• US debt ceiling. Positive rhetoric from both sides supported sentiment. US equities & bond yields rose. USD index firmer, with AUD ~$0.6660.

• Fed speak on the radar. In addition to the debt ceiling, US Fed speakers will be in focus the rest of the week. Markets pricing ~3 rate cuts by January.

• Labour market data. April Australian labour report due today. Labour market is a lagging indicator. Data for April reflects the state of play ~6-months ago.

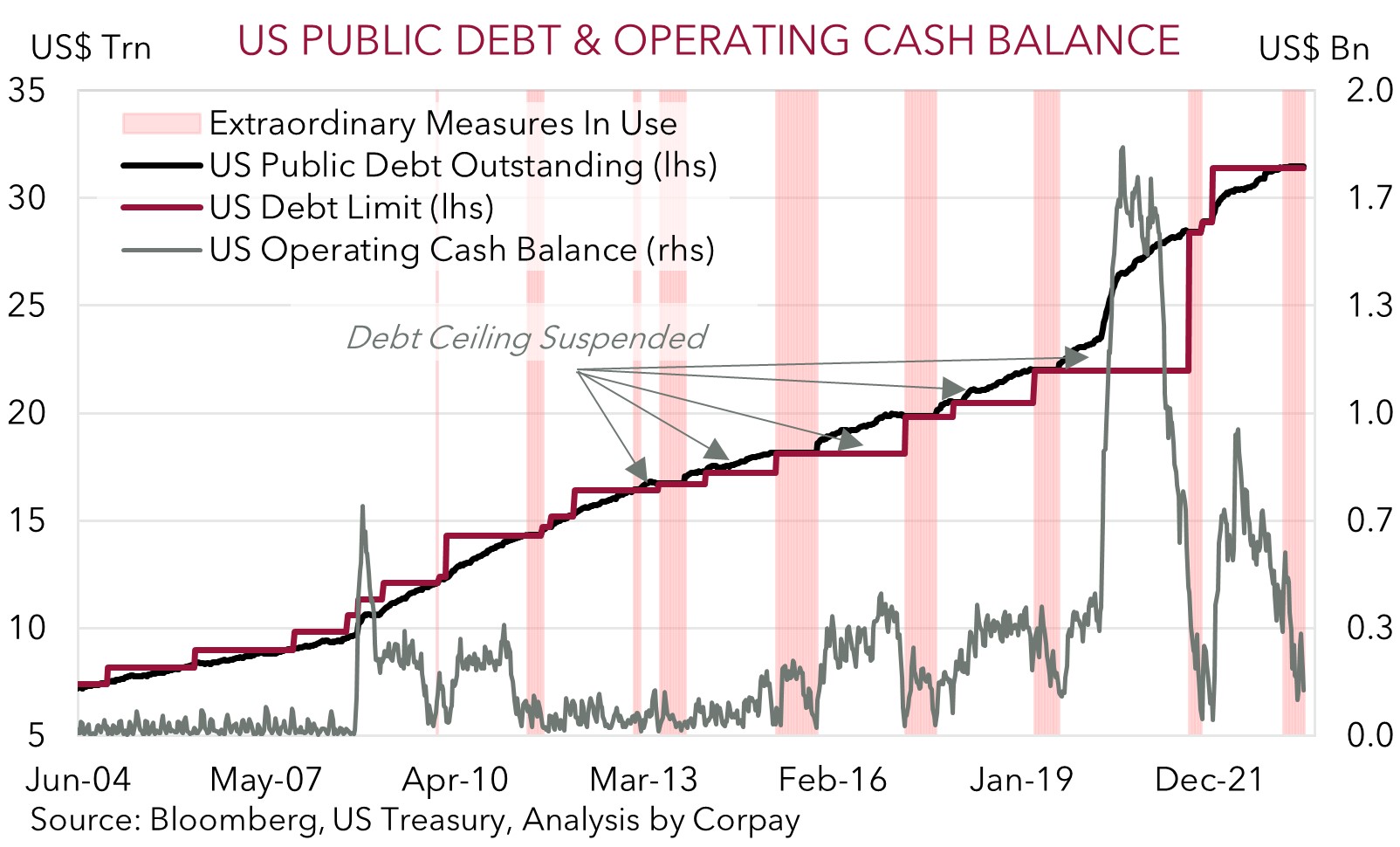

A more positive tone to markets overnight with comments on both sides of the US political spectrum easing fears of a potential US debt default. President Biden stated that he was “confident” on an agreement on the debt ceiling issue and that the US will not default on its obligations, while Republican House Speaker McCarthy also stated that he remained hopeful a deal could be reached. Since the US debt ceiling was reached earlier this year the US Treasury has been employing “extraordinary measures” to pay the governments bills, however these measures are in the home stretch with the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) coming closer into view. US Treasury Secretary Yellen has indicated that the ‘x-date’ could be as soon as 1 June, so the positive dialogue is a welcomed step. Though, with the ‘x-date’ fast approaching, further concrete moves are needed. The debt ceiling negotiations are likely to dominate the headlines over the next few weeks and can be a source of market volatility.

