• ECB repricing. Hawkish comments reinforced expectations the ECB could raise rates aggressively over future meetings. This supported the EUR.

• Fed in focus. US Fed Chair Powell speaks tonight. We think the run of US data should see Chair Powell reiterate that the Fed has more work to do.

• Another RBA hike. RBA expected to raise rates another 25bps today. But will it tinker with its forward-looking policy guidance?

A quiet start to the week, though there were some divergences across asset markets with the underlying theme of central banks continuing to raise rates to fight inflation still front-of-mind. Following Friday’s pullback bond yields rebounded, particularly in Europe where yields in German rose 3-10bps across the curve as hawkish rhetoric from an ECB official bolstered expectations the central bank could deliver a string of 50bp rate hikes. Markets are now factoring in another ~160bps worth of tightening by the ECB over 2023. As a result, the German 2yr yield (now 3.32%) is at its highest level since October 2008.

The upward repricing helped push the EUR back up towards 1.07, ~1.3% above its late-February low. When combined with the weekend news of China’s underwhelming 5% 2023 growth target, AUD/EUR has slipped back to 0.63 for the first time this year. The higher European rates spilled over into the US, though not to the same extent. US yields ticked up ~3bps, with the US 10yr edging up towards 4%. Elsewhere, US equities consolidated, Brent crude oil and base metal prices increased by a modest ~0.3-0.5%, while the stronger EUR has seen the USD Index give back some ground (EUR accounts for ~58% of the USD Index).

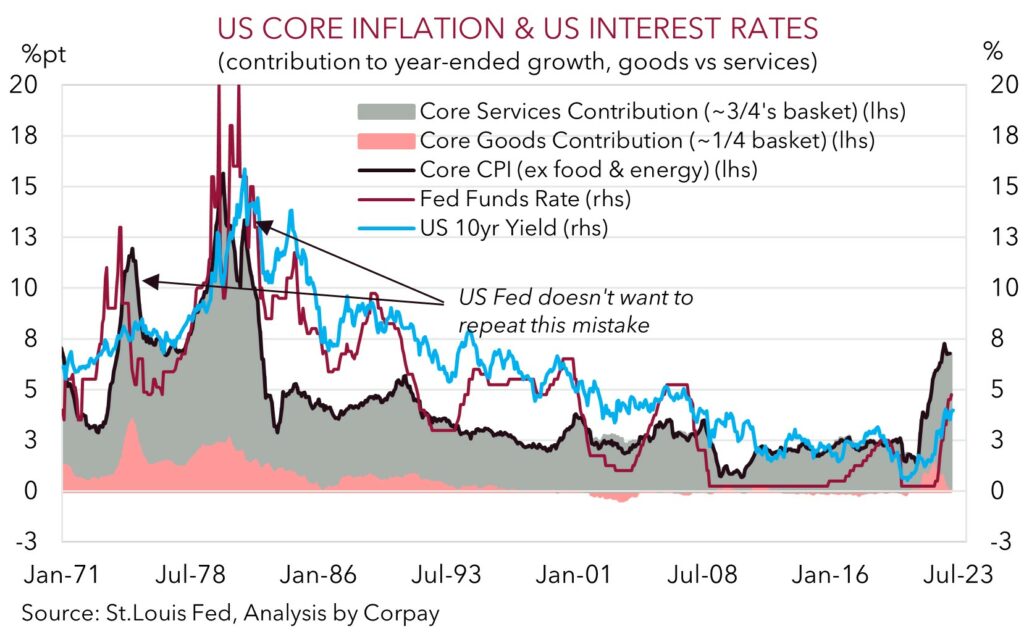

Market attention will be on US Fed Chair Powell’s Congressional Testimony (tonight from 2am AEDT). Focus will be on Powell’s views regarding the recent run of US economic and inflation data, and his thoughts about how high the Fed funds rate could reach and how long ‘restrictive’ settings could be needed in the battle against inflation. As our chart shows, the US Fed doesn’t want to repeat the mistakes of the 1970s when policy wasn’t tightened far enough for long enough, and as a result inflation came back even stronger a few years later. In our view, Chair Powell is likely to reiterate the “hawkish” message that the Fed will keep at it until the job is done, the projected fall in inflation could be a long and bumpy road, and that ongoing economic resilience, sticky inflation or a loosening in financial conditions could be met with even more rate increases than currently anticipated. We expect this type of message to reinforce the markets elevated US interest rate expectations, which in turn should be USD supportive.

Global event radar: RBA Meeting (Today), US Fed Chair Powell Speaks (Tonight & Thurs), Bank of Canada Meeting (Thurs), BoJ Meeting (Fri), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

AUD corner

AUD remains below its 100-day moving average (0.6754), with the softer USD (thanks in large part to the bounce in the EUR, see above) outweighed by the China’s lower than anticipated growth target. Headwinds for the AUD are likely to remain in place, in our opinion.

On the US side, Fed Chair Powell testifies to Congress (tonight from 2am AEDT). As outlined above, we think the underlying message from Powell should remain ‘hawkish’ given the recent run of US economic data, loosening in financial conditions, and elevated inflation. We think this is likely to reinforce the market’s US interest rate pricing, which could support the USD and dampen risk sentiment. The market is factoring in the Fed funds rate, currently 4.75%, to peak at ~5.45% in Q3.

