• US bank woes. SVB developments are weighing on risk sentiment, with US yields falling sharply. The policymaker response is in focus.

• Data flow. Another solid US labour report. US CPI and retail sales this week. If SVB is contained, fundamentals point to rate expectations snapping back.

• AUD holding. AUD remains around ~$0.66. These are several US, global and Australia data points this week that should keep AUD volatility elevated.

A bout of risk aversion is running through markets with the collapse of the US’ Silicon Valley Bank (SVB), and its broader potential fallout, weighing on investors’ minds. The undoing of SVB, the 16th largest bank in the US which specialised in supporting tech startups, was a function of the jump up in interest rates and some unique features of the bank as reduced deposits from tech firms and a large share of its assets being held in US Treasuries meant it needed to sell bonds at a loss to cover demand for liquidity. According to US Treasury Secretary Yellen officials remain focused on protecting depositors, while it is also reported that the US Fed is considering easing the access terms to its ‘discount window’ so that depositor demands can be more easily met.

Markets, still scarred by the GFC, are worrying about the risk of contagion. The unique features of SVB, quick actions of regulators, and stronger equity positions of large US banks in the post-GFC world suggest the risk of a larger issue developing aren’t high, in our view, but that said, market wobbles are likely to continue in the near-term. Over recent weeks we have been flagging the potential negative economic consequences that look set to show up on the back of the most abrupt tightening cycle in several decades, and how volatility should lift over coming months (see Market Musings: Reality check, phase two). The SVB situation reinforces this view, and should also help remind people that US hiking cycles have historically exposed excesses that have built up in pockets of the system. This time shouldn’t be any different.

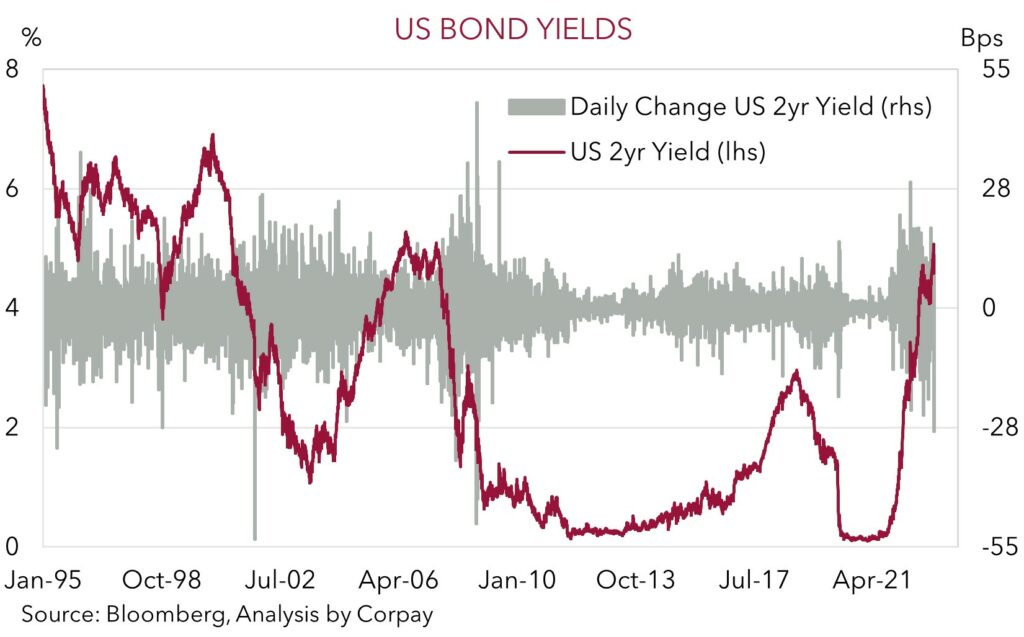

On Friday, US equities fell back with the S&P500 down ~1.5%, while the USD gave up some ground (EUR rose back above 1.0650 and USD/JPY fell below 135, while the AUD continues to hover around $0.66). The bond market experienced greater volatility. US yields fell sharply across the curve. The US 2yr (now 4.59%) declined by 48bps over Thursday and Friday, the largest 2-day slide since September 2008, as markets pared back expectations of how high the Fed could raise rates given the banking concerns and following a lukewarm US labour market report. While non-farm payrolls rose more than forecast (+311,000 in February), the unemployment rate ticked up (now 3.6%) and annual wage growth came in a bit below expectations.

In addition to the banking sector/SVB-related developments, focus in the US this week will be on the CPI (Tues) and retail sales (Wed) reports. Core inflation is forecast to remain elevated, keeping the pressure on the Fed to raise rates again on 23 March and to keep at it over the next few meetings. In Europe, the ECB is forecast to hike rates another 50bps and stress that it has more work to do (Friday AEDT). In our view, given the current risk backdrop this mix should keep volatility elevated and be USD supportive, at least through the early part of the week.

Global event radar: US CPI Inflation (Tues), US Retail Sales (Weds), China Activity Data (Weds), ECB Meeting (Fri), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr).

