• US inflation. Some tentative signs the US inflation pulse is cooling. But core inflation remains a long way from the Fed’s target.

• Fed pricing. Interest rate markets appear too eager to price in the Fed cutting cycle. Expectations that cuts could start as soon as July look misplaced.

• AUD resistance. AUD ticked up, but again found resistance ~$0.68. Another Bank of England rate hike & hawkish tone could see AUD/GBP slip back.

Mixed fortunes and choppy trade across markets, with the latest US inflation print in focus overnight. US equities endured some intra-day volatility but ended the day in positive territory (S&P500 +0.5%) as bond yields slumped on what we judge to be only some very modest signs the underlying inflation pulse is cooling. The US 2-year yield fell ~11bps to 3.91% (where is was trading last Friday) as expectations the US Fed could soon kick off a policy easing cycle intensified. Market pricing for the US Fed is now baking in nearly half a rate cut by the July meeting and around 4 full rate cuts by January 2024. As discussed below we think this is inconsistent with historical trends and the underlying inflation dynamics. We believe this is leaving markets vulnerable to a repricing over the period ahead. FX moves have been modest. The USD Index lost a bit of ground over the day, with EUR ticking up towards ~1.0980 and the yield sensitive USD/JPY dipping to ~134.30. The AUD whipped around but at ~$0.6775 it is only around 0.2% higher compared to this time yesterday.

In terms of the data, US headline inflation cooled ever so slightly from 4.987%pa to 4.957%pa, with core inflation (i.e. excluding food and energy) still tracking at a high 5.5%pa (down from 5.6%pa last month). Markets, particularly bond participants, appear to have been buoyed by a slowing in services inflation excluding housing, a measure closing watched by the US Fed. However, a closer look suggests some large temporary falls in travel related components was the driver. Other non-housing services prices remain strong, consistent with the still tight US labour market and high wage growth.

