• Growth worries. Global growth concerns re-emerged after a run of soft data, particularly out of China. Copper is at its lowest since late-November.

• Risk off tone. Bond yields fell back & the USD strengthened. The Bank of England hiked again, but questions about how much more it will do remain.

• AUD weaker. The negative backdrop has seen the AUD underperform. We expect this challenging environment to remain in place for a while yet.

Concerns about global growth picked up overnight following a string of softer than anticipated data, particularly out of China. US equity markets eased modestly (S&P500 -0.2%), though within that sectors like energy, materials, industrials, and real estate underperformed. Pressures across the US regional banks also returned. PacWest Bancorp said it saw a ~10% fall in total deposits last week. As a result, its share price tumbled ~23%, and this spilled over across the sector. Bond yields were also a bit lower in the US and Europe, with the risk-off tone supporting a bigger move at the longer end of the curve. The US 10-year yield fell ~5bps to 3.39%, near the bottom of its 2023 range.

Elsewhere, commodity prices were broadly weaker. Oil prices declined by ~1.5%, while base metals like copper and aluminum fell ~2-4%. The copper price, typically a barometer for global growth given its wide-ranging applications, hit its lowest point since late-November 2022. These macro trends flowed through to FX. The USD is firmer, with EUR slipping down towards ~1.09 and GBP dipping to ~1.25 despite the Bank of England raising rates by another 25bps to 4.5% (a 15-year high) and keeping the door open to do more in the near-term if price pressures persist. The backdrop has unsurprisingly seen commodity currencies like the AUD and NZD weaken. The AUD is back down near ~$0.67.

