• Market turn. US equities dipped, while bond yields & the USD rose. The reversal has taken some of the heat out of the AUD.

• Data pulse. Solid US data & ‘cautious’ comments from Fed officials about the looming rate cut cycle underpinned the moves.

• Jackson Hole. Fed Chair Powell speaks tonight. A further push back on aggressive rate cut bets could see the USD’s revival extend.

A reversal of fortune in markets over the past 24hrs. US equities dipped (S&P500 -0.9%), with the tech-focused NASDAQ underperforming (-1.7%). US bond yields have risen by ~5-7bps across the curve with the policy expectations driven 2yr rate ticking back up to ~4%. This has helped the USD recapture a little lost ground. EUR has slipped from its year-to-date highs (now ~$1.1111), GBP consolidated just under ~$1.31, and USD/JPY nudged up (now ~146.30). USD/SGD also edged up from its multi-quarter lows (now ~1.3105). NZD drifted back (now ~$0.6140), and after its stellar run AUD lost altitude (now ~$0.6705) thanks to the turnaround in risk sentiment.

A combination of factors drove the moves. The latest global business PMIs showed momentum in the labour-intensive services sectors remains positive. On the back of the jump in France due to the Paris Olympics the Eurozone services PMI touched a 4-month high. There was also an increase in the UK gauge, with the US services PMI moving further into ‘expansionary’ territory. Added to that weekly US jobless claims (i.e. how many people are filing for unemployment benefits) remained low, and existing home sales rose. The US data pulse further eased recession concerns. Members of the US Fed that spoke also pushed back on the markets aggressive policy easing bets. Philly Fed president Harker, Boston Fed president Collins, and Kansas City Fed president Schmid welcomed the latest inflation data but showed little urgency for preemptive action. According to Collins the Fed is likely to begin lowering interest rates soon but “a gradual, methodical pace” of cuts is probably appropriate.

