• Cautious tone. US debt ceiling concerns, more signs of a global slowdown, & tonight’s US CPI inflation data are on investors minds.

• US CPI. Markets now assuming no further Fed rate hikes & are factoring in over two cuts by year-end. Another high core inflation print could see rate cut bets pared back, supporting the USD.

• Budget relief. Targeted measures aimed at low income households should provide some cost of living relief. But will it lead to more inflation down the track?

Markets traded a bit more cautiously overnight with US debt ceiling concerns, more signs of a global slowdown, and tonight’s US CPI inflation data on investors minds. US equities recorded modest falls (S&P500 -0.5%), while US bond yields ticked up slightly (US 2-year rose 2bps to 4.02%), and the USD was a bit firmer. Across the FX majors, EUR has slipped back below ~1.10, USD/JPY is hovering a touch over 135, and the AUD has drifted down towards ~$0.6760.

In terms of the US debt ceiling, as it has done repeatedly over the past few years, things are once again going down to the wire. The ‘x-date’ is coming up fast, with US Treasury Secretary Yellen recently warning that without action the US could exhaust its ability to meet its obligations by 1 June. Both sides of US politics are pushing back on a short-term extension. But anything longer term would require compromise, and the fractured state of US politics means this could be very difficult to achieve. Importantly, there are only a limited number of days the US House and Senate are in session, and President Biden is in town over the rest of May. In our view, the further we move into May without a deal, the higher market anxiety levels (and volatility) could go.

Growth-wise, yesterday’s China trade data added to signs global momentum is slowing. Annual growth in China’s exports stepped down to 8.5%pa, while imports (a guide to domestic activity) declined more than expected (-7.9%pa). Weakening imports, particularly in raw materials and energy, indicate that China’s post COVID recovery, which is being driven by a rebound in consumer spending on services, is having limited flow through for the rest of the world. This is different to previous growth upswings which were led by commodity-intensive infrastructure spending.

