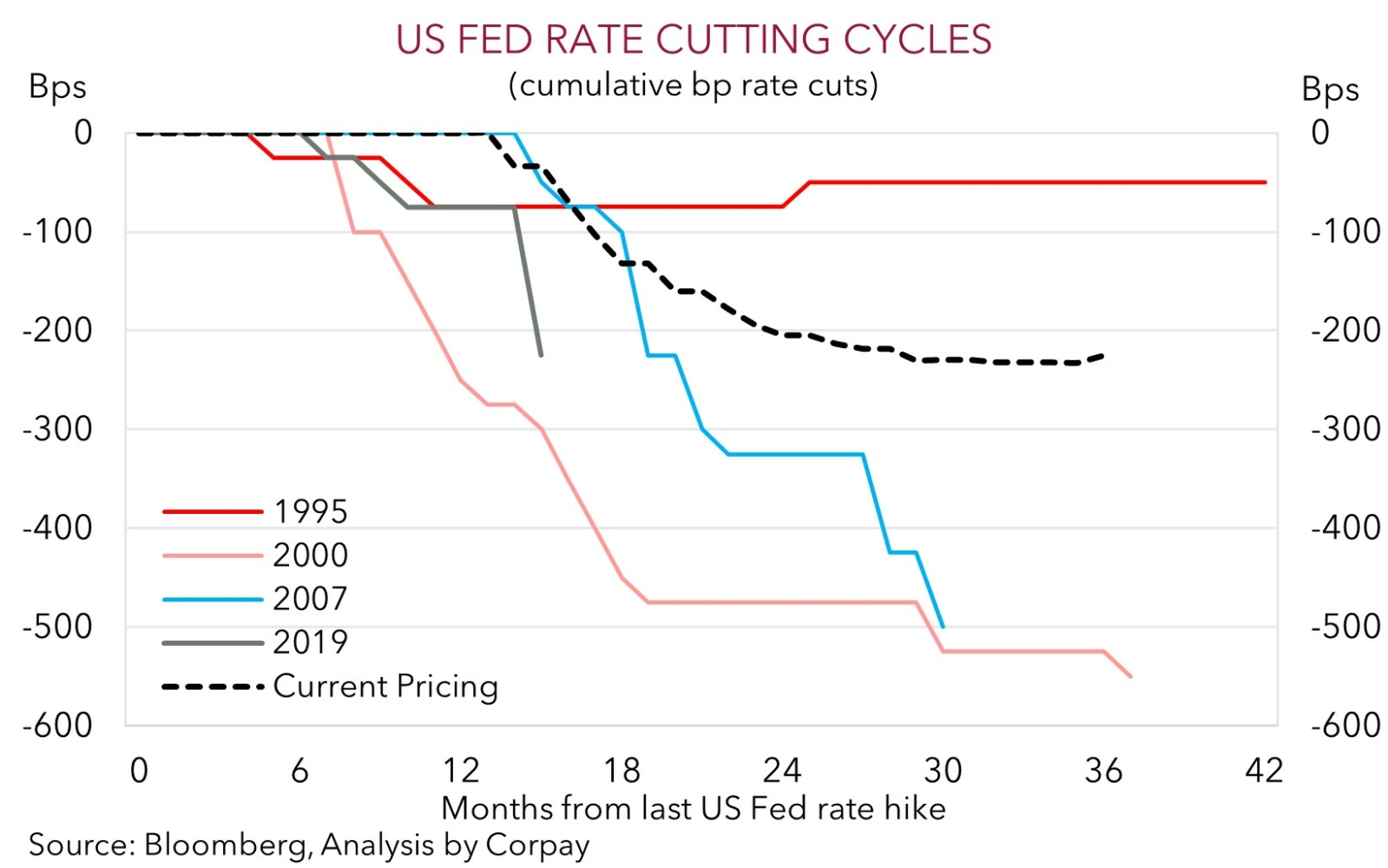

Ahead of the event markets were looking for Chair Powell to give a nod to the approaching start of the Fed’s easing cycle but potentially push back on some of the more aggressive expectations that had crept in. This wasn’t the case with Chair Powell clearly outlining the Fed is turning course given labour market trends, downside risks to jobs, and few upside inflation worries. The pendulum has swung with the Fed now lasering in on the employment side of its dual mandate. According to Chair Powell “the time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks”. Moreover, Powell stressed the Fed “do not seek or welcome” a further cooling in the labour market and that the “current level” of the policy rate (i.e. 5.25-5.50%) gives them “ample room to respond” to the risks they face. A decline back to the equilibrium ‘neutral’ zone, which the Fed pegs at ~2.75%, appears in train.

Markets continue to grapple with whether the Fed will kick things off in 25bp or 50bp steps. Traders are assigning a ~60-70% chance of 50bp reductions by the Fed at its next 5 meetings. We think this is a bit aggressive and continue to believe a steady stream of 25bp moves are more likely. However, the data will be key and the August US jobs report (released 6 September) will be a major input in what the Fed does at its 18 September meeting. In the short-term we believe the USD should remain on the backfoot as Chair Powell’s policy pivot continues to wash through, although later this week signs US inflation and spending is holding up in the PCE report (released Friday) may help it regain a bit of ground. As could an escalation of Middle East tensions.

AUD Corner

The AUD powered ahead on Friday with the ‘dovish’ rhetoric from US Fed Chair Powell simultaneously weighing on US bond yields and the USD while also boosting risk sentiment. The favourable backdrop has pushed the AUD (now ~$0.6794) to the top of the range it has occupied since early-January. The underlying dynamics have also helped the AUD bounce back against the EUR (now ~0.6070), GBP (now ~0.5141), CAD (now ~0.9177), and CNH (now ~4.8342) to differing degrees. By contrast, AUD/JPY has consolidated around ~98, while a slightly stronger upswing in the NZD has pushed AUD/NZD back down to ~1.09.

