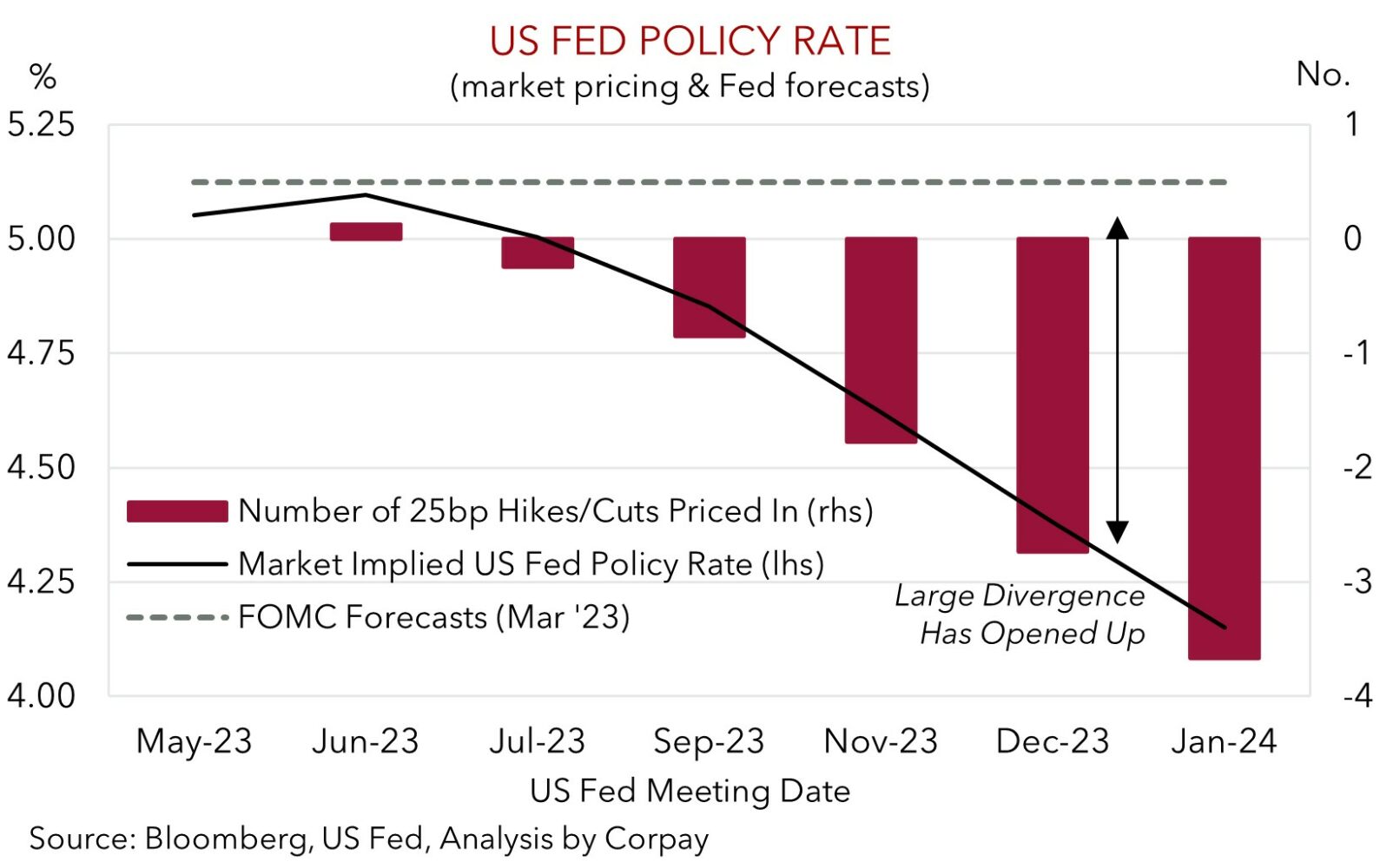

• US inflation worries. Jump in US inflation expectations should catch the US Fed’s eye. Market pricing for multiple Fed rate cuts looks misplaced.

• USD rebound. Higher yields supported the USD. US retail sales & Fed speakers in focus this week. Reduction in Fed rate cut pricing should be USD positive.

• AUD slips back. The AUD has extended its slide. Local and offshore data should generate AUD vol. On net, we think the AUD can fall back further.

Markets nervousness continued into the end of last week, with growth concerns, higher US inflation expectations, and US debt ceiling worries weighing on investors minds. US equities edged lower (S&P500 -0.2%), as did energy prices (WTI crude oil fell another 1.2% to be down at ~US$70/brl). By contrast, US bond yields bounced back with the data and comments by US Fed officials seeing markets unwind some of their future rate cut bets. The US 2-year yield rose ~9bps to be back near ~4%. This mix helped the USD add to its recent recovery. The USD Index rose ~1.5% last week, its best result since September. EUR has slipped below its 50-day moving average (~1.0875), GBP is under 1.25, the interest rate sensitive USD/JPY has risen, and AUD has extended its slide. At ~$0.6650 the AUD is ~2.5% below last week’s high.