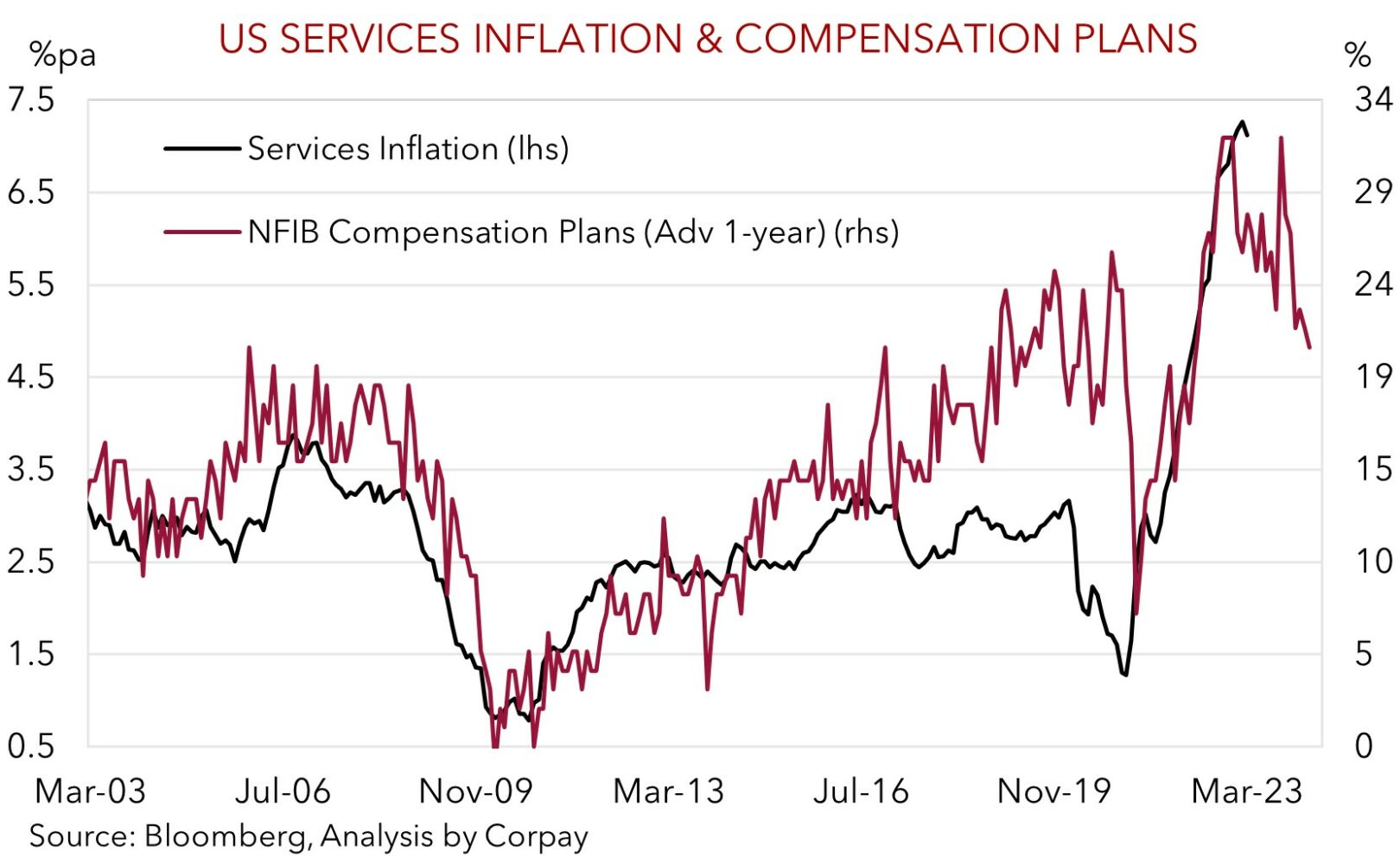

For markets the focus will now be on the US CPI report (10:30pm AEST). Consensus expectations are for headline inflation to hold steady at ~5%pa, and for core inflation to tick down slightly to ~5.5%pa. Given interest rate markets are now assuming no further rate hikes by the US Fed and are factoring in over two rate cuts over H2 2023, we think there could be an uneven reaction to the data, with a ‘positive’ surprise likely to generate a larger lift in US yields and the USD. More broadly, as our chart shows, leading indicators suggest the turn in core/services inflation to the required 2-2.5%pa could take some time, and this will require an extended period of tight policy. This is something NY Fed President Williams reiterated again overnight.

Global event radar: US CPI (Tonight), Bank of England Meeting (Thurs), US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD corner

The AUD has eased back towards ~$0.6760, with the firmer USD and dip in US equity markets exerting some downward pressure overnight. On the crosses, the AUD has had a mixed 24hrs. While AUD/EUR and AUD/JPY are still up around recent highs, the AUD has lost a bit of ground against GBP and NZD.

The Federal Budget was handed down last night. The budget is expected to be in surplus for 2022-23 (~$4.2bn or ~0.2% of GDP). This is a dramatic turnaround, with the budget position helped by higher commodity prices and low unemployment. This will be the first surplus since 2007-08. Further out, the budget is expected to swing back into small deficits, although less than previously projected. In terms of the key initiatives, the centerpiece was the measures aimed at easing cost of living pressures on lower income households. The measures included rental assistance, energy price relief, modest increases to welfare payments, and changes to some health costs. The measures were strategically crafted in a way that should mechanically dampen ‘measured’ inflation, however the lift in the tobacco excise works in the other direction.

