• Higher for longer. Markets continue to bolster their US rates outlook. Others are at a different point. The Bank of Canada paused overnight.

• US curve inversion. The jump in rate expectations has moved the US yield curve further into negative territory. The curve has a strong record of picking US downturns.

• AUD sub $0.66. Deeply negative rate differentials are a AUD headwind, but the high terms of trade is an offsetting factor.

Relatively calmer markets overnight. US equities consolidated, while bond yields ticked up further and were once again led by the front-end of the curve. The US 2yr yield rose another 6bps to be at a new multi-year high of 5.06% as markets continue to bolster their bets on how high the Fed funds rate will reach this cycle. With the US 10yr yield tracking just under 4%, the yield curve has moved further into negative territory. As mentioned yesterday, US yield curve inversions have a long track record of picking economic downturns. Since the 1940s, of the previous 4 times (1969, 1979, 1980, 1981) the US 2s10s yield curve has been more than 100bps inverted, as it is now, a US recession has either already kicked off or has happened within 8-months. Some food for thought that supports our thinking volatility could pick up over coming months as optimistic markets potentially crash up against the harsher economic reality generated by the most abrupt tightening cycle in several decades (see Market Musings: Reality check, phase two).

In FX, the USD remains near its highs, with EUR holding below 1.0550, USD/JPY above 137, and the AUD under $0.66 (~2.7% below last week’s close). USD/CAD has risen to 1.38, its highest since early-November after the Bank of Canada followed-through on its guidance and left rates unchanged at 4.5%. This was the first time in 9 meetings the BoC held steady. The BoC retained a tightening bias, noting that it will assess things and “is prepared to increase” rates further “if needed”, however markets are skeptical and the policy divergence with the US is boosting USD/CAD.

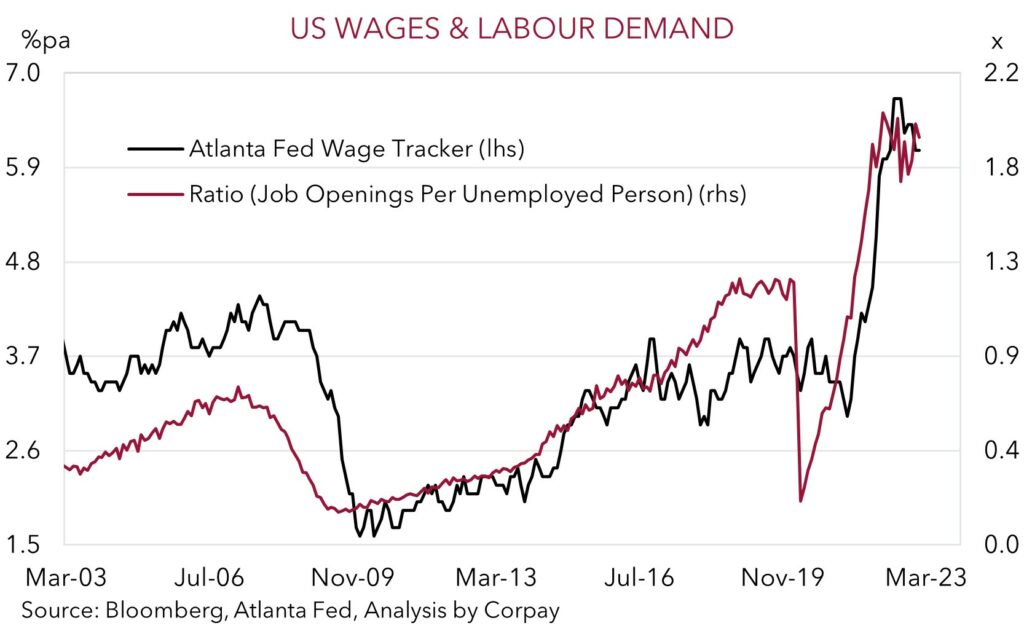

Overnight US Fed Chair Powell delivered the second round of his Congressional Testimony. Chair Powell largely repeated the same underlying hawkish message, though he did add a caveat that no decision had been made and future moves are data dependent. The upcoming US labour market (released Saturday AEDT), CPI (14th March) and retail sales (15th March) reports are key inputs ahead of the 23 March Fed meeting. We think the US labour market data should continue to show that conditions remain tight. This was the signal from indicators released overnight. ADP employment was stronger than expected, and the number of job openings (a gauge of labour demand) remains very high. As shown, there are now ~1.9 job openings for each unemployed person in the US. The excess demand is pushing up wages. For wage growth to be consistent with the Fed’s 2%pa inflation target, the ratio needs to be closer to 1. This requires slower growth and higher unemployment. The US Fed clearly has more work to do. In our view, the upswing in US interest rates should continue to underpin the USD in the near-term.