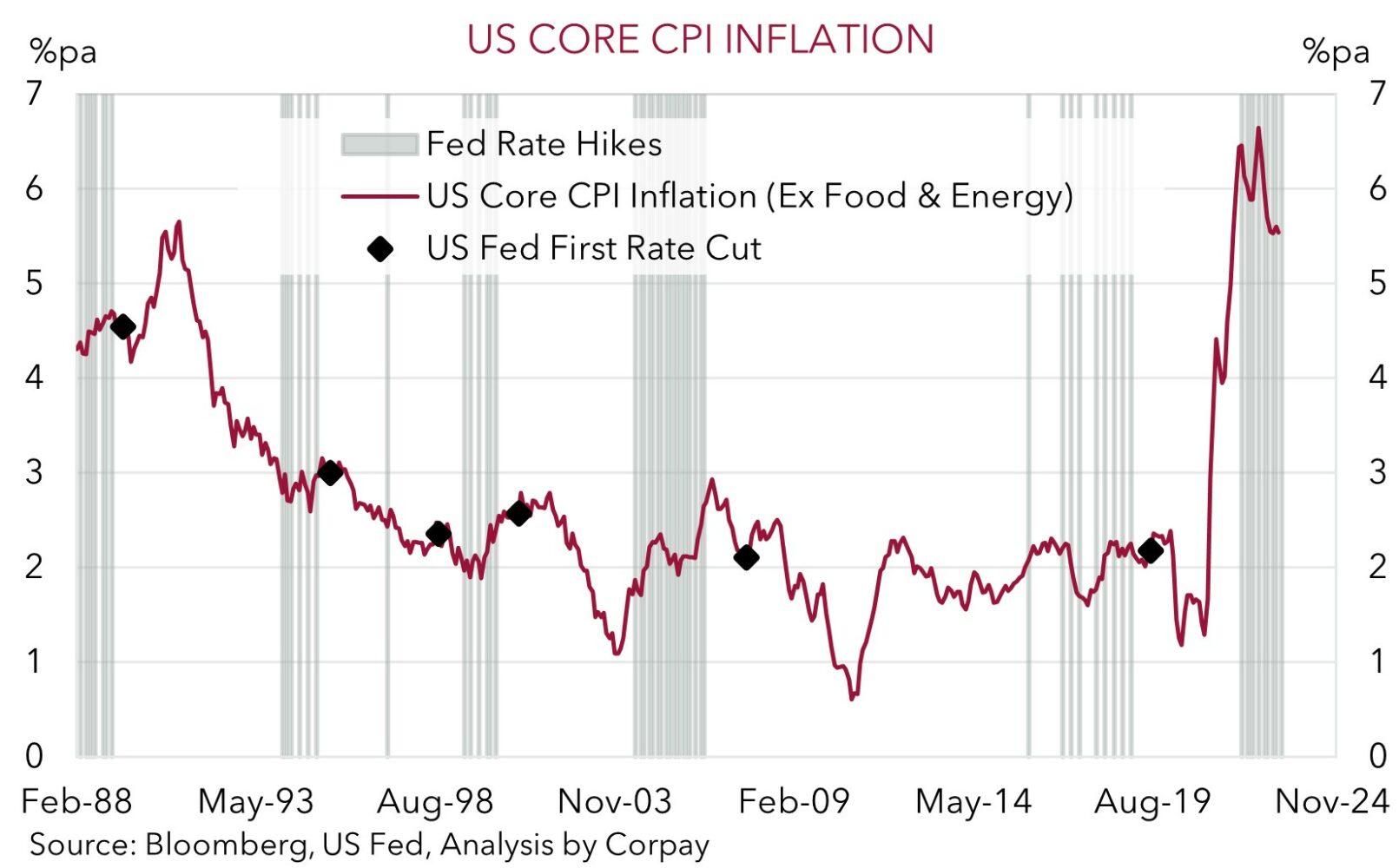

Looking ahead, while annual inflation should moderate a bit further over the next 1-2 months, as the last of last year’s large price increases roll out of calculations, US inflation looks like it could settle at uncomfortably high rates once these base-effects run their course. While we don’t believe the Fed is likely to hike rates again, we also don’t see rate cuts coming through for some time, and think pricing looking for a quick U-turn is misplaced. The Fed is a student of history, and a lesson from the 1970’s inflation experience was for policymakers to keep policy ‘restrictive’ for an extended period to ensure inflation has washed out of the system. More recent history also suggests Fed cuts could be a long way off. As our chart shows, over the past 5 Fed easing cycles, US core inflation averaged ~2.3%pa at the time of the first cut. Even optimistic forecasts don’t see core inflation this low for at least another year. We continue to think that over the next few months an unwind of US rate cut expectations could generate market volatility and give the USD some renewed support.

Global event radar: Bank of England Meeting (Tonight), US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD corner

The AUD experienced a modest amount of volatility around the US CPI inflation release overnight, but on net at ~$0.6775 it is only around 0.2% higher compared to this time yesterday. As it has done repeatedly over the past few months, the AUD is finding stiff resistance just above ~$0.68.