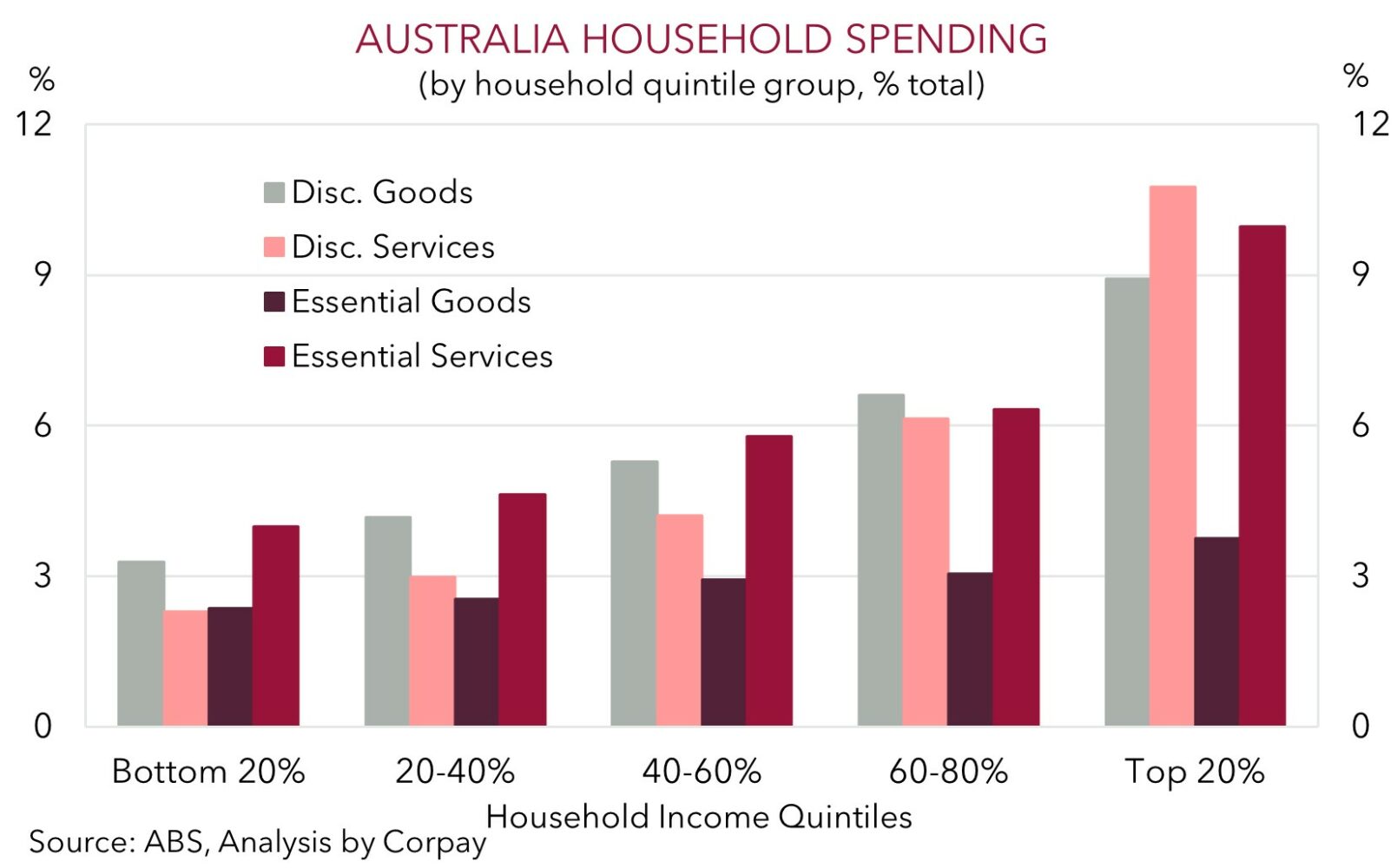

A debate is whether the ‘relief’ measures will also lead to relatively greater spending by households and in turn higher inflation down the track. We don’t think they will. While it is a risk, the measures are targeted towards lower income households, which as our chart shows, account for a disproportionately small share of consumer spending, particularly on ‘discretionary’ items. And the bigger picture headwinds for consumers, such as rising mortgage costs, lower sentiment and greater economic uncertainty remain firmly in place. These negative trends were illustrated yesterday by data showing retail sales volumes fell again in Q1. Volumes are a gauge of underlying demand. This is the first back-to-back fall in quarterly retail volumes in over a decade.

Tonight’s US CPI inflation data is the next AUD focal point (10:30pm AEST). As discussed above, based on where US interest rate expectations now sit, we believe there could be an asymmetric market reaction to the data. We think that US core inflation holding up at a high ~5.5-5.6%pa could see markets unwind expectations looking for over two rate cuts by the US Fed over H2 2023. If realised, we think this could give the USD some renewed support and weigh a bit on the AUD.

AUD event radar: US CPI (Tonight), Bank of England Meeting (Thurs), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD levels to watch (support / resistance): 0.6595, 0.6685 / 0.6790, 0.6858

SGD corner

USD/SGD has nudged back up towards ~$1.3270 on the back of the firmer USD (see above). As outlined, for markets the US CPI inflation report (released tonight) is the next major data release and event risk. Given the tightness in the US labour market and elevated wage growth we think core inflation is likely to have held up at an elevated ~5.5-5.6%pa in April. In our judgement, this ‘sticky’ strong US inflation pulse could support an upward repricing in US interest rate expectations. Markets are now assuming no further rate hikes by the US Fed, and they are also factoring in more than two rate cuts over H2 2023. We don’t expect this to happen. We think a paring back of US rate cut expectations could see the USD (and USD/SGD) bounce back over the period ahead.

SGD event radar: US CPI (Tonight), Bank of England Meeting (Thurs), US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Singapore CPI (23rd May), Eurozone PMIs (23rd May), US PCE Deflator (26th May), China PMIs (31st May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3336, 1.3377