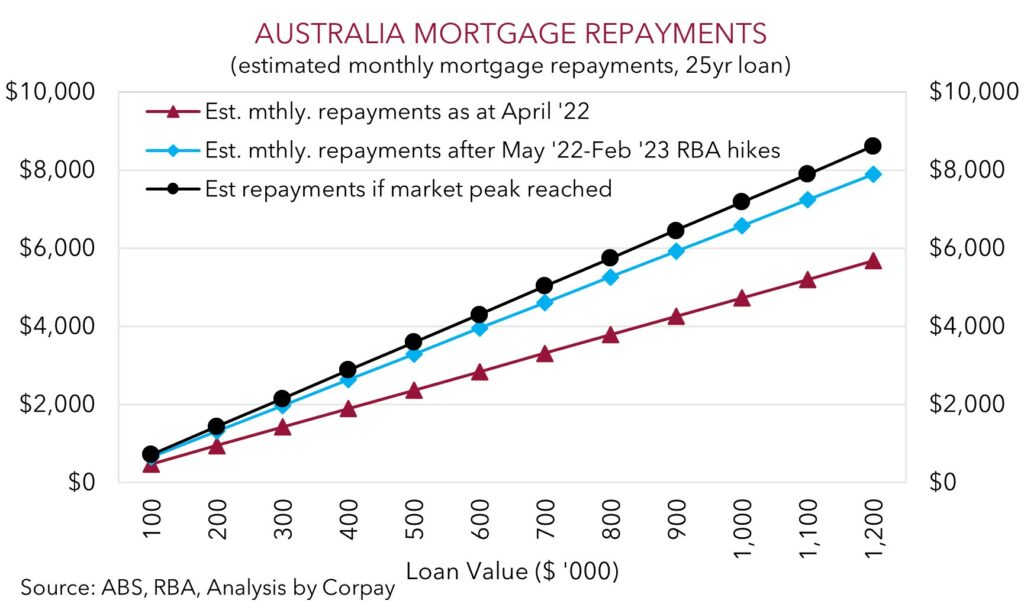

Locally, the RBA is universally expected to raise rates by another 25bps at today’s meeting, lifting the cash rate to 3.6% (2:30pm AEDT). This would mark the 10th straight meeting the RBA has increased rates, making it the fastest and largest tightening cycle since at least the early-1990s. However, based on the delivery of this latest hike and signs the large increase in mortgage costs (see chart below) is starting to have an impact across the economy (see Market Wire: Growth Momentum Slowing), we think there is scope for the RBA to mildly soften its forward-looking policy guidance. Last month the RBA surprised by adjusting its rhetoric to “further interest rate rises are expected”. We think there is a risk this could revert to its earlier view that it “expects to increase interest rates further”. It may appear to be a bit of word play, but in our thinking, this would keep the door open to further rate rises this cycle, yet also give the RBA some flexibility based on how things unfold. If realised, this could further temper the markets expectations about how high the RBA cash rate could reach, moving relative interest rate differentials further in the US’s favour and exerting a bit more downward pressure on the AUD.

On the crosses, AUD/EUR remains on the backfoot, falling to its lowest level since late-December. We continue to see more downside, and are looking for AUD/EUR to decline to ~0.60 (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). Markets are now assuming the ECB could end up raising rates by more than the RBA this cycle, and we think the shift in relative interest rate expectations should continue to guide AUD/EUR lower. Added to that, signs China is pivoting away from infrastructure-led growth and towards more labour-intensive consumer-driven activity should favour the EUR given the Eurozone arguably has stronger linkages to this side of the story.

AUD event radar: China Trade Data (Today), RBA Meeting (Today), RBA Governor Lowe Speaks (Tomorrow), US Fed Chair Powell Speaks (Tonight & Thurs), Bank of Canada Meeting (Thurs), BoJ Meeting (Fri), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar), AU Retail Sales (28th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

AUD levels to watch (support / resistance): 0.6610, 0.6690 / 0.6789, 0.6898

SGD corner

USD/SGD has remained in tight range near ~1.3460 in the early part of this week. Our central view continues to be that USD/SGD should remain supported and that any near-term pullbacks should be modest. As mentioned above, the market focus over the next 24hrs will be US Fed Chair Powell’s Congressional Testimony. Our thinking is that the positive run of US labour and activity data, coupled with still too high inflation should see Chair Powell reiterate that the Fed’s rate hiking cycle has further to run, and that the higher level of ‘restrictive’ interest rates are set to remain in place for some time. This should, in our opinion, reinforce the upswing in US interest rate expectations and support the USD. We continue to think that USD/SGD can edge up towards its 100-day moving average (1.3558) over the period ahead.

SGD event radar: RBA Meeting (Today), Fed Chair Powell Speaks (Tonight & Thurs), BoJ Meeting (Fri), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

SGD levels to watch (support / resistance): 1.3313, 1.3377 / 1.3558, 1.3590