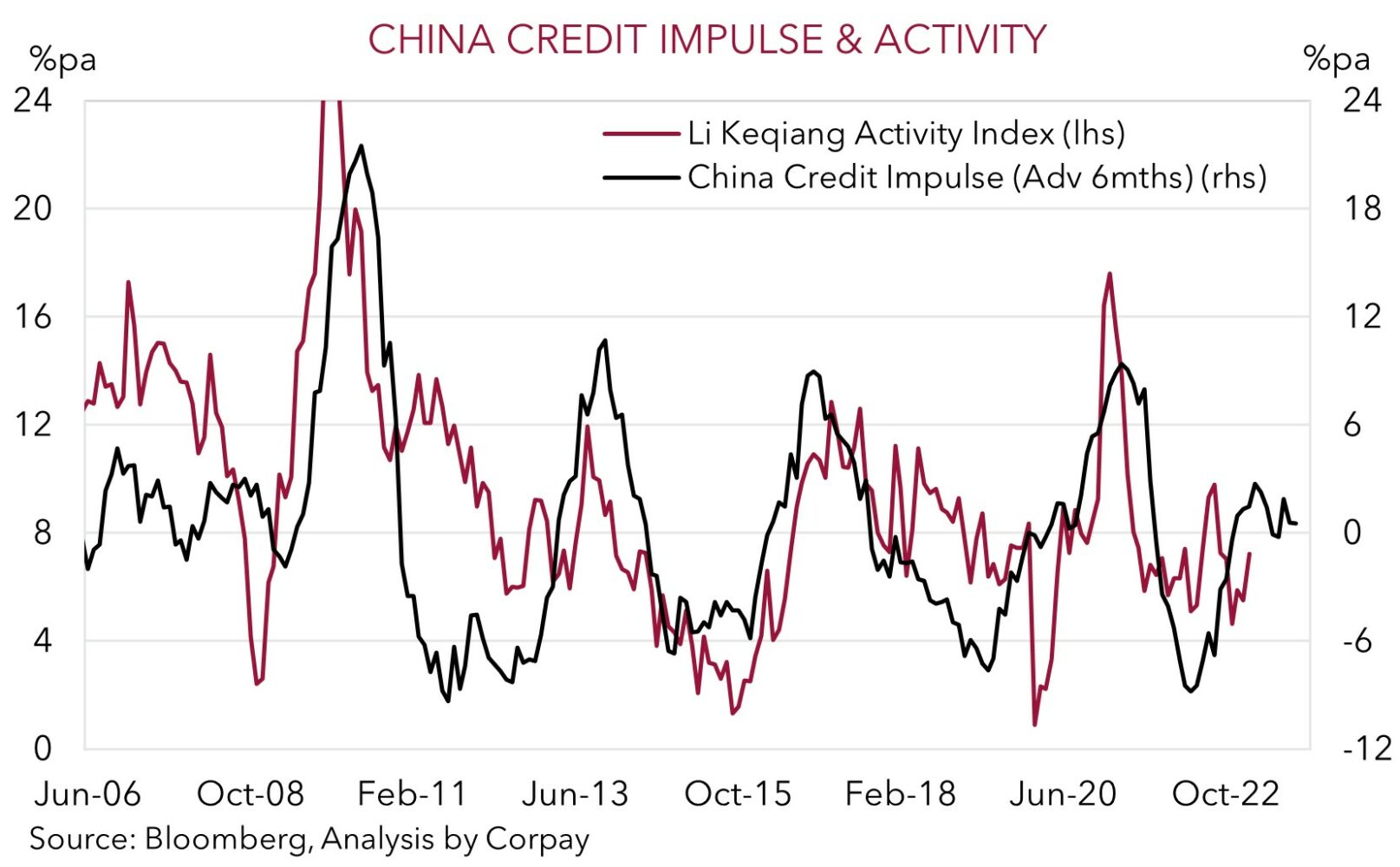

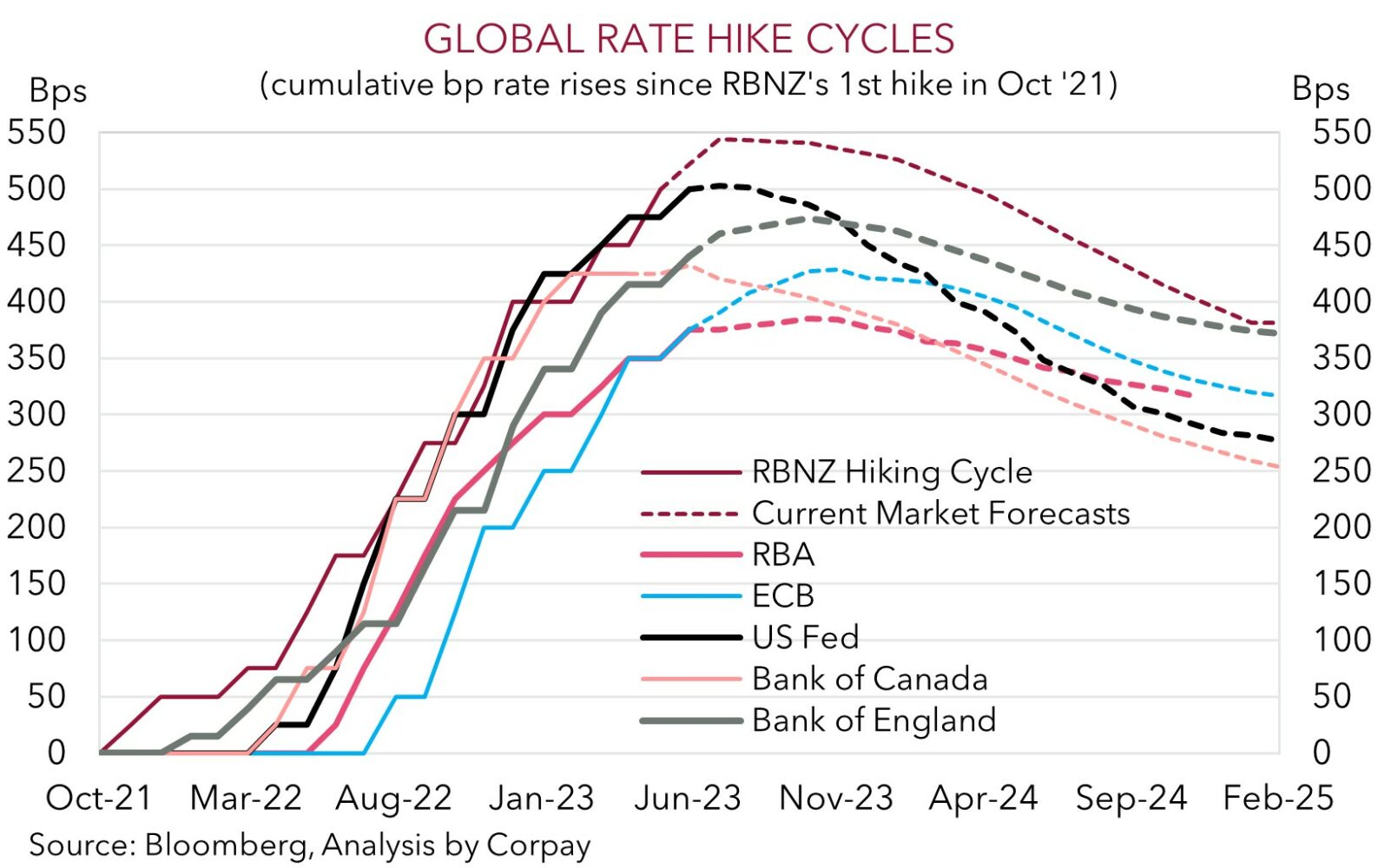

Data wise, US producer price inflation (a gauge of pipeline pressures) was a bit softer than predicted, while initial jobless claims (one of the best and most timely reads on the US labour market) edged up to 264,000. This is a high since October 2021 and shows that the very tight labour market is starting to crack under the weight of tighter credit conditions and slowing growth. Things are moving in the right direction for the US Fed, but in our view, not at the pace that justifies the aggressive market pricing looking for four rate cuts by January 2024 (see Market Musings: US inflation: still a long way from home). In China, inflation and credit data were weaker than expected. In contrast to the rest of the world China doesn’t have an inflation problem, with CPI rising by just 0.1%pa in April. From an activity (and in turn commodity demand) perspective, the sluggish credit growth compounds data released earlier this week showing that imports contracted in the year to April. Growth in imports is a yardstick of domestic momentum. The run of data is raising fears that China’s post-COVID lockdown recovery is faltering. Indeed, as our chart shows, China’s credit impulse looks to have hit a ceiling, and this doesn’t tend to bode well for future growth, commodities, and/or cyclical currencies like the AUD, NZD, and Asian FX.

Global event radar: US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD corner

A relatively rough 24hrs for the AUD with global growth worries and softer than anticipated credit data out of China weighing on commodities (see above). When combined with the firmer USD, the AUD has dipped down towards ~$0.67 (~1.7% below this week’s high). The more negative backdrop has also seen the AUD underperform on the crosses. AUD/EUR has edged back under its 50-day moving average (~0.6148), AUD/NZD has drifted down towards ~1.0640, and AUD/JPY is tracking near ~90 (~2.4% below the 2 May high point). AUD/GBP has also come off its recent highs following last nights BoE rate hike decision. We think AUD/GBP can fall back further near-term with relative interest rate expectations continuing to favour the BoE over the RBA.

In our view, the unfolding global economic slowdown should intensify over coming months, as the large jump up in interest rates and tighter credit conditions around the world constrain activity. Signs that China’s post-COVID lockdown recovery is faltering is an added headwind. Compounding the growth challenges are the still elevated core inflation pressures and signs that improvement on this front is slow going. We believe markets have become too