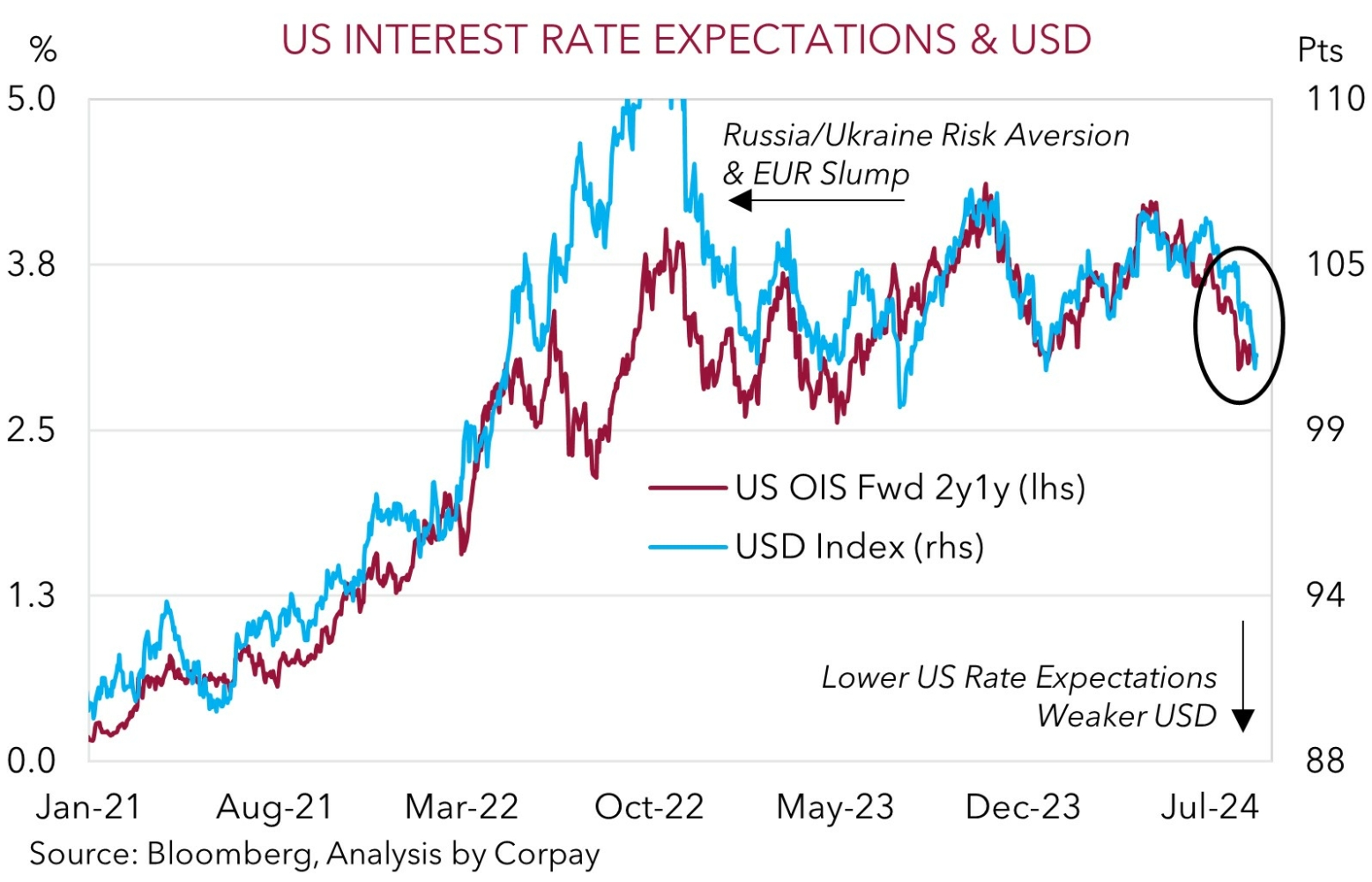

In response markets have modestly pared back their US Fed rate cut assumptions. That said, with ~31bps of easing still factored in for the September Fed meeting and ~97bps discounted over the remaining 3 meetings of the year we think there could be further to run. As outlined over the past week, we believe Fed Chair Powell, who is speaking tonight at the annual Jackson Hole event (12am AEST), should note that a move in September is up for discussion but also stress a data-driven and cautious approach to the cycle is anticipated. This type of ‘reality check’ may disappoint overeager ‘dovish’ market expectations. We think an upward adjustment in US interest rates on the back of a ‘cautious’ message from Chair Powell might see the USD’s rebound extend over the short-term.