Across markets, US equities rose, with the S&P500 ending the day up ~1.2%. In addition to the debt ceiling optimism, banking sector concerns eased after regional bank Western Alliance Bancorp said its deposits had grown. In bonds, the US 10-year yield lifted for the 4th straight day to be up at 3.56% (~18bps above last week’s low), while the 2-year yield rose to 4.15%, the top end of its one-month range. In FX, the more upbeat mood supported the risk sensitive commodity bloc, with the NZD, AUD, and CAD a touch firmer compared to this time a day ago. The yield sensitive USD/JPY has continued its upward march, rising above its 200-day moving average (~137.10). This has helped push the USD Index a bit higher. Across Asia, USD/CNH also rose above ~7 for the first time this year, with the recent weakness in China’s economic data and faltering post-COVID lockdown recovery fueling bets that policymakers could announce further monetary support.

In addition to the debt ceiling developments, US Fed speakers will be in focus over the next few days, with Chair Powell rounding things out (Sat morning AEST). Assuming a debt ceiling deal is reached, we think the US Fed is unlikely to crystallise the market pricing looking for ~3 rate cuts by January given the US’ high inflation. We think a further push back by Fed officials towards a ‘higher for longer’ rates view could see these expectations pared back and this is likely to give the USD some further near-term support (see Market Musings: US inflation: still a long way from home).

Global event radar: Japan CPI (Fri), Fed Chair Powell Speaks (Sat), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD corner

The more positive rhetoric surrounding the US debt ceiling negotiations and lift in equities gave the AUD some modest support overnight. However, at ~$0.6660, the AUD remains in the bottom half of its 3-month range, with the upswing in US bond yields, rebound in the USD, and weaker CNH following the run of underwhelming data out of China and building expectations of further monetary support working in the opposite direction.

Locally, there was some statistical jiu-jitsu in the Q1 Wage Price Index released yesterday. Quarterly growth was a touch softer than expected (0.8%qoq), however because of upward revisions to history annual growth (excluding bonuses) quickened to 3.7%pa. Reflecting the tightness in the labour market, private sector wage growth (ex bonuses) is running at ~3.8%pa, the fastest since 2012, with several sectors now recording above average growth. Today, the April labour force data is released (11:30am AEST). The labour market is a lagging indicator, with the April data reflecting the state of play ~6-months ago. The aggressive RBA rate rises have yet to have their full effect, and based on the range of labour demand indicators another solid jobs report looks likely with unemployment predicted to hold at 3.5%.

In our view, another positive jobs report, coupled with the tick up in wages, is likely to keep the RBA talking tough about inflation and should keep the door open to another hike over the next few months. After today’s data, the retail sales report (26 May), the monthly CPI (31 May), and the Q1 GDP (which will include a more detailed view on spending, productivity growth etc, but is due the day after the next RBA meeting) are the major upcoming releases that could shape near-term RBA expectations.