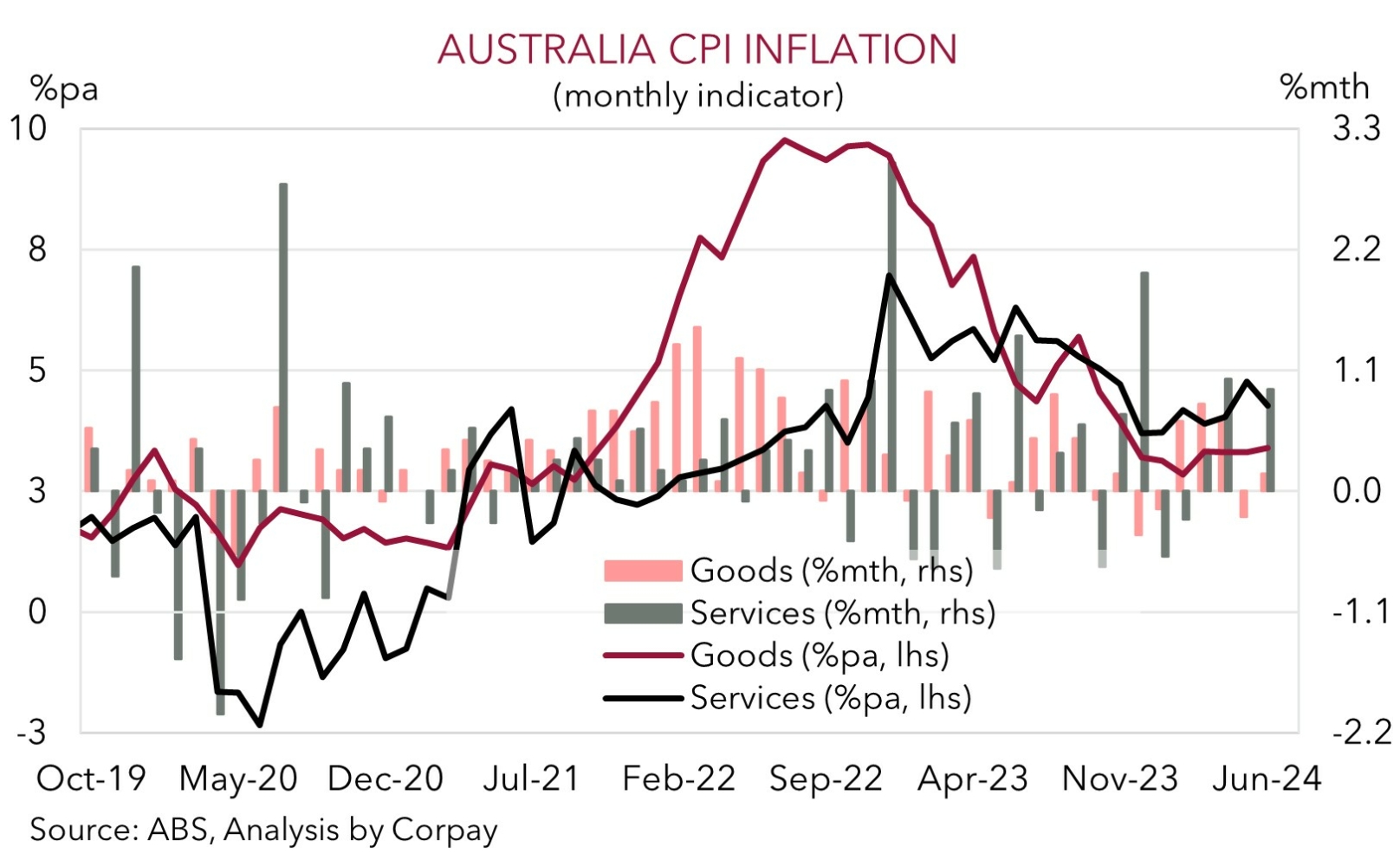

Over the next few sessions we think further reaction to Fed Chair Powell’s signals a sizeable interest rate cutting cycle may be about to unfold could keep the USD on the backfoot. This in turn should be a tailwind for cyclical assets like the AUD, barring an escalation in Middle East tensions. That said, with the AUD still hovering around ‘overbought’ levels on various technical indicators like Relative Strength Indices, there is a risk it soon pauses for breath and some of its gains are unwound. Indeed, we believe the incoming Australian monthly CPI report (released Wednesday) might generate ‘sticky shock’ and near-term headwinds for the AUD. Being the first month of the quarter the July CPI reading will be more heavily skewed to ‘goods’ rather than ‘services’ prices. The latter is what the RBA has been focusing in on. Added to that the various Federal and State government electricity subsidies should also be starting to negatively impact headline inflation. We feel there is a chance annual headline inflation slows more than consensus anticipates (mkt 3.4%pa from 3.8%pa in June). If realised, and the construction work (Weds), CAPEX (Thurs), and July retail sales (Fri) reports also point to sluggish growth momentum we think markets could look to price in a greater probability of the RBA shifting course like the US Fed which may take some of the heat out the AUD.

However, we feel this would only be a short-term phenomenon. Over the medium-term, we continue to expect a weaker USD on the back of lower US interest rates, signs of improvement in China’s economy, and/or the RBA lagging its peers in terms of when it starts and how far it goes during the next easing cycle to be AUD positive factors.