Global event radar: BoJ Meeting (Tomorrow), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

AUD corner

AUD remains sub $0.66, around ~2.7% below last week’s close and ~8% from its early-February highs. The diverging US Fed and RBA policy outlooks has seen relative interest rate expectations move heavily in the US’ favour, and this is weighing on the AUD. Expectations about how high the US Fed could raise rates this cycle and how long it may keep them there have continued to build, and this is underpinning then USD (see above). At the same time, the RBA has shifted to a more measured stage of its cycle. Following on from Tuesday’s updated guidance, in a speech yesterday Governor Lowe highlighted that with policy “now in restrictive territory” the RBA is “closer to the point” where it may “pause” its rate rises and watch how the economy unfolds. Governor Lowe called out the business survey (14th March), employment (16th March), retail sales (28th March), and monthly CPI indicator (29th March) as the local data that will influence the RBA’s April decision. As a result, AUD and Australian interest rate volatility is likely to be higher than normal around these releases.

Overall, we think that the relative interest rate outlook can keep the AUD under a bit more downward pressure in the near term. Another strong US labour market report (released Saturday morning AEDT) could raise the odds the US Fed moves by a larger 50bp clip later this month, which would likely give the USD a further boost and/or dampen risk sentiment.

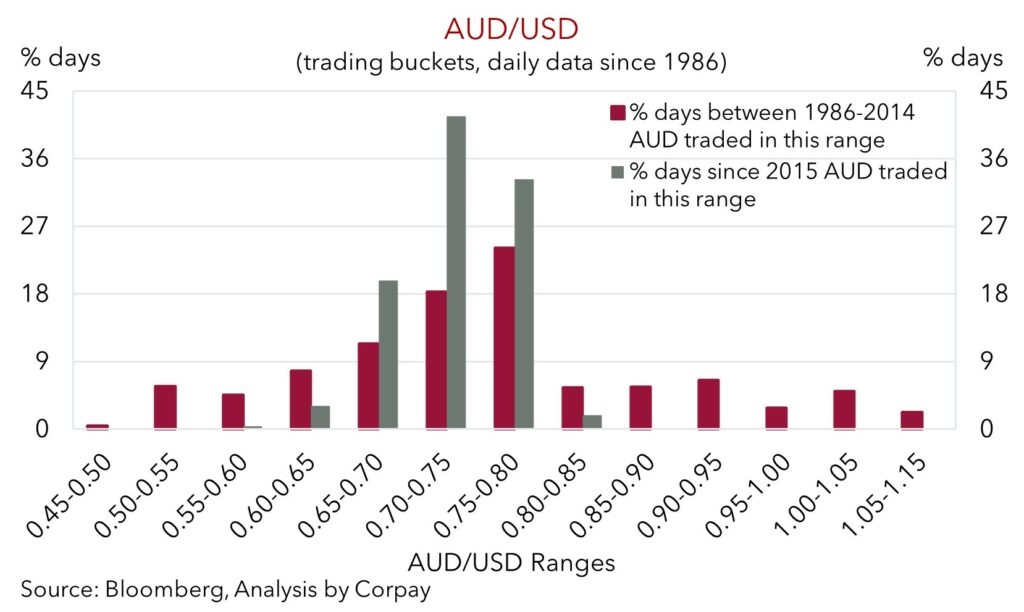

However, taking a step back, it is worth remembering that interest rates are only one part of the story, and we think differentials are unlikely to move that much further from here. The elevated level of commodity prices and the positive flows generated by Australia’s move to a current account surplus (now ~1% of GDP compared to a long run average of a ~3% deficit) are offsetting factors that should limit the speed and extent of any further falls from here, in our view. Indeed, the AUD is now trading in more rarified air. As shown, since 1986 the AUD has only been at ~$0.65 or below ~15% of the time, and the bulk of that happened pre-2015. Importantly, Australia’s terms of trade is now ~60% above its long-run average, a medium-term fundamental support for the AUD.

AUD event radar: BoJ Meeting (Tomorrow), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar), AU Retail Sales (28th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

AUD levels to watch (support / resistance): 0.6490, 0.6522 / 0.6680, 0.6759

SGD corner

USD/SGD remains up near its 100-day moving average (1.3544) as the adjustment in interest rate expectations and higher US bond yields continues to support the USD (see above). The run of positive US activity data and high inflation point to further rate hikes by the US Fed over future meetings. Policy settings still aren’t sufficiently ‘restrictive’ to take the heat out of the US economy and labour market, in our view. We continue to expect that in the near-term the uptrend in US rates should remain USD/SGD supportive.

The US Fed will be looking at the upcoming labour market, CPI and retail sales data closely. These are the major releases ahead of the 23 March Fed meeting. As such, FX and interest rate volatility is likely to be even higher than normal around these releases, as large positive or negative misses could see Fed rate hike expectations shift meaningfully. In terms of the upcoming labour market report, we think the risks are tilted to the data showing conditions are still quite tight. If realised, this should, in our view, further open the door to the Fed considering a larger 50bp hike at the late-March meeting. This would be a positive for the USD.

SGD event radar: BoJ Meeting (Tomorrow), US Employment (Sat), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar).

SGD levels to watch (support / resistance): 1.3315, 1.3377 / 1.3590, 1.3620