AUD corner

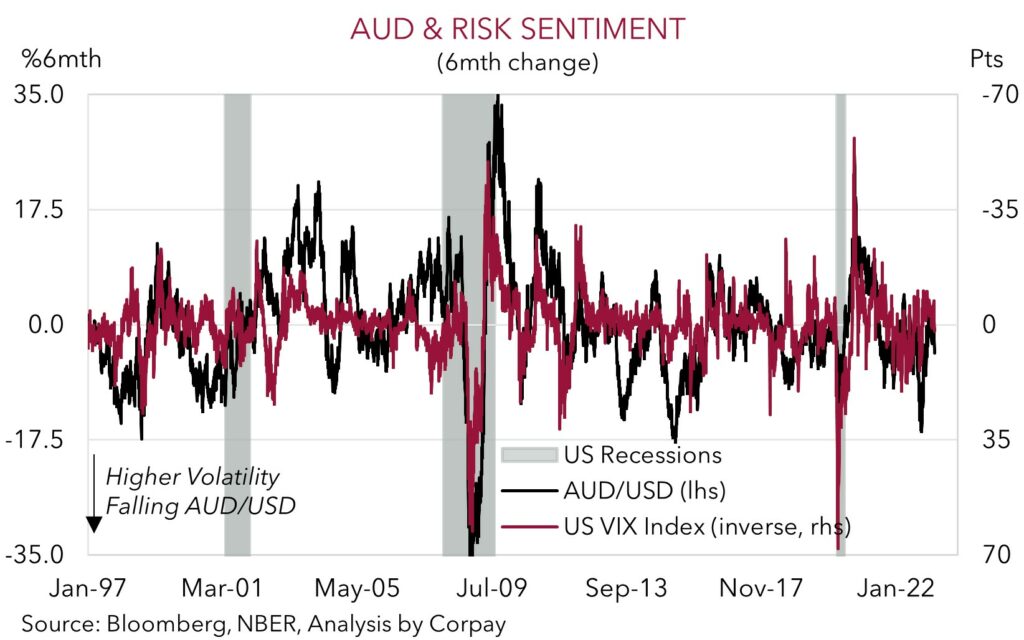

AUD has continued to oscillate around $0.66, with the negative risk sentiment and large fall in bond yields on the back of the SVB developments and contagion fears not flowing through that much to FX markets (see above). The focus in the near term will be on whether the actions being undertaken, and regulatory enhancements put in place since the GFC, can avoid a broader issue from developing. Our take is that it should, however volatility is likely to continue until the situation simmers down and markets become confident any fallout has been contained. As our chart shows, increased market volatility tends to exert downward pressure on the AUD.

Taking a step back from the banking issues, from a fundamental perspective, there are several important global and domestic data releases that also look set to generate volatility this week. Heightened volatility around the economic data is likely to remain over the next few weeks as the outcomes will heavily influence what the US Fed and RBA do at their upcoming meetings. This week US CPI (Tues), US retail sales (Weds), the China activity data (Weds), Australian labour force report (Thurs), and ECB policy meeting (Fri) are on the schedule.

Our view is that, assuming SVB risks recede, another high US core CPI print should see US interest rate expectations snap back, with the strong inflation pulse reinforcing the need for the Fed to deliver further rate hikes. In our opinion, this should be USD supportive over the early part of this week, though we also believe that a bounce back in Australian employment (as some technical issues from last month unwind) and a hawkish ECB can help the AUD recover lost ground later this week. Barring an acute bout of risk aversion and/or an exogenous shock, we continue to think that the AUD should find solid support around the ~$0.65-0.66 area.

AUD event radar: AU Business Survey (Tues), US CPI Inflation (Tues), US Retail Sales (Weds), China Activity Data (Weds), AU Jobs Data (Thurs), ECB Meeting (Fri), US FOMC Meeting (23rd Mar), AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr).

AUD levels to watch (support / resistance): 0.6490, 0.6522 / 0.6680, 0.6767

SGD corner

USD/SGD has eased back from its 100-day moving average (1.3523) with the large fall in US bond yields stemming from the SVB developments and repricing in Fed interest rate expectations exerting a bit of pressure on the USD (see above). We doubt this trend can continue, and remain of the view that USD/SGD pull-backs should remain limited, with the pair finding solid support just above ~1.34. We think that the response from US officials and regulatory changes put through since the GFC should keep the situation contained. Assuming this holds true, we expect fundamentals to quickly reassert themselves. And on this basis, we believe another strong US CPI report (Tues) could see US interest rate expectations rebound quickly and aggressively, which in turn should be USD supportive, at least over the early part of the week. That said, another large ECB rate hike and hawkish guidance later this week could also act to limit the anticipated USD (and USD/SGD) uplift.

SGD event radar: US CPI Inflation (Tues), US Retail Sales (Weds), China Activity Data (Weds), ECB Meeting (Fri), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), MAS Review (by mid-Apr).

SGD levels to watch (support / resistance): 1.3320, 1.3377 / 1.3590, 1.3620