optimistic in their thoughts about how far/fast inflation, particularly in the US, may slow from here, and in turn what this could mean for interest rates. Barring an exogenous shock (which would also be quite a negative for risk markets and the AUD) we don’t think the market’s current outlook for the US Fed is consistent with historical trends and US’ underlying inflation dynamics. We think risks are skewed to markets being caught out and for aggressive US Fed rate cut bets to be pared back over the period ahead. If realised, we expect this to generate additional market volatility and help the USD recover some more lost ground (see Market Musings: US inflation: still a long way from home).

Overall, recent trends support our existing thinking that the AUD should face a difficult backdrop over the near-term as the ‘aftershocks’ from the very fast global tightening cycle continue to show up across economies and markets. As outlined previously, this is normally a setting that favours currencies like the USD, EUR and JPY over cyclical ones like the AUD (see Market Musings: Buckle up, volatility should continue). We are anticipating the AUD to track in a ~$0.66-0.6850 range over the next few months, before kicking on into the low ~$0.70s by early-2024 as the worst of the downturn passes, and currencies like the AUD receive a boost from improved risk appetite and a relative recovery in global growth momentum.

AUD event radar: US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD levels to watch (support / resistance): 0.6595, 0.6685 / 0.6791, 0.6858

SGD corner

USD/SGD has risen towards its 100-day moving average (~$1.3329) overnight, with the shaky risk sentiment stemming from concerns about global growth and firmer USD the drivers (see above). We remain of the opinion that the USD (and USD/SGD) can continue to bounce back over the period ahead. In our judgement, market expectations looking for a string of rate cuts by the US Fed over H2 2023 aren’t likely to materialise based on the still very high US inflation. We think a paring back of this rate cut pricing towards a ‘higher for longer’ view could provide the USD with some further support. At the same time, we also believe the unfolding slowdown in the global economy, as the impacts of the past rate hikes come to the surface, is likely to generate market volatility. This is typically a negative environment for currencies like the SGD which are leveraged to the global cycle.

SGD event radar: US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Singapore CPI (23rd May), Eurozone PMIs (23rd May), US PCE Deflator (26th May), China PMIs (31st May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3347, 1.3377