AUD Corner

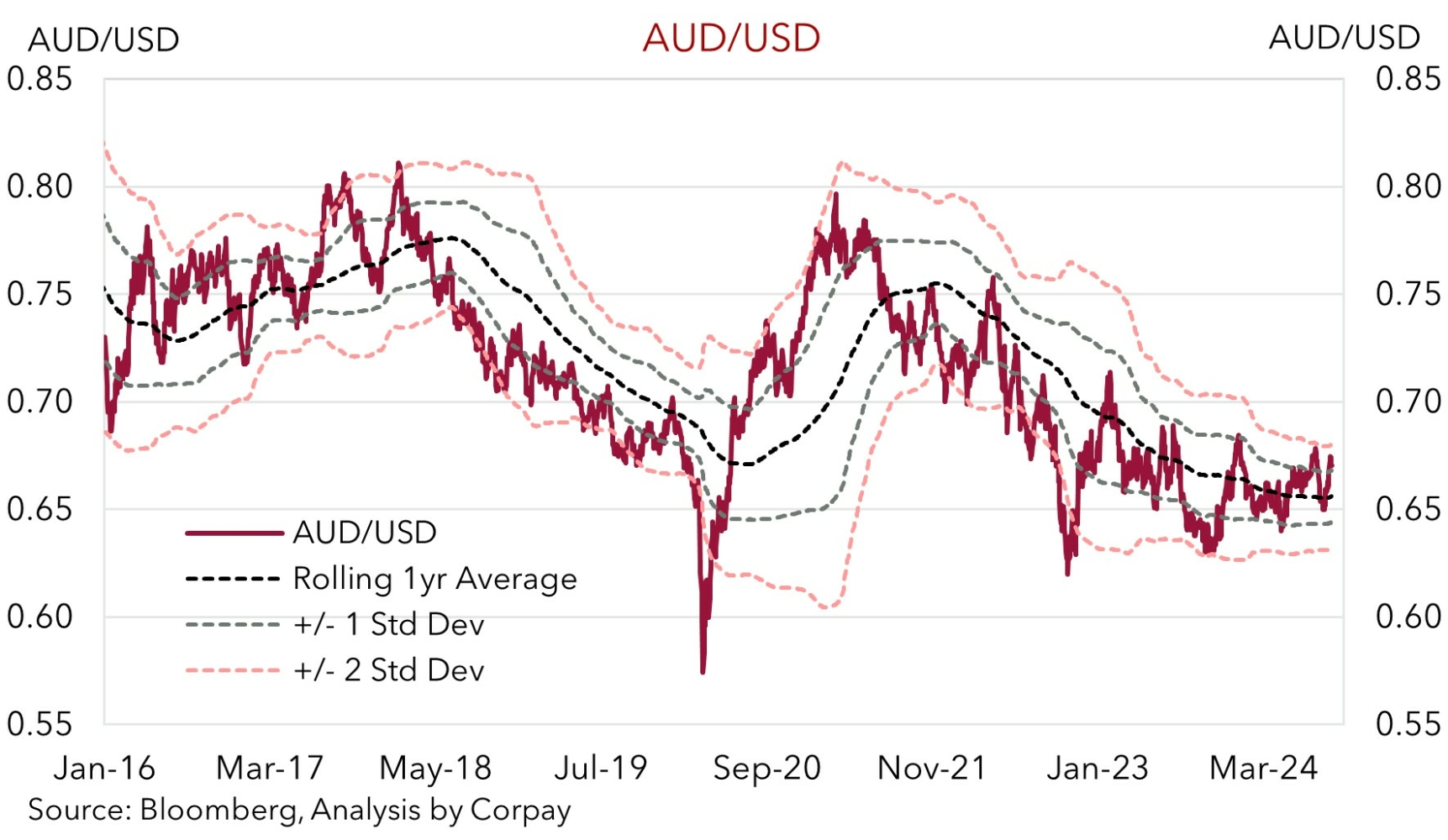

The USD rebound on the back of the uptick in US bond yields, and dip in US equities and base metal prices has taken some of the heat out of the AUD (now ~$0.6705) (see above). That said, this also comes after a very strong run with the AUD still ~5.5% above its early-August panic equity market sell-off low. The backdrop has also seen the AUD lose a little ground on the crosses with falls of ~0.2-0.5% recorded against the EUR, GBP, CAD, and CNH over the past 24hrs. By contrast, AUD/JPY has consolidated near ~98 (just below its 1-year average) ahead of today’s Parliamentary testimony by BoJ Governor Ueda where he will be discussing the recent rate hike and may keep the door open to further action given Japanese inflation trends.

Elsewhere, AUD/NZD has drifted down towards ~1.0920. We doubt this will extend much further and we continue to see AUD/NZD moving higher over the medium-term due to the diverging outlook between Australia and NZ. Data released this morning showed that NZ retail sales volumes contracted by 1.2% in Q2, the 9th fall in the past 10 quarters. The weak NZ economy points to an aggressive easing cycle by the RBNZ which should see yield differentials turn progressively in the AUD’s favour over time.

As mentioned, market focus tonight will be on US Fed Chair Powell’s speech at the Jackson Hole Symposium (12am AEST). As outlined above, and earlier this week, we think there is a risk Chair Powell leans against the still ‘dovish’ Fed rate cut pricing factored into markets. The US economy is slowing and inflation is cooling, things aren’t falling off a cliff. As such, we believe that while Chair Powell could note that the start of the rate cutting cycle will be on the table at the September meeting, without an exogenous shock, a measured and data-driven approach is anticipated. We think this could underwhelm markets, push up US interest rate expectations, and help the USD tick up. If realised, this in turn may see the AUD slip back a bit further. As noted over the past few days, due to the speed of its appreciation, the AUD had reached ‘overbought’ levels on some technical momentum indicators. So a partial short-term retracement and period of consolidation shouldn’t be overly surprising.