In the US the University of Michigan consumer sentiment gauge fell to a multi-month low. But more worrisome was the jump in the 5-10 year ahead inflation expectations measure to 3.2%, a high since 2011. This is something the US Fed watches closely as inflation expectations influence price and wage setting behaviours and drive future inflation outcomes. Fed members continue to express their inflation concerns with Governor Goolsbee reiterating that price pressures are too high, while Governor Bowman noted that it wasn’t clear if policy is ‘restrictive’ enough and that further hikes could be needed if inflation doesn’t cool.

Globally, growth momentum, US Fed speakers, and US debt ceiling developments will be in focus this week. The debt ceiling ‘x-date’, whereby the US could begin to default on its obligations, is estimated to be somewhere in early-June. The closer we get to this date without a resolution, the higher market anxiety levels (and volatility) could go. The China activity data batch (Tues AEST), US retail sales (Tues AEST), and Q1 Japan GDP (Weds) are released, while at least one Fed member is due to speak each day with Chair Powell rounding things out. Given lockdowns at the same time last year, annual growth across the China data should lift sharply, however this is likely to mask the month-on-month moderation that is occurring. In the US, after a couple of falls, leading indicators point to retail sales snapping back in April. Given household spending accounts for around ~70% of US GDP, we think a rebound in retail sales, coupled with comments by Fed members highlighting the ongoing inflation problem could see markets further reduce their rate cut expectations, which in turn could help the USD recover some more lost ground. As outlined, we think pricing looking for ~3-4 Fed rate cuts by January 2024 is consistent with historical trends and the US’ inflation dynamics (see Market Musings: US inflation: still a long way from home).

Global event radar: China Activity Data (Tues), US Retail Sales (Tues), Japan GDP (Weds), Japan CPI (Fri), Fed Chair Powell Speaks (Sat), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD corner

The AUD remained on the backfoot on Friday, falling to ~$0.6650 as the jump in US inflation expectations to a ~12-year high saw US bond yields and the USD lift as markets trimmed aggressive US rate cut expectations (see above). The AUD is now ~2.5% below last week’s high and is back in the bottom half of the range it has occupied over the past few months.

There are several global and domestic economic data releases scheduled for this week which could generate AUD volatility, but on net, we think the offshore trends, particularly out of the US, are likely to see the AUD fall back a bit further. We continue to project the AUD to track in a ~$0.66-0.6850 range over the next few months as the global economy slows, more ‘aftershocks’ from the very fast global tightening cycle continue to show up, and aggressive US rate cut pricing is watered down (see Market Musings: US inflation: still a long way from home).