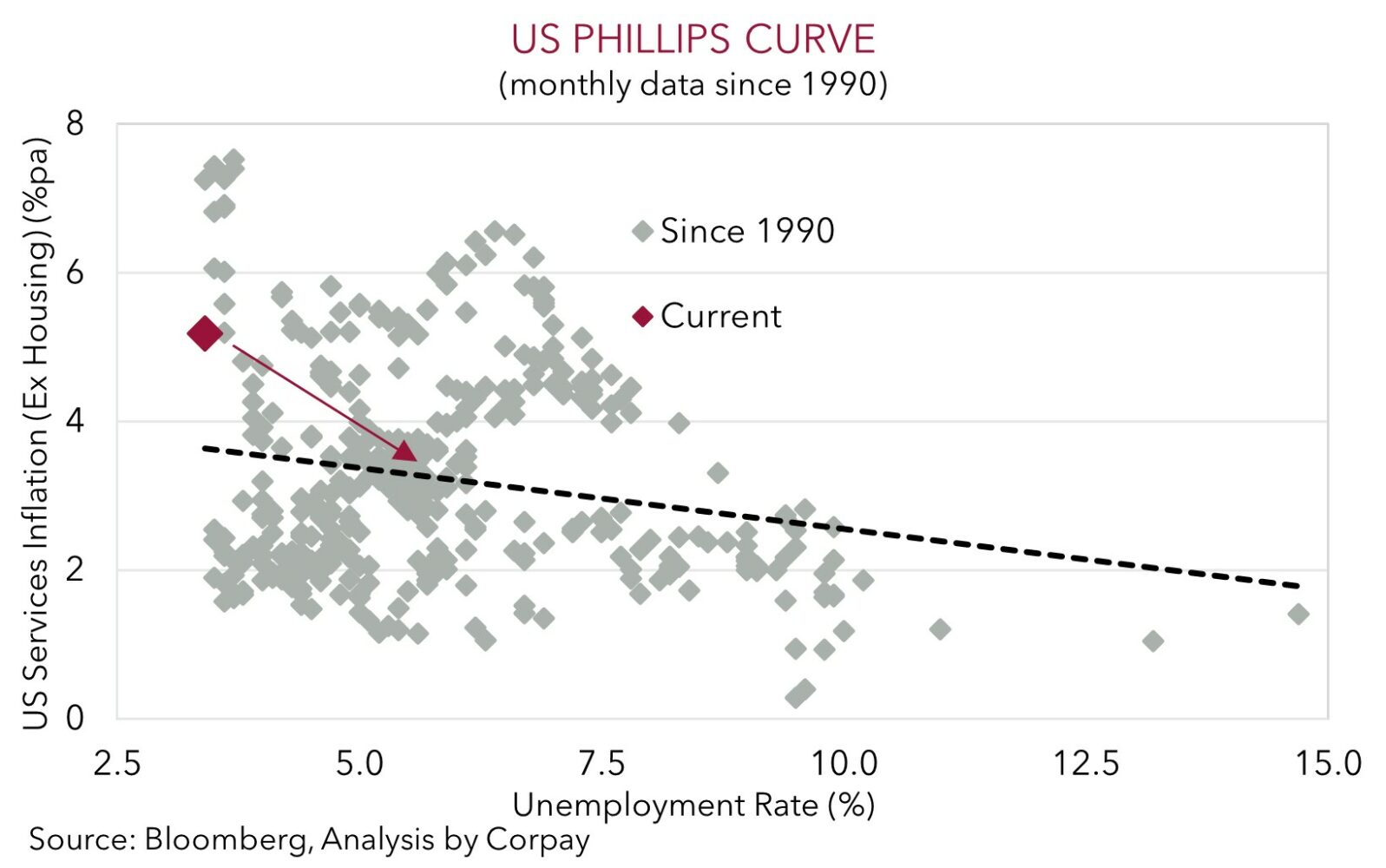

As discussed above, US markets, particularly bonds, latched onto some tentative signs that the US inflation pulse is cooling. However, at ~5.5%pa, core inflation (i.e. excluding food and energy) remains uncomfortably high, and we expect further progress from here to be glacial given the elevated ‘sticky’ services prices and still tight labour market. Underlying services inflation is linked to wages. As our scatter chart illustrates, to get to rates consistent with the Fed’s target, US unemployment (now 3.4%) needs to rise towards ~5-5.5%. And for that to occur, policy settings will need to stay ‘restrictive’ for an extended period for the US economy to slow and for the labour market to weaken. As mentioned, we don’t agree with market pricing looking for US rate cuts to potentially start to come through as soon as the July Fed meeting. Over the next month or so, we think an upward adjustment to a ‘high for longer’ plateau in US interest rates could see the USD bounce back, and this could create headwinds and act to bring the AUD back down, particularly as it is likely to be occurring at the time global growth is slowing.

On the crosses, AUD/GBP has rebounded over the past couple of weeks, rising by over 2% from its late-April low to be back around 0.5368. The Bank of England policy decision is tonight (9pm AEST), with Governor Bailey also speaking (from 9:30pm AEST). We, and the broader consensus, expect the BoE to hike rates by another 25bps. This would take the BoE bank rate to 4.5%. Given the high and sticky UK inflation, we think that the BoE will have more work to do beyond tonight. We believe signals from the BoE that it still open to further tightening could see AUD/GBP give back some of its recent gains.

AUD event radar: Bank of England Meeting (Tonight), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD levels to watch (support / resistance): 0.6595, 0.6687 / 0.6792, 0.6858

SGD corner

USD/SGD has slipped back a bit, but at ~$1.3250 it is only trading where it was earlier this week. As mentioned above, the USD index gave back a little ground overnight with the slight slowing in US inflation seeing expectations of a US Fed rate cutting cycle build and this generated a fall in US bond yields (see above). However, as discussed, we think bond market participants may be getting ahead of themselves. US core inflation remains very high (now 5.5%pa), with the still tight US labour market underpinning ‘sticky’ services prices. In our view, the US Fed is a long way from starting to cut interest rates. We think a paring back of the aggressive US rate cut expectations could see the USD (and USD/SGD) rebound over the period ahead.

SGD event radar: Bank of England Meeting (Tonight), US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Singapore CPI (23rd May), Eurozone PMIs (23rd May), US PCE Deflator (26th May), China PMIs (31st May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3333, 1.3351