• Hawkish Fed. Chair Powell pointed to rates rising even higher than previously thought, with the door to larger hikes still open.

• Market repricing. US rate expectations have risen, supporting the USD. While the outlook for the RBA has been pared back following tweaks to its guidance.

• AUD slump. The diverging RBA and Fed outlooks has weighed on the AUD. The shift in thinking can keep the AUD under pressure near-term.

Market attention was on US Fed Chair Powell’s Congressional Testimony overnight, and he didn’t disappoint. In line with our thinking, which we have highlighted over the past few days, Chair Powell strongly ruffled his hawkish feathers. Chair Powell noted that while inflation has started to turn, getting it back down to 2% “has a long way to go and is likely to be bumpy”. Importantly, he also emphasized that the recent run of stronger economic data suggests that “the ultimate level of interest rates is likely to be higher than previously anticipated”, and that if the data “indicated that faster tightening is warranted, we would be prepared to increase the pace of rate hikes”.

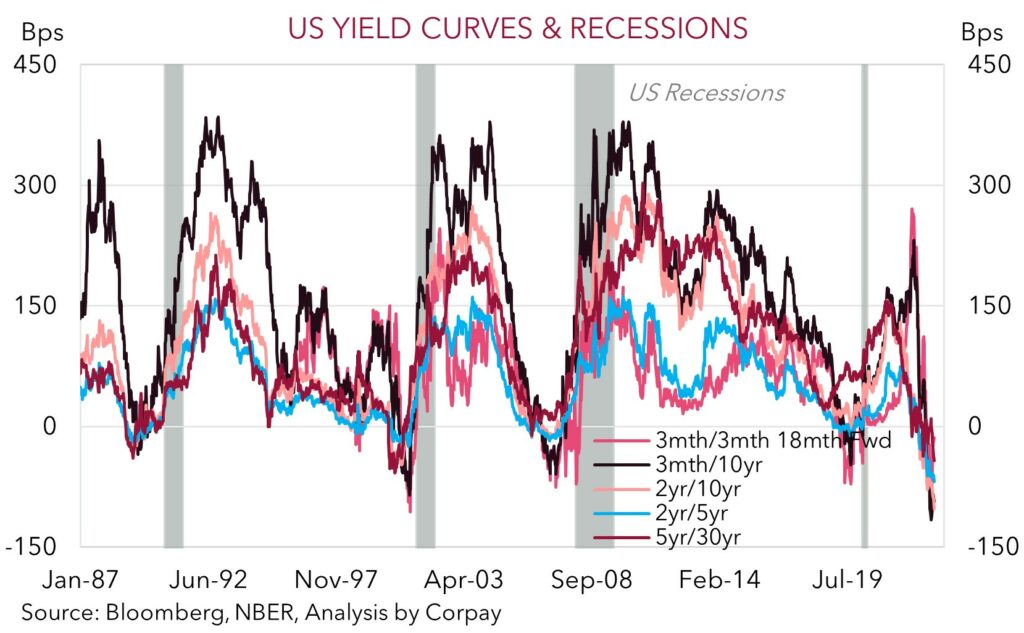

The double dose of hawkishness by Chair Powell cascaded through markets. US bond yields rose, led by the front-end of the curve as markets scrambled to factor in further Fed rate hikes. The US 2yr yield spiked 12bps to 5% (a high since mid-2007). The Fed funds rate (currently 4.75%) is now expected to peak at ~5.64% in Q3, with any expectations of an eventual rate cutting cycle also watered down. The larger move in short-dated bonds has seen various US yield curves invert further. As our chart shows, the key yields curves that have a long history of signaling future US recessions are quite negative now. This supports our earlier thinking that complacent markets had become vulnerable to a policy and/or growth ‘reality check’ over mid-year, with volatility set to pick up (see Market Musings: Reality check, phase two).

The interest rate repricing exerted some pressure on equities, with the US S&P500 falling by 1.5%. Energy and base metal prices were also lower, with oil underperforming (Brent crude fell ~3.5%). In FX, the USD strengthened, with the USD Index moving above its 100-day moving average (105.53) for the first time since November. EUR more than unwound its recent bounce and is near 1.0550, the interest rate sensitive USD/JPY has risen above 137, and GBP tumbled back under 1.1850 as the Fed comments were compounded by a warning from the Bank of England’s Mann that the pound could fall further if the BoE doesn’t keep pace with other central banks. The AUD has also declined sharply, down ~2% over the past 24hrs to be under $0.66, on the back of the diverging Fed and RBA outlooks.

Fed Chair Powell speaks again tonight, and the US labour market report is released at the end of the week. Powell’s message shouldn’t change, and the data is expected to show labour market conditions remain tight. In our view, this should keep US interest rate expectations elevated and continue to support the USD.