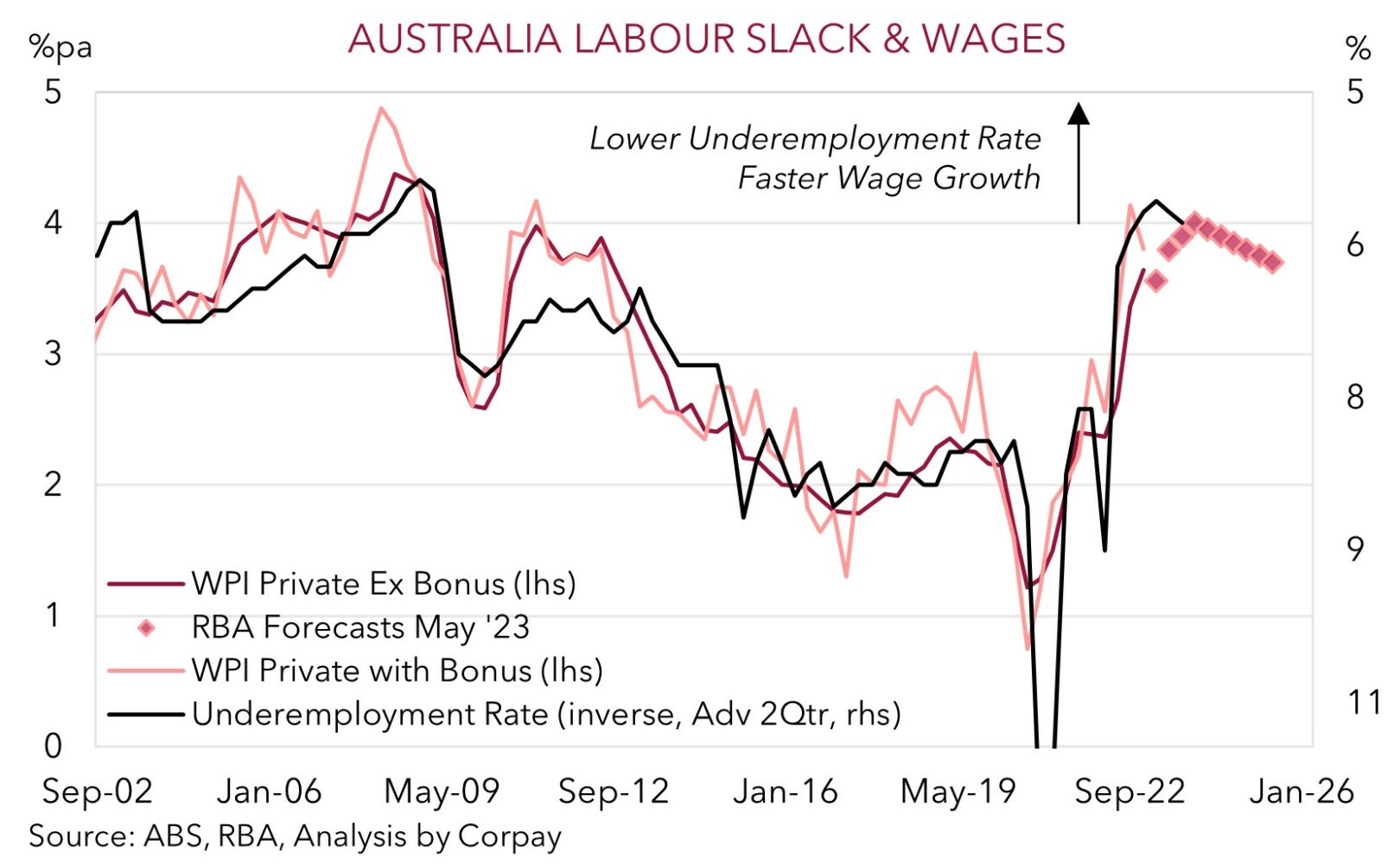

Locally, Q1 wages (Weds) and April labour force report (Thurs) are the main events. The labour market is a lagging indicator, with the April data reflecting the state of play ~6-months ago. The aggressive RBA rate rises have yet to have their full effect, so another solid jobs report looks likely, while the tightness in conditions should see wage growth edge a little higher. The market (and RBA) are penciling in wage growth to accelerate to ~3.6%pa. While faster, this is consistent with inflation running around the mid-point of the RBA’s target band, so we doubt this type of result will be strong enough to generate a meaningful adjustment higher in RBA interest rate expectations.

Offshore, the China data batch (Tues) should look strong given the comparison to a year ago when lockdowns were in place. However, we think the monthly data is likely to show that the post-COVID recovery is starting to falter. And importantly, in the US, as outlined above, we believe that retail sales (Tues) should bounce back and that Fed policymakers speaking during the week could push back on market pricing still looking for several rate cuts over H2 2023. In our judgement, a shift up in US rate expectations as fewer cuts are factored in is likely to see relative differentials move in favour of a stronger USD.

AUD event radar: China Activity Data (Tues), US Retail Sales (Tues), Japan GDP (Weds), AU Wages (Weds), AU Jobs Report (Thurs), Japan CPI (Fri), Fed Chair Powell Speaks (Sat), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), AU Retail Sales (26th May), US PCE Deflator (26th May), China PMIs (31st May), AU monthly CPI (31st May).

AUD levels to watch (support / resistance): 0.6565, 0.6630 / 0.6683, 0.6724

SGD corner

USD/SGD has moved above its 100-day moving average (~$1.3329), with the pair near its highest level since late-April. As discussed above, the uplift in US inflation expectations has seen markets pare back some future US rate cut expectations and this has boosted US bond yields and the USD. We think this trend can continue in the near term. Based on a range of indicators we expect US retail sales (released Tuesday) to bounce back in April after a couple of weak months, while we also believe the various Fed officials speaking throughout the week are likely to lean against market pricing looking for a string of rate cuts over H2 2023. As we have outlined previously, we judge that current expectations looking for a quick turnaround and rapid rate cuts by the US Fed over coming months are inconsistent with historical trends and the current economic environment. A shift up towards a ‘higher for longer’ view is likely to provide the USD (and USD/SGD) with some further support, in our opinion.

SGD event radar: China Activity Data (Tues), US Retail Sales (Tues), Japan GDP (Weds), Japan CPI (Fri), Fed Chair Powell Speaks (Sat), Singapore CPI (23rd May), Eurozone PMIs (23rd May), US PCE Deflator (26th May), China PMIs (31st May).

SGD levels to watch (support / resistance): 1.3250, 1.3330 / 1.3440, 1.3500