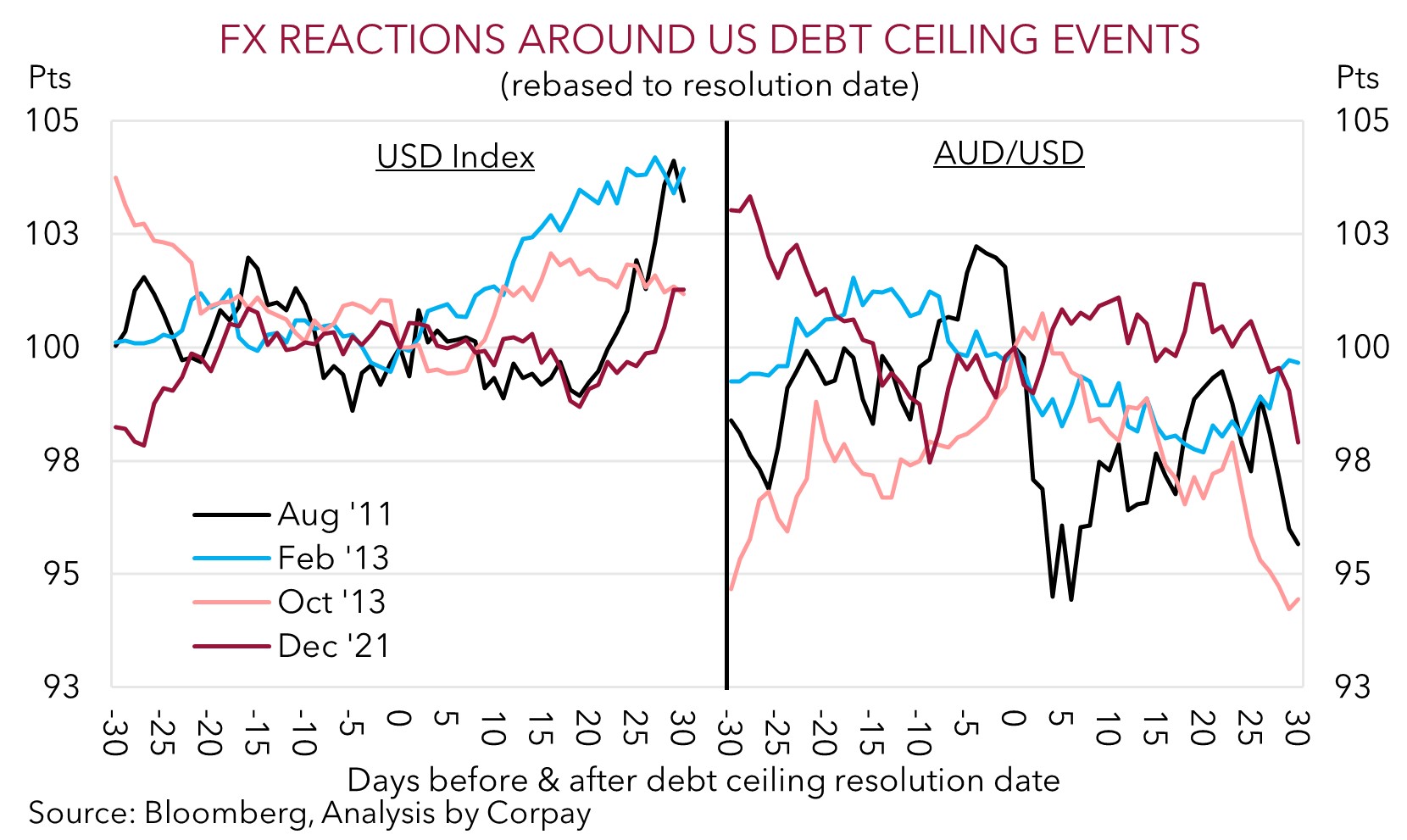

That said, FX is a relative price, and based on the global environment we continue to think that near-term AUD upside is likely to be limited. China’s post lockdown recovery is faltering, and the world economy is slowing. We expect the global downturn to intensify over the next few months as tighter credit conditions constrain activity. At the same time, as discussed above, we believe that pricing for multiple rate cuts by the US Fed over H2 is unlikely to materialise given the US’ inflation problem. A paring back of US rate cut bets should, in our judgement, be a USD positive. And while the rhetoric overnight regarding the US debt ceiling was more positive, risks remain. As our chart shows, in past US debt ceiling episodes that have gone down to the wire (such as August 2011 when the US credit rating was downgraded) the uncertainty and negative risk environment weighed on the AUD.

AUD event radar: AU Jobs Report (Today), Japan CPI (Fri), Fed Chair Powell Speaks (Sat), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), AU Retail Sales (26th May), US PCE Deflator (26th May), China PMIs (31st May), AU monthly CPI (31st May).

AUD levels to watch (support / resistance): 0.6565, 0.6620 / 0.6686, 0.6716

SGD corner

USD/SGD has continued to grind higher, and at ~$1.3420 is around a two-month high, with the higher US bond yields and firmer USD on the back of the more positive expectations regarding the US debt ceiling negotiations supportive factors (see above). The US debt ceiling negotiations are ongoing and could be a source of market volatility over the next few weeks, especially as the estimated ‘x-date’ comes closer into view. As discussed above, assuming a deal is reached, the focus should return to the US Fed’s ongoing inflation fight. And based on the still high/sticky US inflation pulse, we believe that market pricing looking for ~3 rate cuts by January is misplaced. A shift up towards a ‘higher for longer’ outlook is likely to provide the USD (and USD/SGD) with some further support, in our opinion.

SGD event radar: Japan CPI (Fri), Fed Chair Powell Speaks (Sat), Singapore CPI (23rd May), Eurozone PMIs (23rd May), US PCE Deflator (26th May), China PMIs (31st May).

SGD levels to watch (support / resistance): 1.3250, 1.3327 / 1.3440, 1.3500