Global event radar: US Fed Chair Powell Speaks (Tonight), Bank of Canada Meeting (Tonight), BoJ Meeting (Fri), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

AUD corner

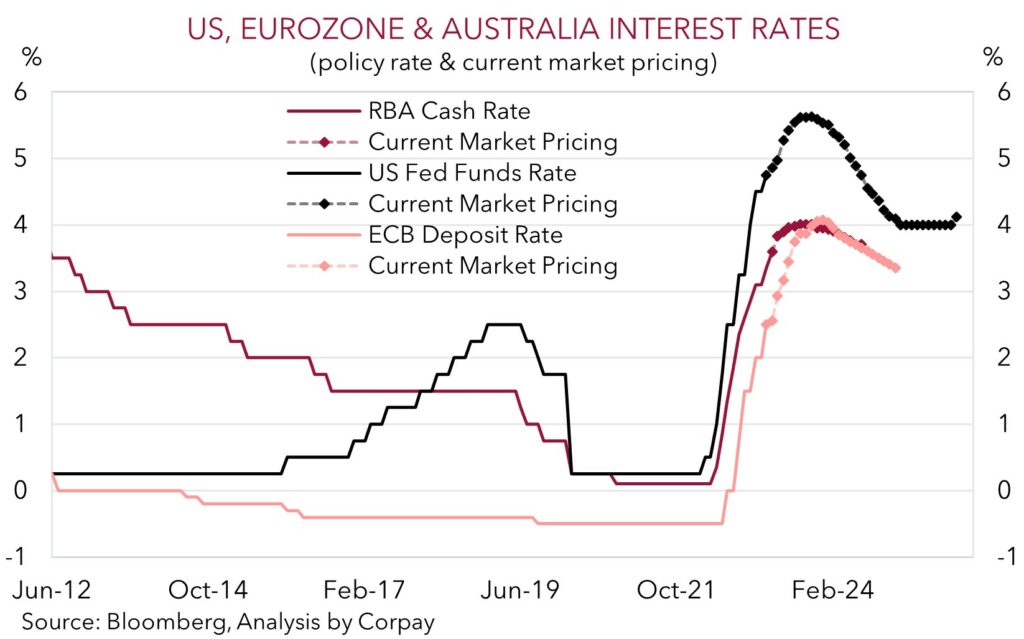

AUD has fallen by ~2.6% from last week’s close, to be back below $0.66 for the first time since mid-November. The risks we have been flagging, on both sides of the ledger, have crystallised. On the US side the ‘hawkish’ message from Fed Chair Powell overnight has seen interest rate expectations jump up. This has dampened risk sentiment, weighed on commodity prices, and boosted the USD (see above). At the same time, the RBA looks to be taking things off autopilot and appears set to take a more measured and staggered data-dependent approach in its rate hikes from here. At yesterday’s meeting the RBA lifted rates by another 25bps, taking the cash rate to 3.6%. However, while the RBA retains a tightening bias, it is also noting that “in assessing when and how much further interest rates need to increase” the data flow has become more important. Based on the slowdown coming through in parts of the economy, and the policy lags, we continue to see the RBA cash rate topping out at ~3.85%, possibly 4.10%, over the next few months, with the next 25bp hike not necessarily coming in April (see Market Wire: RBA in the home straight).

FX is a relative price, and the diverging outlooks for the US Fed and RBA has seen relative interest rate expectations move further in the USD’s favour. In our opinion, this should continue to keep the AUD under downward pressure in the near-term, though at the same time, the elevated level of commodity prices and the positive flows generated by Australia’s move to a current account surplus (now ~1% of GDP compared to a long run average of a ~3% deficit) are offsetting factors that can limit the extent and speed of any further falls. It is also worth noting that since 2015, the AUD has only spent ~3.5% of the time at $0.65 or below, with exogenous shocks like the USD liquidity squeeze at the start of COVID and last years fears of a deep European/global recession the catalysts. AUD intra-volatility should remain elevated today. In addition to another appearance by Fed Chair Powell, RBA Governor Lowe is speaking this morning on “inflation and recent economic data”.

On the crosses, we continue to see AUD/EUR moving down towards ~0.60, with the shift in thinking around how high ECB and RBA interest rates could reach this cycle a factor that should guide the pair lower (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). Added to that, signs China is pivoting away from infrastructure-led growth and towards more labour-intensive consumer-driven activity should favour the EUR given the Eurozone arguably has stronger linkages to this side of the story.

AUD event radar: RBA Governor Lowe Speaks (Today), US Fed Chair Powell Speaks (Tonight), Bank of Canada Meeting (Tonight), BoJ Meeting (Fri), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar), AU Retail Sales (28th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

AUD levels to watch (support / resistance): 0.6490, 0.6522 / 0.6680, 0.6756

SGD corner

USD/SGD has pushed up towards its 100-day moving average (1.3551) on the back of the upward repricing in US interest rate expectations and stronger USD (see above). The ‘hawkish’ message from Chair Powell is inline with our view that the Fed still has work to do, and that given the US’ sticky services-driven inflation policy will need to remain ‘restrictive’ for an extended period to ensure the job is done.

We think the upswing in US yields should continue to underpin the USD in the short-term. As a result, we believe that USD/SGD can edge up further, and that any near-term retracements should be limited. Fed Chair Powell speaks again tonight. We expect his ‘hawkish’ tone to be repeated. Moreover, we think the US labour market data, released at the end of this week, is likely to again show that conditions remain tight. Another strong US labour market report should, in our opinion, further open the door to the Fed seriously considering a larger 50bp hike at the 23 March meeting.

SGD event radar: Fed Chair Powell Speaks (Tonight), BoJ Meeting (Fri), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

SGD levels to watch (support / resistance): 1.3313, 1.3377 / 1.3551, 1.3590